Owner Corporation Form With Decimals

Description

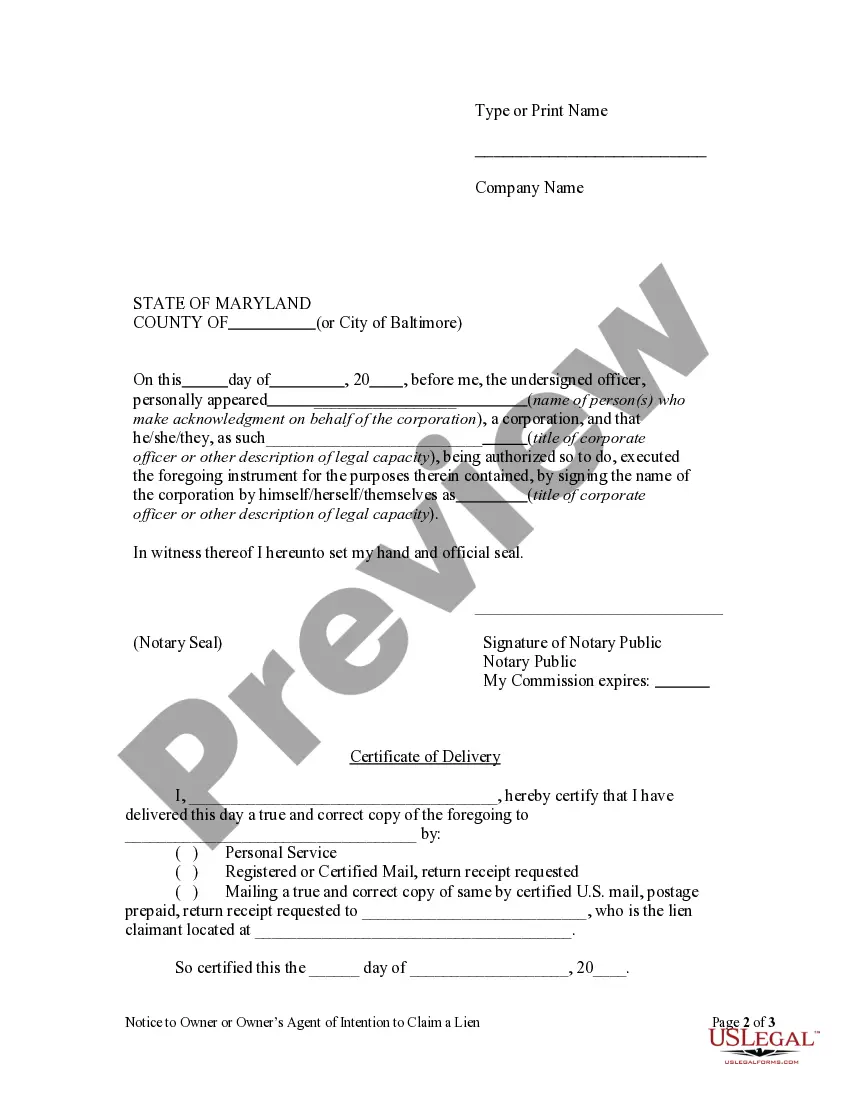

How to fill out Maryland Notice To Owner Or Owner's Agent Of Intention To Claim A Lien By Corporation Or LLC?

- If you are a returning user, log in to your account and navigate to the Download button for your desired form. Ensure your subscription is active or renew it if necessary.

- For first-time users, start by browsing the Preview mode and reading the form description carefully. Verify that your selection satisfies your needs and adheres to local jurisdiction requirements.

- Should you find any discrepancies, utilize the Search tab to find the correct template that meets your criteria.

- Once you've identified the right document, click on the Buy Now button to choose a suitable subscription plan. You'll need to create an account for full access to the library's extensive resources.

- Complete your order by entering your payment details via credit card or PayPal, then finalize your purchase.

- After the payment is processed, download your owner corporation form with decimals directly to your device. You can always find it later in the My Forms section of your profile.

In conclusion, US Legal Forms simplifies the process of accessing essential legal documents like the Owner Corporation Form with Decimals. With their extensive library and excellent user support, you can complete your paperwork accurately and efficiently.

Get started today and take advantage of US Legal Forms' vast resources to make your legal documentation hassle-free!

Form popularity

FAQ

Corporations are required to file Form 8938 if they have specified foreign financial assets exceeding certain thresholds. This owner corporation form with decimals helps the IRS keep track of your international holdings and ensures compliance with U.S. tax laws. It is crucial to determine whether your corporation meets these criteria to avoid potential fines. You can find useful guidance and templates on uslegalforms to assist you in this filing process.

Yes, some corporations are subject to the Alternative Minimum Tax (AMT). This tax applies to corporations that have certain tax benefits that exceed the allowed limits. If your corporation falls under these criteria, it will need to calculate its AMT liability correctly, using the owner corporation form with decimals. For more detailed information, check out uslegalforms for resources tailored to your needs.

Yes, Form 1120 can be filed electronically, which streamlines the filing process for corporations. Utilizing e-filing can ensure your owner corporation form with decimals is submitted accurately and on time. Many tax professionals recommend e-filing as a quicker and more efficient option. To facilitate this, explore the solutions provided by uslegalforms for easy e-filing.

Not all corporations need to file Form 4626. This form is specifically for corporations that are subject to the Alternative Minimum Tax (AMT). If your corporation qualifies, you will need to complete the owner corporation form with decimals accurately to meet your tax obligations. For more guidance, uslegalforms offers templates and resources that simplify this process.

Form 966 is generally required when a C Corporation is undergoing liquidation or dissolution. This owner corporation form with decimals allows the corporation to notify the IRS about the dissolution process formally. It is important to file this form to avoid complications regarding final tax obligations. If you’re unsure, consider consulting the resources available on uslegalforms for assistance.

Yes, Form 720 is still required for businesses that engage in taxable activities subject to Federal Excise Taxes. This includes taxes on specific products and services, which may affect your corporation directly. Staying informed about your filing requirements is crucial, and resources like US Legal Forms can help you manage these forms effectively and ensure your compliance.

The owner of a corporation is typically taxed at the corporate level, with profits distributed through dividends subject to personal income tax. This results in double taxation, which is an important consideration for corporate owners. To mitigate this, many choose strategies like utilizing an S Corporation status. To understand your obligations better, consider exploring the owner corporation form with decimals as it provides clear guidance on tax implications.

Whether IRS Form 7203 is required depends on your business structure and tax situation. It is primarily necessary for S Corporations needing to report financial information regarding stock and loans. Be sure to consult tax guidelines or utilize the owner corporation form with decimals to ensure you meet all necessary requirements and accurately report your information.

Form 7203 is necessary for certain business owners who want to report their basis in S Corporation stock or loans. If your corporation operates as an S Corporation and meets specific income criteria, you will need to fill out this form. It is important to accurately complete the owner corporation form with decimals to reflect your financial situation correctly.

You need to file Form 720 if your corporation engages in activities that require you to report certain Federal Excise Taxes. This includes activities such as selling certain goods, uses of certain products, or services that are subject to excise tax. To ensure compliance, you can review with your tax advisor or use resources like US Legal Forms to guide you through the necessary requirements.