Bird Deed Statement Form Texas

Description

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Four Individuals?

Legal management can be frustrating, even for experienced experts. When you are looking for a Bird Deed Statement Form Texas and do not have the time to spend searching for the right and up-to-date version, the operations can be demanding. A robust web form library could be a gamechanger for everyone who wants to deal with these situations efficiently. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms available anytime.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and organization forms. US Legal Forms covers any requirements you may have, from personal to organization papers, all-in-one spot.

- Make use of advanced tools to complete and deal with your Bird Deed Statement Form Texas

- Access a useful resource base of articles, tutorials and handbooks and resources highly relevant to your situation and needs

Save effort and time searching for the papers you need, and use US Legal Forms’ advanced search and Preview feature to locate Bird Deed Statement Form Texas and acquire it. In case you have a subscription, log in for your US Legal Forms profile, look for the form, and acquire it. Review your My Forms tab to view the papers you previously saved and also to deal with your folders as you can see fit.

Should it be the first time with US Legal Forms, make a free account and get limitless usage of all advantages of the library. Listed below are the steps to take after getting the form you need:

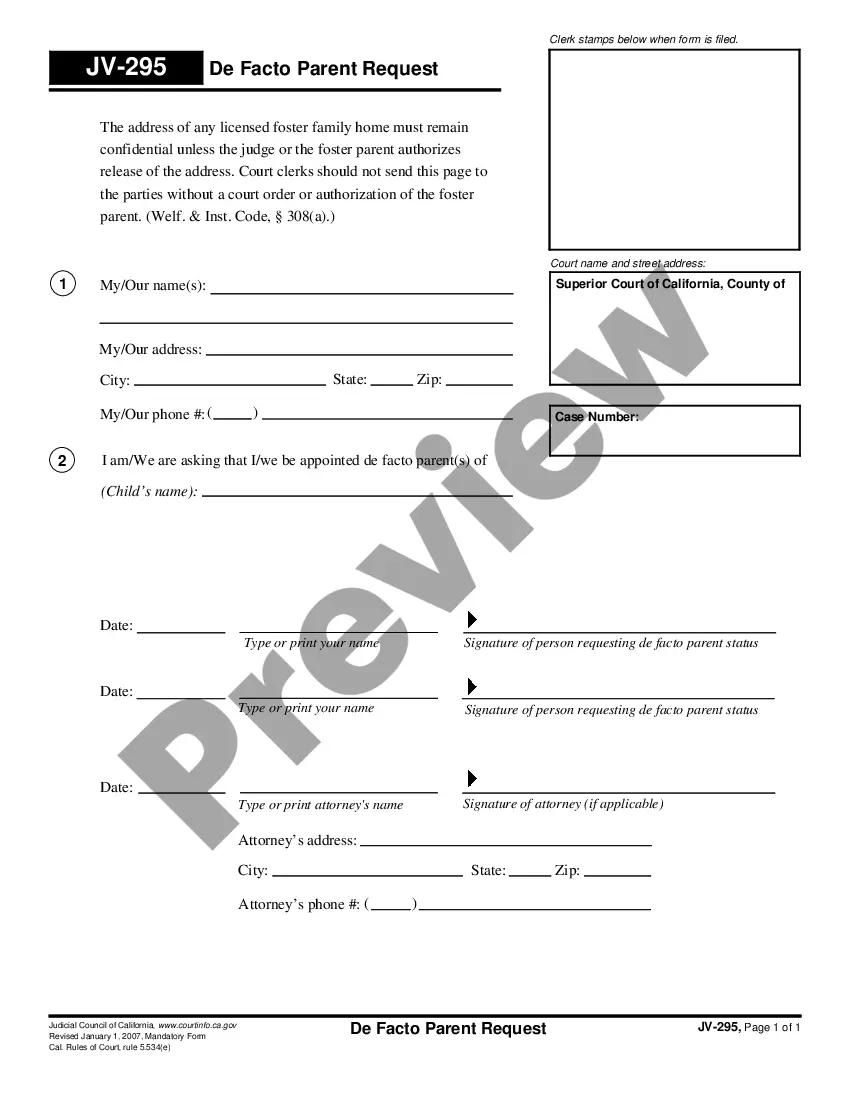

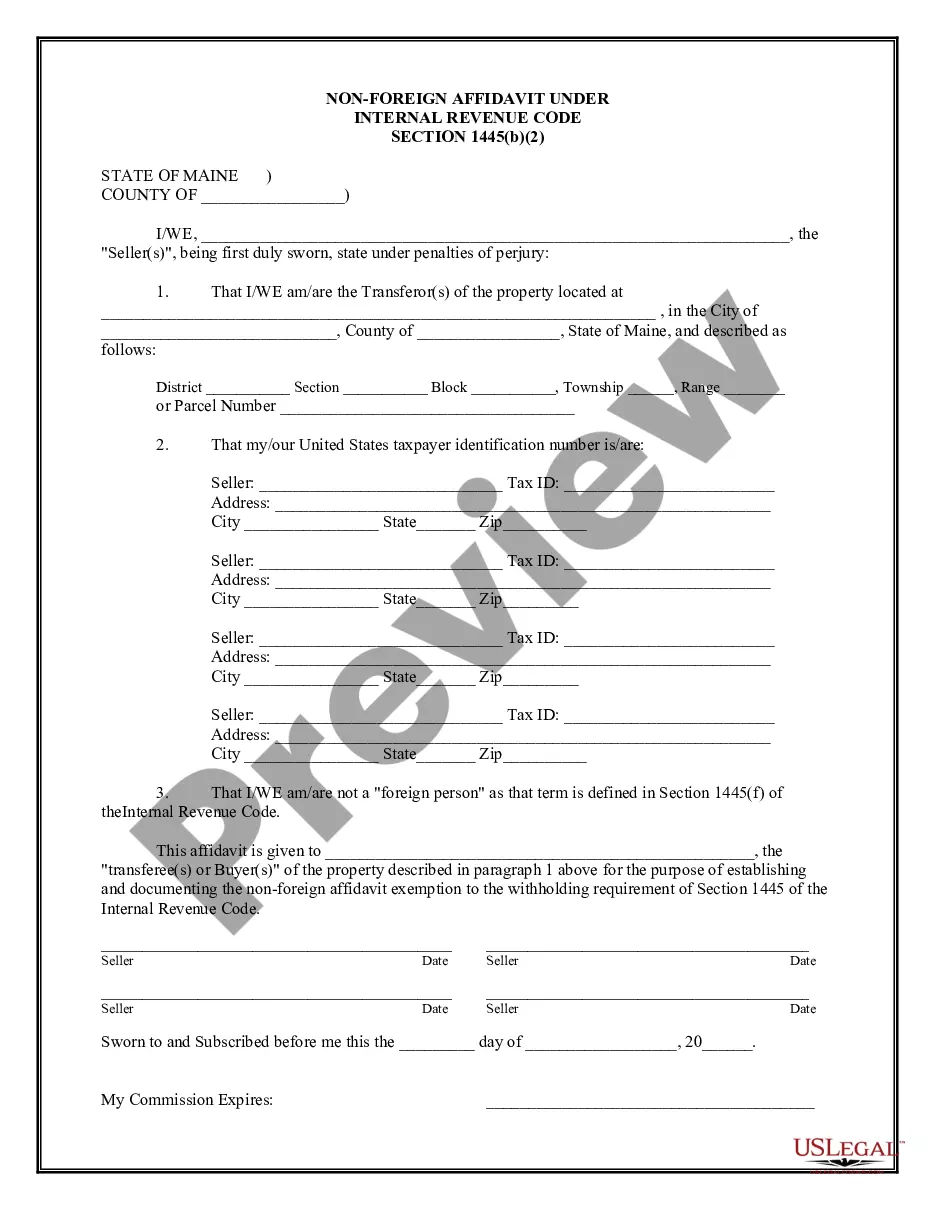

- Validate this is the right form by previewing it and looking at its information.

- Ensure that the sample is acknowledged in your state or county.

- Pick Buy Now when you are ready.

- Choose a subscription plan.

- Find the format you need, and Download, complete, sign, print and send your document.

Take advantage of the US Legal Forms web library, supported with 25 years of experience and trustworthiness. Enhance your daily document management into a easy and intuitive process today.

Form popularity

FAQ

A general warranty deed must include the following to be valid: The name and address of the seller (called the grantor) The name and address of the buyer (called the grantee) A legal description of the property (found on the previous deed) A statement that the grantor is transferring the property to the grantee.

In order for a Transfer on Death Deed to be valid, it must be signed, notarized, and recorded in the property records of the county where the property is located. In contrast, a Lady Bird Deed does not have a recording requirement. All that is required for a deed to be valid in Texas is delivery to the Grantee.

Transfer on death deeds cannot be signed by anyone other than the property owner. But as long as the Lady Bird deed form is signed in the presence of a licensed notary, Lady Bird deeds can be signed by the owner or the owner's agent under power of attorney.

Tax Consequences of Ladybird Deeds This can allow the beneficiary to sell the property without incurring income taxes on the sale. The deeds also do not trigger Federal gift taxes. They are not completed gifts for gift tax purposes. The property does remain in the decedent's taxable estate for estate tax purposes.

In order for a deed to be effective it must be signed and acknowledged before a notary by the seller. The buyer is not required to sign, but if the deed includes language about specific agreements between the buyer and seller, then it is advisable to include the buyer's signature.