Factoring Agreement Editable Form 2-t In Illinois

Description

Form popularity

FAQ

To add a changing, or remote, sales location: Log in to your MyTax Illinois account and select 'View More Account Options' in the ST-1 account. Under the "Account Maintenance Section", select the 'Maintain Locations' link. Select 'Next' until you reach the "Add Changing Location Site" tab.

In some states, sales tax rates, rules, and regulations are based on the location of the seller and the origin of the sale (origin-based sourcing). In others, sales tax is based on the location of the buyer and the destination of the sale (destination-based sourcing). Illinois generally uses destination-based sourcing.

Most general maintenance can be completed electronically using MyTax Illinois which allows you to update legal and mailing address information, responsible party, owners/officers and members/managers (for Limited Liability Companies), contact information, and cease tax accounts.

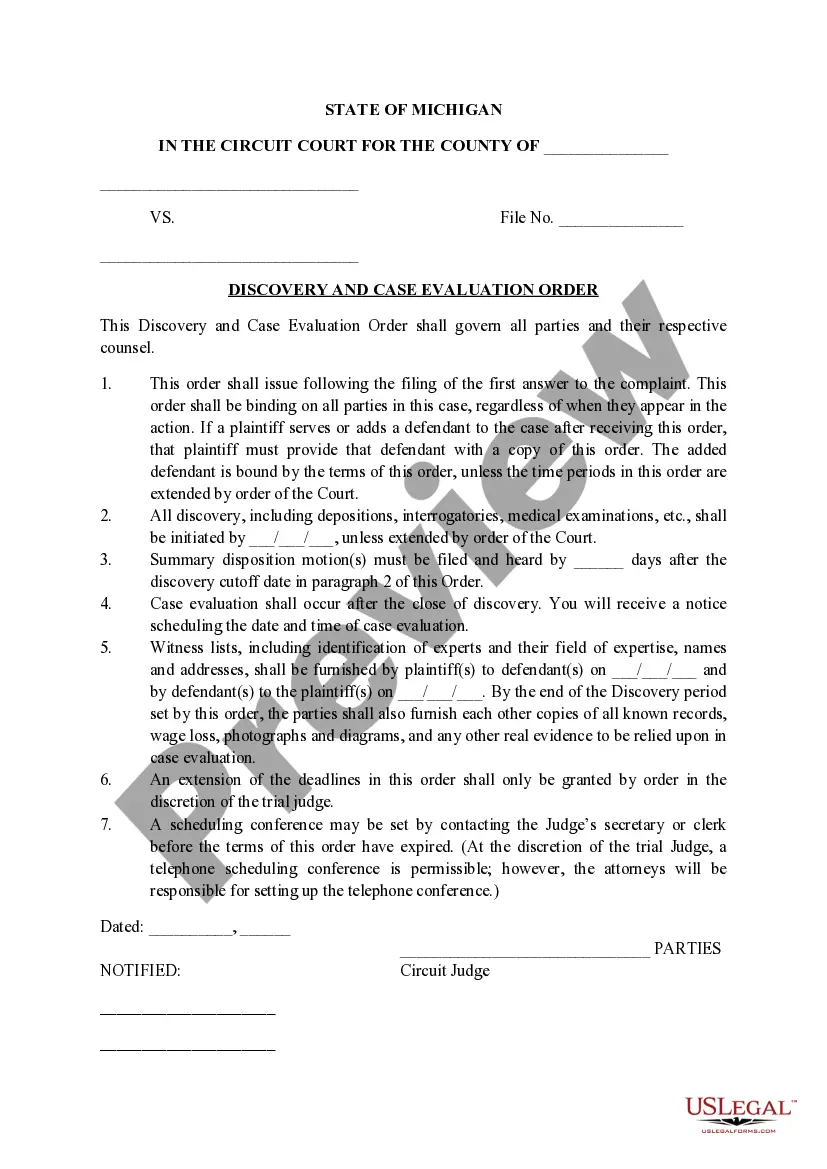

The factoring agreement will also include representations that each factored account is bona fide and represents indebtedness incurred by the customer for goods actually sold and delivered to the customer; that there are no setoffs, offsets, or counterclaims against the account; that the account does not represent a ...

If you have successfully enabled pop-ups in your browser and are still having trouble accessing these MyTax Illinois features, you can call us at 1 800 732-8866 or 217 782-3336 or email us at Rev.MyTaxHelp@illinois.

If you have already filed, you may call us at 800 732-8866 to update the address while verifying tax information from your account with a representative. Call with a copy of your previously filed IL-1040 or with a notice you received.