Types Of Wage Garnishments

Description

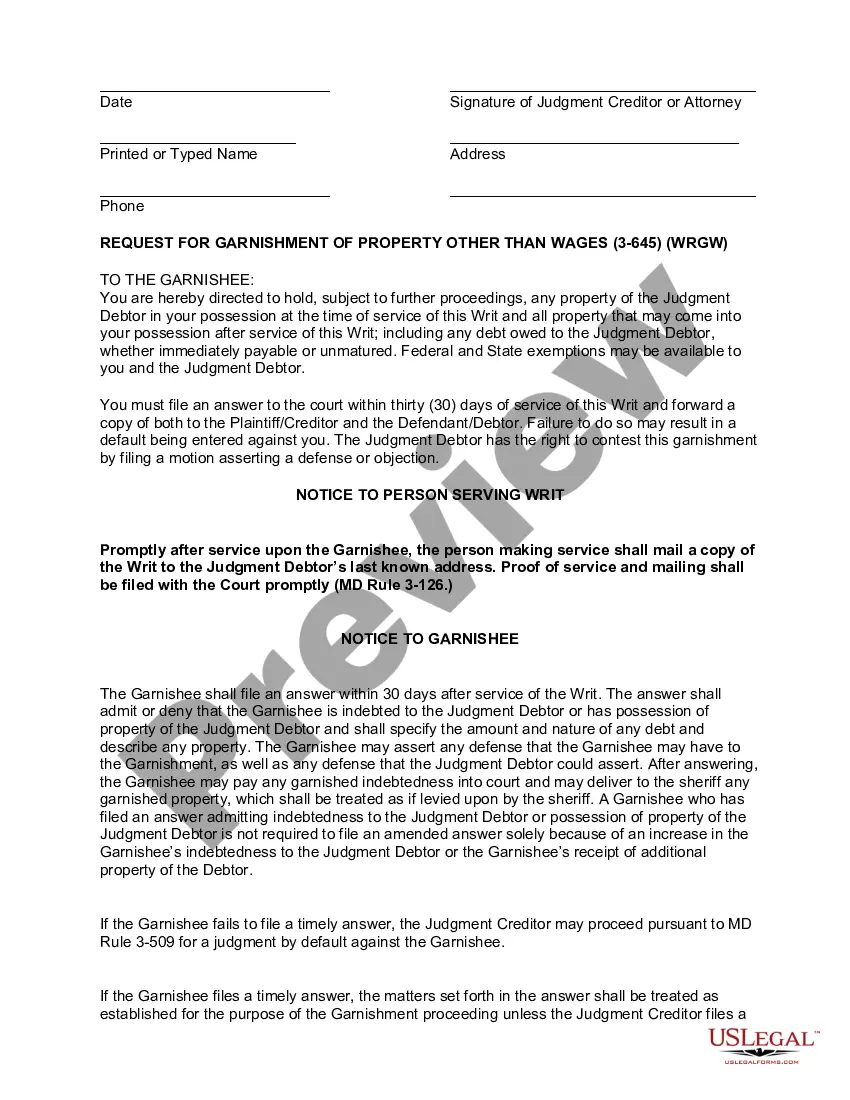

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

Managing legal documents and processes can be a lengthy addition to your schedule.

Categories of Wage Garnishments and similar documents often require you to locate them and understand how to fill them out accurately.

Therefore, if you are managing financial, legal, or personal issues, having a thorough and accessible online library of documents readily available will be extremely beneficial.

US Legal Forms is the leading online source of legal templates, featuring over 85,000 state-specific documents and various resources to assist you in completing your paperwork efficiently.

Simply Log In to your account, locate Categories of Wage Garnishments, and obtain it instantly from the My documents section. You can also access previously saved documents.

- Explore the collection of relevant documents available with just one click.

- US Legal Forms provides state- and county-specific templates available at any time for download.

- Protect your document management processes with a high-quality service that enables you to create any document within moments without extra or concealed fees.

Form popularity

FAQ

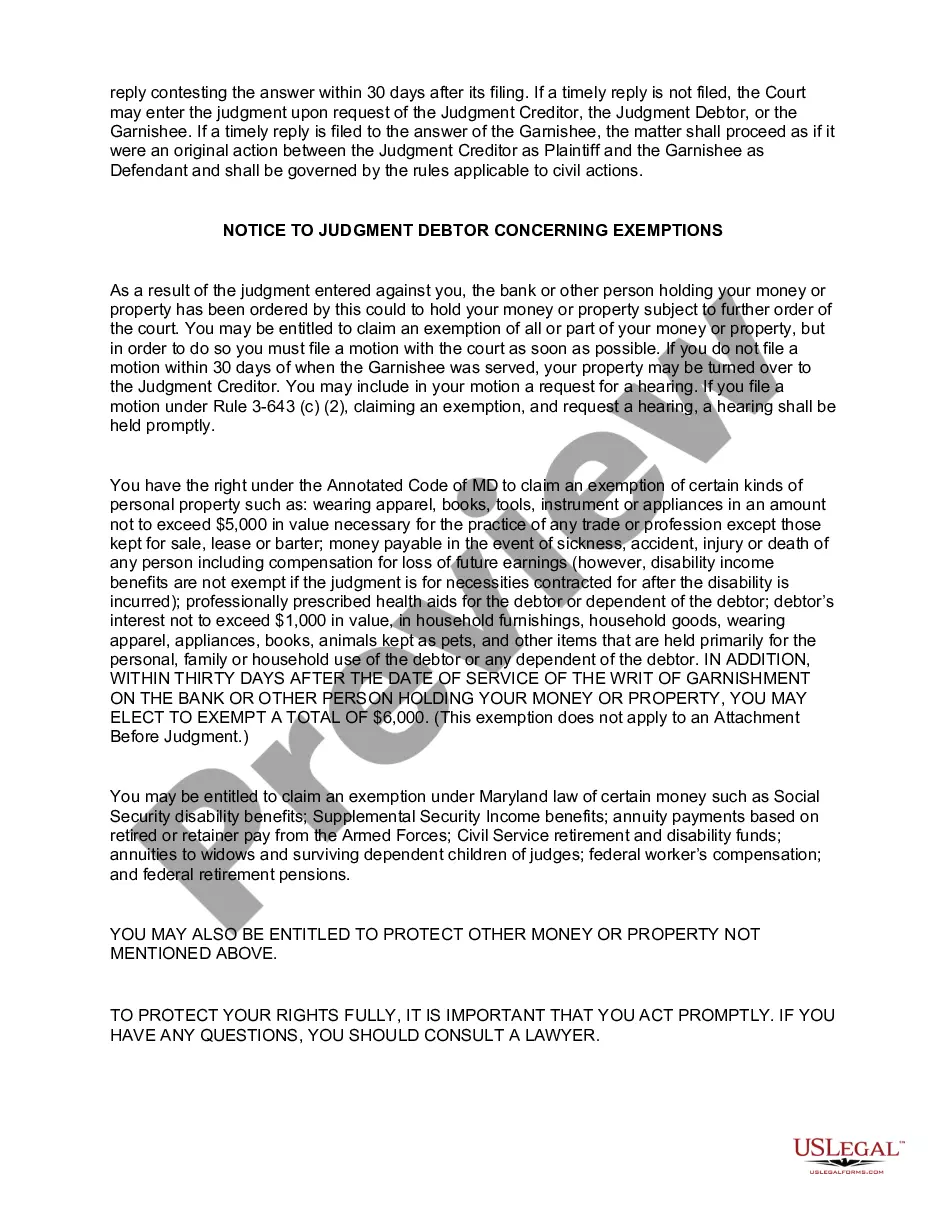

You can stop a garnishment by: Paying off the debt in full. Filing an objection to the garnishment with the court if you have legal basis, such debt was a result of fraud or identity theft. Filing for court protection and debt resolution through Chapter 13 or Chapter 7 bankruptcy.

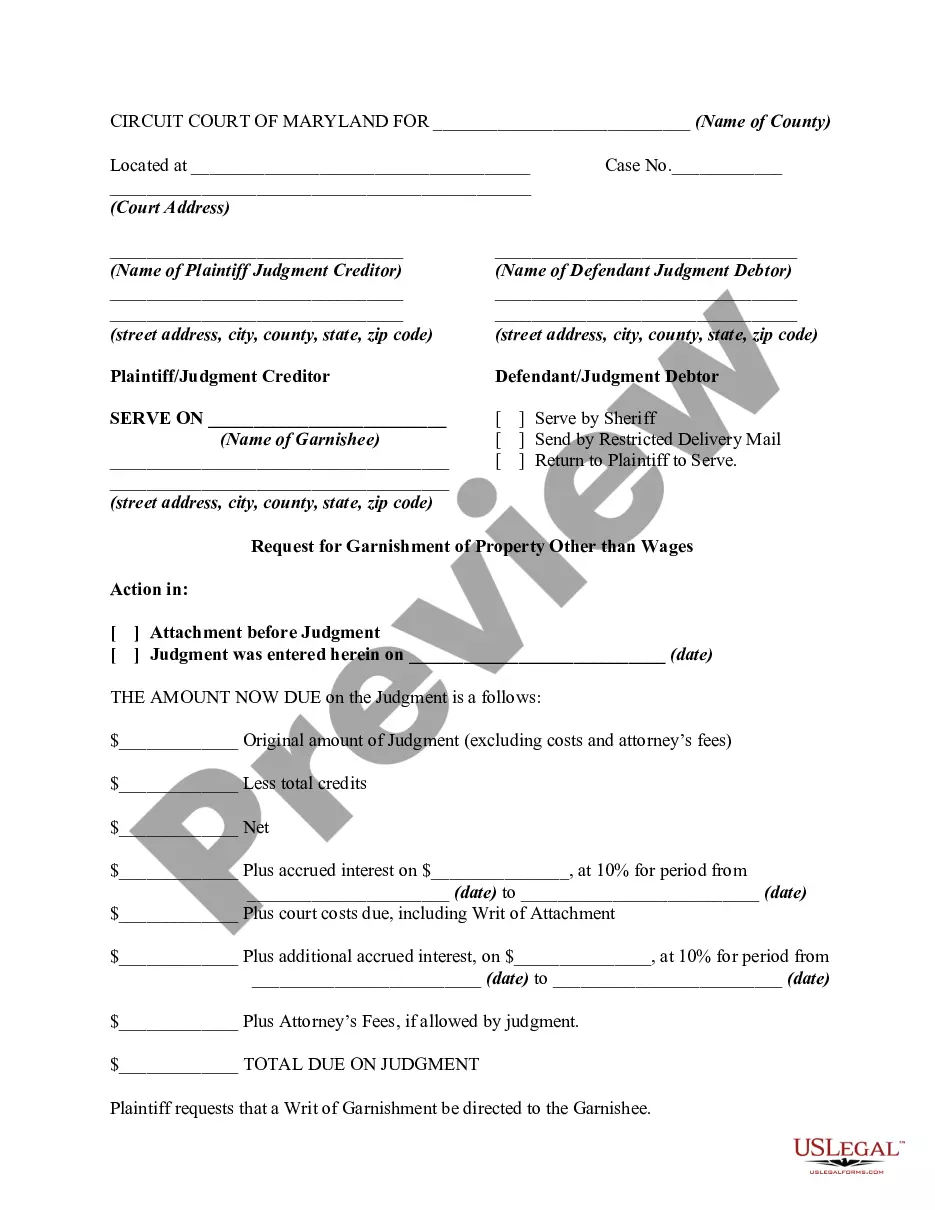

EXAMPLES OF AMOUNTS SUBJECT TO GARNISHMENT An employee's gross earnings in a particular week are $263. After deductions required by law, the disposable earnings are $233.00. In this week, $15.50 may be garnished, because only the amount over $217.50 may be garnished where the disposable earnings are less than $290.

QuickBooks Online Payroll Go to Payroll, then Employees. Select your employee. From Deductions & contributions, select Start or Edit. Select + Add Garnishment. In the dropdown menu ?select the Garnishment Type. Enter a description. ... Enter the following fields based on the garnishment type you chose. ... Select Save.

Child support is the most common wage garnishment in the United States, but it's not the only reason an employer may receive a garnishment order. Other examples include: Creditor garnishments. Bankruptcy.

If a judgment creditor is garnishing your wages, federal law provides that it can take no more than: 25% of your disposable income, or. the amount that your income exceeds 30 times the federal minimum wage, whichever is less.