Remainder Unitrust Definition

Description

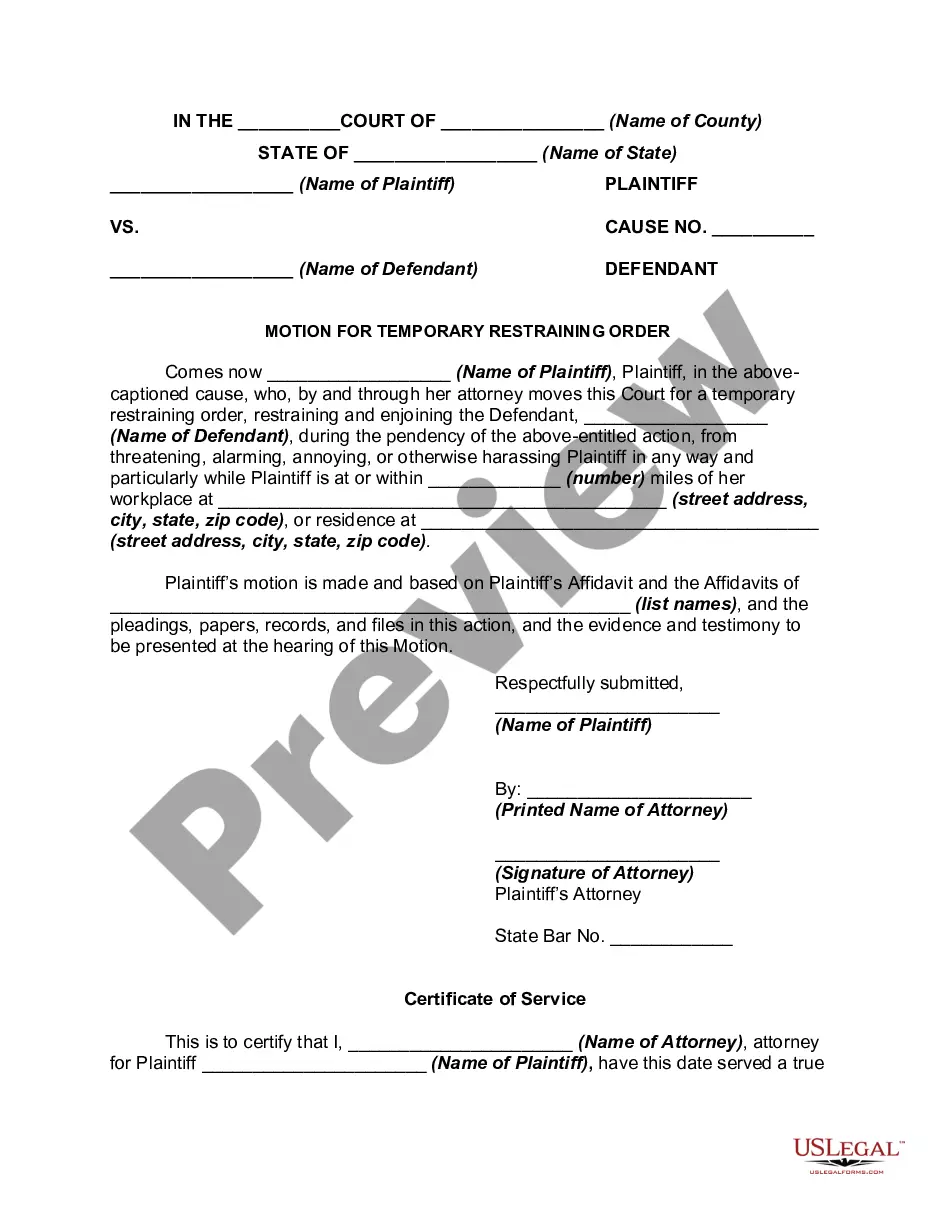

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

- Log in to your existing account at US Legal Forms. Verify that your subscription is active; renew if necessary.

- Preview the available forms to ensure you select the correct one. Pay attention to the local jurisdiction requirements for accuracy.

- If you need a different form, utilize the search function to find alternatives that better suit your needs.

- Purchase the document by clicking the 'Buy Now' button and choose the subscription plan that best fits your requirements.

- Complete the payment process by entering your credit card information or connecting your PayPal account.

- Download your chosen form to your device and access it anytime from the 'My Forms' section of your profile.

Using US Legal Forms empowers both individuals and attorneys by providing a vast library of over 85,000 legal forms. The service not only offers a comprehensive selection but also connects users with premium experts for assistance, ensuring documents are precise and legally sound.

In conclusion, navigating the legal forms landscape doesn't have to be a challenge. With US Legal Forms, securing the documents you need becomes seamless and efficient. Start your process today!

Form popularity

FAQ

Establishing a charitable remainder unitrust involves drafting a trust document that meets legal requirements, including specifying the beneficiaries and the charitable organization involved. It's crucial to work with legal and financial advisors to ensure compliance with all tax and legal aspects. Platforms like USLegalForms offer templates and guidance, making it easier to navigate the process. By understanding the remainder unitrust definition, you can effectively set up a CRUT.

An example of a charitable remainder unitrust would be a donor who contributes real estate valued at $1 million. They choose to receive 6% of the trust's value annually for their lifetime. After their passing, the remaining assets would go to a charity they support. This example illustrates how the remainder unitrust definition helps create lasting benefits for both the donor and the charitable organization.

While a charitable remainder unitrust offers benefits, there are some downsides to consider. Once assets are placed in the trust, they cannot be easily retrieved or redirected, limiting flexibility. Additionally, administrative fees can be high, and complex rules must be followed to retain tax advantages. Understanding the remainder unitrust definition helps in weighing these potential drawbacks against its benefits.

A charitable remainder unitrust operates by converting assets into a trust that provides income to beneficiaries for a specified period or their lifetime. After that period ends, the remaining assets go to the designated charity. This arrangement allows donors to enjoy tax deductions and potential income during their lifetime while supporting a cause they care about. Familiarizing yourself with the remainder unitrust definition can enhance your understanding of its operations.

The 5% rule for a charitable remainder unitrust stipulates that the annual payout to beneficiaries must be at least 5% of the fair market value of the trust's assets, calculated annually. This rule ensures a sustainable income for beneficiaries while also maintaining the trust's growth. Failure to follow this rule may impact the tax benefits associated with a CRUT. Learning the remainder unitrust definition can clarify changes to income over time.

To establish a charitable remainder unitrust (CRUT), the trust must satisfy specific legal criteria outlined in the Internal Revenue Code. The donor must specify a charitable organization that will benefit from the trust upon its termination. Additionally, the unitrust must provide a fixed percentage of its assets to beneficiaries, which must be at least 5%. Understanding the remainder unitrust definition helps ensure compliance with these requirements.

The rules for charitable remainder unitrusts include ensuring that the trust distributes a fixed percentage of its assets annually, adhering to the 10% minimum for charity, and providing clear information about income and assets. These regulations maintain the trust's integrity and ensure beneficiaries and charities receive their respective portions. Familiarizing yourself with these rules is essential to grasping the remainder unitrust definition.

Calculating a charitable remainder trust deduction involves estimating the present value of the charitable interest based on IRS guidelines. You will need to consider parameters such as the trust's expected income, the beneficiary's life expectancy, and the discount rate. Utilize uslegalforms to streamline and guide you through this calculation process, reinforcing your understanding of the remainder unitrust definition.

A charitable remainder unitrust is a type of trust that allows individuals to donate assets, receive income during their lifetime, and leave a portion for charity after their passing. In simple terms, you get regular payments based on the trust's value while supporting your favorite charity. Understanding this remainder unitrust definition can empower more individuals to create impactful legacies.

The 5% rule helps ensure that the income payments from a charitable remainder trust do not exceed 5% of the trust's assets each year. This rule balances providing income to beneficiaries while preserving the trust's principal for charitable purposes. It's an essential component of the remainder unitrust definition that contributes to effective trust management.