Agreement Between Partnership For Restaurant Business In Florida

Description

Form popularity

FAQ

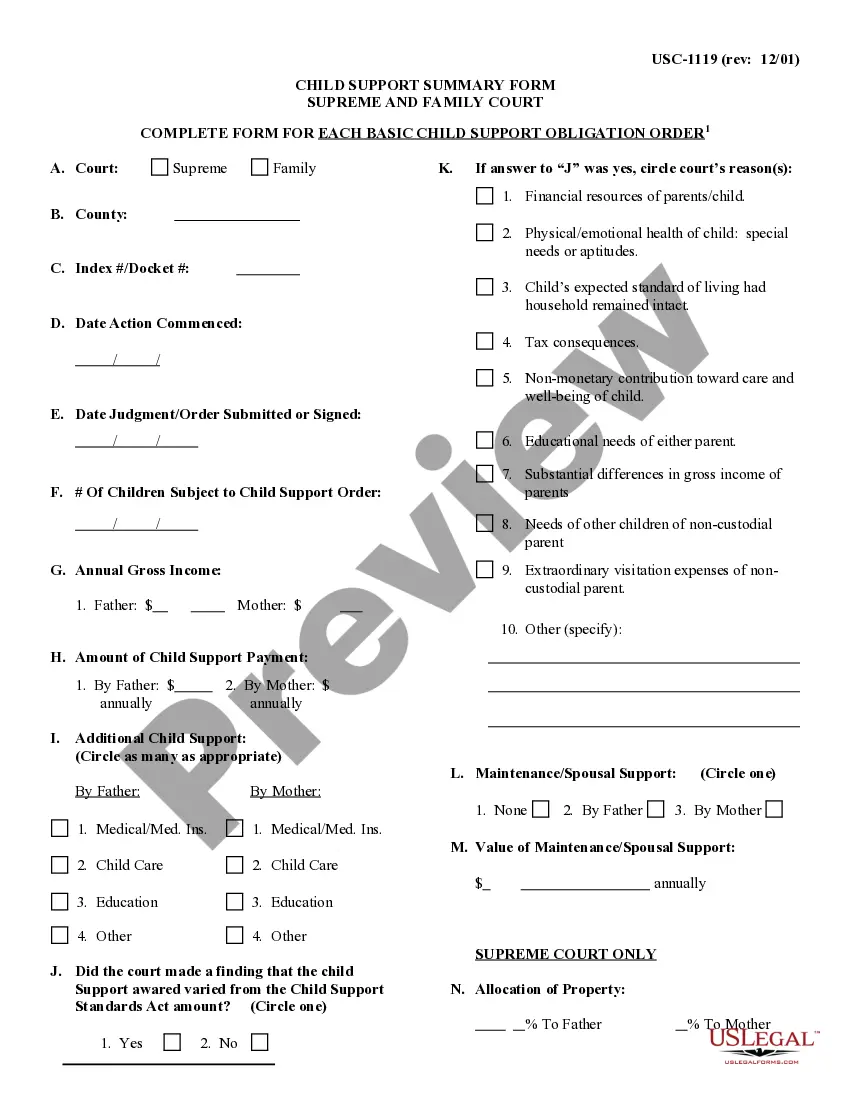

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell out how disputes are to be adjudicated and what happens if one of the partners dies prematurely.

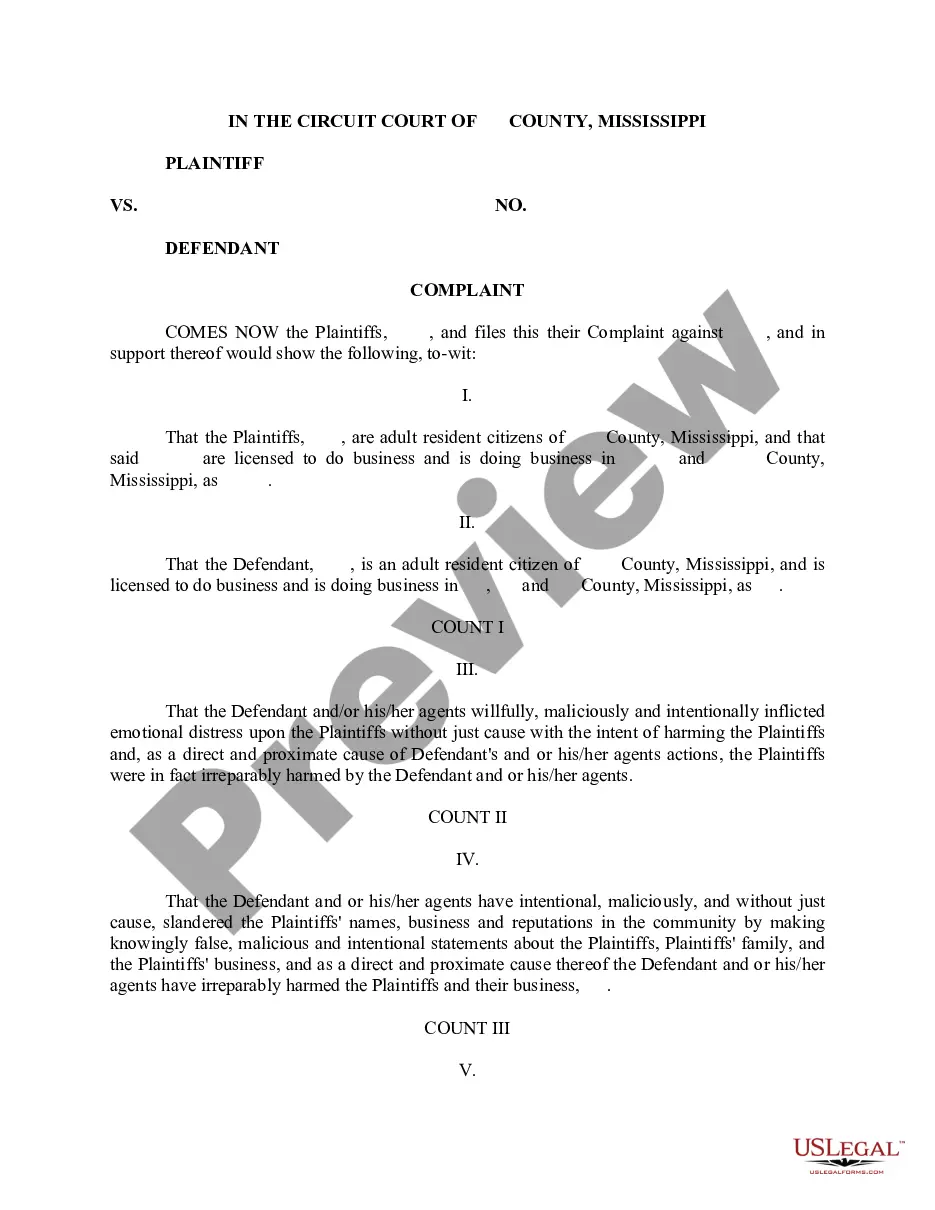

To draft a contract from scratch, start by identifying the parties involved and clearly outlining the agreement. Include consideration (what is exchanged), define the terms and conditions, ensure all parties are legally competent, and finalise it with signatures. These essential elements make the contract enforceable.

The parties hereto hereby form a Partnership under the name and style of _______________________________________________ (hereafter referred to as "the Partnership") to own real property, develop real property, and thereafter to manage, operate, develop, mortgage, lease or sell real property and do all other lawful ...

How to Write a Partnership Agreement Define Partnership Structure. Outline Capital Contributions and Ownership. Detail Profit, Loss, and Distribution Arrangements. Set Decision-Making and Management Protocols. Plan for Changes and Contingencies. Include Legal Provisions and Finalize the Agreement.

How to Write a Partnership Agreement Define Partnership Structure. Outline Capital Contributions and Ownership. Detail Profit, Loss, and Distribution Arrangements. Set Decision-Making and Management Protocols. Plan for Changes and Contingencies. Include Legal Provisions and Finalize the Agreement.

Kickstart your new business in minutes There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP). A fourth, the limited liability limited partnership (LLLP), is not recognized in all states.

The three different types of partnership are: General partnership. Limited partnership. Limited liability partnerships.

Forming a Partnership in Florida Choose a business name for your partnership and check for availability. Register the business name with local, state, and/or federal authorities. Draft and sign a partnership agreement. Obtain any required local licenses.

Every partnership doing business, earning income, or existing in Florida that has a partner subject to the Florida Corporate Income/Franchise Tax must file Florida Form F-1065. A limited liability company is considered a partnership if classified as a partnership for federal income tax purposes.