Revocation Living Trust With A Will

Description

How to fill out Texas Revocation Of Living Trust?

- If you're a returning user, log in to your account and download the required creditable template by clicking the Download button. Ensure your subscription is active; renew if necessary based on your plan.

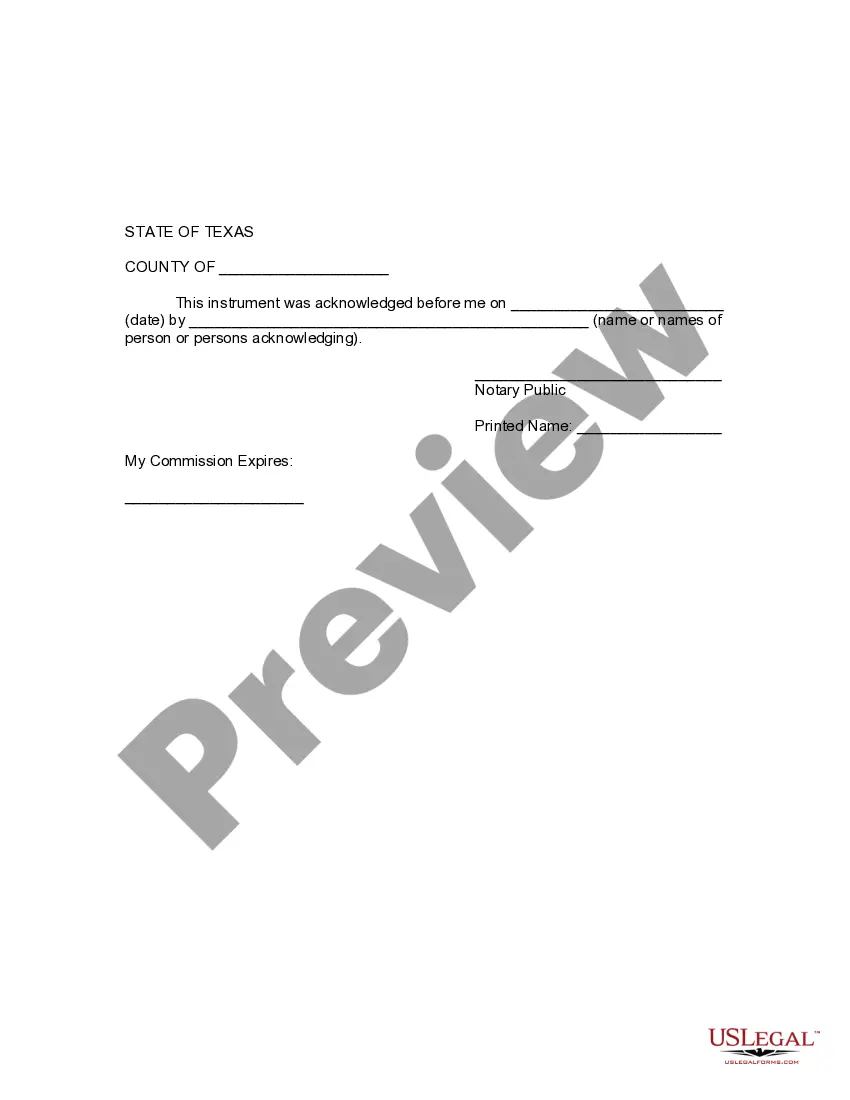

- For first-time users, start by reviewing the preview mode and form description. Confirm that you have selected the correct template that aligns with your specific needs and adheres to your jurisdiction's requirements.

- If you find that the current template doesn't meet your needs, utilize the Search tab to look for alternative options and ensure you have the right one.

- Purchase the selected document by clicking the Buy Now button. Choose the subscription plan that suits you best and register for an account to access the library.

- Complete the payment using your credit card or PayPal account to finalize your subscription.

- Download your chosen form and save it to your device. You can access it anytime in the My Forms section of your profile.

US Legal Forms empowers individuals and attorneys alike to efficiently execute legal documents, enhancing accessibility to over 85,000 easily fillable forms. With a robust selection that surpasses competitive offerings, you can rest assured your legal needs are met.

Start streamlining your legal process today. Visit US Legal Forms and discover how easy it is to handle your revocation living trust with a will!

Form popularity

FAQ

A form to dissolve a revocable trust typically includes specific information about the trust, the trustee, and the reason for dissolution. This document serves as a legal declaration of your intentions to terminate the trust and can clarify how assets should be handled moving forward. Consider integrating this form with your revocation living trust with a will to create a cohesive estate plan. US Legal Forms provides various templates that make this process straightforward.

Invalidating a living trust often involves proving the trust is no longer valid under certain circumstances, such as lack of capacity or undue influence at the time it was created. If you’ve formed a trust with a will, these factors should be addressed together to ensure clarity and legality. Legal advice is recommended, but tools from US Legal Forms can assist you in documenting your wishes and actions effectively.

To dissolve a revocable trust, you typically need to follow a straightforward process, which includes creating a formal document indicating your intent to revoke the trust. Ensure you clearly identify the trust in question and your reasons for dissolution. Additionally, consider any related documents, like a revocation living trust with a will, to maintain clarity in your estate planning. Platforms like US Legal Forms offer helpful resources for creating these documents.

A letter of termination is a formal document that officially ends a trust. This letter outlines the reasons for the termination and details how the remaining assets will be distributed. If you have a revocation living trust with a will, you can include instructions for the distribution in the letter, ensuring all parties understand your wishes. Utilizing templates from US Legal Forms can simplify this process.

Yes, a will can override a living trust under specific conditions. If the will clearly states different intentions regarding your assets than what the living trust specifies, the will takes precedence. However, it is essential to ensure that your estate plan is cohesive and that both documents align to avoid confusion after your passing. For a seamless process, consider using US Legal Forms to create a revocation living trust with a will.

While a revocation living trust with a will offers many benefits, it does come with some disadvantages. For instance, setting up and maintaining a trust can involve higher initial costs and ongoing management. Additionally, if you do not fund your trust properly by transferring assets into it, you may face complications in the estate settlement process.

Yes, a revocation living trust generally supersedes a will concerning the assets that transfer into it. If you have specific assets listed in your trust, those assets bypass the probate process and follow the instructions laid out in the trust. This can lead to a more efficient transition of your estate to your heirs.

A revocation living trust with a will typically carries more power regarding asset distribution without the need for probate. Trusts can manage your assets during your lifetime and dictate distribution after your death. Wills, on the other hand, require court approval, which can prolong the distribution process and may expose your estate to public scrutiny.

In general, a revocation living trust with a will takes precedence over a will in terms of asset distribution. When you establish a trust, it governs how your assets are managed and distributed after your passing. However, having both a trust and a will is common, and the specific terms outlined in your documents will ultimately determine which takes precedence.

The 5-year rule for trusts involves the consideration of an individual's ability to transfer assets without incurring gift taxes. When you create a revocation living trust with a will, assets transferred within five years before applying for Medicaid may still count towards your eligibility. Understanding this rule is essential for effective estate planning, as it helps you structure your assets wisely.