Bird Deed Statement Form Florida

Description

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Four Individuals?

Finding a go-to place to access the most current and appropriate legal templates is half the struggle of working with bureaucracy. Discovering the right legal files requirements precision and attention to detail, which is why it is important to take samples of Bird Deed Statement Form Florida only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You can access and check all the information regarding the document’s use and relevance for the circumstances and in your state or county.

Take the following steps to finish your Bird Deed Statement Form Florida:

- Use the catalog navigation or search field to locate your sample.

- Open the form’s description to see if it matches the requirements of your state and area.

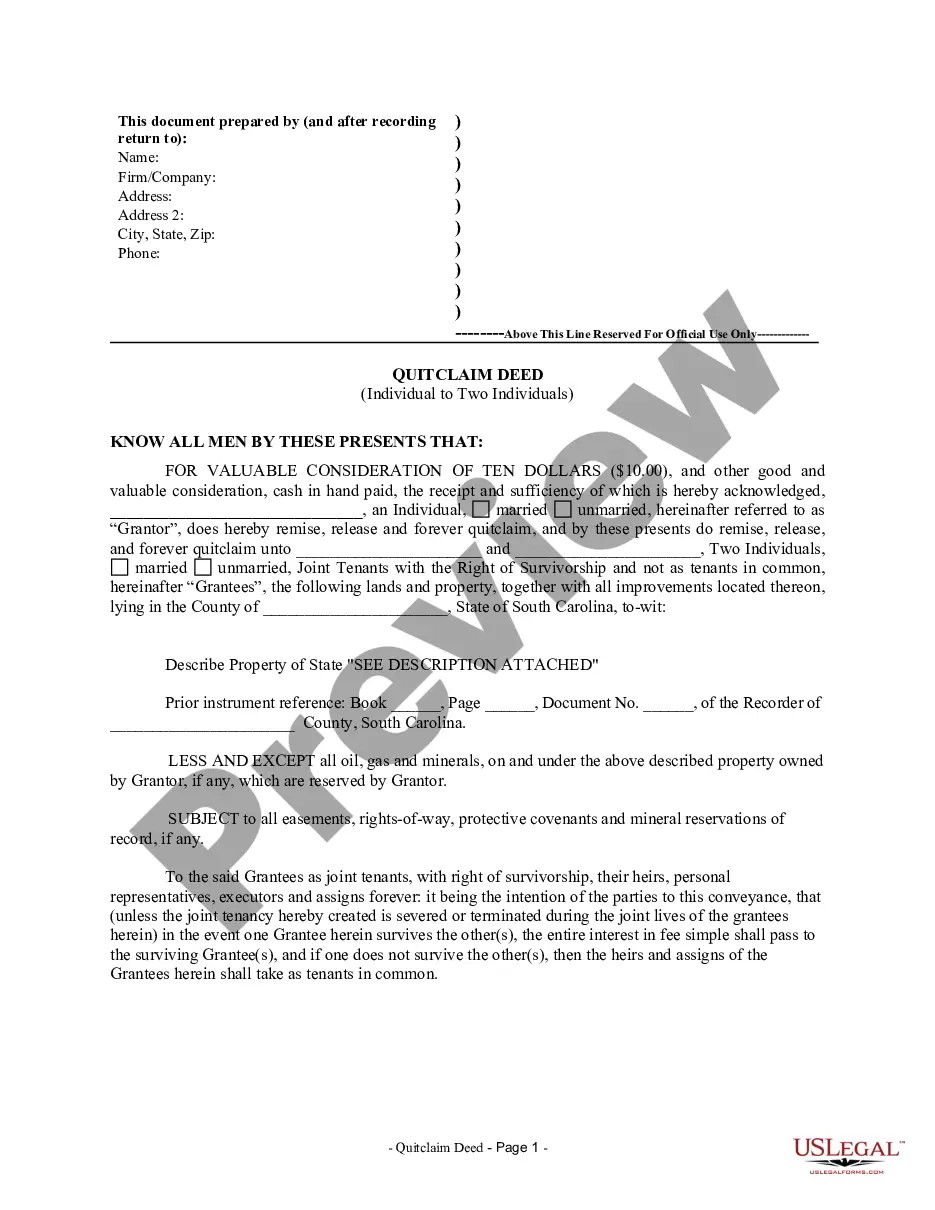

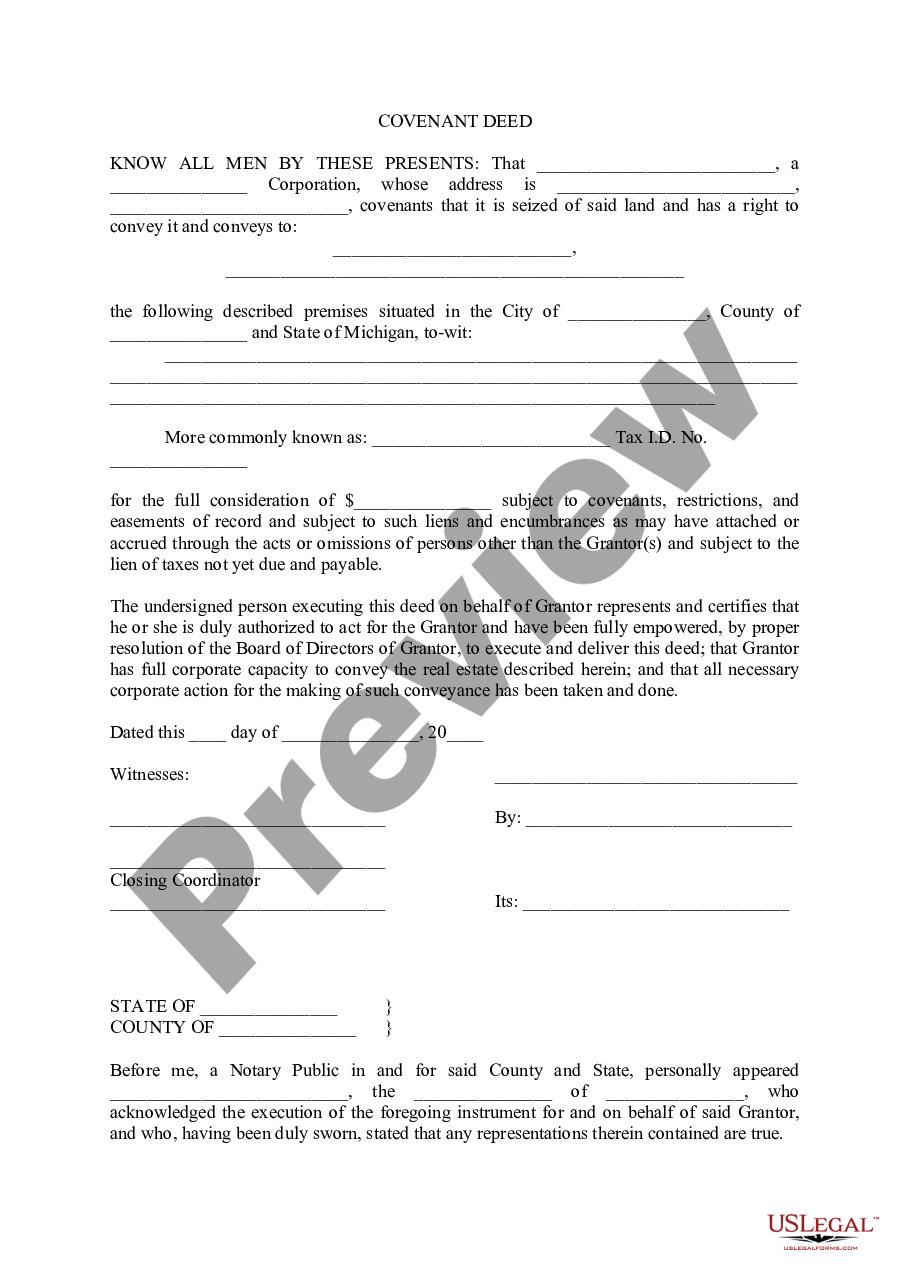

- Open the form preview, if available, to ensure the form is the one you are looking for.

- Get back to the search and locate the right template if the Bird Deed Statement Form Florida does not match your requirements.

- If you are positive regarding the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Pick the pricing plan that fits your preferences.

- Go on to the registration to finalize your purchase.

- Complete your purchase by picking a transaction method (bank card or PayPal).

- Pick the file format for downloading Bird Deed Statement Form Florida.

- When you have the form on your gadget, you may change it using the editor or print it and complete it manually.

Get rid of the inconvenience that comes with your legal documentation. Check out the comprehensive US Legal Forms library where you can find legal templates, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

In Florida, a property owner technically can prepare their own Lady Bird deed (also known as an Enhanced Life Estate Deed).

A Florida Lady Bird Deed allows you to avoid probate court In the case of lady bird deed, when you pass away you interest extinguishes and the beneficiaries you listed under the deed will inherit the property outside of probate code.

Disadvantages of Lady Bird Deeds Therefore, a Lady Bird deed cannot be used to create a remainder interest in third parties without the consent and involvement of the life interest holder's spouse and children. (2) Title insurers are often skeptical to insure Lady Bird deeds in certain situations.

How to Create a Florida Lady Bird Deed A correct legal description of the property. A statement of the consideration is provided if there is any. The name of the grantor. The name(s) of the beneficiary(ies) (if multiple owners are on title, a specification as to how the co-owners will hold title is required).

In Florida, inheriting property through a Lady Bird Deed generally does not trigger any income tax liabilities for the beneficiaries. This is because inherited property is not considered taxable income at the federal level.