Factoring Agreement Investopedia Format In Allegheny

Description

Form popularity

FAQ

The process of finding factors of a given value or mathematical expression is called factorisation. Factors are the integers that are multiplied to produce an original number. For example, the factors of 18 are 2, 3, 6, 9 and 18, such as; 18 = 2 x 9.

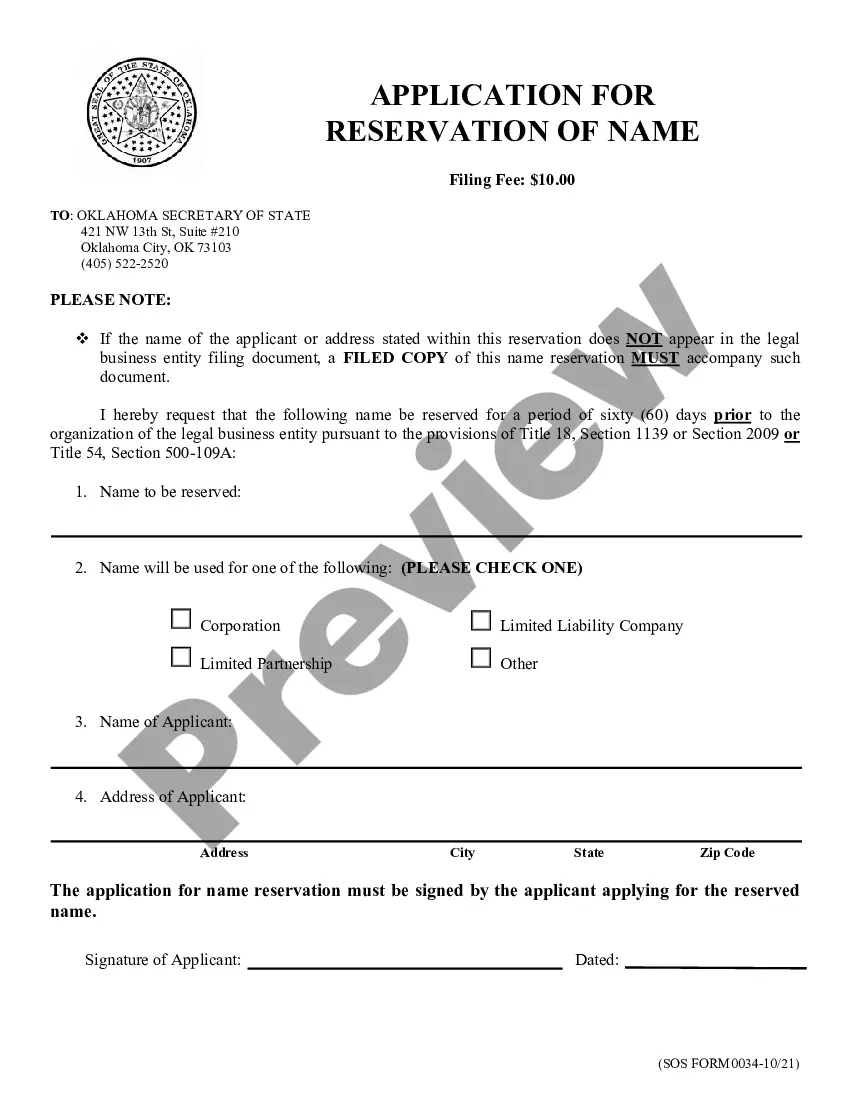

Documents you will have to provide: Factoring application. Articles of Association or registered Amendments to the Articles of Association of your company. Annual report for the previous financial year. Financial report (balance sheet andf profit/loss statement) for the current year (for 3, 6 or 9 months, respectively)

Factor expressions, also known as factoring, mean rewriting the expression as the product of factors. For example, 3x + 12y can be factored into a simple expression of 3 (x + 4y). In this way, the calculations become easier. The terms 3 and (x + 4y) are known as factors.

In mathematics, factorization or factoring is the breaking apart of a polynomial into a product of other smaller polynomials. If you choose, you could then multiply these factors together, and you should get the original polynomial (this is a great way to check yourself on your factoring skills).

The Most Common Invoice Factoring Requirements A factoring application. An accounts receivable aging report. A copy of your Articles of Incorporation. Invoices to factor. Credit-worthy clients. A business bank account. A tax ID number. A form of personal identification.

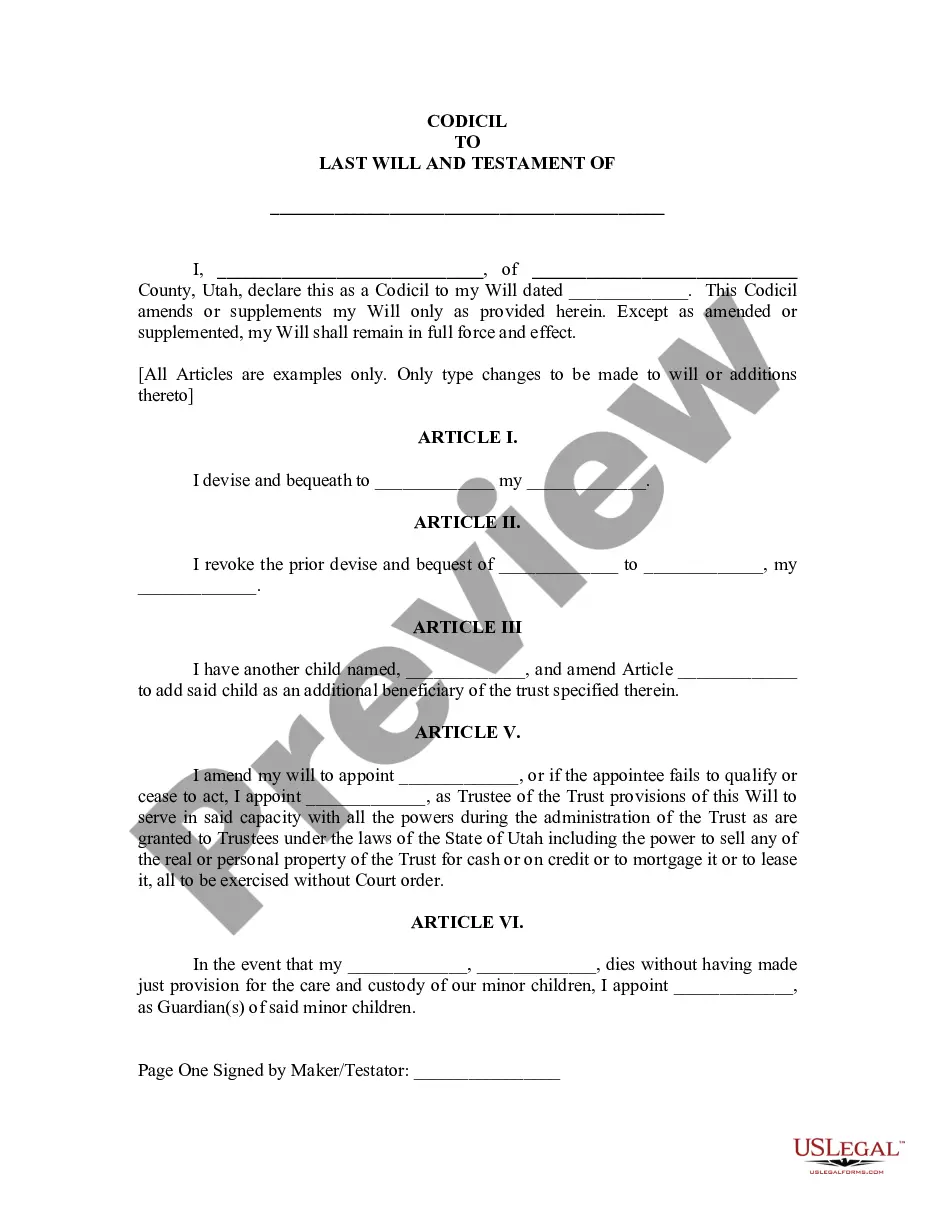

What is Process of Factoring? Factoring is a financial transaction in which a business sells its accounts receivable (invoices) to a third party, called a factor, at a discount.