Charitable Form Trust File With Irs

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

- Log in to your US Legal Forms account. If you don't have an account, create one to gain access to thousands of legal documents.

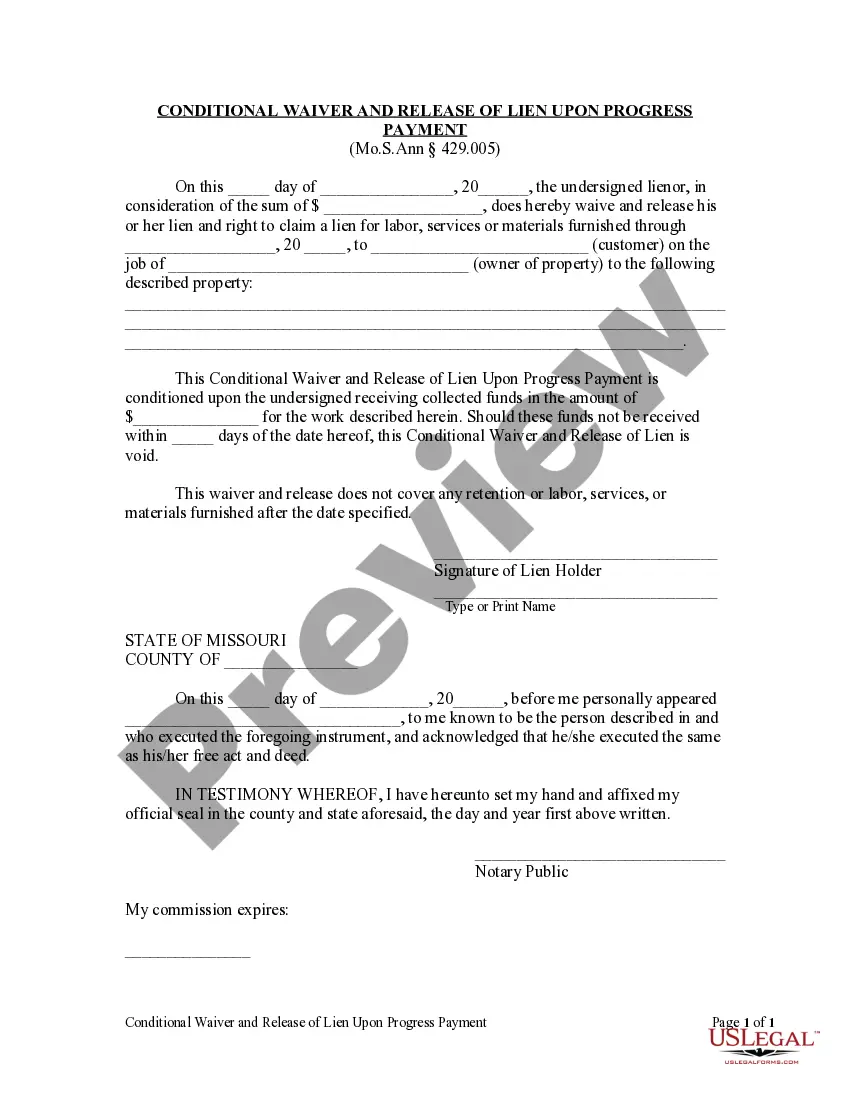

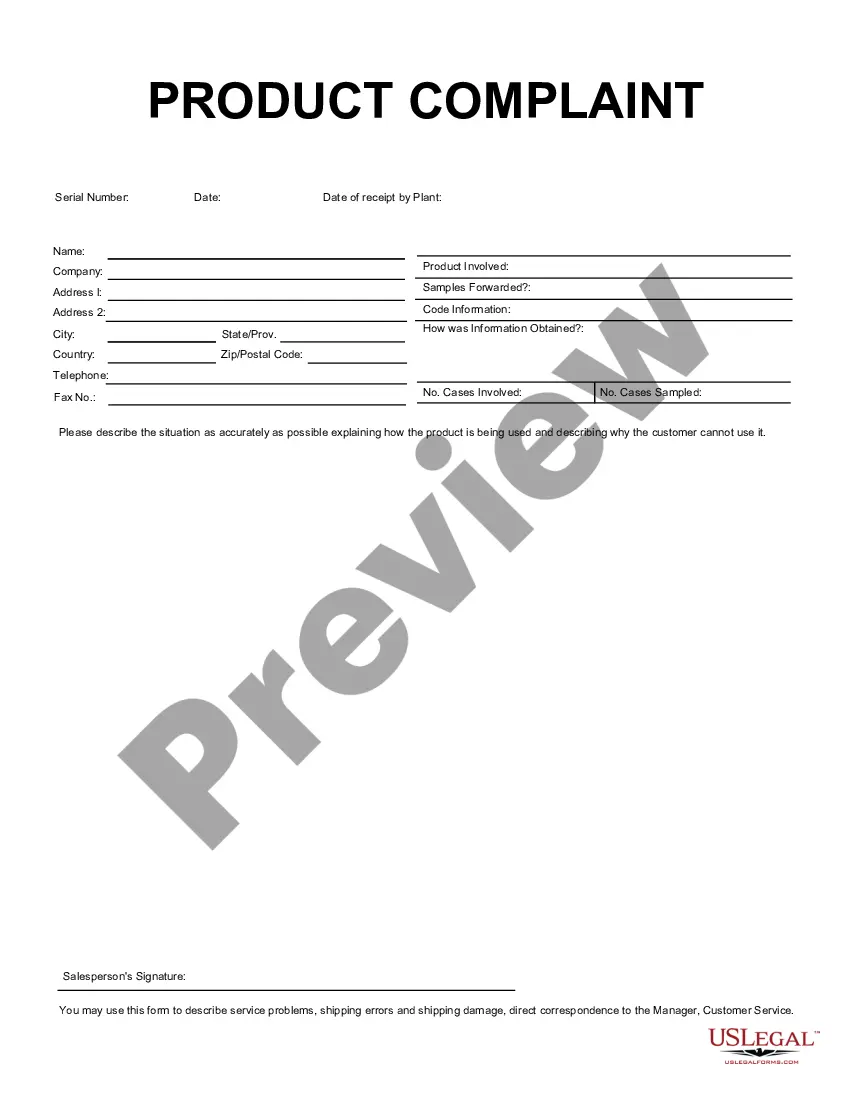

- Search for the charitable form trust template. Utilize the preview mode to ensure the template aligns with your specific needs and jurisdiction.

- If the initial document does not meet your requirements, use the Search feature to find a more suitable template.

- Select your preferred subscription plan to purchase the document, ensuring continuous access to form resources.

- Enter your payment details, either via credit card or PayPal, to complete your subscription.

- Download the completed form directly to your device and refer to the 'My Forms' section in your account for future access.

Completing your charitable form trust efficiently is crucial for maintaining your organization’s compliance and status with the IRS. US Legal Forms stands out with its extensive library and premium expert assistance, ensuring accuracy in all documentation.

Don’t wait any longer—start your journey to compliance today with US Legal Forms and secure your charitable form trust with the IRS effortlessly!

Form popularity

FAQ

Yes, you can file an IRS form 1041 electronically, which simplifies the process of managing your charitable form trust file with IRS. By e-filing, you can reduce the chances of errors, speed up the processing time, and receive confirmation of your submission quickly. This method is efficient and allows for better tracking of your filings. Utilizing platforms like USLegalForms can enhance your experience, offering tools that guide you through each step of the filing process.

Form 5227 must be filed by the trustees of charitable remainder trusts, charitable lead trusts, and other split-interest trusts. If your trust has charitable and non-charitable beneficiaries, you should ensure that this form is completed annually. Using platforms like uslegalforms can help you access resources and tools necessary for managing your charitable form trust file with IRS efficiently.

For most trusts, you'll file Form 1041, the U.S. Income Tax Return for Estates and Trusts. However, if you're dealing with a charitable trust, you'll specifically need Form 5227. By understanding the right forms to use, you can simplify the process of maintaining your charitable form trust file with IRS and ensure all obligations are met.

The IRS form for a charitable trust is Form 5227, also known as the Split-Interest Trust Information Return. This form is essential for reporting the activities of a charitable trust that holds both charitable and non-charitable interests. Properly completing and submitting this form allows you to maintain compliance and effectively manage your charitable form trust file with IRS.

Yes, you can file Form 5227 electronically. The IRS allows the electronic submission of this form, which makes the process more efficient and streamlined. By using tax software or IRS-approved e-filing services, you can easily manage your charitable form trust file with IRS. This method also helps in reducing errors and ensuring timely submission.

Yes, a charitable lead trust typically files Form 1041 to report its income and distributions. As the trust generates income, it's necessary to maintain compliance with IRS requirements. Utilizing the resources available at uslegalforms can help streamline this process, ensuring you file correctly and on time.

A charitable trust primarily files Form 1041 if it has taxable income or is required to report its finances. In some cases, if the trust has received 501(c)(3) status, it may file Form 990 instead. The choice of form depends on the trust’s structure and income, thereby emphasizing the importance of understanding your tax obligations.

Form 1041 must be filed by estates and trusts that have any taxable income or need to report certain gains. If your charitable trust has income, you are obligated to file this form. Using resources from uslegalforms can help simplify the filing process and ensure compliance with IRS regulations.

To obtain an IRS transcript for your trust, you can use the IRS's online Get Transcript tool or submit Form 4506-T. The transcript provides important information needed for filing and verifying the charitable form trust file with the IRS. Keeping track of transcripts can be beneficial for future tax preparations.

You can file IRS Form 1041 electronically using various tax software programs approved by the IRS. Electronic filing simplifies the process and can help you avoid common mistakes. Ensure that you have the necessary information ready so you can efficiently complete your charitable form trust file with the IRS.