Triple Net Lease

Overview of this form

A triple net lease is a legal agreement where the tenant agrees to pay all real estate taxes, building insurance, and maintenance costs, in addition to regular rent and utilities. This type of lease is different from traditional leases because it shifts more responsibility to the tenant. It is often used in commercial real estate and allows property owners to have a more predictable income stream while tenants benefit from potentially lower rental fees.

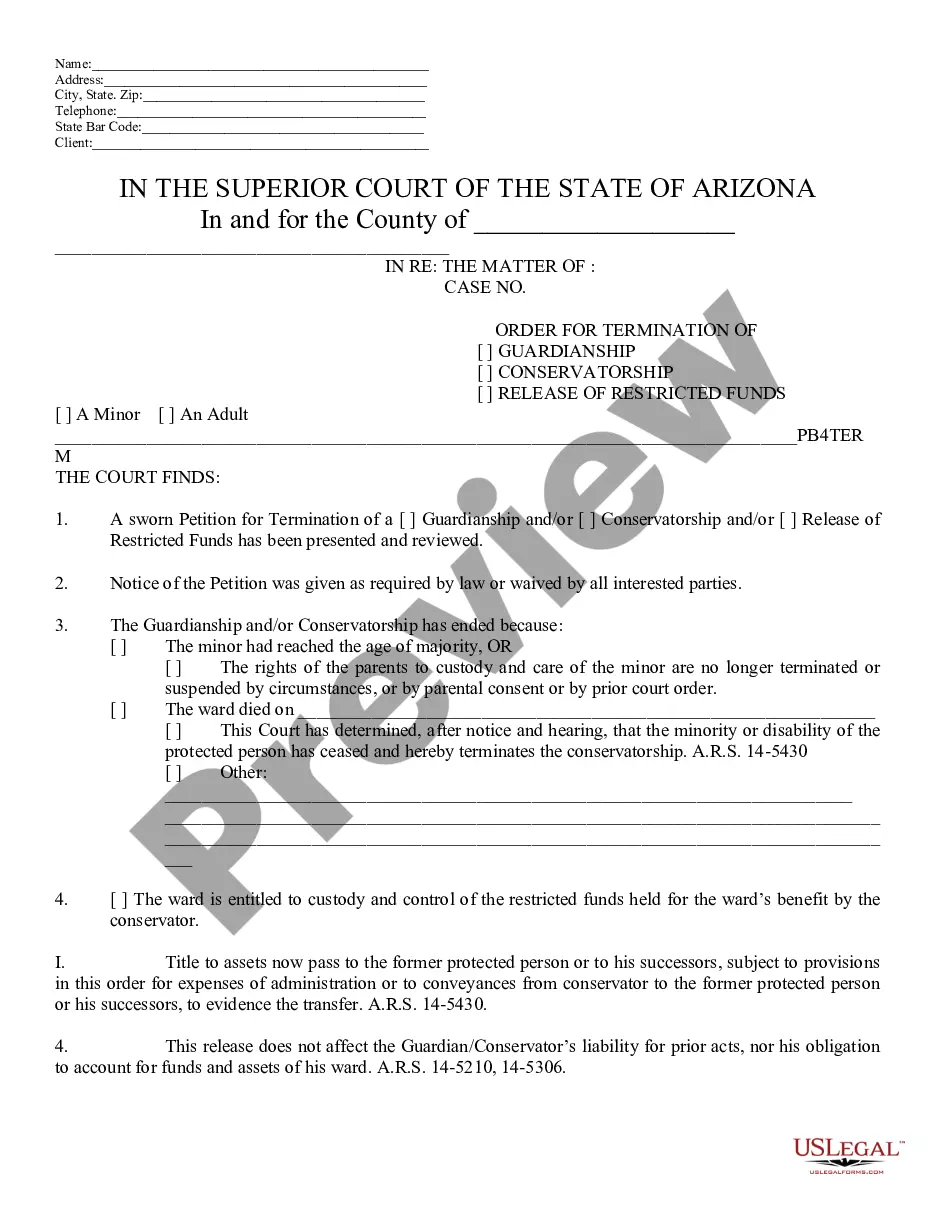

Form components explained

- Title and Condition: Specifies the legal state of the property and any existing claims.

- Permitted Uses: Describes how the premises can be used and obligations of the tenant regarding compliance with laws.

- Taxes: Outlines the tenant's responsibility for all real estate taxes during the lease term.

- Destruction of Premises: Addresses responsibilities for repairs if the property is damaged.

- Subletting or Assignment: Sets conditions under which the tenant may transfer rights under the lease.

- Repairs and Maintenance: Obligates the tenant to keep the property in good condition, at their own expense.

Common use cases

This form should be used when landlords want to lease property while transferring responsibilities for property expenses to the tenant. It is ideal for commercial property owners who seek stable income and businesses willing to manage property costs. It's particularly useful when the landlord desires less involvement in property management.

Who should use this form

- Landlords looking to lease commercial property with specific expense responsibilities.

- Businesses that require space and are capable of managing property maintenance and expenses.

- Real estate professionals seeking a standard lease format that includes cost-sharing terms.

Steps to complete this form

- Identify the parties involved: Clearly state the landlord's and tenant's names and addresses.

- Specify the property: Describe the lease property precisely, including the address and any specific features.

- Enter the lease term: Define the start and end dates of the lease agreement.

- Detail payment responsibilities: Outline the rent and specify the tenant's responsibilities for taxes, insurance, and maintenance.

- Sign and date the lease: Both parties should sign to make the agreement legally binding.

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to specify all expenses that the tenant is responsible for, leading to confusion later.

- Not ensuring that the lease complies with local laws, which can affect enforceability.

- Missing the signatures of both parties, resulting in an invalid agreement.

Advantages of online completion

- Convenient access: Download and complete the form at your own pace from anywhere.

- Editability: Customize the document to meet specific needs and circumstances before finalizing.

- Reliability: Ensure that the form is prepared by licensed attorneys to meet legal requirements.

Looking for another form?

Form popularity

FAQ

A triple net lease is one of three types of net leases, a type of real estate lease where a tenant pays one or more additional expenses. Net leases generally include property taxes, property insurance premiums, or maintenance costs, and are often used in commercial real estate.

With a triple net lease, the tenant agrees to pay the property expenses such as real estate taxes, building insurance, and maintenance in addition to rent and utilities.A single net lease on a commercial property includes property taxes in addition to rent.

A net lease is a real estate lease in which a tenant pays one or more additional expenses.Double net leases include property taxes and insurance premiums, in addition to the base rent. A triple net lease includes property taxes, insurance, and maintenance costs, in addition to the base rent.

Net lease expenses payable by the tenant are typically divided into three categories: property taxes, insurance, and common area maintenance.

As the triple net property owner (unless otherwise specified in the NNN lease), you'll generally be responsible for maintaining and repairing these 3 main aspects of your building: Roof (repairs, maintenance, upgrades) Exterior Walls. Utility Repairs and Upkeep (for major things such as plumbing and electricity)

An NNN lease is the most common type of commercial lease and is commonly called a triple net lease. On an NNN lease, tenants pay additional expenses in addition to the lease fee, to the landlord or lessor. The NNN fees includes property taxes, property insurance and common area maintenance for a building (CAM).

The most obvious benefit of using a triple net lease for a tenant is a lower price point for the base lease. Since the tenant is absorbing at least some of the taxes, insurance, and maintenance expenses, a triple net lease features a lower monthly rent than a gross lease agreement.

A triple net lease might have some sort of cap, but likely, a tenant would be forced to cover rising taxes and insurance rates. Granted, this might not be much, but it could potentially cost a tenant a substantial amount of capital. Imagine tax or insurance changes over the course of a DECADE; it could be substantial.