Promissory Note Sample For Hospital Bill

Description

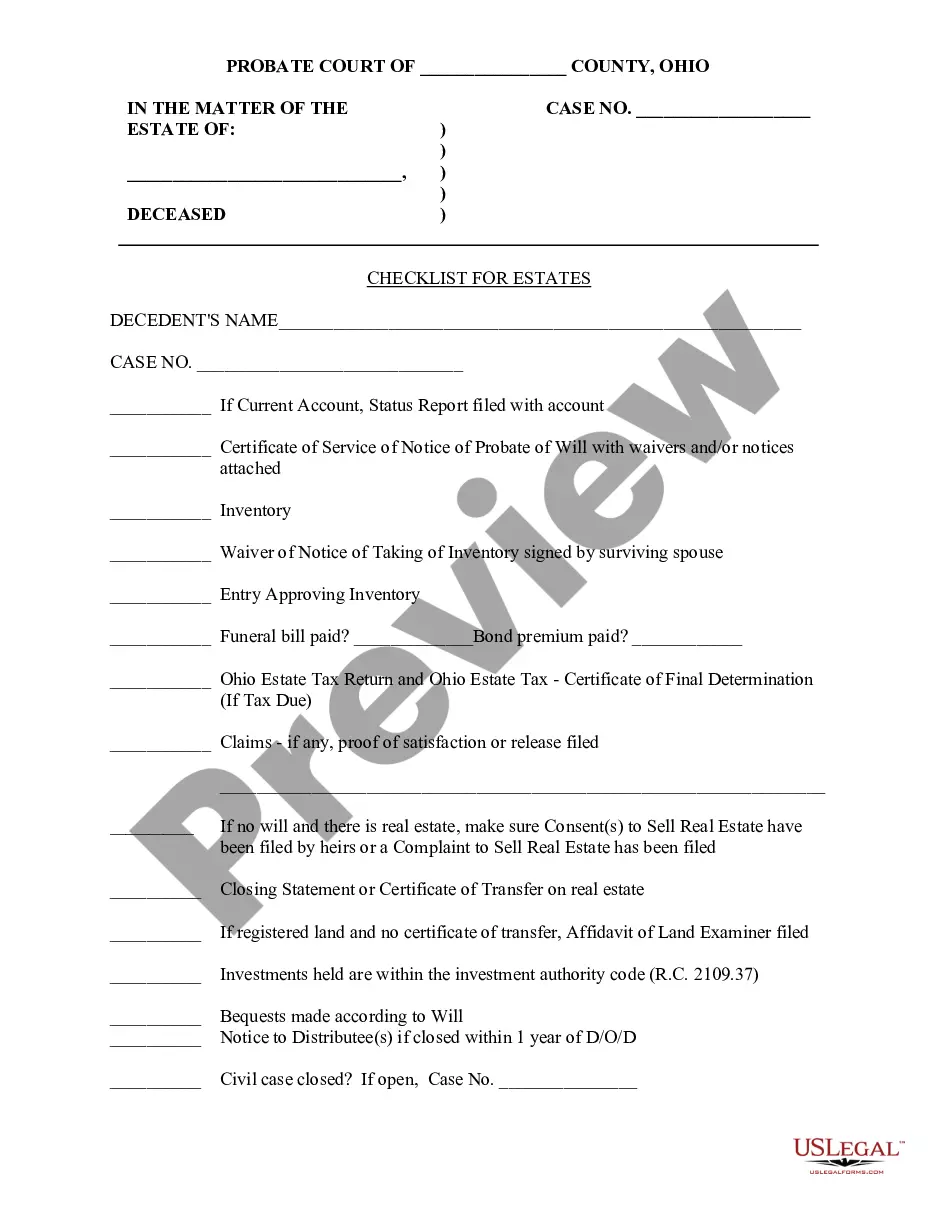

How to fill out Checklist - Items To Consider For Drafting A Promissory Note?

There’s no longer a reason to spend countless hours searching for legal documents to adhere to your local state requirements.

US Legal Forms has consolidated all of them in one place and streamlined their accessibility.

Our website provides over 85k templates for any business and personal legal situations organized by state and area of application.

Use the Search field above to explore another template if the previous one didn’t meet your needs. Click Buy Now next to the template title when you locate the correct one. Select the desired subscription plan and create an account or Log In. Process your payment for your subscription via card or through PayPal to proceed. Choose the file format for your Promissory Note Sample For Hospital Bill and download it to your device. Print your form to fill it out manually or upload the sample if your preference is to utilize an online editor. Preparing legal documentation under federal and state regulations is quick and uncomplicated with our library. Give US Legal Forms a try now to organize your documentation!

- All forms are properly drafted and verified for authenticity, ensuring you receive an up-to-date Promissory Note Sample For Hospital Bill.

- If you are familiar with our platform and already possess an account, make sure your subscription is current before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also access all saved documents whenever needed by navigating to the My documents tab in your profile.

- If you haven't used our platform before, the procedure will require additional steps to finalize.

- Here’s how new users can locate the Promissory Note Sample For Hospital Bill in our library.

- Review the page content thoroughly to confirm it possesses the sample you require.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

Dear District Administrator NAME OF ADMINISTRATOR: I received care at NAME OF HOSPITAL on DATES OF SERVICE. The hospital is demanding payment on this bill, and/or my bill has been sent to collections, and/or I am being sued for collection of this bill, and/or I was forced to pay more than I owe.

To Whom It May Concern: I am writing to negotiate the above medical bills because I am unable to pay the amount requested. Pursuing me for these bills will force me (and my family) into further financial hardship. This is where you explain your current financial situation and why you are unable to pay.

Dear Sir or Madam: I am writing to notify you of my inability to pay the above-referenced bill for (describe your condition and treatment). I have received the enclosed bill (enclose a copy of the documentation received from the billing company), but I am unable to pay the bill as outlined.

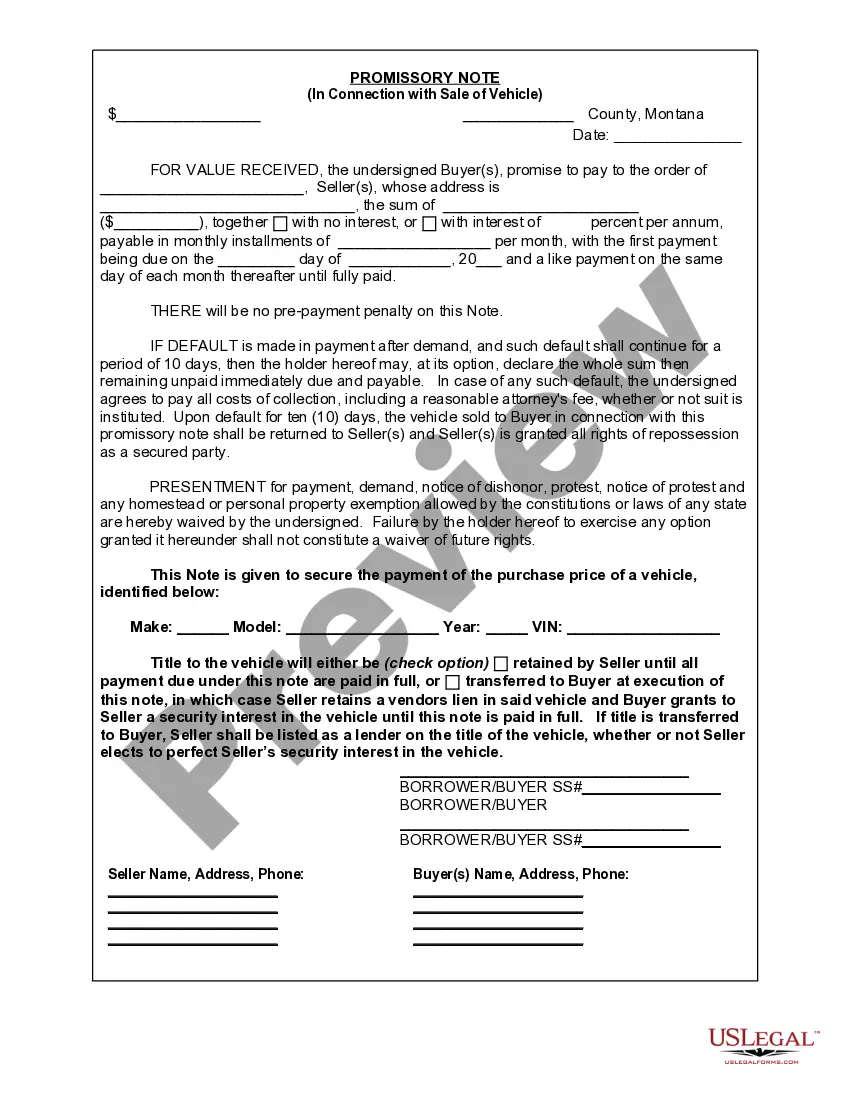

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.