Complaint Promissory Note Without Interest

Description

How to fill out Complaint For Past Due Promissory Note?

There is no longer a necessity to squander time searching for legal documents to comply with your local state statutes. US Legal Forms has assembled all of them in one location and enhanced their accessibility.

Our platform offers over 85,000 templates for any commercial and personal legal situations, categorized by state and usage area. All forms are properly drafted and verified for legitimacy, ensuring you can confidently acquire an up-to-date Complaint Promissory Note Without Interest.

If you are acquainted with our service and already possess an account, you must verify that your subscription is valid before accessing any templates. Log In to your account, choose the document, and click Download. You can also revisit all saved documents at any time by navigating to the My documents tab in your profile.

Print your form to fill it out by hand or upload the template if you wish to complete it using an online editor. Preparing official documentation under federal and state regulations is quick and easy with our platform. Experience US Legal Forms today to maintain your paperwork organized!

- If you have not previously utilized our service, the procedure will involve a few additional steps to finalize.

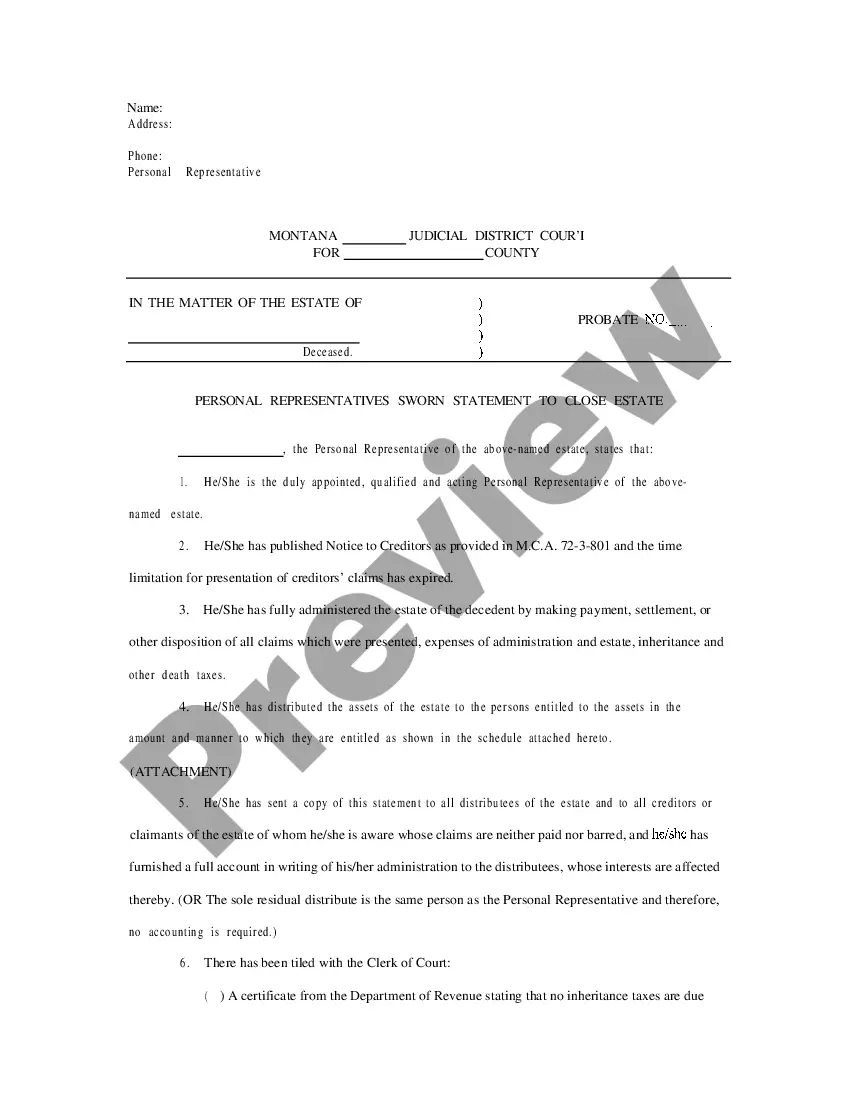

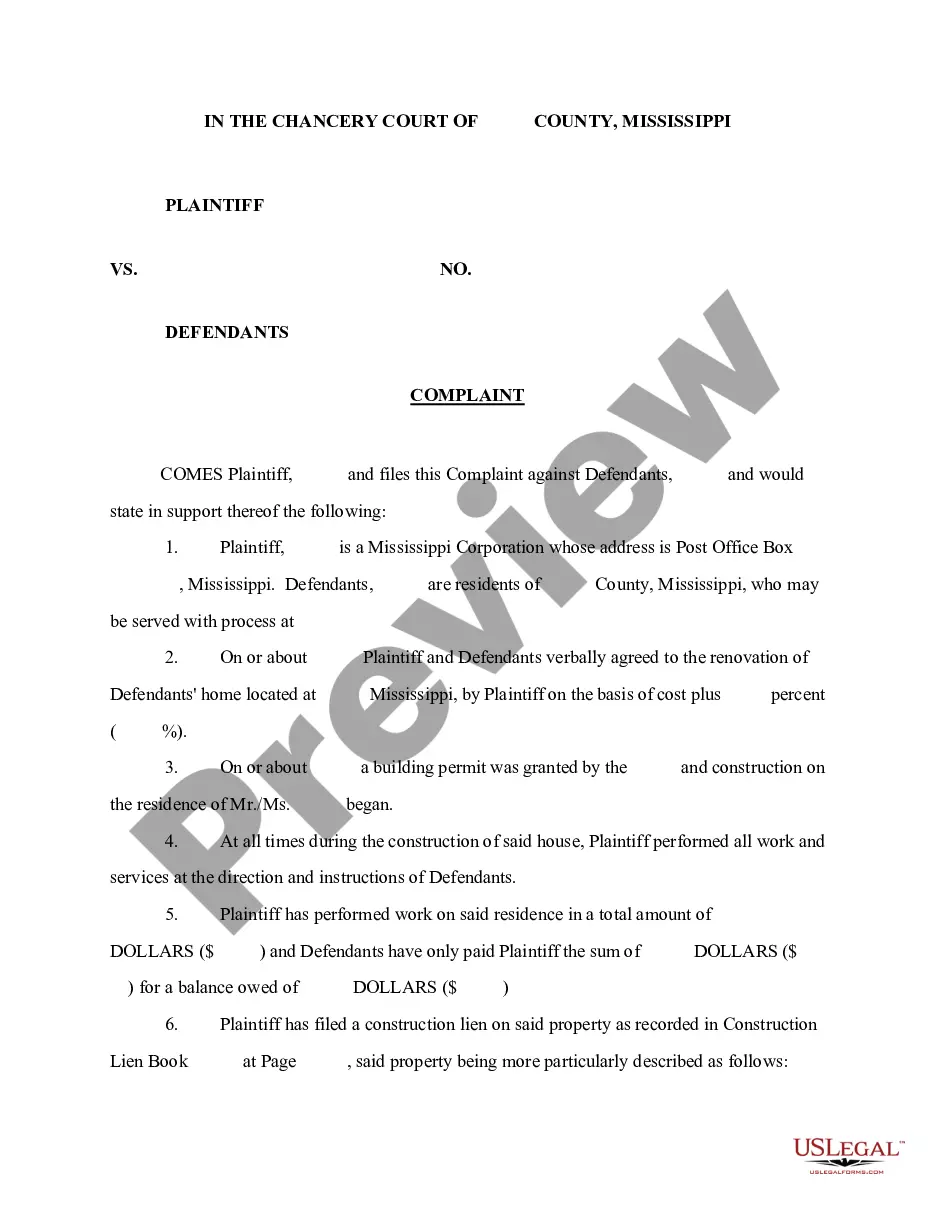

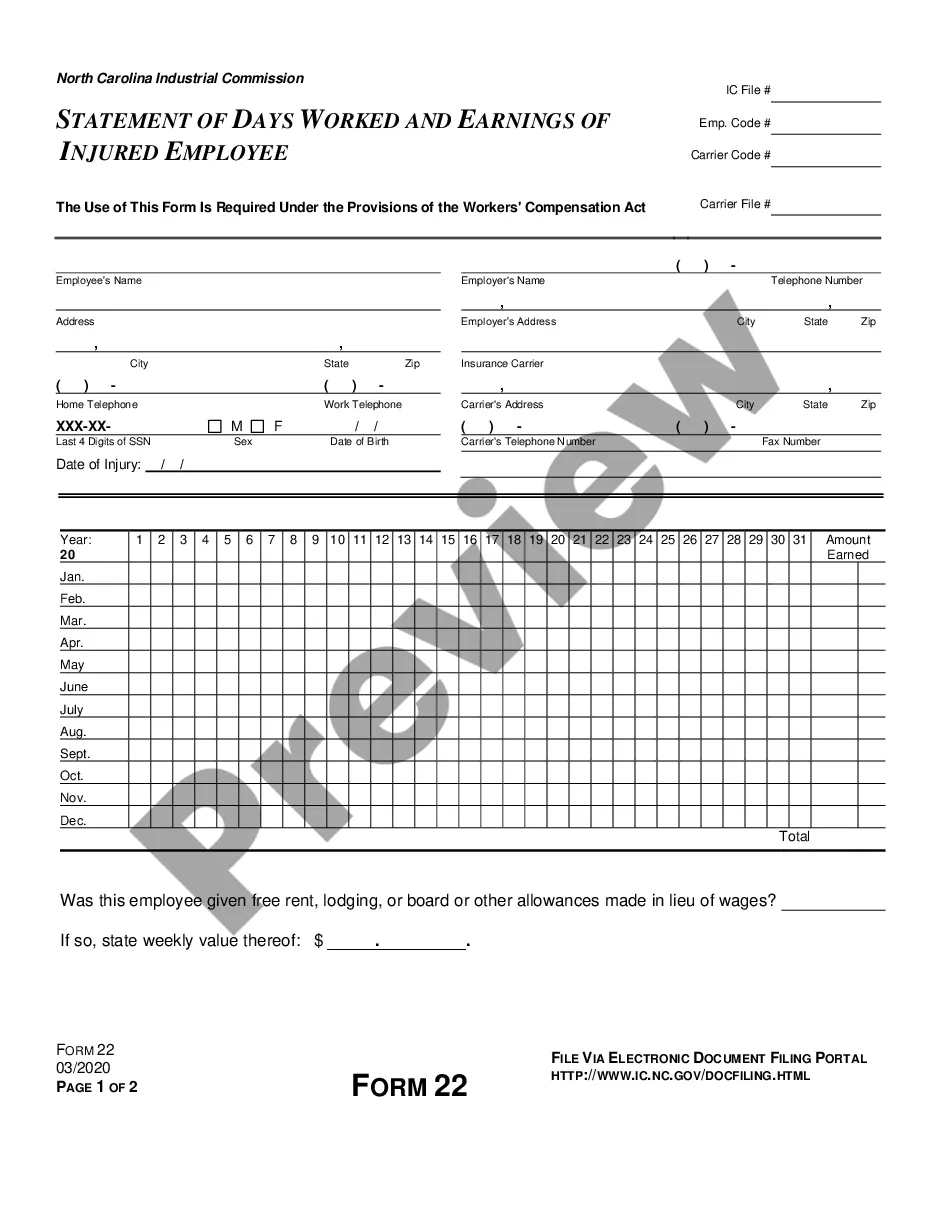

- Examine the page content thoroughly to confirm it includes the template you need.

- To do this, utilize the form description and preview options if available.

- Employ the search bar above to look for another template if the current one is not suitable.

- Click Buy Now next to the template title once you identify the appropriate one.

- Select the desired pricing plan and either register for an account or Log In.

- Process payment for your subscription using a card or via PayPal to continue.

- Choose the file format for your Complaint Promissory Note Without Interest and download it to your device.

Form popularity

FAQ

A simple promissory note will state the full amount is due on the stated date; you won't need a payment schedule. You can decide whether to charge interest on the loan amount and include the interest in the document if needed.

Based on all of the elements included in the promissory note, the maturity date or end date of the promissory note must be determined before the borrower and lender can calculate simple interest. This is the date upon which the promissory note needs to be repaid.

If you decide to give the loan without charging any interest, be prepared to justify it to the IRS, because it literally is a gift in the IRS's eyes. The IRS can "impute" interest on your loan, whether you actually charged any interest or not, and require you to report that imputed interest as income.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.