Charitable Remainder Trust To Private Foundation

Description

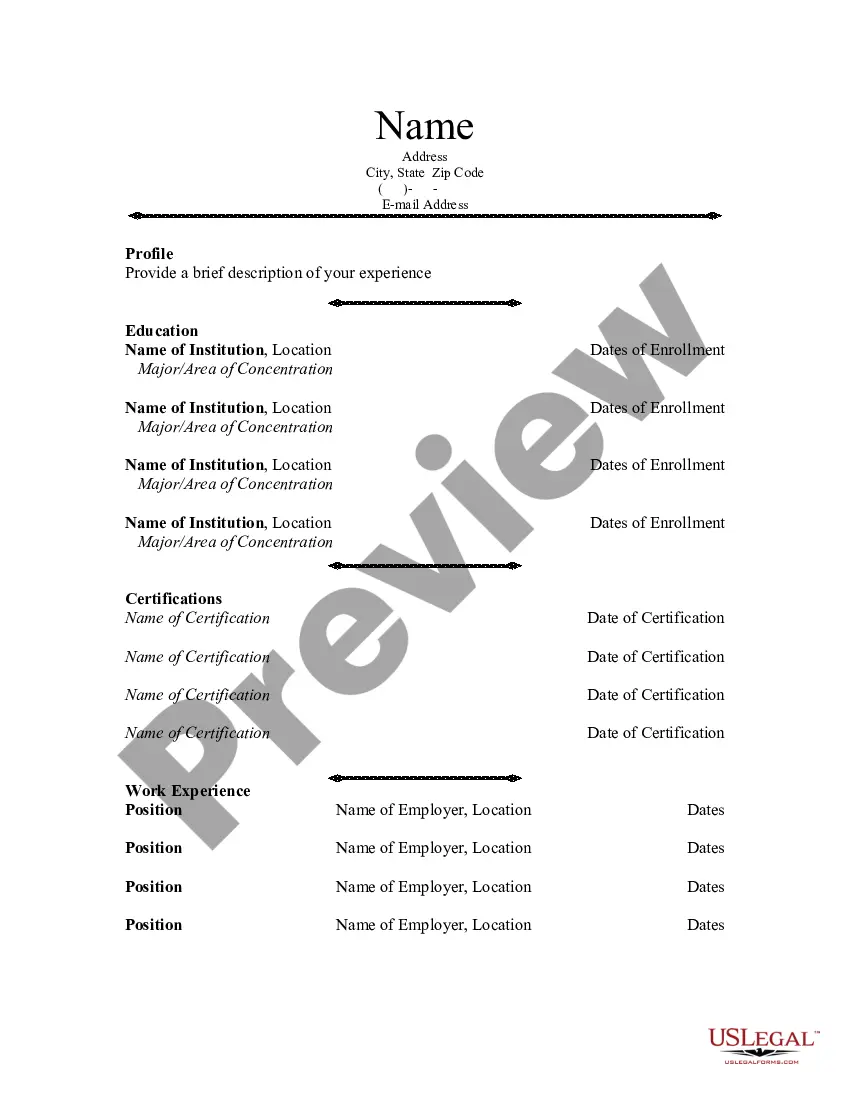

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

Regardless of whether for commercial objectives or personal affairs, every individual must confront legal circumstances at some time in their lifetime. Completing legal paperwork demands meticulous consideration, starting from the choice of the correct form template.

For example, selecting an incorrect version of the Charitable Remainder Trust To Private Foundation will result in its rejection upon submission. Thus, it is crucial to have a reliable source for legal documents such as US Legal Forms.

With a vast array of US Legal Forms available, you no longer need to waste time searching for the correct template online. Utilize the library’s intuitive navigation to locate the suitable template for any situation.

- Acquire the template you require by using the search bar or browsing the catalog.

- Review the form’s description to ensure it meets your circumstances, state, and county.

- Click on the form’s preview to examine it.

- If it is not the appropriate document, utilize the search option to find the Charitable Remainder Trust To Private Foundation template you need.

- Download the file if it aligns with your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- In case you do not yet have an account, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the registration form for your profile.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the format you wish for the document and download the Charitable Remainder Trust To Private Foundation.

- After downloading, you can complete the form using editing software or print it out and fill it in manually.

Form popularity

FAQ

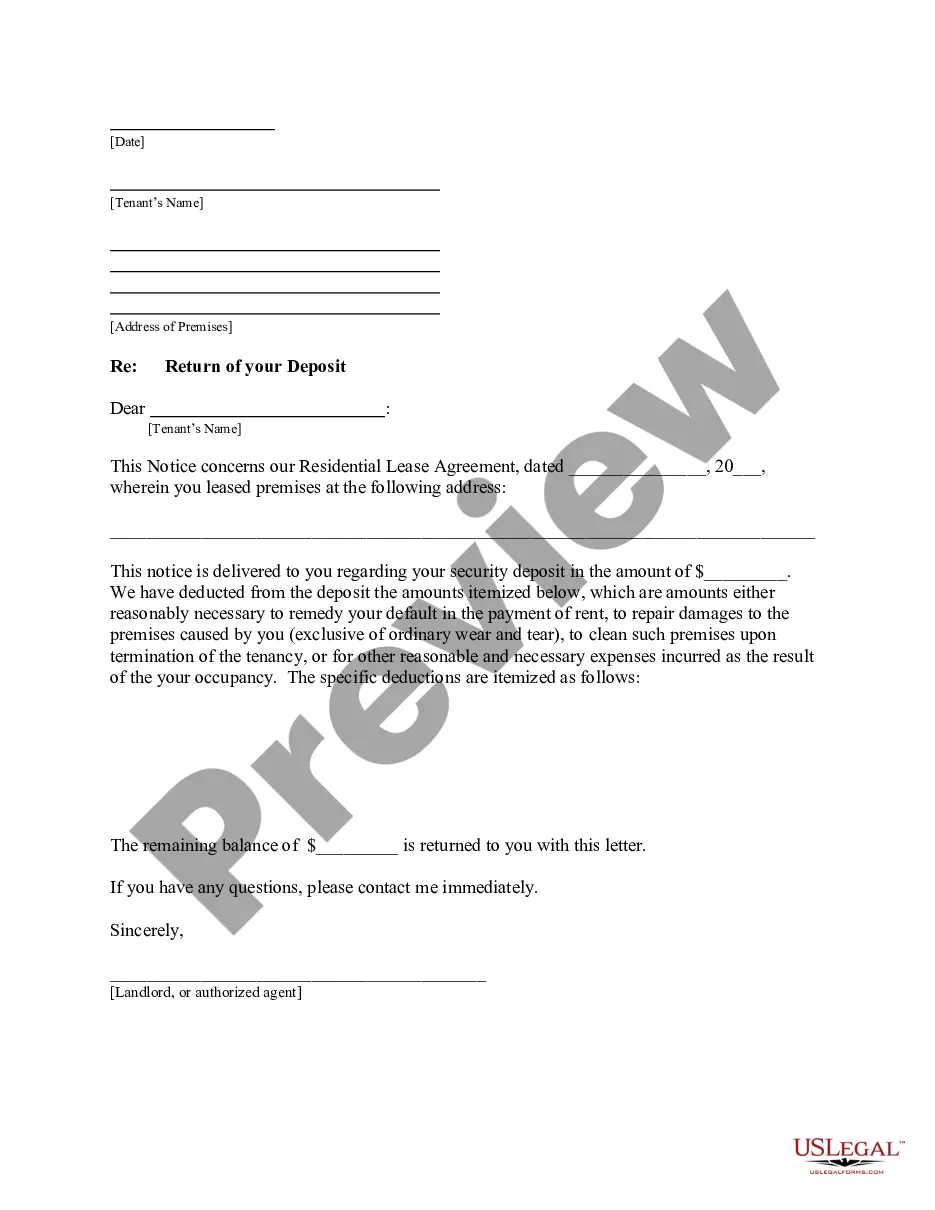

The 5% rule for a charitable remainder trust (CRT) ensures that at least 5% of the trust's initial fair market value is distributed annually to the income beneficiaries. This distribution helps maintain the trust's charitable intentions while providing regular income. Understanding this rule is vital for successful trust management as you decide to move funds from a charitable remainder trust to a private foundation. Resources like US Legal Forms can offer valuable insights into managing these assets.

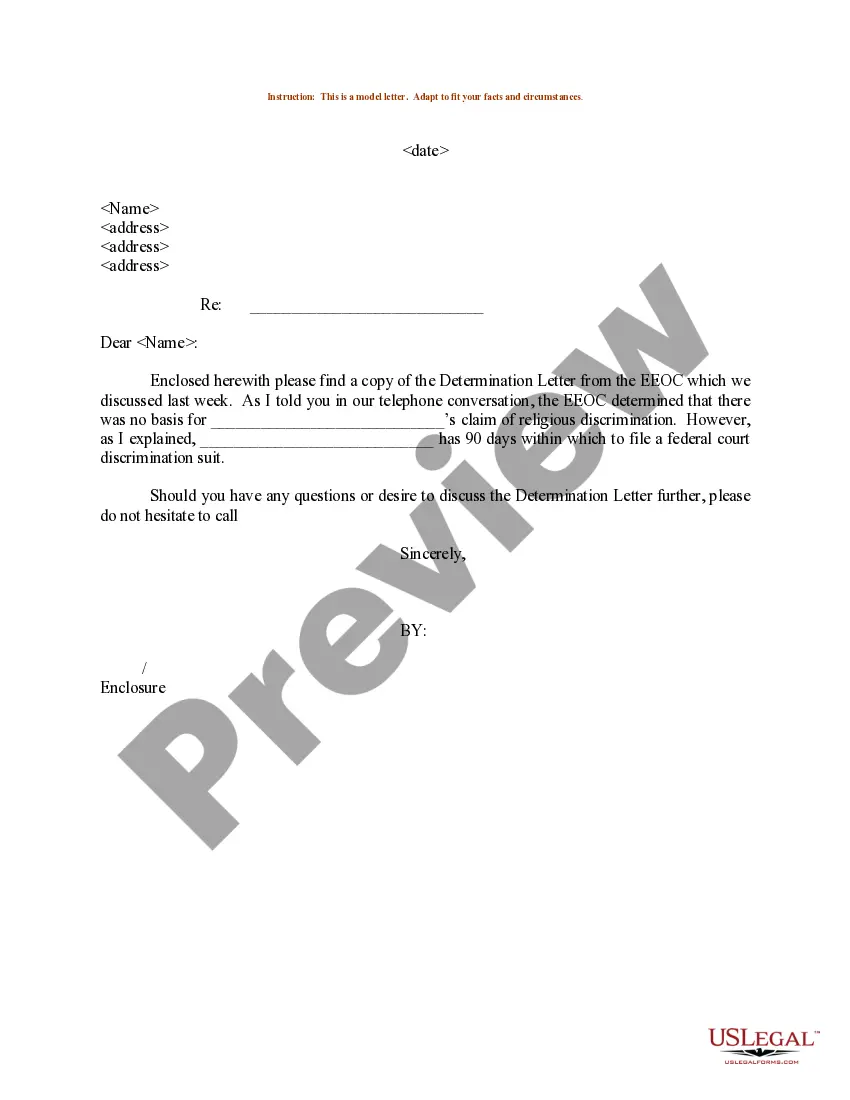

Yes, a private foundation can be named as a beneficiary of a charitable remainder trust. This setup allows for a strategic approach to charitable giving, enabling you to benefit from the income generated during your lifetime while supporting your foundation. However, consider the implications on tax deductions and reporting requirements when structuring this arrangement. Utilizing services like US Legal Forms can guide you through this process effectively.

The 5% rule refers to the minimum payout requirement for a charitable remainder trust, which must distribute at least 5% of its assets annually. This rule ensures that the trust effectively benefits both the income beneficiaries and the charitable organization over time. When planning your charitable contributions, it's crucial to balance your income needs with fulfilling your charitable objectives. Using a platform like US Legal Forms can help you understand this rule as you transition from a charitable remainder trust to a private foundation.

A Qualified Charitable Distribution (QCD) cannot go directly to a private foundation. QCDs are permitted only for qualified charities that meet IRS requirements. If you're considering a charitable remainder trust to private foundation strategy, it's vital to structure your giving appropriately. Consulting with a financial advisor can help you navigate these rules effectively.

Choosing between a foundation and a charitable remainder trust involves understanding your financial and philanthropic goals. A charitable remainder trust offers immediate tax benefits and allows you to receive income for a set period. On the other hand, a private foundation offers more control over your donations but typically requires more administrative oversight. Assessing your priorities will help you decide which option aligns best with your intentions to transition assets from a charitable remainder trust to a private foundation.

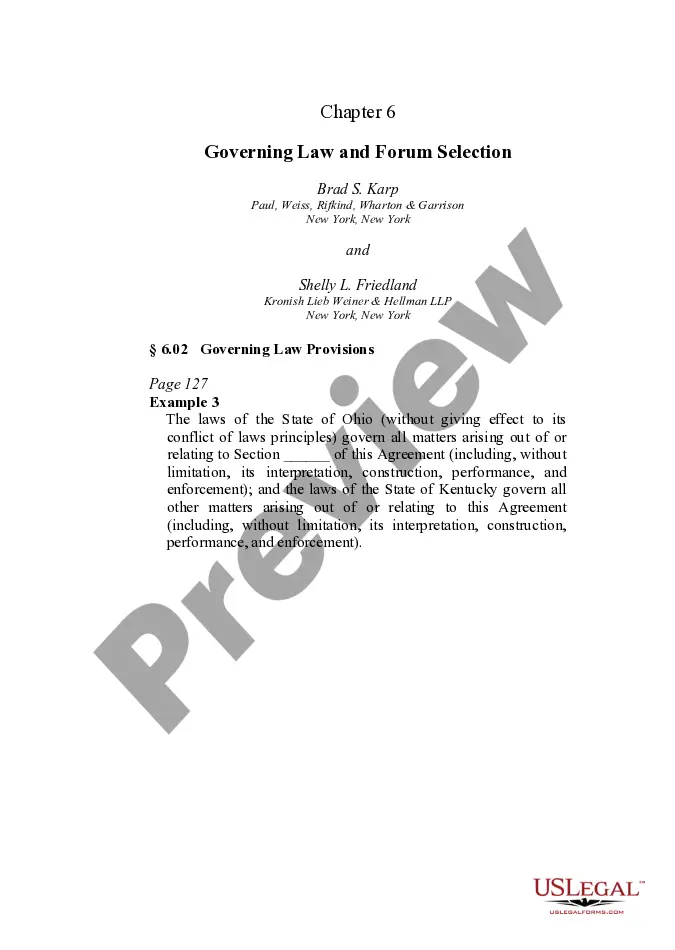

A charitable trust and a foundation are not the same, although they may share similar goals. A charitable trust is a legal arrangement where assets are held for charitable purposes, typically benefiting the public. In contrast, a private foundation is an independent entity that typically gives grants to charities. When exploring options like a charitable remainder trust to a private foundation, understanding this distinction is crucial.

Charitable trusts are not classified as private foundations. While both serve charitable interests, a charitable trust is often governed by a trust agreement and focuses on specifying how assets are managed and distributed. In contrast, a private foundation operates as a nonprofit entity granting funds to support charitable activities. Understanding these definitions is crucial for making informed decisions about charitable giving. Turn to US Legal Forms to access tools that simplify your legal setup.

No, a charitable trust cannot operate as a foundation, as they represent different legal entities. A charitable trust focuses on managing and distributing assets for its stated charitable purpose, whereas a foundation is typically a nonprofit that grants funds to support various causes. Each serves its purpose uniquely, so it is essential to choose the right vehicle based on your charitable intentions. For more details on setting these up, US Legal Forms offers useful guides.

Charitable remainder trusts are generally not subject to private foundation rules because they function differently. While a private foundation is a type of nonprofit organization, a charitable remainder trust serves to provide income to beneficiaries and support charitable organizations thereafter. However, tax regulations still apply, and understanding these nuances can help in effective planning. If you wish to learn more, resources on US Legal Forms can provide clarity on compliance.

Charitable remainder trusts must adhere to specific IRS guidelines to maintain their tax-exempt status. The trust must provide at least a 5% income distribution to the non-charitable beneficiaries, and it should distribute its remaining assets to designated charities upon termination. These structures allow for significant tax benefits while supporting charitable goals during your lifetime. For guidance in setting up a charitable remainder trust, explore the tools available on US Legal Forms.