Difference Between Factoring And Assignment

Description

How to fill out General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may necessitate extensive research and significant financial investment.

If you're looking for a more straightforward and economical approach to preparing Difference Between Factoring And Assignment or any other forms without unnecessary complications, US Legal Forms is always accessible.

Our online assortment of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal affairs.

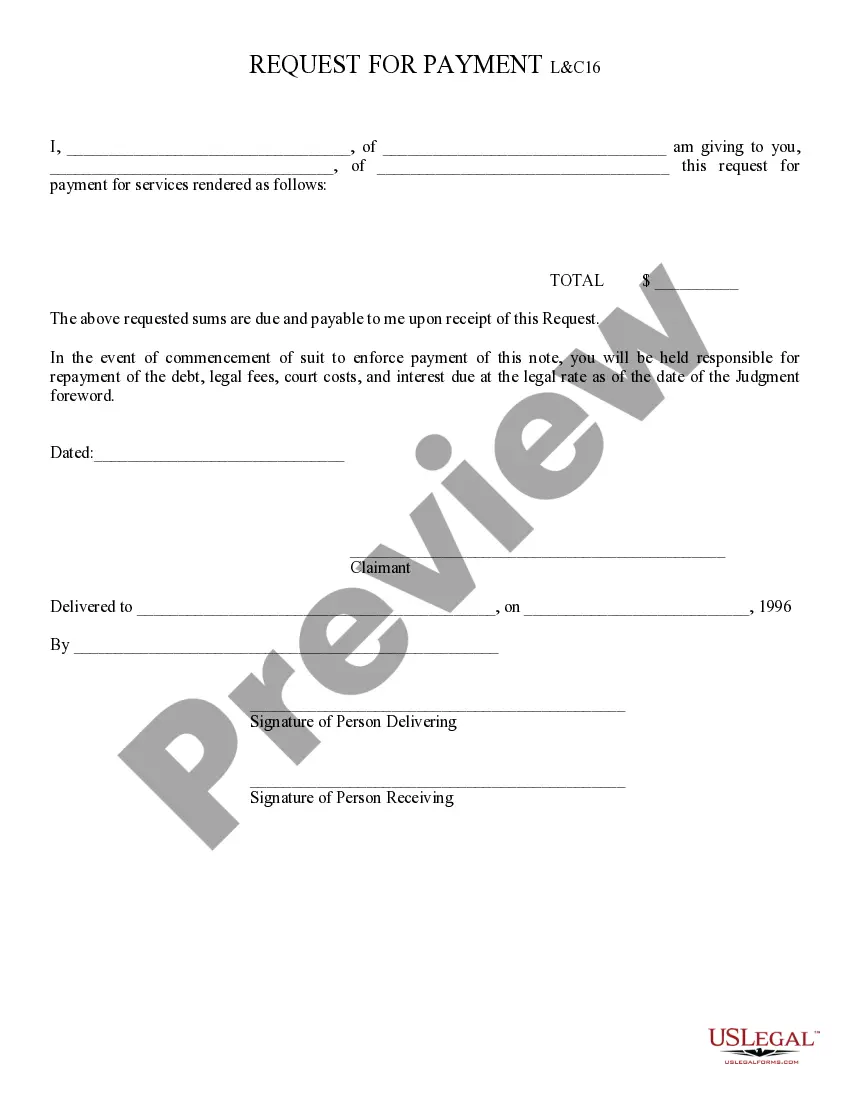

Examine the form preview and descriptions to ensure you are looking at the correct document. Verify if the template you select meets the standards of your state and county. Choose the most appropriate subscription option to purchase the Difference Between Factoring And Assignment. Download the file, then complete, sign, and print it out. US Legal Forms has a solid reputation and over 25 years of expertise. Join us today and make document execution a simple and efficient process!

- With just a few clicks, you can promptly obtain state- and county-compliant templates meticulously crafted by our legal experts.

- Utilize our platform whenever you require a dependable and trustworthy service to easily find and download the Difference Between Factoring And Assignment.

- If you're familiar with our website and have previously created an account, simply Log In, select the form, and download it or re-download it later from the My documents tab.

- Not registered yet? No worries. It takes minimal time to create an account and browse the catalog.

- But before proceeding to download the Difference Between Factoring And Assignment, adhere to these suggestions.

Form popularity

FAQ

The notice of assignment or NOA is a simple letter that the factoring company sends to the debtors. It is used to inform them that the financial rights to invoices issued by the original lender (the factoring client) are sold to and adapted by the factoring company.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

What is an assignment of an invoice? It is the process that takes place to legally assign the rightful ownership of the selected invoice to another party, typically by sending a Notice of Assignment (NOA) letter to your customer to inform them of this.

The assignment procedure makes no distinction between long-term and short-term accounts receivable, unlike factoring, which only applies to short-term accounts receivable, defined as those maturing within one year from the sale of goods or provision of services.

When a company is factoring their invoices, what they are agreeing to do is assign their accounts receivables to their factoring company, who in turn has the right to collect payments for those invoices. The Notice of Assignment is the document used to alert your customers that this change in ownership has taken place.