Administrative Wage Garnishment Request For Hearing

Description

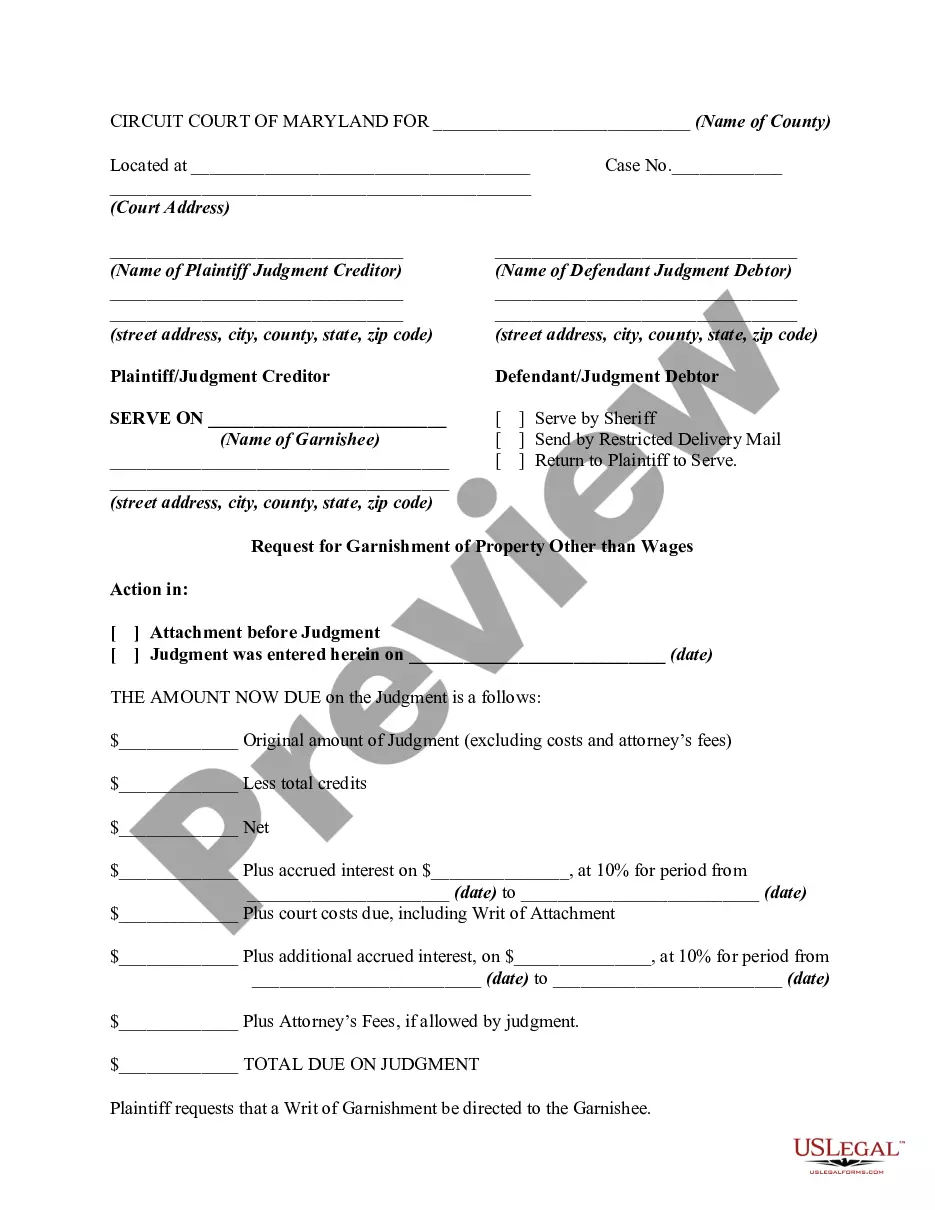

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

- If you're a returning user, log in to your account to download the required form template. Make sure your subscription is up-to-date.

- For new users, start by previewing the form descriptions available. Confirm that the selected form aligns with your requirements and local jurisdiction regulations.

- If the current form does not meet your needs, utilize the Search feature to find the correct template. This ensures you have the exact document necessary.

- Proceed to purchase the document by clicking the Buy Now button. Choose the subscription plan that works best for you and create an account to access the library.

- Complete your transaction by entering your payment details via credit card or PayPal to finalize your subscription.

- Download the form directly to your device, or access it later via the My Forms section in your profile.

US Legal Forms provides a robust collection of over 85,000 legal forms and packages, ensuring you can easily find and customize the documents you need.

Take advantage of our comprehensive library and premium expert assistance to ensure your legal documents are completed accurately. Start your journey with US Legal Forms today!

Form popularity

FAQ

Writing a letter to stop wage garnishment includes detailing your reasons for halting the process. Begin with your information and date, followed by a clear explanation of your situation. Make sure to mention your administrative wage garnishment request for hearing so the recipient understands the context. Keep a copy for yourself and send the letter through certified mail to ensure receipt.

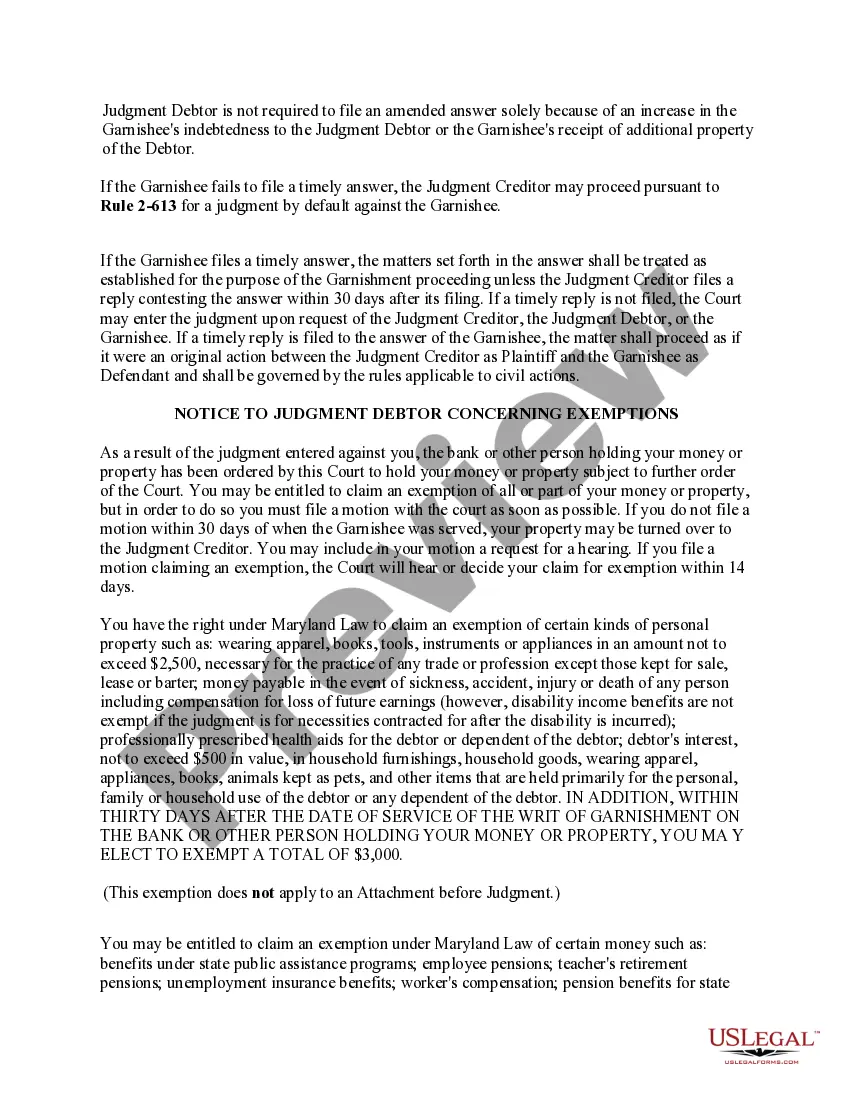

To fill out a wage garnishment exemption, you need to provide your details and outline the specific exemptions you’re claiming. Common exemptions include essential living expenses and necessary assets. Make sure to attach any documentation that supports your claims. Submitting a well-prepared exemption alongside your administrative wage garnishment request for hearing can safeguard your financial well-being.

The right to claim exemptions allows you to protect certain income or assets from wage garnishment. This means that you might be eligible to keep a portion of your earnings or specific properties essential for living. When you submit an administrative wage garnishment request for hearing, it is crucial to state any applicable exemptions. This can significantly reduce the impact on your financial situation.

Filling out a challenge to garnishment form requires careful attention to detail. Start by providing your personal details, including your name, address, and case number. Then, explain why you believe the garnishment is unjust, referencing specific legal grounds where applicable. Ensure all information is accurate, as errors can delay your administrative wage garnishment request for hearing.

To write a letter to stop wage garnishment, begin with your contact information and the date at the top of the letter. Clearly state your intention to submit an administrative wage garnishment request for hearing, and explain the reasons for your request. Include any relevant details, such as the type of debt and your financial situation. Don’t forget to make a copy for your records and send it via certified mail.

Yes, you can negotiate even after wage garnishment has started. It’s important to communicate with your creditor to explore possible payment plans or settlements. Conducting an administrative wage garnishment request for hearing can also give you leverage in negotiations. Being proactive is key to regaining control of your financial situation.

When you go to court for garnishment, you will have the opportunity to present your side of the case. The creditor will also present their reasons for the garnishment. The judge will evaluate both sides before making a decision. Understanding the process helps when you make an administrative wage garnishment request for hearing.

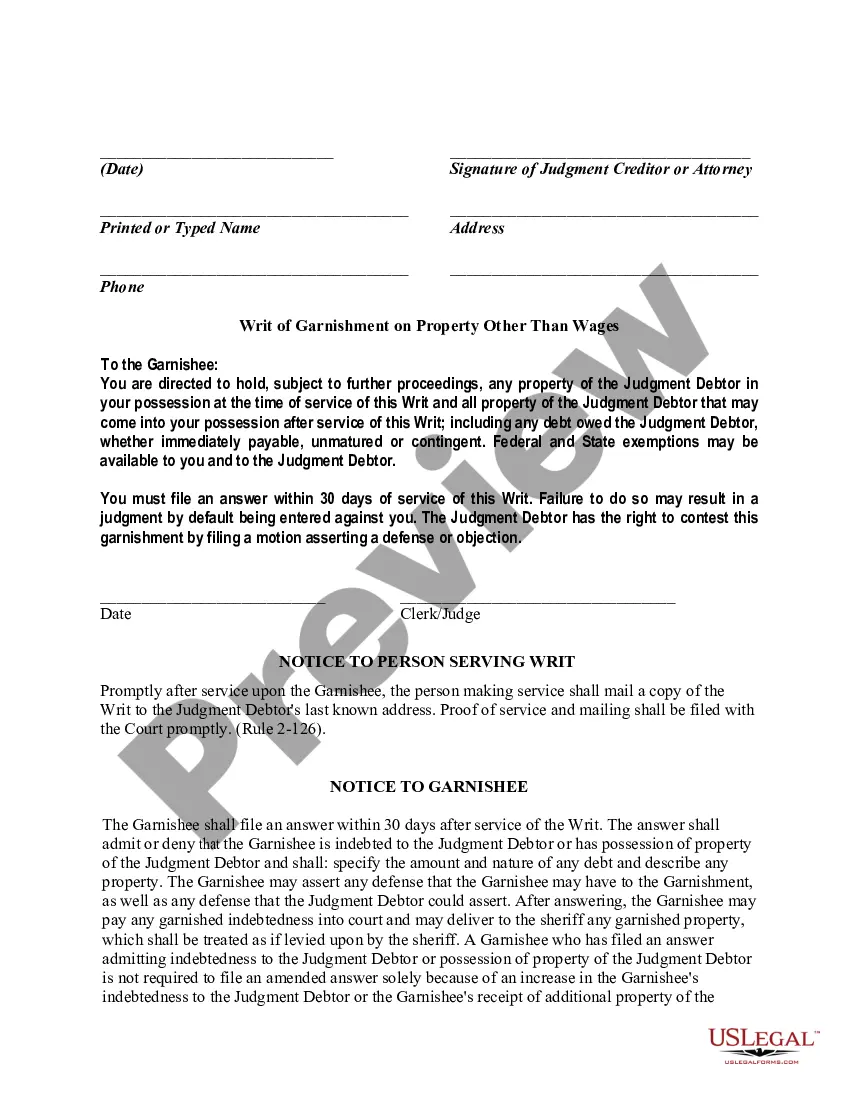

Administrative wage garnishment is a legal process where a portion of your wages is withheld to repay a debt without going through court. This process can happen swiftly, so responding timely is crucial. When making an administrative wage garnishment request for hearing, you may challenge the garnishment before it takes effect. Awareness of your rights can guide you through this situation.

Generally, federal law allows garnishment of up to 25% of your disposable earnings. However, if your income is below a specific threshold, the amount garnished could be lower. Knowing the specifics of your case can help you during an administrative wage garnishment request for hearing. Being informed empowers you to take action.

During a wage garnishment hearing, you will present your case to a judge or hearing officer. You should prepare to discuss your financial situation and any reasons for disputing the garnishment. This is essential for making an administrative wage garnishment request for hearing. It's a chance to ensure your voice is heard.