Remainder Inter Form Sample With 0

Description

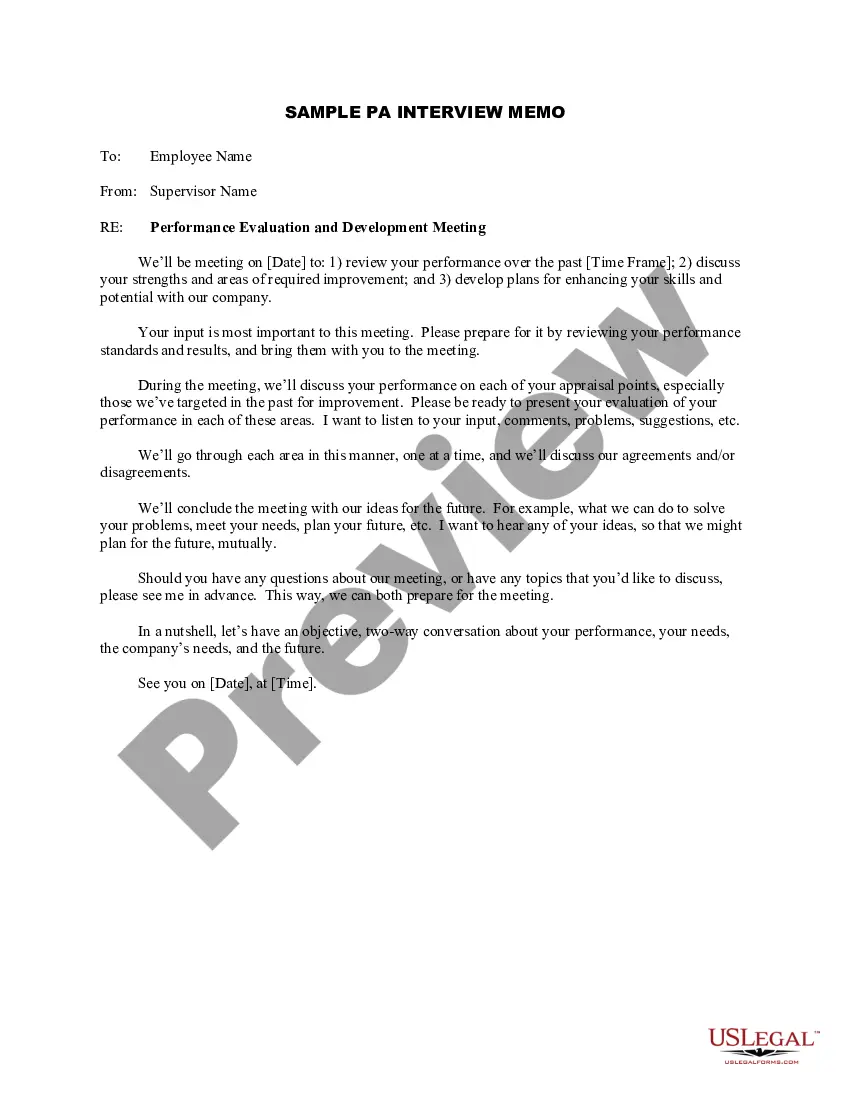

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

- If you're a returning user, start by logging into your account. Ensure your subscription is active; if it's expired, renew it based on your payment plan.

- For first-time users, begin by browsing the Preview mode. Check the form description to confirm it aligns with your local jurisdiction's requirements.

- If you find discrepancies or need a different template, utilize the Search tab at the top of the page to locate the correct form.

- Once you've selected the appropriate document, click on the 'Buy Now' button and choose your preferred subscription plan, creating an account for full access.

- Complete your purchase by entering your payment details—either credit card information or your PayPal account.

- Finally, download your chosen form to your device, allowing you to fill it out and access it anytime through the My Forms section of your profile.

In conclusion, US Legal Forms provides a powerful solution for accessing a wide selection of legal documents swiftly and easily. Their comprehensive library and expert assistance ensure that you create legally sound forms tailored to your needs.

Start your journey today by exploring our vast collection!

Form popularity

FAQ

IRS Form 5227 is designed for reporting the financial activities of charitable remainder trusts. This form captures details about income, deductions, and distributions made to beneficiaries. If you are navigating this area, consider using a remainder inter form sample with 0 for reference, ensuring accurate reporting.

You need to file a 1041 if the estate or trust has generated income, or if the gross income exceeds a certain threshold. It's essential to review the trust or estate's income and distributions carefully. For a clearer understanding, a remainder inter form sample with 0 can serve as a helpful tool.

Form 709, which covers gifts over the annual exclusion limit, does not need to be filed with Form 1040. However, if you have substantial gifts to report, you should prepare each form according to your specific tax situation. A remainder inter form sample with 0 can give you insight into how these forms interrelate.

To report no income, you typically need to file Form 1040, indicating there was no income for the tax year. In some situations, you can also use a 1041 if it applies to an estate or trust with zero income. A remainder inter form sample with 0 might help illustrate this process and facilitate your filing.

In most cases, if an estate or trust is required to file a 1041, it will also need to include a 5227 if it manages a CRUT. Each form addresses different financial details, so it is essential to handle both correctly. A remainder inter form sample with 0 could aid in deciphering these specific requirements.

Yes, a charitable remainder unitrust (CRUT) is required to file a tax return, specifically a 5227 form. This form provides detailed information about the trust's income and distributions. Utilizing a remainder inter form sample with 0 can simplify this process, ensuring compliance with tax obligations.

The 1041 form is for estates and trusts, while the 5227 form is specifically for charitable remainder trusts. Both forms require specific income reporting, but they cater to different financial structures. A remainder inter form sample with 0 can help clarify their unique requirements.

You must file a 1041 form if you represent an estate or a trust that has generated income. This tax form documents the income, deductions, and distributions for the estate or trust. If you're dealing with a remainder interest, a remainder inter form sample with 0 may come in handy in understanding your filing obligations.