Texas Deed Estate For Death

Description

How to fill out Texas Executor's Deed - Estate To Five Beneficiaries?

Finding a go-to place to take the most current and relevant legal templates is half the struggle of working with bureaucracy. Choosing the right legal files demands precision and attention to detail, which is the reason it is vital to take samples of Texas Deed Estate For Death only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and check all the information regarding the document’s use and relevance for your circumstances and in your state or region.

Take the listed steps to complete your Texas Deed Estate For Death:

- Utilize the catalog navigation or search field to locate your sample.

- Open the form’s description to ascertain if it suits the requirements of your state and area.

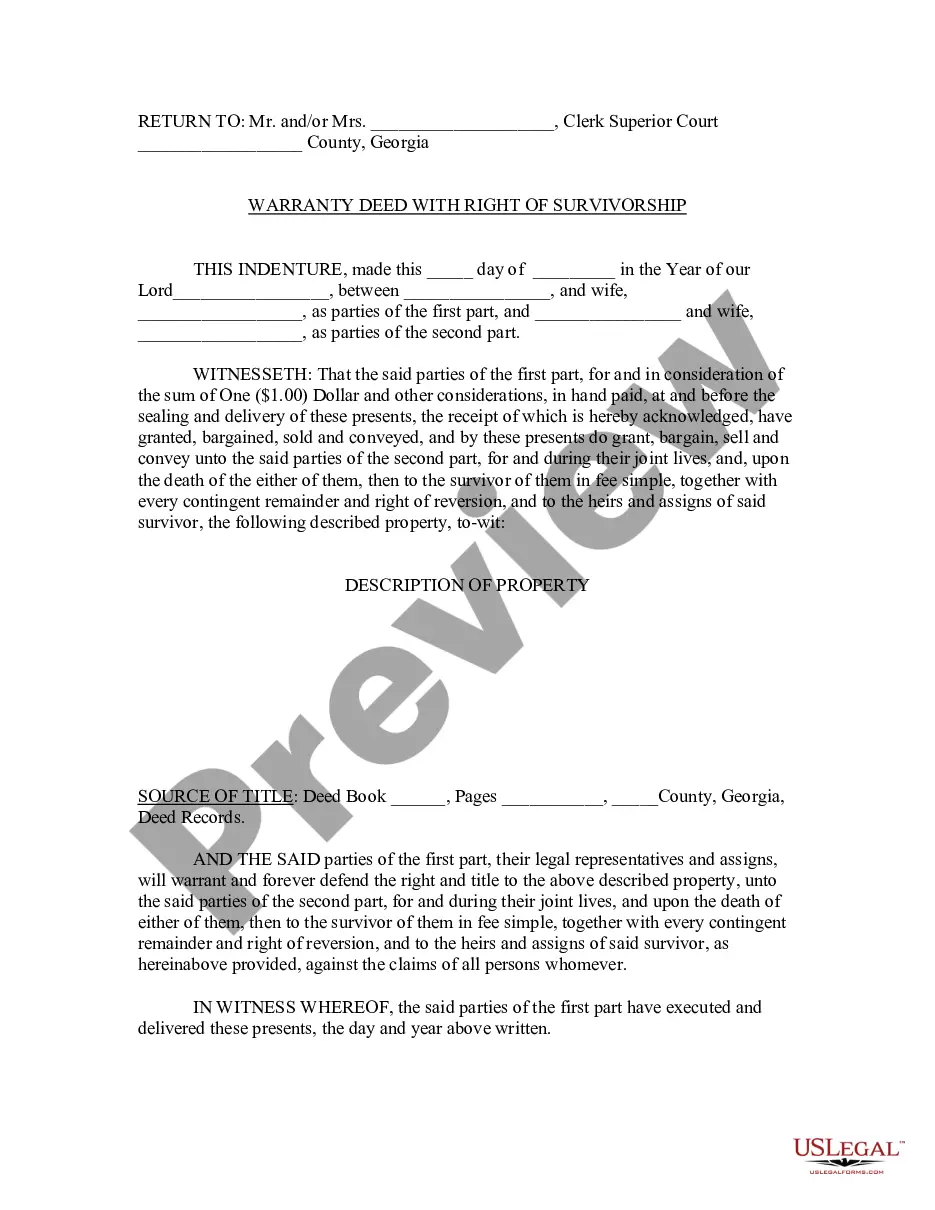

- Open the form preview, if there is one, to make sure the template is the one you are interested in.

- Return to the search and look for the correct template if the Texas Deed Estate For Death does not match your requirements.

- If you are positive regarding the form’s relevance, download it.

- If you are an authorized user, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Choose the pricing plan that fits your needs.

- Go on to the registration to finalize your purchase.

- Complete your purchase by picking a transaction method (credit card or PayPal).

- Choose the document format for downloading Texas Deed Estate For Death.

- When you have the form on your gadget, you can modify it using the editor or print it and finish it manually.

Get rid of the headache that comes with your legal paperwork. Discover the extensive US Legal Forms library to find legal templates, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

After the Grantor dies, an affidavit of death and a certified copy of the Grantor's death certificate should be filed in the county clerk's office of the county where the deed was recorded. This creates a link in the chain of title to show that the beneficiary is now the owner of the property.

You do not need a TOD deed. Your spouse will automatically own the entire property at your death, and vice versa. You and your spouse can make a TOD deed together, but it would not have any effect until both you and your spouse have died.

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized, Have a legal description of the property (The description is found on the deed to the property or in the deed records. ... Have the name and address of one or more beneficiaries, State that the transfer will happen at the owner's death,

Good to know: To be valid and enforceable, the transfer must be in writing and signed by the owner. The document should be filed with the County Clerk for the County in which the property is located. For example, you cannot simply say that your grandfather said he wanted you to have the property.

You must sign the deed and get your signature notarized, and then record (file) the deed with the county clerk's office before your death. Otherwise, it won't be valid. You can make a Texas transfer on death deed with WillMaker.