New York Revocation of Living Trust

Understanding this form

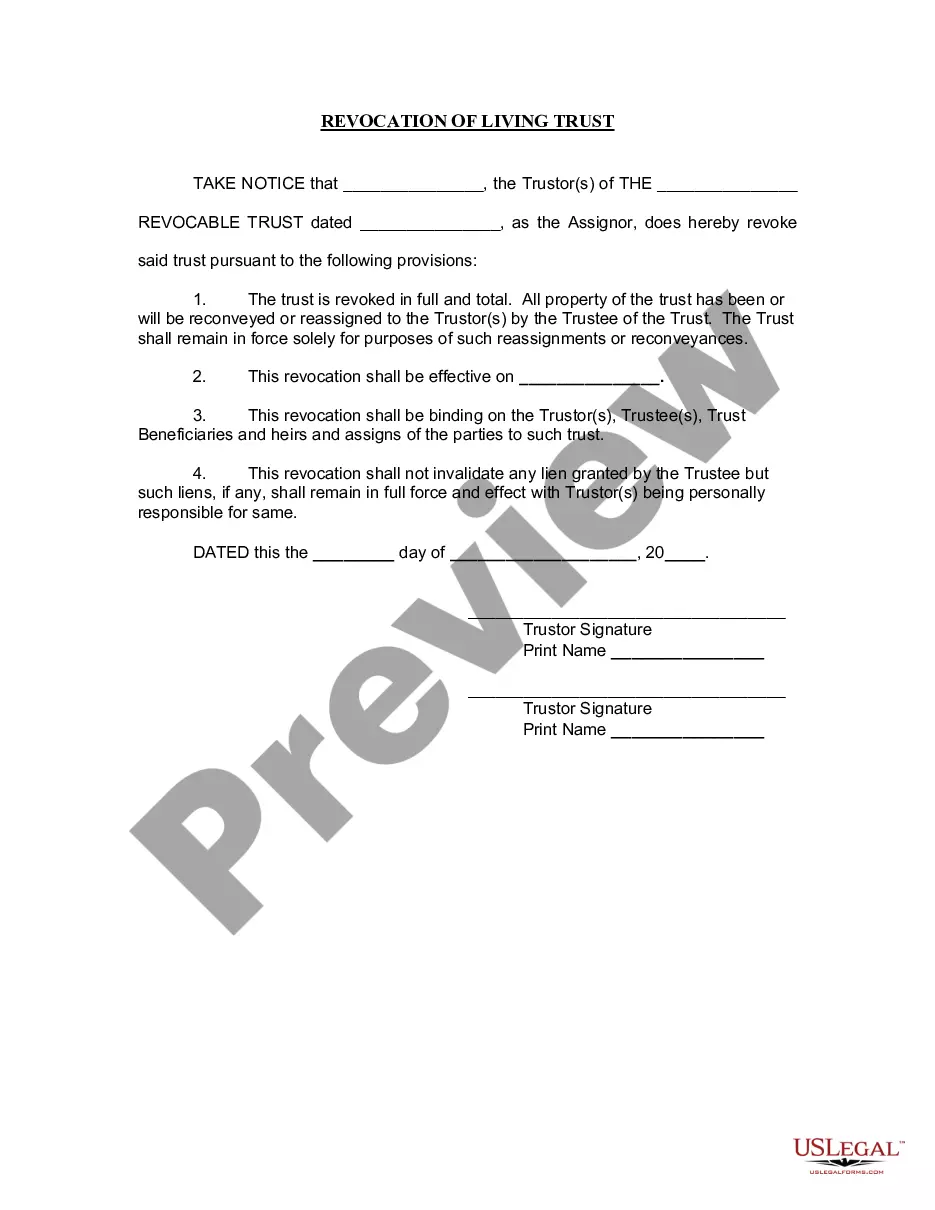

The Revocation of Living Trust form is a legal document used to revoke a previously established living trust. This form officially declares that the trust is no longer valid, allowing the assets and property within the trust to be returned to the trustor(s). Unlike other forms that may modify or update a trust, this form provides a full and total revocation, making it essential for individuals who wish to completely dissolve their living trust.

Form components explained

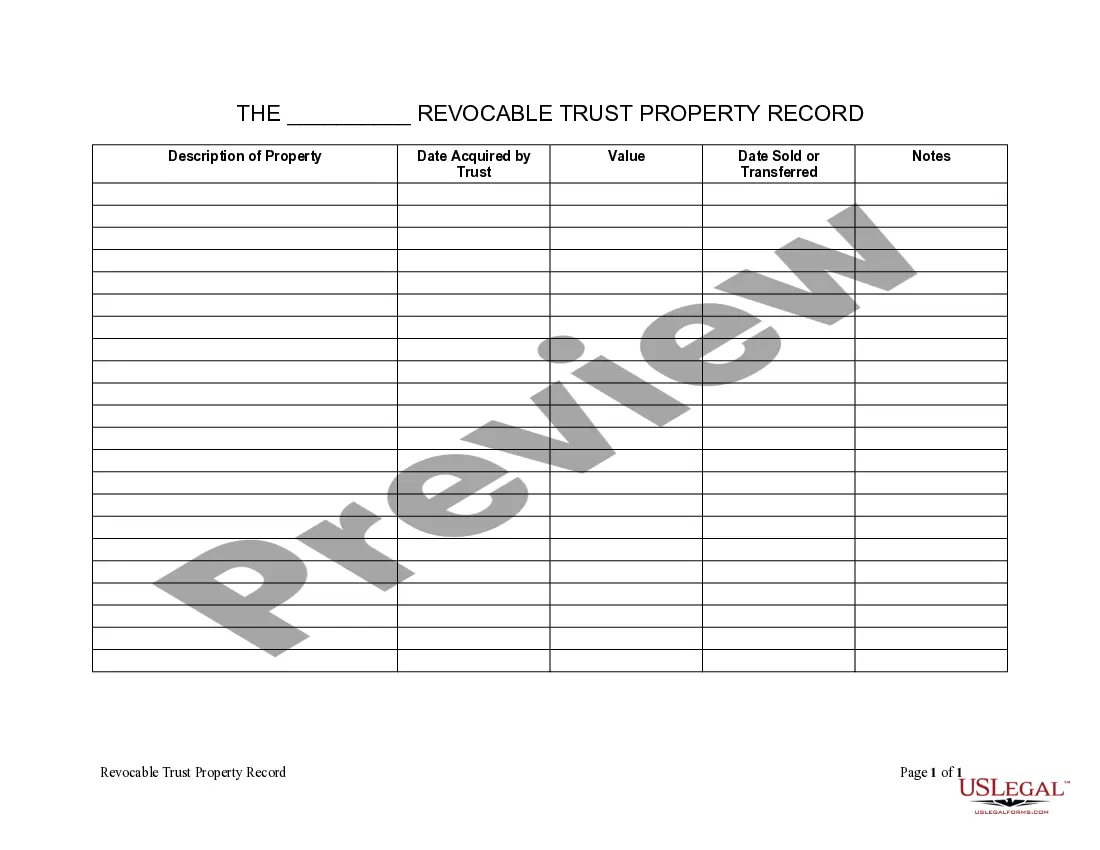

- Identification of the trustor(s) and the specific living trust being revoked.

- A declaration stating the revocation of the trust in full and total terms.

- Confirmation that all property will be returned to the trustor(s).

- The effective date of the revocation.

- Signature lines for trustor(s), including printed names.

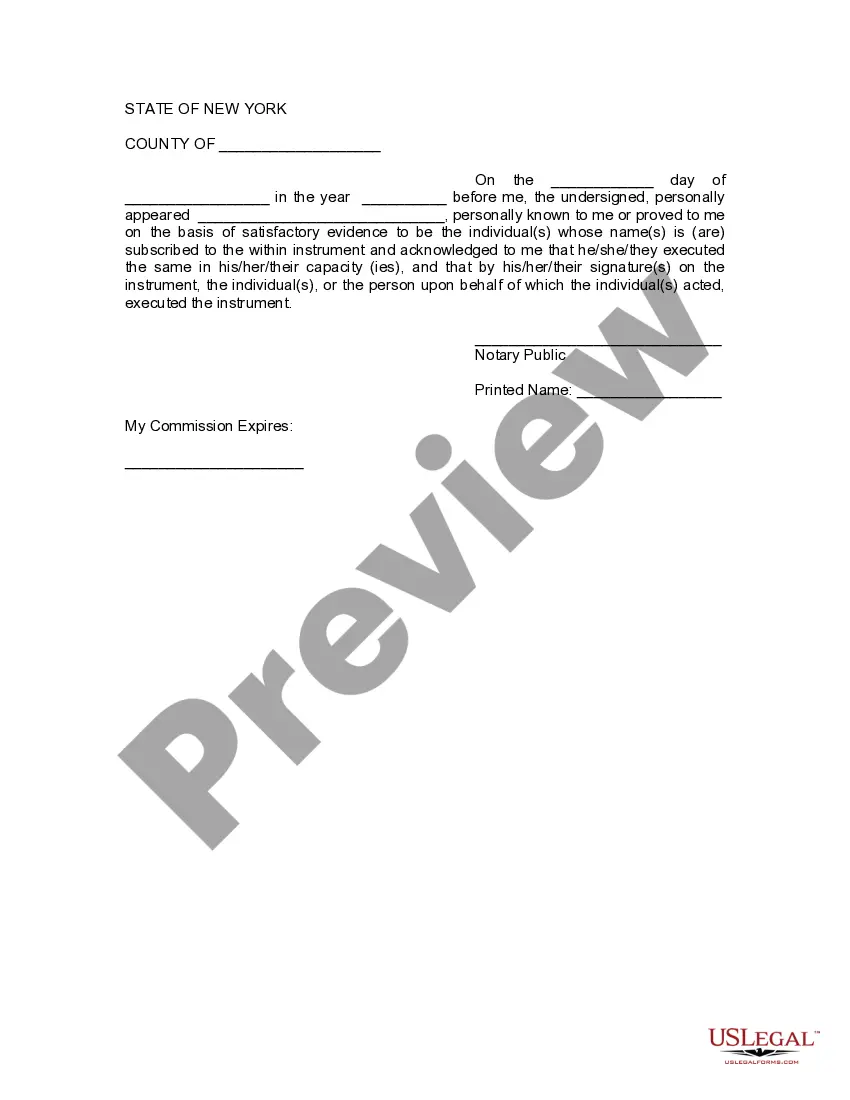

- Notary acknowledgment section to validate the document.

Common use cases

This form should be used when a trustor decides to terminate their living trust for any reason. Common scenarios include changes in financial circumstances, the passing of a loved one, or a desire to have a different estate planning strategy. If you wish to ensure that all assets are returned to you and that the trust is completely dissolved, utilizing this form is necessary.

Who needs this form

- Individuals who have established a living trust and now wish to revoke it.

- Trustors who need to manage the distribution of their assets differently.

- Anyone looking to simplify their estate planning by eliminating a living trust.

Instructions for completing this form

- Identify the trustor(s) and the specific revocable trust being revoked.

- Clearly state that you are revoking the trust in full and total terms.

- Ensure all property has been or will be returned to the trustor(s).

- Enter the effective date of the revocation.

- Have all trustor(s) sign the document in the designated spaces.

- Arrange for the document to be notarized by a notary public.

Is notarization required?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to specify the full name of the trust being revoked.

- Not entering the effective date, which can create confusion.

- Omitting one or more signatures from the trustor(s).

- Neglecting to notarize the document, leading to potential legal challenges.

Main things to remember

- The Revocation of Living Trust form is essential for individuals who wish to fully revoke an established living trust.

- All property held within the trust must be reconveyed to the trustor(s).

- Signatures of the trustor(s) and notarization are crucial for the document's validity.

- Consult local laws to ensure compliance with specific state requirements.

Looking for another form?

Form popularity

FAQ

The New York law provides for statutory mechanisms which allow for a trust creator to amend or revoke an irrevocable trust.New York law provides that if a trust settlor obtains the acknowledged, written consent of all those beneficially interested in an un-amendable, irrevocable trust, she may amend or revoke it.

You can be the trustee of your own living trust, keeping full control over all property held in trust.In contrast to revocable trusts, irrevocable trusts cannot be revoked or modified after they are signed.

EXAMPLE: Yvonne and Andre make a living trust together. Step 1: Transfer ownership of trust property from yourself as trustee back to yourself. Step 2: A revocation prints out with your trust document. Step 3: Complete the Revocation of Trust by filling in the date, and then sign it in front of a notary public.

The terms of an irrevocable trust may give the trustee and beneficiaries the authority to break the trust. If the trust's agreement does not include provisions for revoking it, a court may order an end to the trust. Or the trustee and beneficiaries may choose to remove all assets, effectively ending the trust.

A revocation of a will generally means that the beneficiaries will no longer receive the specified property or financial assets. A beneficiary may have been depending on the trust property for various reasons. If the revocation occurs at a certain time, it can cause legal conflicts in many cases.

A trust is created by a Settlor, also called a Trustor or a Grantor, who transfers property to a Trustee. The Trustee holds that property for the trust beneficiaries.An irrevocable living trust, however, cannot be modified or revoked by the Settlor at any time nor for any reason once active.

A revocable trust, or living trust, is a legal entity to transfer assets to heirs without the expense and time of probate.A living trust also can be revoked or dissolved if there is a divorce or other major change that can't be accommodated by amending the trust.

An irrevocable trust is a type of trust where its terms cannot be modified, amended or terminated without the permission of the grantor's named beneficiary or beneficiaries.Irrevocable trusts cannot be modified after they are created, or at least they are very difficult to modify.

Yes. Generally you can refinance property placed in irrevocable trust.