Michigan Enhanced Estate Deed Without Powers

Description

How to fill out Michigan Enhanced Life Estate Deed - Husband And Wife / Two Individuals To Four Individuals?

Individuals generally link legal documents with complexity that only an expert can manage. In a sense, this is accurate, as crafting a Michigan Enhanced Estate Deed Without Powers requires significant expertise regarding subject standards, including local and state laws.

Nevertheless, with US Legal Forms, the process has become simpler: pre-prepared legal templates for various life and business events tailored to state regulations are gathered in a single online repository, making them accessible to all.

US Legal Forms offers over 85,000 current documents categorized by state and usage area, allowing users to locate the Michigan Enhanced Estate Deed Without Powers or any other specific template in just a few moments. Previously registered users with an active subscription must Log In to their accounts and click Download to retrieve the form. New users will need to create an account and subscribe before they can download any documents.

All templates in our collection are reusable: once obtained, they are saved in your profile. You can access them whenever necessary through the My documents tab. Experience all the advantages of using the US Legal Forms platform. Sign up today!

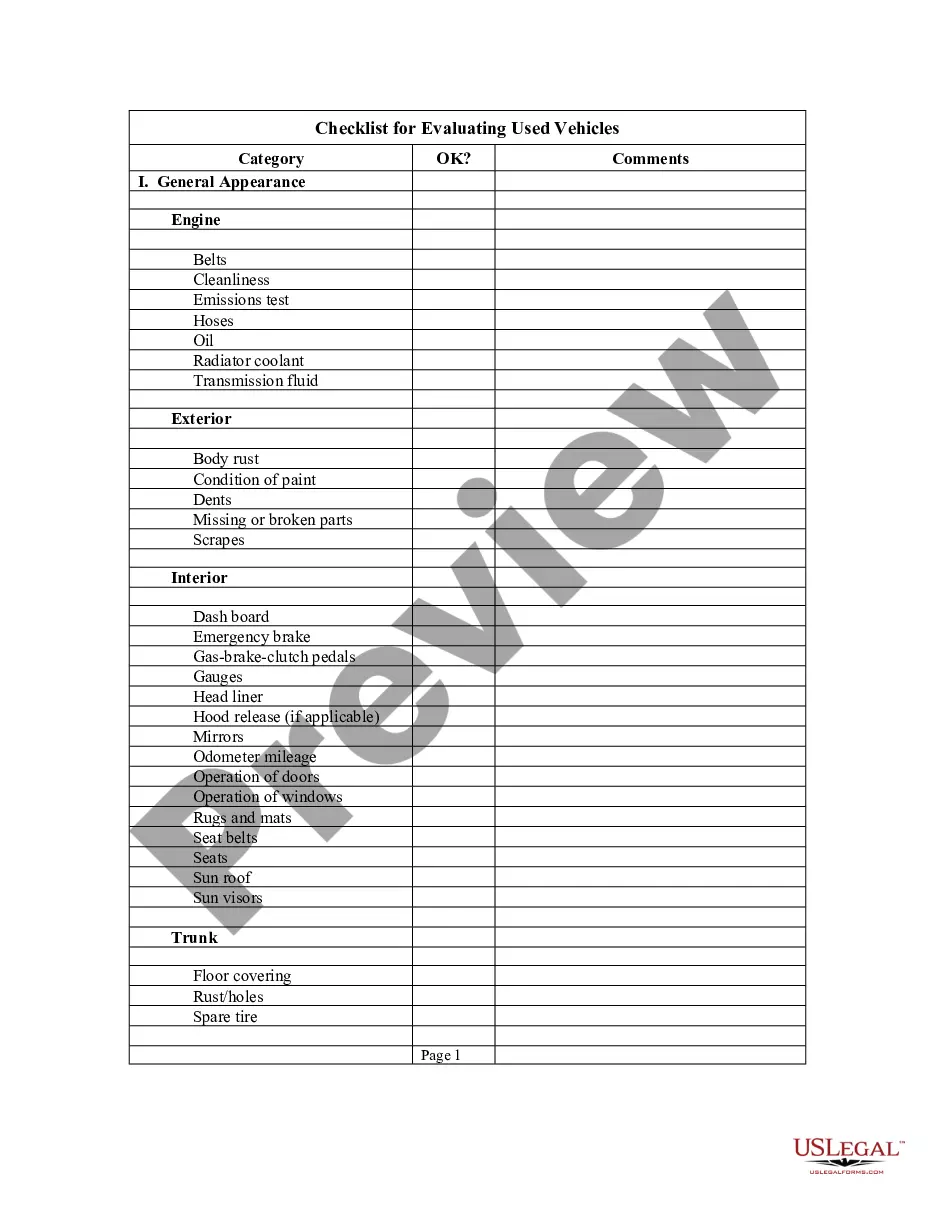

- Examine the page content carefully to confirm it meets your requirements.

- Review the form description or check it through the Preview feature.

- Look for another template using the Search field in the header if the prior one does not meet your needs.

- Click Buy Now once you find the appropriate Michigan Enhanced Estate Deed Without Powers.

- Select a pricing plan that aligns with your needs and budget.

- Create an account or Log In to proceed to the payment page.

- Complete your subscription payment via PayPal or with your credit card.

- Choose the format for your file and click Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

The process for transferring Michigan real estate usually involves four steps:Find the most recent deed to the property.Create the new deed.Sign and notarize the deed.File the deed in the county land records.

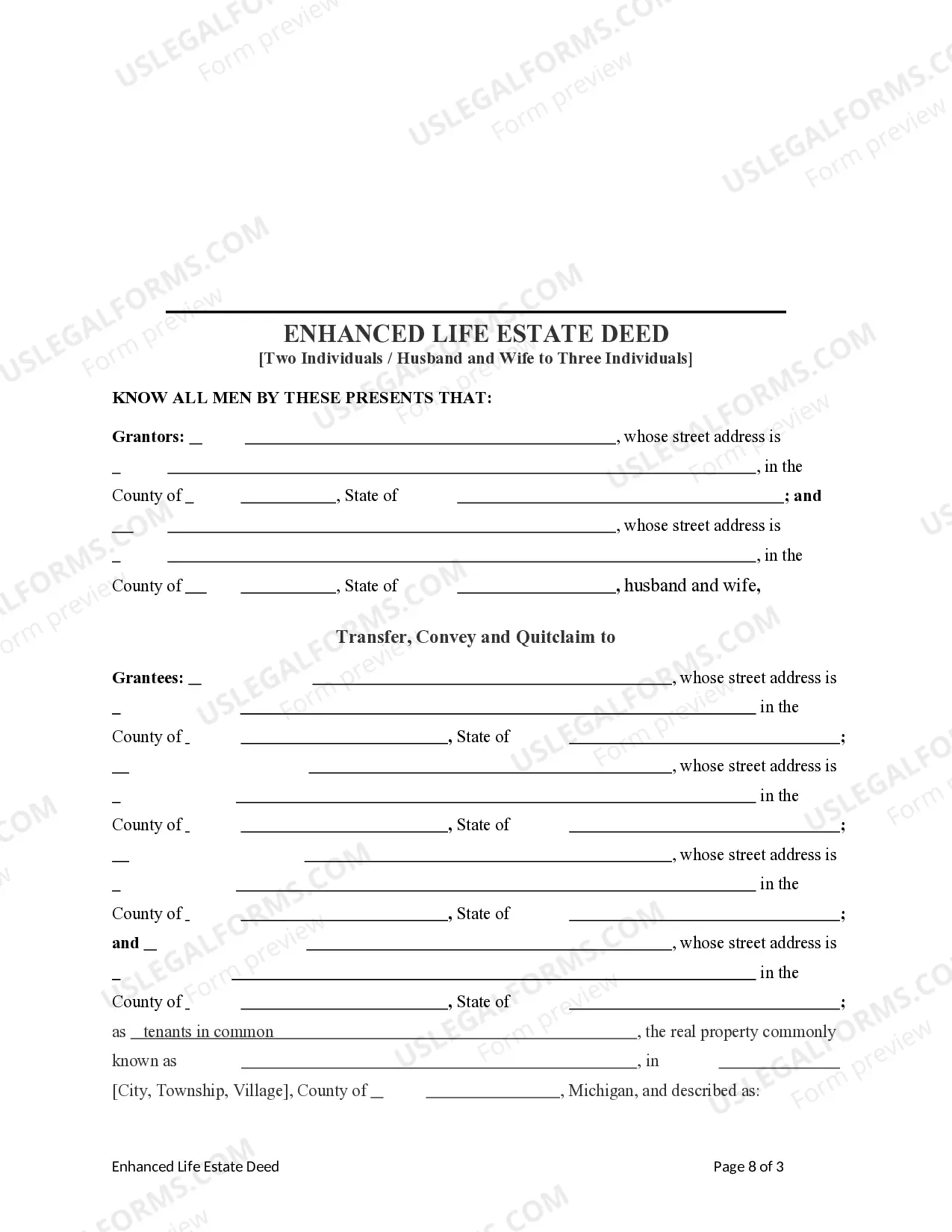

Michigan does not allow real estate to be transferred with transfer-on-death deeds. There is a type of deed available in Michigan known as an enhanced life estate deed, or "Lady Bird" deed, that functions like a transfer-on-death deed.

In Michigan, a Lady Bird Deed (also known as a Ladybird Deed or Enhanced Life Estate Deed) is a type of Quitclaim Deed that allows you, the creator, to transfer your property upon your death to a named beneficiary without having to go through the expensive and time consuming Probate process.

Fill out and file a probate petition with the Michigan probate court in your area. If the deceased left property in her will, the probate court will use a fiduciary deed signed by the executor of the estate to transfer the property to the beneficiary.

Disadvantages.Confusion Banks and title companies may not understand the non-vested nature of the remainder interest and require that the remaindermen join in a conveyance or a mortgage.Creditors.Homestead Devise Restrictions This type of deed should not be used by an owner with a spouse or minor child.More items...