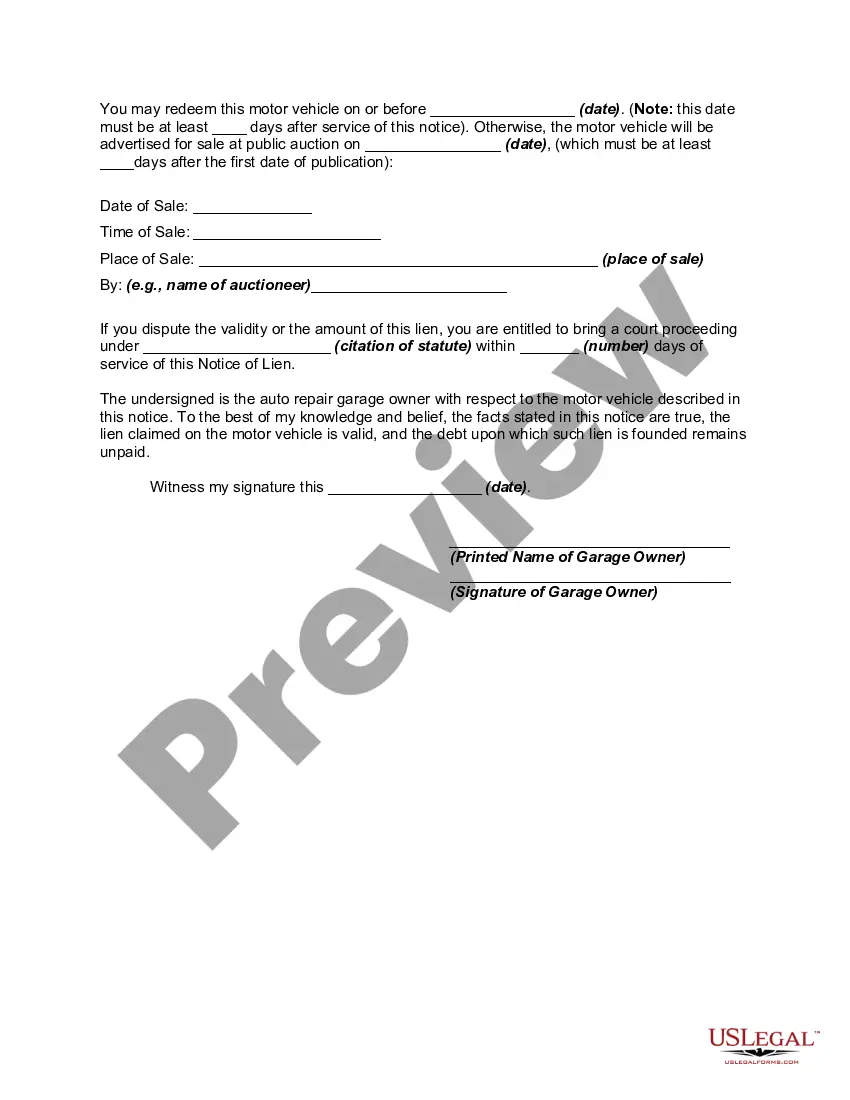

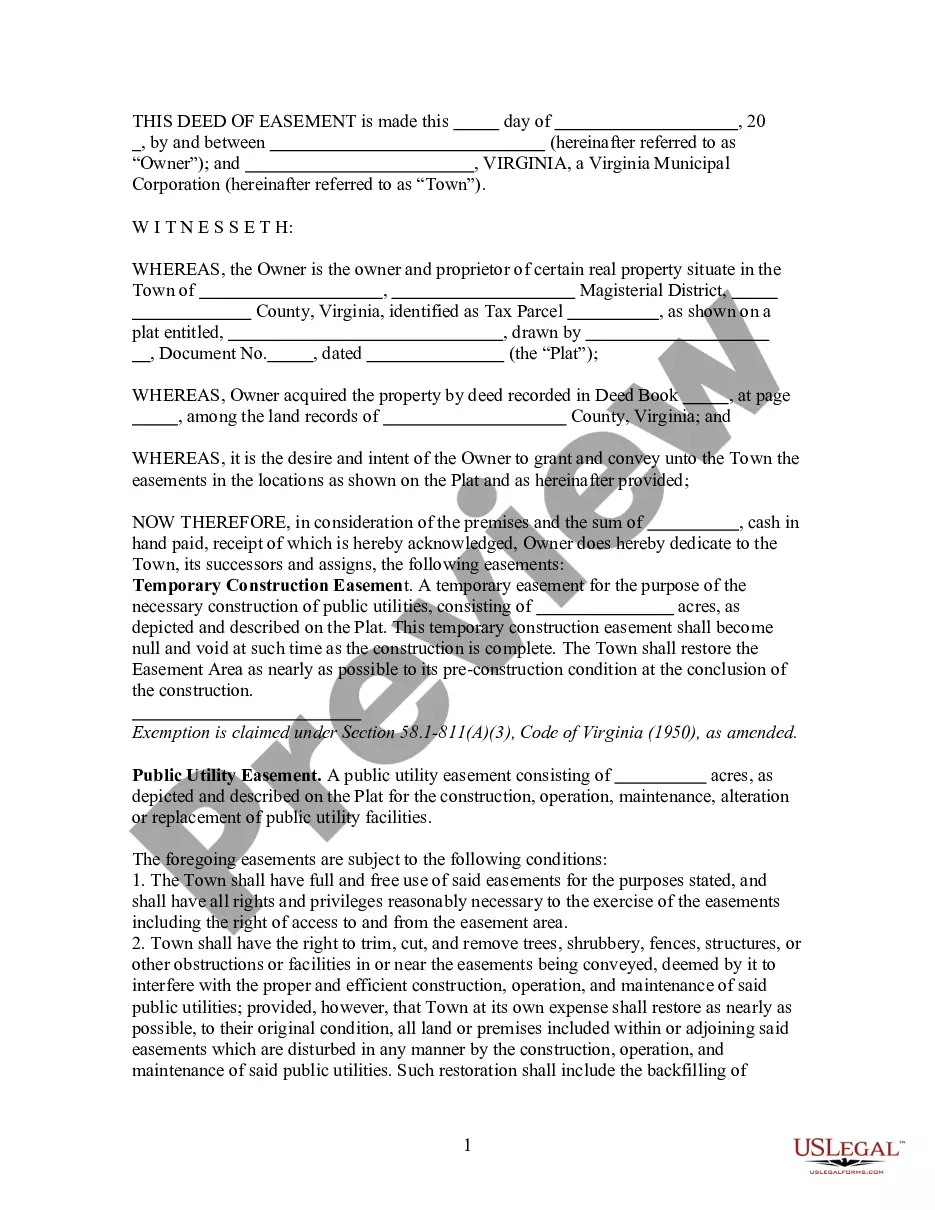

Notice Lien Owner For The Payment

Description

How to fill out Notice Of Lien By Owner Of Auto Or Car Repair Garage And Notice Of Sale?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active to access the templates.

- If you are a first-time user, begin by checking the form preview and detailed descriptions to confirm you have selected the right document according to your jurisdiction.

- If necessary, utilize the Search function to find an alternative template that suits your requirements better.

- Purchase your selected document by clicking on the Buy Now button and opt for your preferred subscription plan. Registration will be required to access the full library.

- Complete your transaction by entering payment details using a credit card or via your PayPal account.

- Download the form to your device, enabling you to fill it out easily, and access it anytime from the My Forms section of your account.

In conclusion, utilizing US Legal Forms for your legal document needs not only simplifies the notification process but also assures both accuracy and compliance with legal standards. Save time, resources, and potential legal issues by leveraging their extensive library of legal forms.

Start your journey with US Legal Forms today!

Form popularity

FAQ

Lien rights in Tennessee are granted to various parties including contractors, subcontractors, and suppliers who have contributed to the property. These individuals can assert their rights to ensure they receive payment for their services or materials. Understanding who has these rights is important for property owners to avoid unexpected liens. Always respond properly to any Notice lien owner for the payment to protect your interests.

Yes, a contractor can file a lien without a formal contract in Tennessee if they provided services or materials to improve a property. However, they must prove the work done or materials supplied. It is crucial to notify the lien owner effectively through a Notice lien owner for the payment to establish the contractor’s right to payment. Consider consulting legal assistance to navigate this process.

Several parties can file a lien on a property, including contractors, subcontractors, suppliers, and even homeowners. These individuals or businesses typically have a legal right to secure a debt owed for services rendered or materials supplied. However, the specific rules can vary from state to state, and it's essential to understand Tennessee’s laws regarding liens. Always address the lien with a clear Notice lien owner for the payment to establish communication.

To contest a lien in Tennessee, you need to file a petition in the appropriate court. This petition should explain your reasons for contesting the lien and provide evidence to support your claim. It is also beneficial to inform the lienholder of your intentions, which can sometimes lead to an amicable resolution. Properly addressing the Notice lien owner for the payment can streamline the process.

Yes, you can look up liens in California through public records maintained by the county recorder's office. They provide access to property records, including any notice lien owner for the payment that may affect your property. Online search tools and databases can also streamline the process, making it easier to find the necessary information. Consider using resources like US Legal Forms, which can assist you in navigating these public records.

To obtain a lien release letter, you usually need to contact the lien holder directly. This letter serves as proof that you have settled your debt and that the notice lien owner for the payment has been resolved. After paying the due amount, request the release letter in writing to ensure you have documentation in case of future disputes. Platforms like US Legal Forms can help guide you through this process.

Yes, it is possible for someone to place a lien on your property without your immediate knowledge. Often, this happens when a debt remains unpaid, and creditors file a notice lien owner for the payment with the local authorities. To protect yourself, regularly check public records or consult with a legal expert. Awareness can help you take steps to address any liens and prevent complications.

A notice of lien is a legal document that asserts a claim against a property for unpaid debts. This notice informs relevant parties of the claim, establishing a right to payment. Understanding this is crucial for anyone involved in the lien process, especially when needing to notify the lien owner for the payment.

When writing a letter of intent for a lien, clearly state your intention to file a lien on the property due to unpaid debts. Include important details, such as the amount owed and deadlines for payment. This letter serves as a formal notice to the lien owner for the payment.

To file a lien in Ohio, you need to provide the property owner's name, address, and a detailed description of the debt. It’s important to gather documents that prove the claim and verify your right to file. This step is essential to effectively notify the lien owner for the payment.