Co-ownership Agreement Example In Massachusetts

Description

Form popularity

FAQ

Choosing the Right Type of Co-Ownership While joint tenancy and tenancy in common are widely recognised as the most common types of co-ownership, the increasing popularity of fractional ownership, made possible at August, shows that there is a growing diversity in how people approach property ownership.

Co-ownership might entail more complex legal agreements, specifically outlining each party's rights and responsibilities. Joint property ownership usually involves a simpler, more standardised agreement.

Community property under California state law, such as real estate purchased during a marriage or domestic partnership, is a joint tenancy arrangement. Each of the owners shares equal interest in the property and are both named on the same deed.

Joint Tenants – When one joint tenant dies, the surviving joint tenant automatically owns the entire property. This is said to be a “right of survivorship.” A deed to two or more people must specify that they hold the property “as joint tenants” to create a joint tenancy.

Outlining the rights and obligations of each party Agree on what rights and responsibilities each party will have. Ensure that each party understands and agrees to the duties and obligations assigned to them. Identify what each party is responsible for, including any financial contributions.

The Living Together section of Nolo also discusses various forms of contracts for unmarried people who want to share ownership of property. Also, because your shared home represents a major economic investment, you should hire a lawyer to help you prepare an agreement that meets your needs.

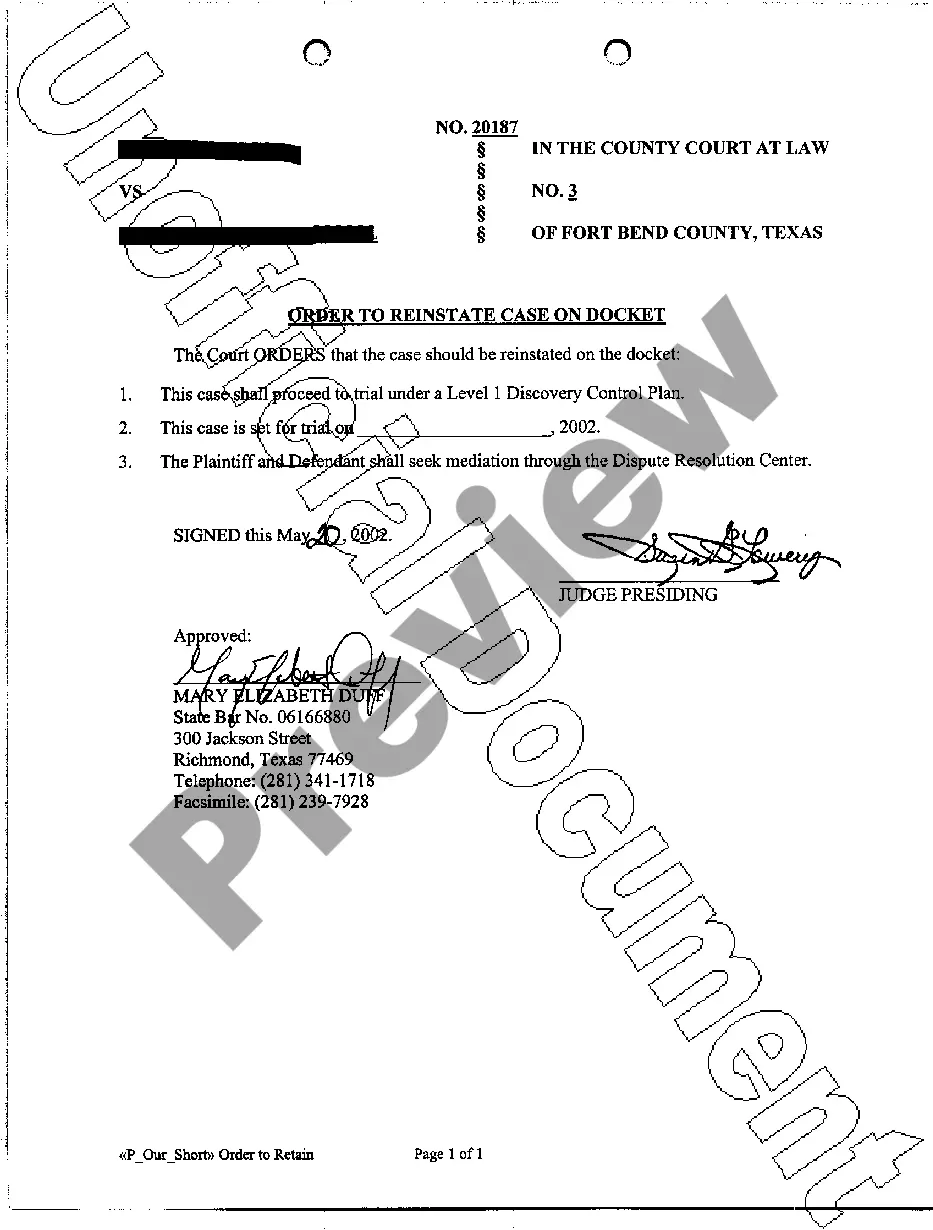

Draft a document for the parties to sign specifying the relationship between them, such as joint tenants in common, tenants in entirety, etc. Both parties must agree to the terms of the relationship, and sign the document to ensure that it is legally binding.

Joint Tenancy Has Some Disadvantages They include: Control Issues. Since every owner has a co-equal share of the asset, any decision must be mutual. You might not be able to sell or mortgage a home if your co-owner does not agree. Creditor Issues.

Medicaid rules provide that for jointly owned real estate, such as a home or farm land, the entire value of the property can, in certain circumstances, be disregarded as a non-countable resource, meaning it will not count against the applicant.