Beneficiary Trustee Trust For Beneficiary

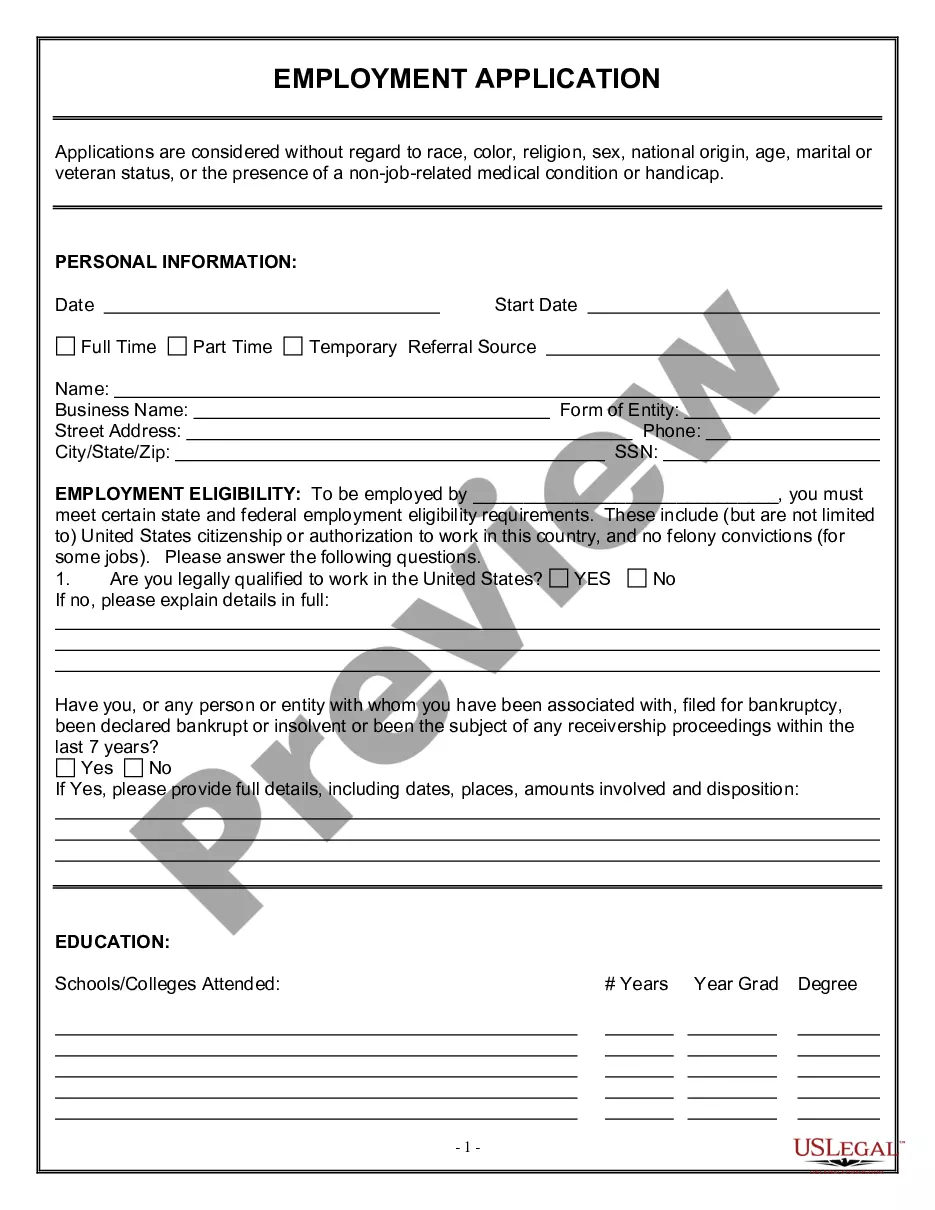

Description

How to fill out Termination Of Trust By Trustee?

- If you are a returning user, log in to your account and simply download the required form template by clicking the Download button. Ensure your subscription is active; renew as necessary based on your plan.

- For first-time users, start by exploring the Preview mode and reviewing the form description to confirm it aligns with your requirements and complies with local jurisdiction.

- In case you need additional templates, use the Search tab above to find the right one. If you identify any discrepancies, search for the correct form.

- Proceed to purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. Registration is required to unlock access to the extensive library.

- Finalize your purchase by entering your credit card information or opting for a PayPal transaction to complete the subscription.

- Download your form and save it to your device. You can also access it anytime from the My Forms section in your profile.

With US Legal Forms, you gain access to an impressive library of over 85,000 editable legal documents, ready for your use. Their support includes premium experts who can assist you in ensuring your forms are legible, accurate, and legally sound.

Don't hesitate to take advantage of the benefits offered by US Legal Forms. Start your journey today to simplify your legal document processes.

Form popularity

FAQ

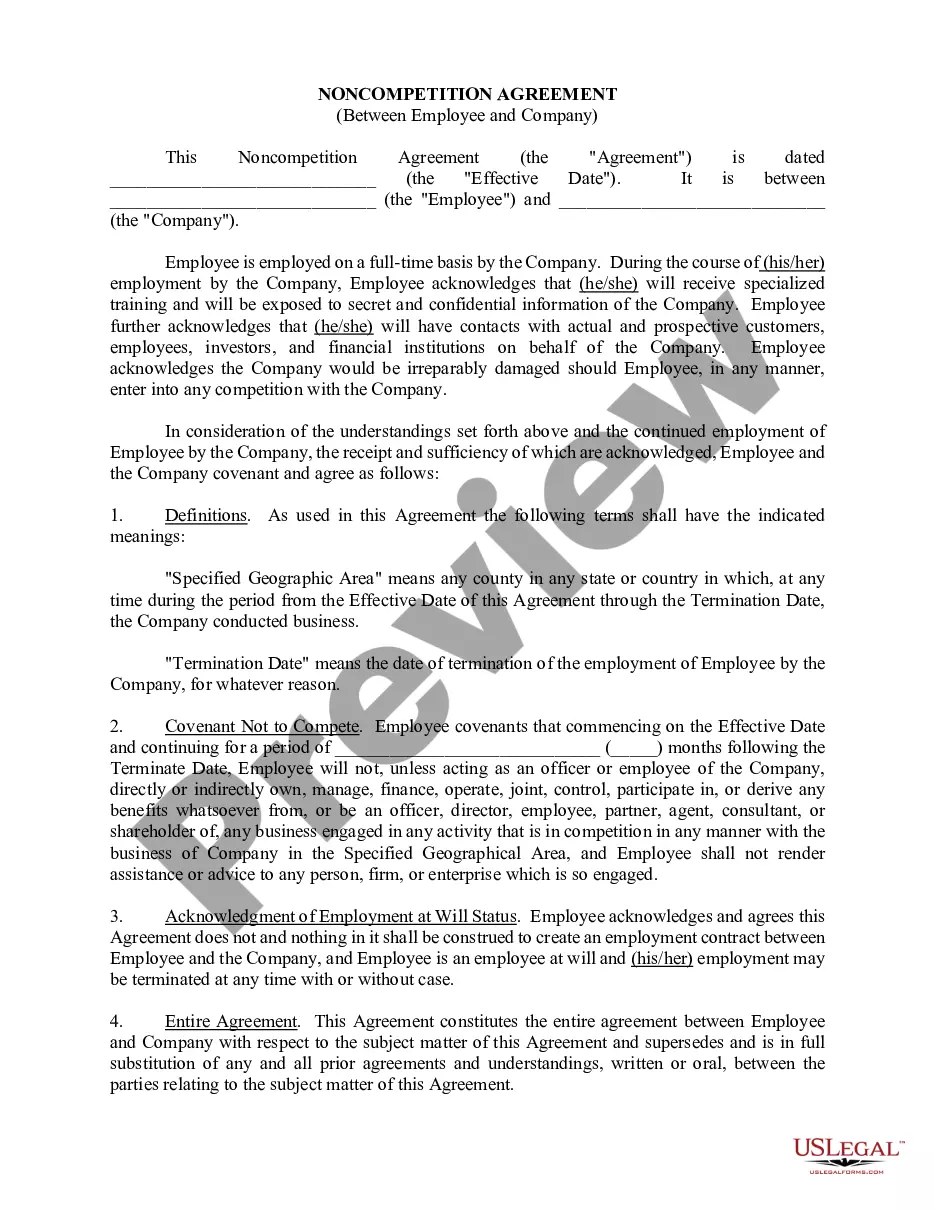

Yes, a trustee of a trust can also be a beneficiary. This arrangement may lead to potential conflicts of interest, so it’s important to manage this relationship carefully. Clear terms in the trust agreement can help mitigate any issues that arise. When establishing a beneficiary trustee trust for beneficiary, consider consulting with a legal expert to navigate these complexities.

As a beneficiary, filing a Form 1041 may depend on the trust's income and your personal tax situation. Generally, if the trust generates income, it must file a 1041, but you should also report your share of that income on your tax returns. Understanding the tax obligations linked to your beneficiary trustee trust for beneficiary is essential for compliance. Consulting a tax professional can provide clarity on your specific requirements.

To add a trust as a beneficiary, you typically need to update the relevant legal documents, such as life insurance policies or retirement accounts. It’s crucial to provide the correct trust details to avoid any complications. Manage this process carefully to ensure your beneficiary trustee trust for beneficiary is included correctly. Professional assistance can help ensure all documentation meets legal standards.

The trustee holds the real power in a trust. This individual is responsible for managing the assets and ensuring that the terms of the trust are followed. Meanwhile, beneficiaries receive the benefits as outlined in the trust agreement. Understanding the roles and responsibilities of both parties can clarify how your beneficiary trustee trust for beneficiary operates.

Yes, you can add your trust as a beneficiary. This process allows your assets to be managed according to the trust's terms after your passing. It's essential to ensure that your trust is properly set up and aligns with your overall estate plan. Consulting with a legal professional can help clarify any complexities regarding your beneficiary trustee trust for beneficiary.

Overall, the trustee holds more power in a trust due to their responsibilities to manage the trust assets. Nonetheless, beneficiaries do enjoy significant rights, such as receiving trust benefits and holding trustees accountable. The power struggle between trustee and beneficiary often depends on the trust's structure and the responsibilities laid out. By setting up a beneficiary trustee trust for beneficiary, both parties can better understand their respective powers and responsibilities.

In a trust, the trustee typically holds more power, as they manage and control the trust's assets. However, beneficiaries have rights that can limit a trustee's authority, such as the right to receive information and distributions. The balance of power can vary based on the trust's terms and the goals established in the trust document. Establishing a clear beneficiary trustee trust for beneficiary can help achieve a fair power dynamic.

A trustee has a fiduciary duty to act in the best interests of the beneficiaries, which means ignoring them is not acceptable. This duty includes keeping beneficiaries informed and providing them with relevant information about the trust's activities. If a trustee neglects these responsibilities, it could lead to legal issues or disputes. A well-structured beneficiary trustee trust for beneficiary helps clarify these roles and expectations.

Yes, a beneficiary can serve as a trustee of a trust. This arrangement often benefits both parties, as the trustee can manage the trust with a personal understanding of the beneficiaries' needs. Using a beneficiary trustee trust for beneficiary allows for more transparent communication and decision-making. However, it is essential to ensure that this setup does not lead to conflicts of interest.

One significant mistake is failing to name the trust accurately and ensure resources align with beneficiaries' needs. Parents often overlook the importance of regularly updating the trust in response to life changes, such as births or deaths. By using a beneficiary trustee trust for beneficiary, you can avoid these pitfalls, ensuring that your assets are managed effectively for future generations. Services like uslegalforms can provide the necessary guidance and templates to get it right.