Revocation Living Trust For Property

Description

How to fill out New York Revocation Of Living Trust?

- If you are an existing user, log in to your account and check your subscription status. Download the necessary form by clicking the Download button.

- If you're new to US Legal Forms, begin by browsing the library. Preview your desired form and ensure it complies with local laws.

- In case you need a different template, utilize the Search function to explore additional forms that meet your specifications.

- Select the document. Click on 'Buy Now' and choose your subscription plan. You will need to create an account for full access.

- Complete your purchase using a credit card or PayPal to finalize your subscription.

- Once purchased, download the template to your device and access it later through the My Forms section.

Revoking a living trust is manageable when you have the right resources. US Legal Forms provides more than 85,000 fillable and editable legal forms, ensuring you have everything you need at your fingertips.

Empower yourself today with US Legal Forms to make the legal process seamless. Start your journey now!

Form popularity

FAQ

One downside to placing assets in a trust is the potential loss of control over those assets during the grantor's lifetime. This can create complications, especially if the grantor needs access to the assets for personal expenses or unexpected financial needs. Additionally, the initial setup and ongoing management of a trust can be resource-intensive. Therefore, consider these challenges before proceeding.

While family trusts can be effective for managing assets, they also have potential disadvantages. One issue may be the lack of privacy, as trusts are often subject to legal scrutiny. Furthermore, if the trust is not structured correctly, it could lead to unintended tax consequences. It's critical to weigh these factors carefully when considering a family trust.

One of the most significant mistakes parents make is failing to fund the trust adequately after its creation. A trust is only effective if it contains the right assets, ensuring the property is managed according to their wishes. Additionally, not updating the trust regularly to reflect changes in their situation can lead to complications later. It's vital to review and manage the trust consistently.

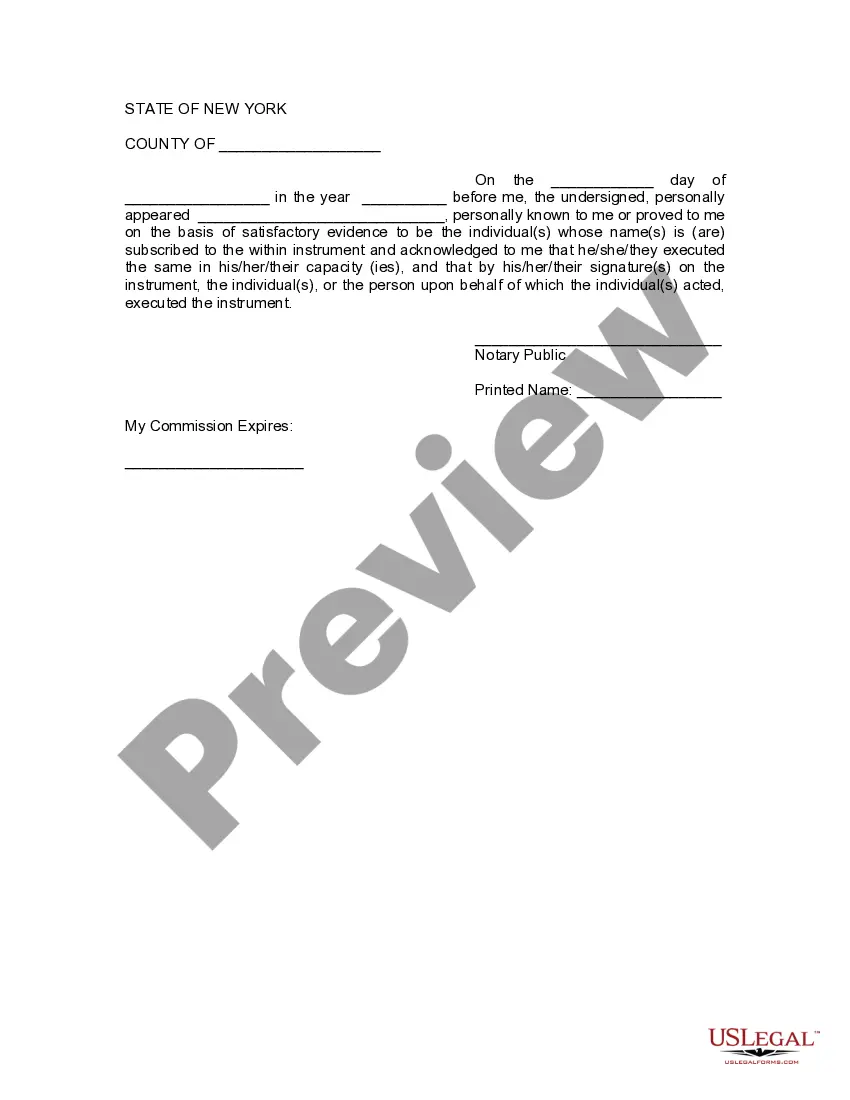

Revoking a revocable living trust straightforwardly involves following specific legal steps to ensure proper execution. The trust document typically outlines the procedure for revocation, which may include creating a written declaration or notifying the trustee. It is crucial to consult legal advice to ensure all necessary actions are taken for the revocation to be valid. Using a platform like USLegalForms can help simplify this process by providing necessary templates and guidance.

Placing assets in a trust can provide significant benefits for your parents. It allows for easy management and distribution of their property while potentially avoiding probate. A well-structured trust can protect their assets and ensure that their wishes are honored. However, the decision should be made considering personal circumstances and goals.

While revocable living trusts offer many benefits, they also come with some disadvantages. One key downside is that they do not provide protection from creditors, as assets in the trust are still considered part of your estate. Additionally, creating a revocation living trust for property can involve upfront costs in terms of setup and management, which might not be worth it for everyone.

Certain assets are generally not recommended for inclusion in a revocable living trust. Typically, assets like retirement accounts, certain types of life insurance, and vehicles are best kept outside the trust due to specific regulations. However, transferring these assets can complicate estate planning, so consider using a revocation living trust for property for assets that benefit from easy management and transfer, while addressing the others separately.

Suze Orman often highlights the importance of having a revocable living trust as part of your estate planning strategy. She emphasizes that a revocation living trust for property provides flexibility, allowing you to make changes or revoke the trust as needed. Orman believes that this trust can protect your assets and provide peace of mind, ensuring your family's future needs are met.

The primary purpose of a revocable living trust is to manage and protect your assets during your lifetime and ensure they are distributed according to your wishes after you pass away. This type of trust allows you to maintain control over your property while avoiding the lengthy probate process. By setting up a revocation living trust for property, you can simplify the transfer of assets and potentially reduce estate taxes.

Revoking a revocation living trust for property is typically a straightforward process. You can revoke the trust at any time while you are alive, as long as you have the mental capacity to do so. The process usually involves drafting a document that states your intention to revoke the trust and then notifying any relevant parties. This flexibility makes revocable trusts a popular choice for individuals who may want to adapt their estate plans over time.