Severance Payment Tax Withholding

Description

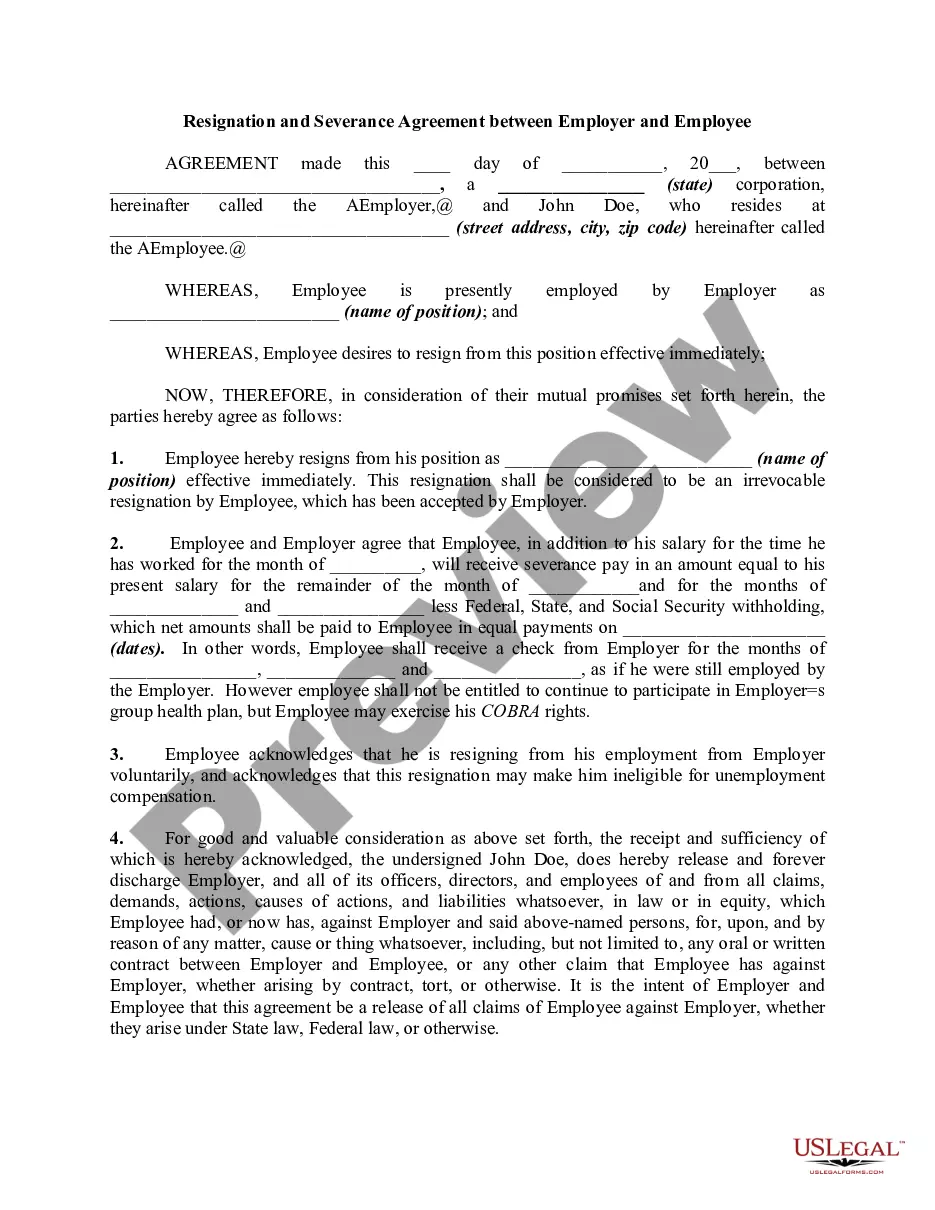

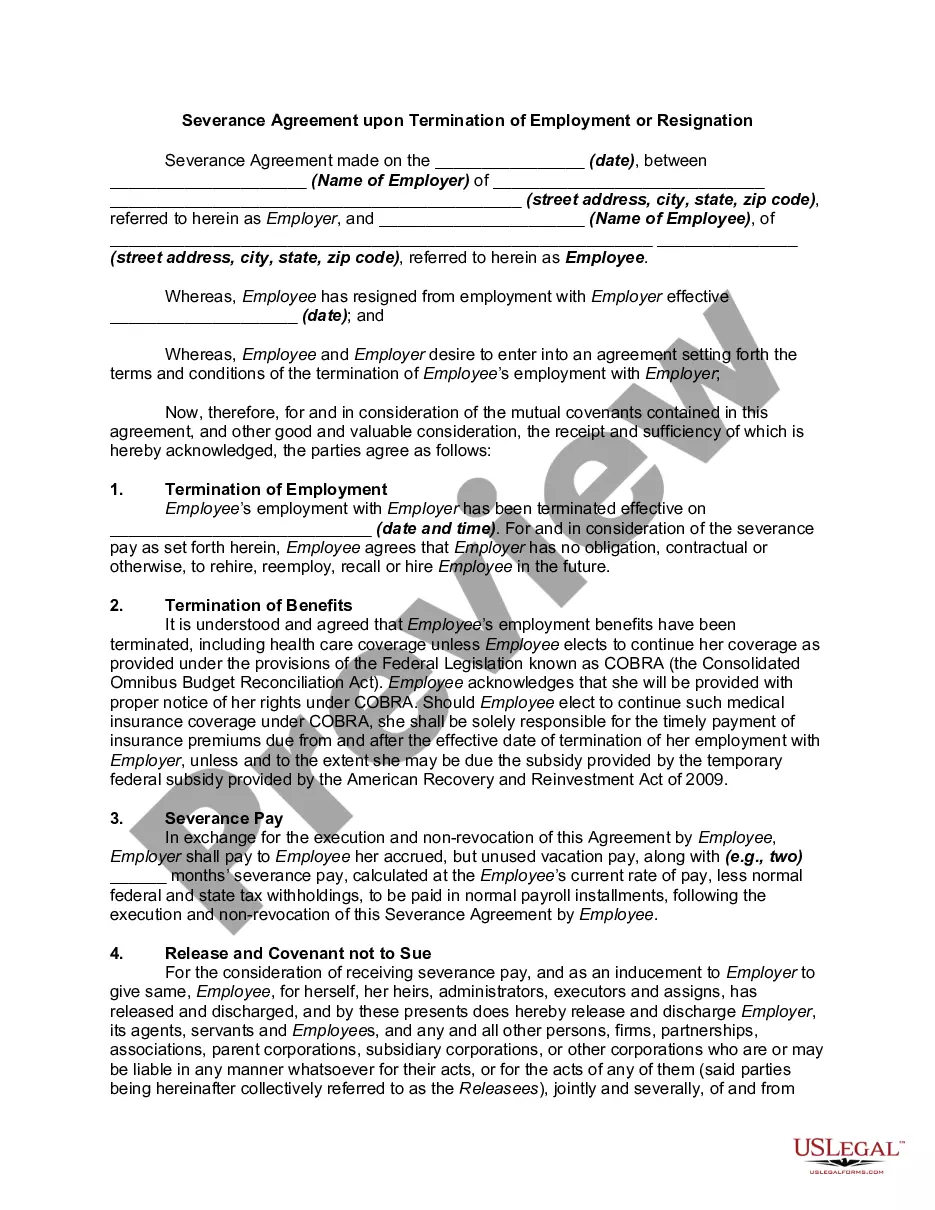

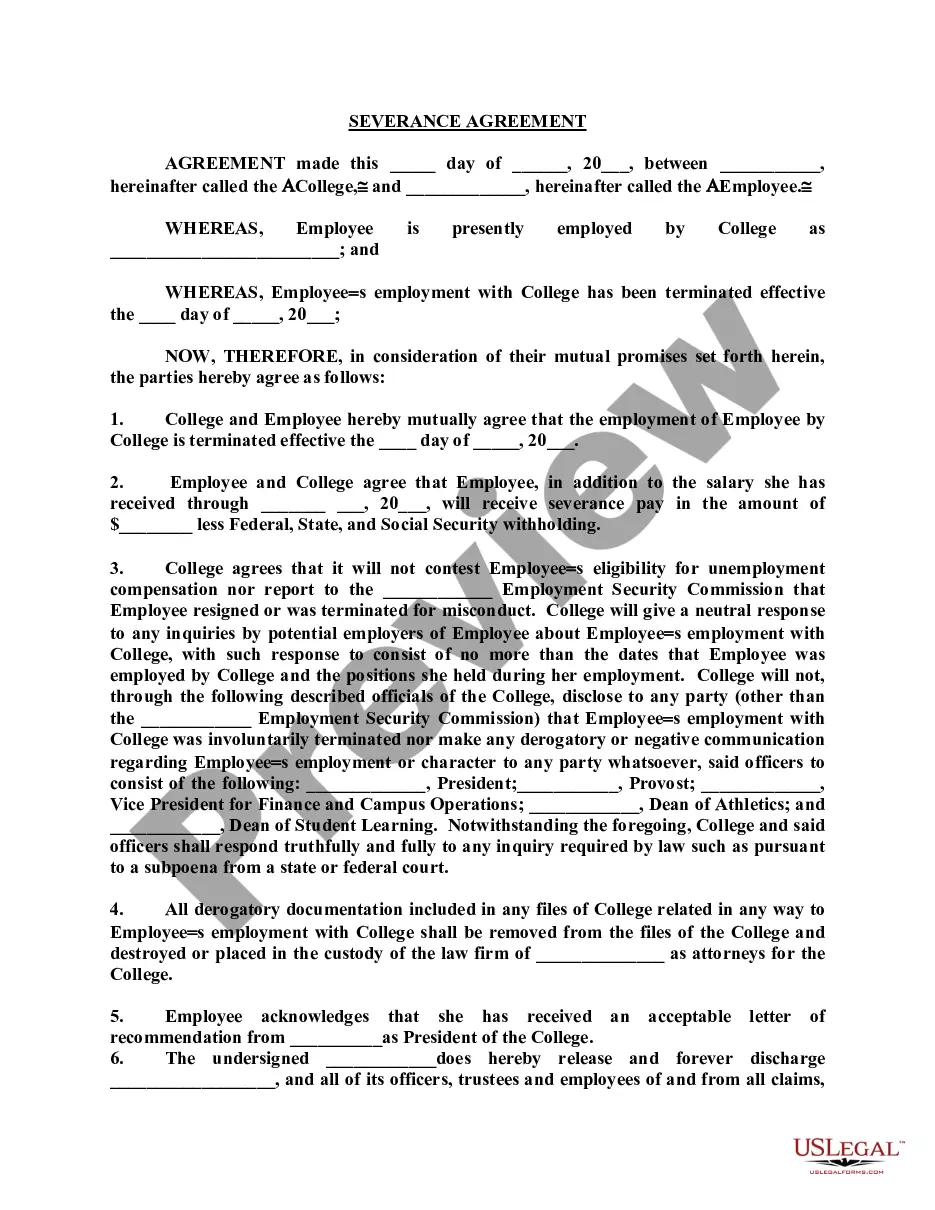

How to fill out Severance Agreement Between Employee And Employer?

- Log in to your US Legal Forms account if you've used the service before. Ensure your subscription is active, and if it's not, renew it to enjoy uninterrupted access.

- If you're new to the service, start by exploring the Preview mode and reviewing form descriptions. Choose the one that aligns with your requirements and complies with local laws.

- Use the Search tab to find alternative forms if necessary. This ensures you select the right document that fits your situation.

- Purchase your selected document. Click 'Buy Now' and select a subscription plan that suits your needs. You'll need to create an account to gain full access to their resources.

- Complete your payment with your credit card or PayPal, then download your selected form to your device for immediate use. You can also find it later in the 'My Forms' section under your profile.

In conclusion, US Legal Forms simplifies the process of obtaining severance payment forms and ensures that you have access to expert assistance when needed. This method provides a streamlined approach to legal documentation.

Try US Legal Forms today and make your legal form needs hassle-free!

Form popularity

FAQ

When filling out your tax withholding form, be sure to accurately reflect your current financial situation. Start by entering your personal information, including your name, address, and Social Security number. It is essential to consider any severance payment tax withholding implications, as this may affect your overall tax liability. To ensure the correct amount is withheld, calculate your expected severance payment and consult with a tax professional if needed.

Several employee benefits do not incur FICA taxes, and this aspect is crucial for understanding severance payment tax withholding. Common examples include certain health benefits, education assistance, and qualified retirement plan contributions. By focusing on what is exempt from FICA, you can maximize your benefits during and after your severance period. US Legal Forms offers resources to assist you in navigating these complexities.

Certain types of earnings are exempt from FICA, which includes severance payment tax withholding. For instance, income earned from pensions, certain types of disability benefits, and interest income are not subject to FICA taxes. This exemption can significantly influence your financial decisions when considering severance payments. Knowing these exemptions allows you to make better-informed choices regarding your earnings.

Employers typically handle tax withholding for severance payments as they would for regular wages. It's essential to review your IRS Form W-4 to ensure your withholding is set appropriately prior to receiving your severance payment. If you have specific concerns, you may opt to speak with your HR department or a tax advisor for further guidance. Awareness around severance payment tax withholding can help you understand what to expect in your final payout.

To minimize taxes on your severance payment, consider structuring the payout over multiple years rather than taking a lump sum. This approach can help you stay in a lower tax bracket and reduce your overall tax burden. Additionally, consulting a tax professional can provide personalized strategies that align with your financial situation. Understanding severance payment tax withholding will also empower you to make informed decisions.

Box 14 on the W-2 form provides the employer with a space to report additional information that is not captured in other boxes. This may include certain deductions like union dues, nontaxable income, or severance payment tax withholding details. It's important to review this information as it can affect your overall tax situation. If you're uncertain about the entries in box 14, consider using legal forms from US Legal Forms for guidance on proper reporting.

Boxes 12a, 12b, and 12c on the W-2 form report various types of compensation or deductions that may not be included in your total taxable income. These boxes can help clarify severance payment tax withholding by indicating specific types of payments made to you during the tax year. For example, box 12 may include codes for retirement plan contributions or other benefits. Understanding these boxes is essential for filing your taxes accurately and ensuring all severance payments are accounted for.