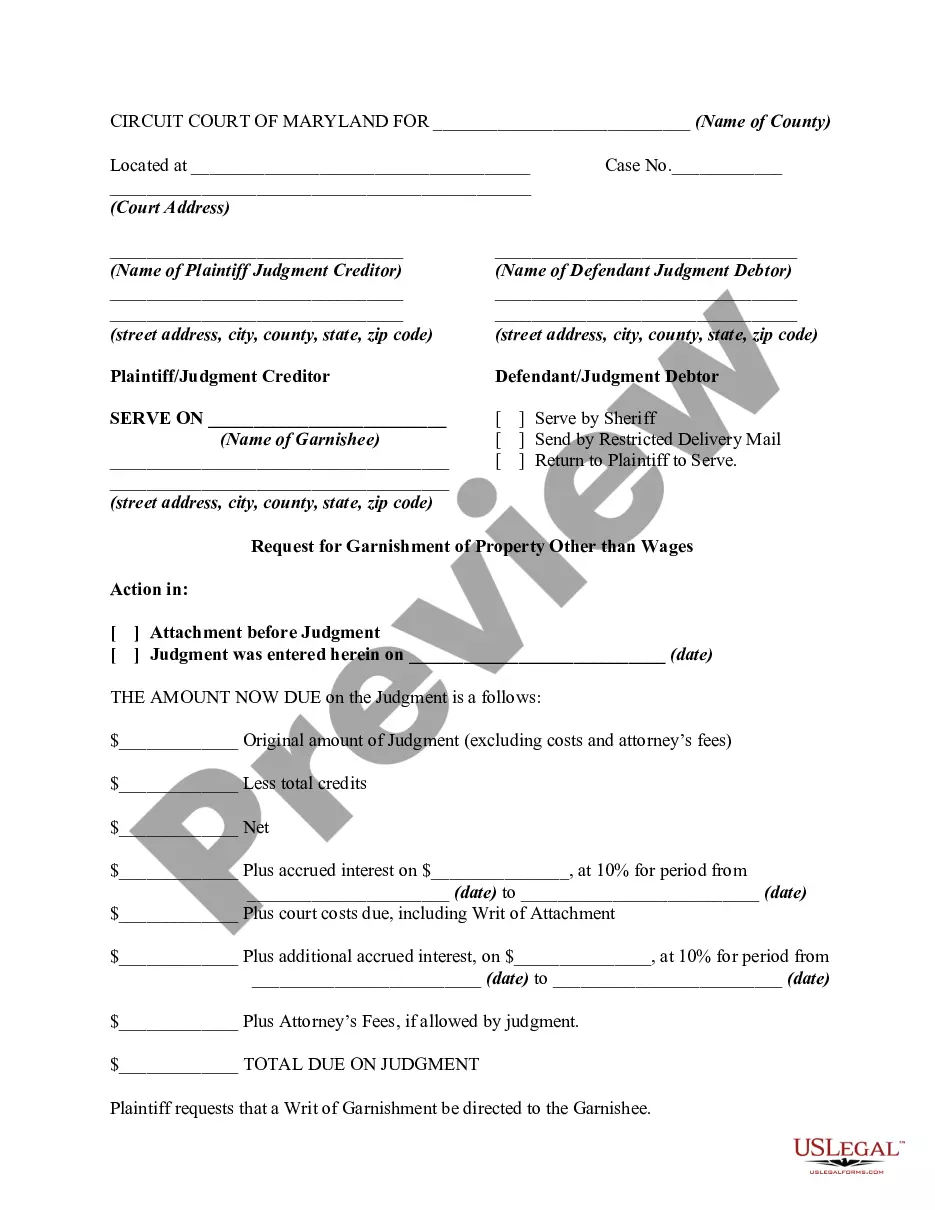

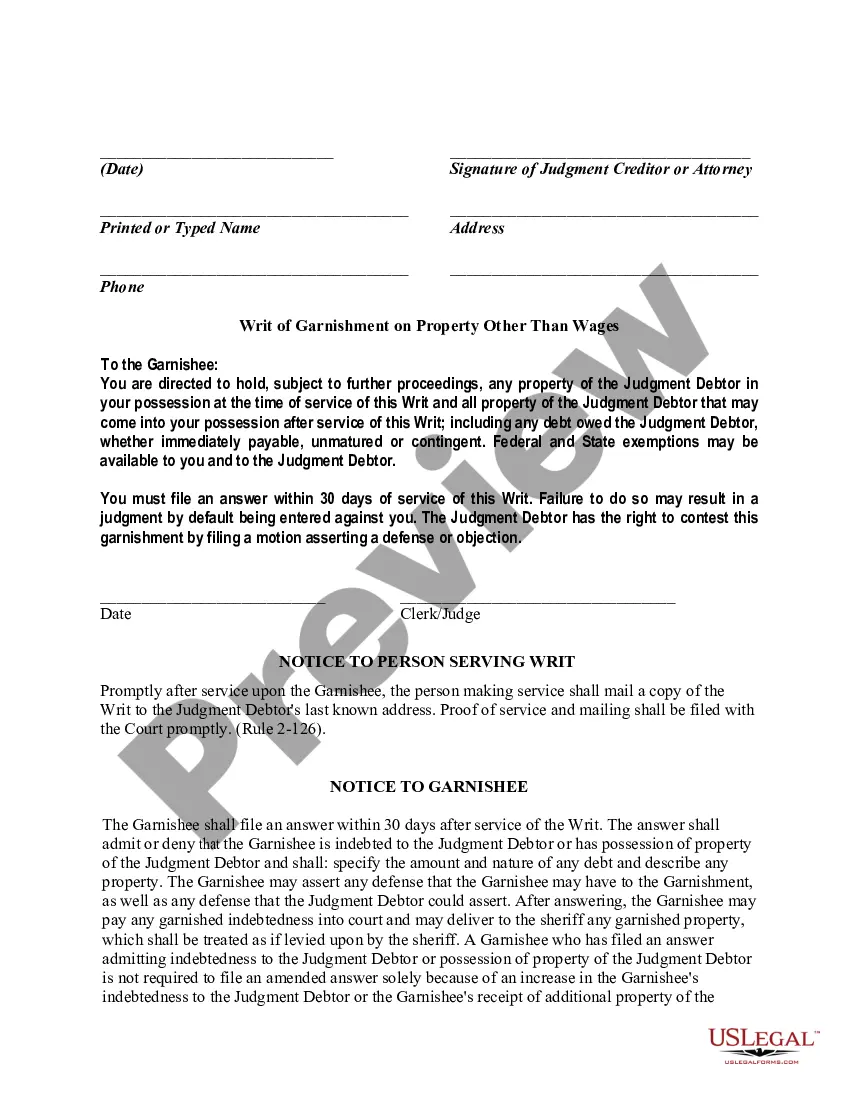

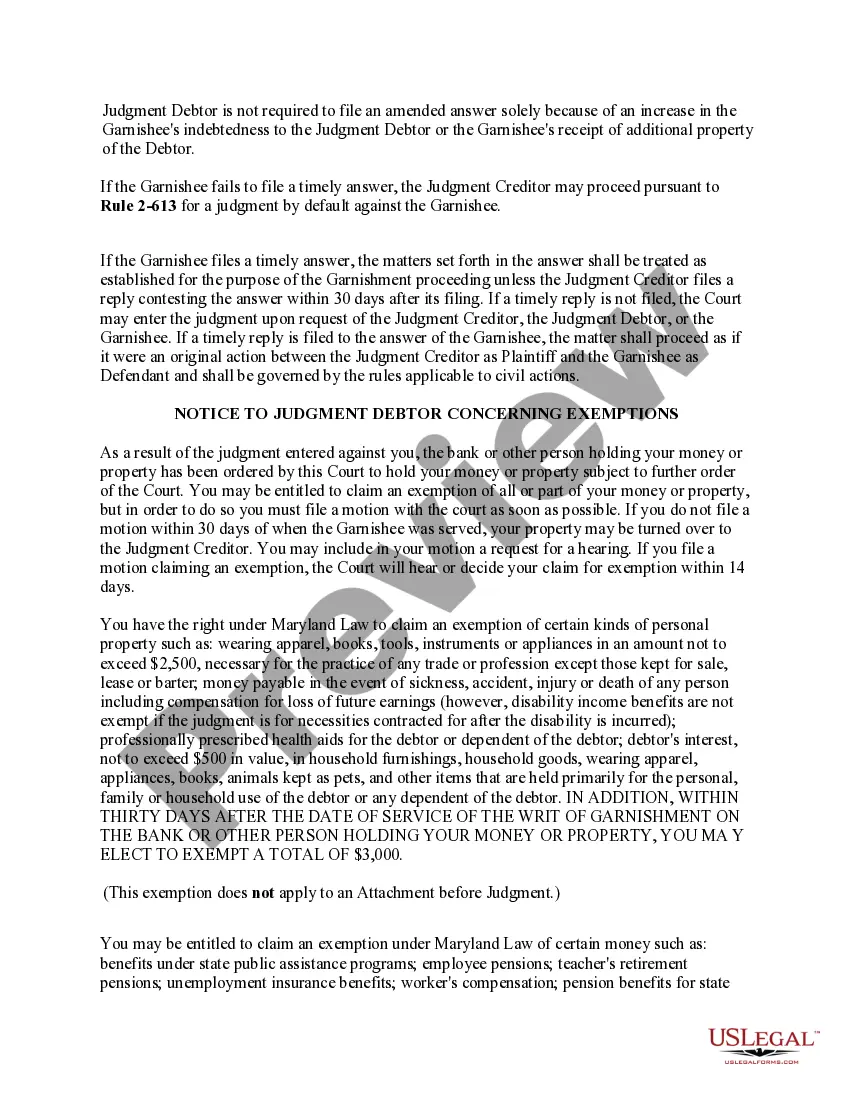

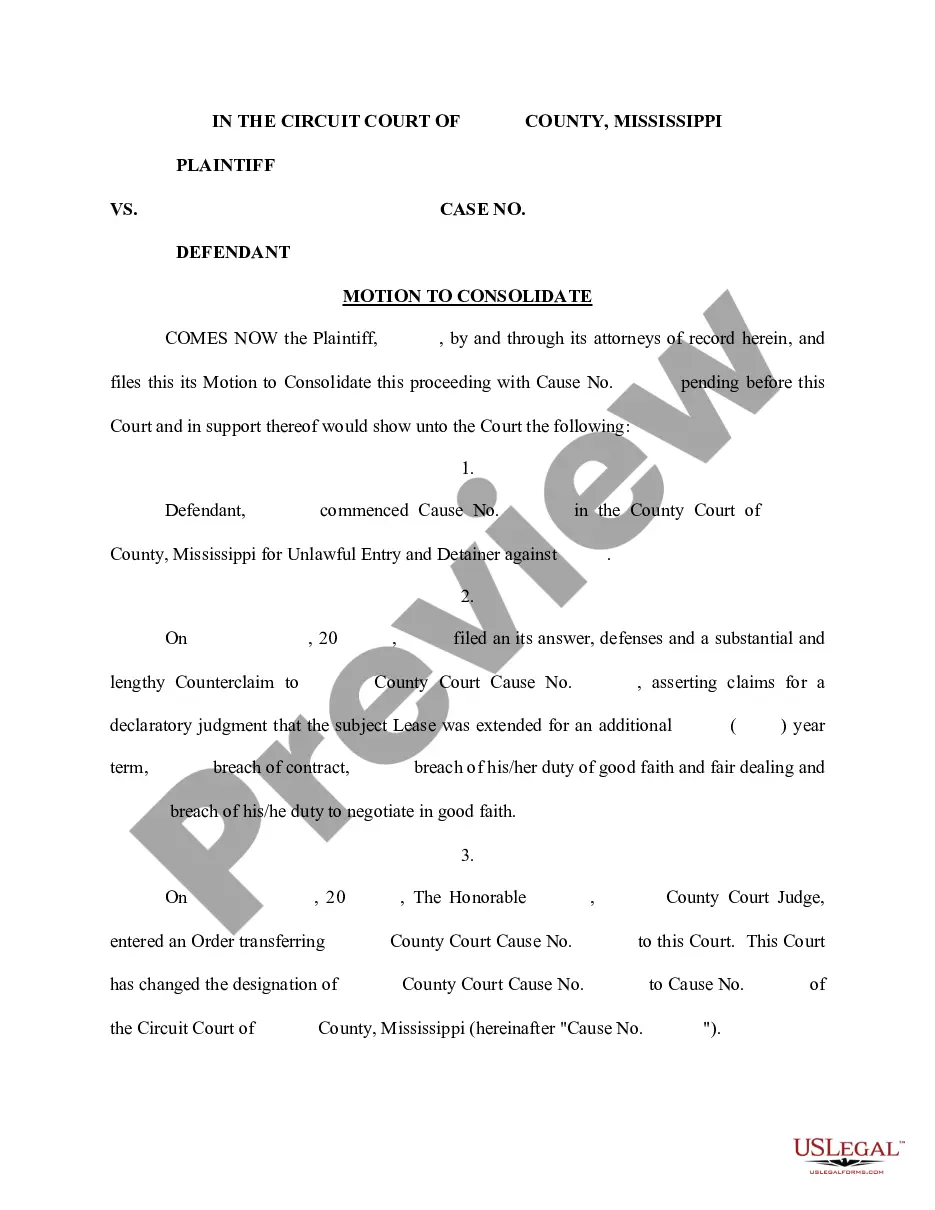

Request For Garnishment

Description

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

- If you have previously used US Legal Forms, log into your account, verify your subscription status, and download the required template by hitting the Download button.

- For first-time users, start by reviewing the Preview mode and form description to ensure you have the correct document that aligns with your local jurisdiction.

- If you need another template, utilize the Search tab at the top to find the right form that meets your specific requirements.

- Once you have selected the correct document, click on the Buy Now button and choose a suitable subscription plan. You'll need to create an account to access our extensive library.

- Proceed with your purchase by entering your credit card details or opting for PayPal to complete the transaction.

- Finally, download the form onto your device. You can access it anytime from the My Forms menu in your profile.

By empowering users with a vast collection of over 85,000 legal forms, US Legal Forms stands out in the market. Its robust offerings and expert assistance make it easy to fill out legal documents accurately, providing peace of mind in legal processes.

Don't let legal paperwork overwhelm you. Start your journey with US Legal Forms today and empower yourself with the resources you need for successful legal transactions!

Form popularity

FAQ

To file an appeal for wage garnishment, first check the specific court procedures for your jurisdiction. Gather the necessary documentation that supports your appeal, including the original garnishment order and any evidence contradicting it. Submit your appeal within the designated time frame along with required fees. This process may help you challenge the garnishment and seek a favorable outcome.

The best way to stop a garnishment is to take prompt action. This can involve negotiating with the creditor, seeking a court review, or filing for bankruptcy in some cases. You may also consider submitting a request for garnishment exemption based on your financial situation. Taking proactive steps can help you regain control over your finances and stop the garnishment.

Filling out a challenge to garnishment form requires you to access the correct documentation for your situation. Start by entering your personal information, the details of the garnishment, and the reasons for your challenge. Be concise and clear in your statements to strengthen your position. This form allows you to formally contest the garnishment, making it an important step in protecting your rights.

Writing a hardship letter for wage garnishment involves clearly explaining your financial struggles. Include specific details about your income, expenses, and any personal circumstances that impact your ability to meet your obligations. It’s important to convey how the garnishment creates further financial hardship. This letter can be an effective tool in your request for garnishment reconsideration.

When filling out a wage garnishment exemption, start by obtaining the appropriate exemption form. Fill in your personal information, including your income and any applicable expenses. It’s essential to provide accurate financial details to support your exemption claim. Being precise helps to effectively present your situation and can lead to removing the garnishment.

To write an objection letter for wage garnishment, begin by clearly stating your intent to object. Include relevant details such as your name, contact information, and the details of the garnishment. Be sure to explain your reasons for the objection, citing any supporting evidence. This letter can help you initiate the process to request a garnishment modification or termination.

To stop a wage garnishment immediately in New Jersey, you can file a motion to vacate the garnishment order. If you can prove the garnishment is causing undue hardship or if you were never notified, the court might rule in your favor. Utilizing legal resources, like our platform, can offer guidance on how to navigate this process seamlessly.

Yes, creditors can initiate wage garnishment without your knowledge once they have a court judgment. However, you should receive notification of their intent, often referred to as a 'request for garnishment,' detailing the amount they plan to withdraw. It's crucial to respond promptly to any legal notices to protect your rights.

A garnishment can be deemed invalid for various reasons, such as lack of proper notification or failure to follow legal procedures. If you believe a 'request for garnishment' was improperly issued, you can contest it in court. It’s important to act quickly and gather any necessary documentation to support your case.

In Wisconsin, the law limits wage garnishments to a percentage of your disposable earnings. Specifically, creditors can garnish up to 20% of your wages or the amount that exceeds 75% of the federal minimum wage, whichever is less. When facing a 'request for garnishment,' understanding these limits can help you plan your finances.