Convert Debt To Equity Ratio To Percentage

Description

How to fill out Equity Share Agreement?

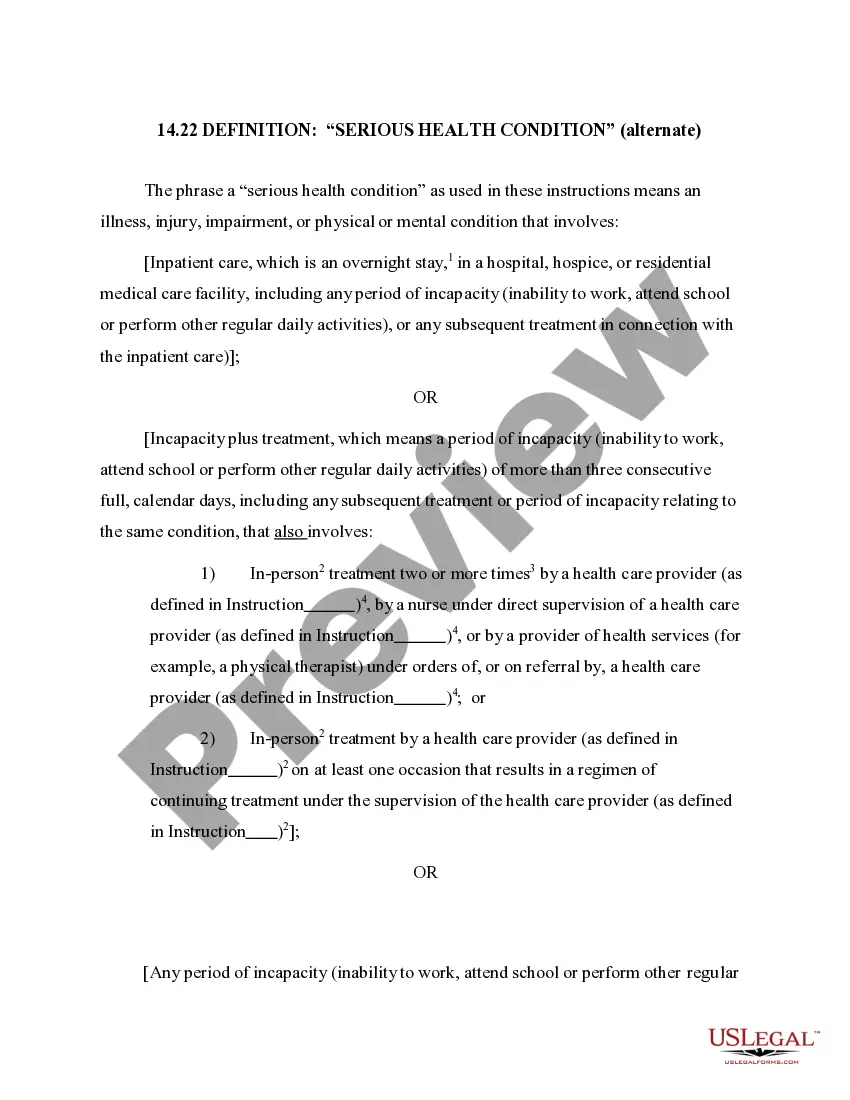

The Transform Debt To Equity Ratio Into Percentage you observe on this site is a versatile legal model crafted by expert attorneys in alignment with national and local statutes.

For over 25 years, US Legal Forms has offered individuals, entities, and lawyers more than 85,000 authenticated, state-specific documents for any corporate and personal circumstances. It is the quickest, most straightforward, and most trustworthy way to acquire the records you require, as the service assures bank-level data protection and anti-malware safeguards.

Register with US Legal Forms to have verified legal models for all of life's events readily available.

- Search for the document you require and review it.

- Look through the sample you sought and preview it or evaluate the form description to ensure it meets your needs. If it doesn't, utilize the search feature to find the suitable one. Click Buy Now once you have located the template you require.

- Choose a subscription and Log In.

- Select the payment plan that works for you and create an account. Use PayPal or a credit card to make a rapid payment. If you already possess an account, Log In and verify your subscription to proceed.

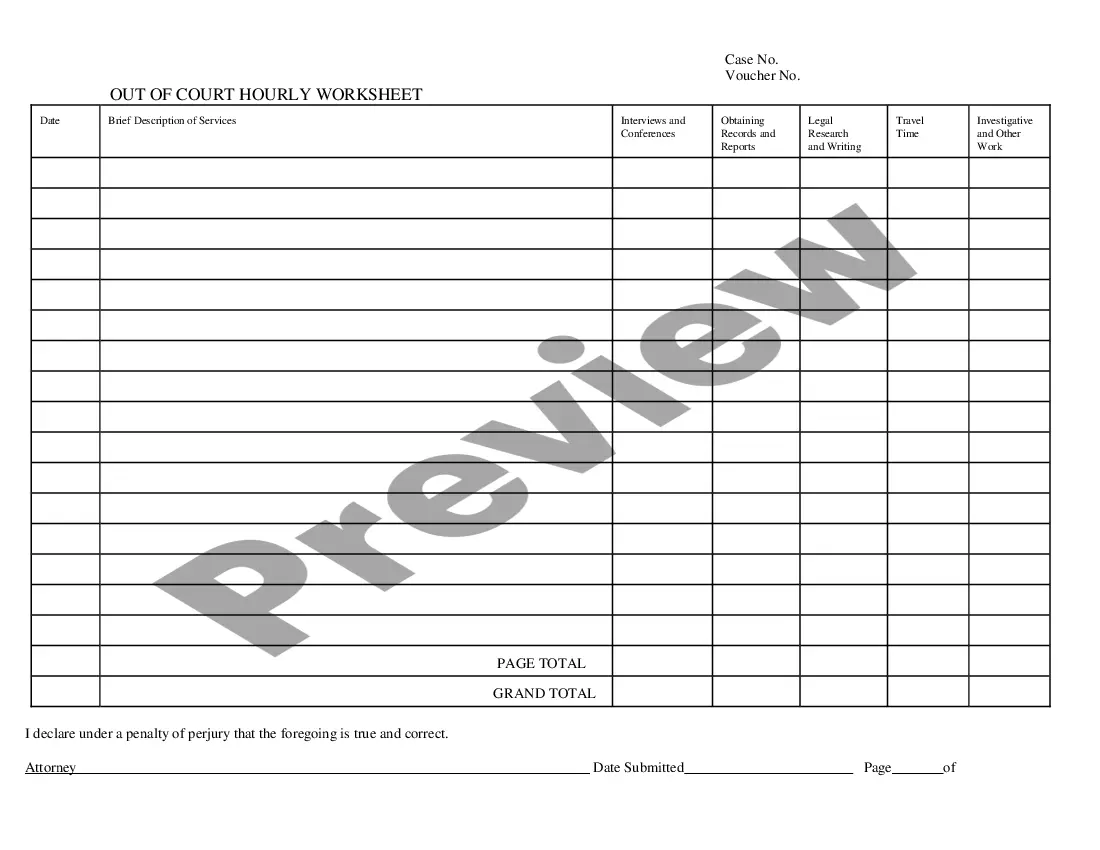

- Obtain the editable template.

- Choose the format you prefer for your Transform Debt To Equity Ratio Into Percentage (PDF, DOCX, RTF) and save the document on your device.

- Complete and sign the document.

- Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to quickly and accurately fill out and e-sign your form.

- Re-download your documents.

- Utilize the same form again whenever required. Access the My documents section in your account to redownload any previously saved documents.

Form popularity

FAQ

toequity ratio translates to 250%, indicating that a company uses significantly more debt than equity. This high ratio can signal potential risks, especially if economic conditions change. To convert debt to equity ratio to percentage, it's beneficial to evaluate how this ratio aligns with your industry standards. If you're navigating this challenge, uslegalforms provides resources to help review and restructure your financial approach.

A good debt-to-equity ratio typically falls between 30% and 50%, but this can vary by industry. Converting debt to equity ratio to percentage involves looking at the overall financial health of a company. Companies with lower ratios may have more flexibility and less risk, making them attractive to investors. It’s important to assess these ratios in the context of your business strategy.

A 50% debt-to-equity ratio can be considered acceptable depending on the industry. It suggests that a company has a balanced approach to leveraging debt and equity. However, when you convert debt to equity ratio to percentage, it's essential to compare it with industry standards. This will give you a clearer picture of how well a company is managing its financial structure.

A healthy debt-to-equity percentage typically ranges between 20% and 40%. This ratio indicates a balanced approach to financing, where a company uses both debt and equity to support its operations. To convert debt to equity ratio to percentage, you can use the formula: (Total Debt / Total Equity) x 100. A lower percentage signifies less risk, which can attract potential investors.

toequity ratio of 50% is often considered a balanced approach to financial leverage. It indicates that the company uses an equal amount of debt and equity financing, which can be healthy depending on the industry. To make the most informed decision, converting debt to equity ratio to percentage alongside other financial metrics will help you understand the overall financial health of the company.

Yes, converting the debt ratio to a percentage is beneficial for clarity and easier comparison. A percentage format allows stakeholders to quickly understand the relationship between a company's total liabilities and its equity. Utilizing tools such as those offered by uslegalforms can simplify the process of calculating and interpreting these financial metrics.

The debt-to-equity ratio is a financial metric expressed as a ratio or a percentage. When you convert debt to equity ratio to percentage, you can quickly understand how much debt a company uses to finance its operations compared to its equity. This percentage helps you gauge financial stability and the potential risks associated with the company’s capital structure.

Yes, the debt-to-equity ratio can indeed be expressed as a percentage. To convert debt to equity ratio to percentage, you simply multiply the ratio by 100. This percentage provides a clearer picture of the company’s financial leverage, making it easier for investors to assess risk and financial health.

Yes, the debt-to-equity ratio can indeed be expressed in percentage terms. This allows for easier comparison across different companies or industries. When represented as a percentage, it visually portrays the proportion of debt versus equity in financing. Thus, knowing how to convert debt to equity ratio to percentage can provide valuable insights for informed decisions.

To convert debt-to-equity percentage into a ratio, divide the debt percentage by the equity percentage. This formula provides a clearer view of how much debt exists in relation to equity. Understanding this relationship is essential for accurate financial assessments. As you navigate ways to convert debt to equity ratio to percentage, ensure you grasp this simple yet effective equation.