Answer Debt Collection Lawsuit With Banks

Description

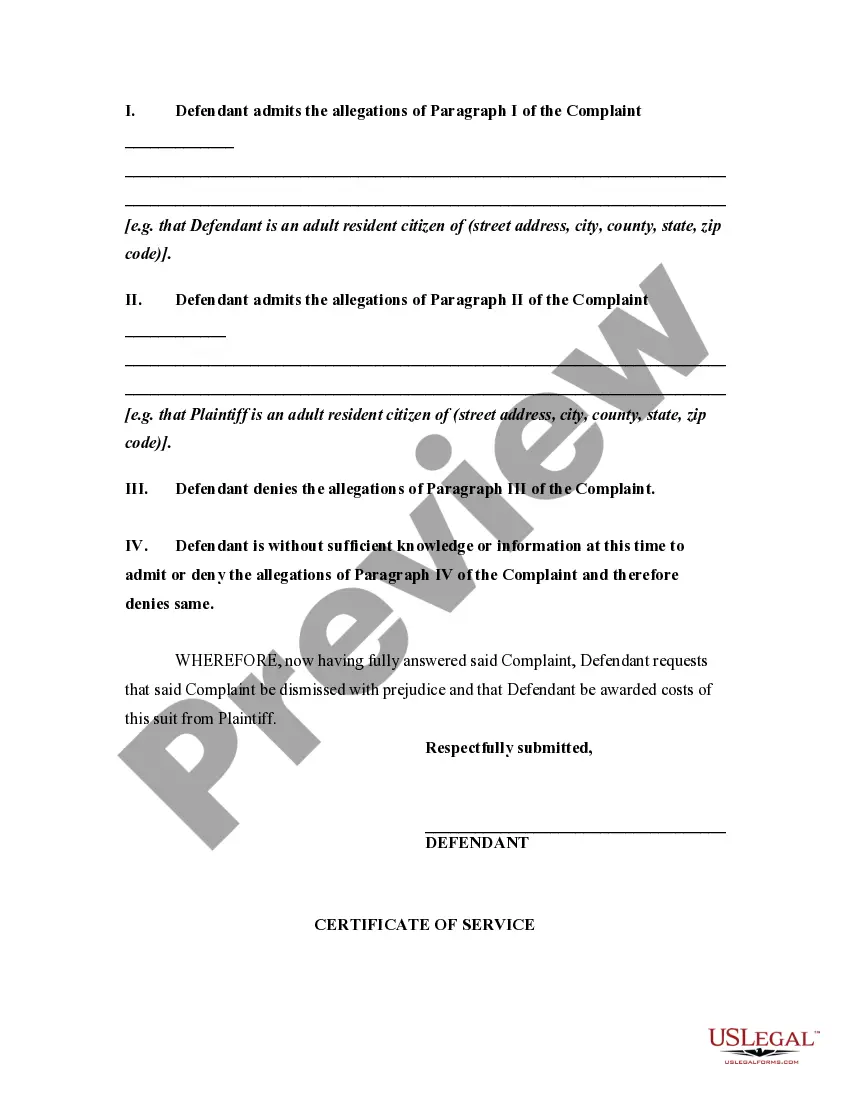

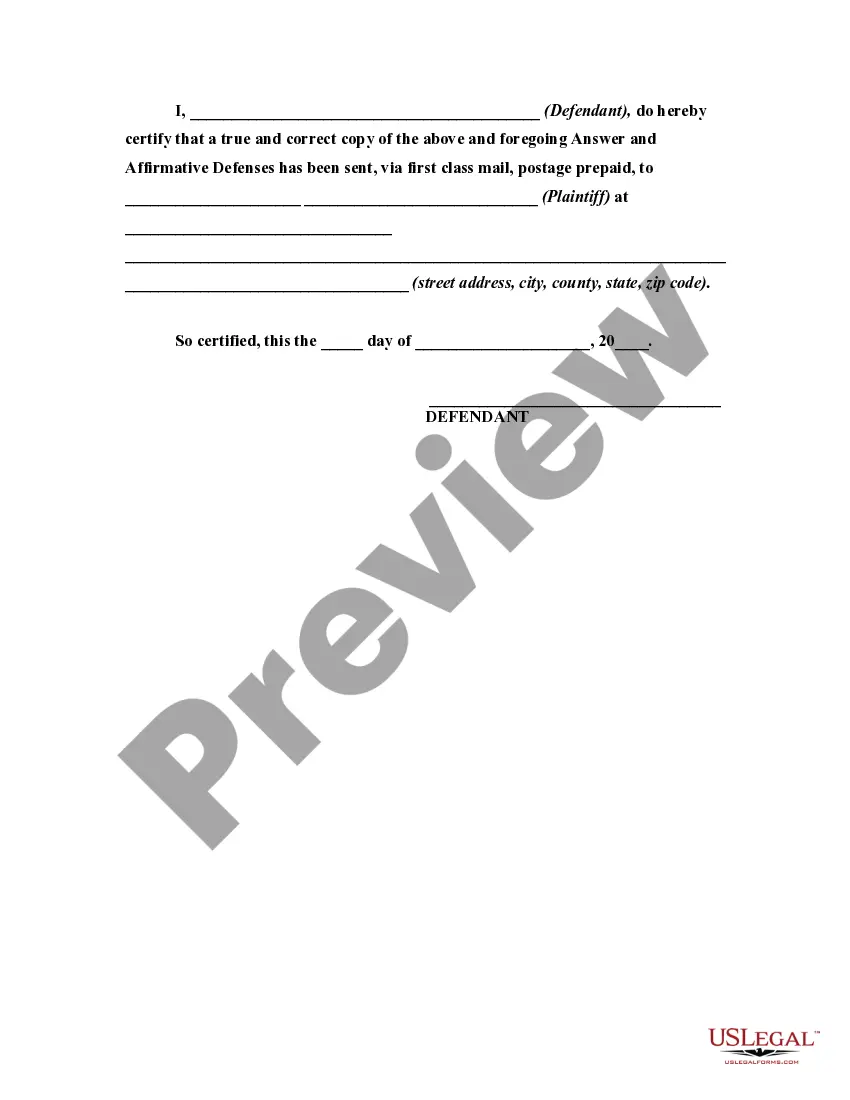

How to fill out Answer By Defendant In A Civil Lawsuit Alleging The Affirmative Defense Of Contributory Negligence?

Legal oversight can be overwhelming, even for the most seasoned experts.

If you are seeking to Address Debt Collection Lawsuit With Banks and do not have the opportunity to invest in finding the correct and up-to-date version, the procedures can be challenging.

Utilize advanced tools to complete and manage your Address Debt Collection Lawsuit With Banks.

Gain access to a collection of articles, guides, and resources related to your situation and requirements.

Ensure it is the correct document by previewing it and reviewing its details.

- Save time and effort in locating the documents you need, and use US Legal Forms' advanced search and Preview tool to identify Address Debt Collection Lawsuit With Banks and obtain it.

- If you have a membership, Log In to your US Legal Forms account, search for the form, and acquire it.

- Visit the My documents tab to review the documents you have previously downloaded and manage your folders as needed.

- If this is your first experience with US Legal Forms, create a free account and enjoy unlimited access to all the benefits of the library.

- Here are the steps to follow after finding the form you need.

- A robust online form repository can be transformative for anyone aiming to manage these matters efficiently.

- US Legal Forms stands as a leading provider in online legal forms, offering over 85,000 state-specific legal forms accessible to you at any time.

- With US Legal Forms, you can address all your legal and organizational document requirements in a single location.

Form popularity

FAQ

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

Tell the Truth and Keep a Consistent Story Make a list of the reasons you've fallen behind in payments. Debt often results from hardships such as job loss, divorce, medical bills. Put them down on paper to use as a reference when you're negotiating a debt settlement with a creditor.

Explain your current situation and how much you can pay upfront. Also, provide them with a clear description of what you expect in return, such as the removal of missed payments or the account shown as paid in full on your report. Ask for a written confirmation after settling on an agreement.

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.

You contacted me by [phone/mail], on [date] and identified the debt as [any information they gave you about the debt]. I do not have any responsibility for the debt you're trying to collect. If you have good reason to believe that I am responsible for this debt, mail me the documents that make you believe that.