Limited Limited

Description

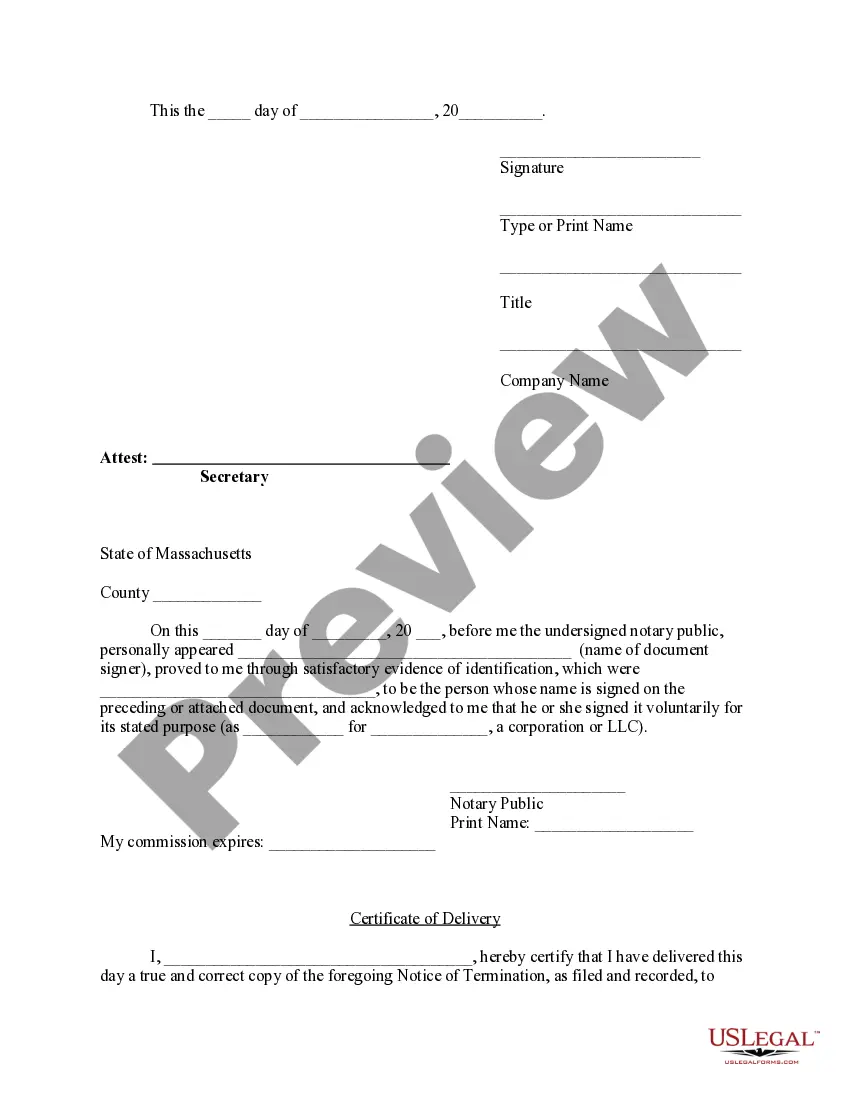

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

- If you are a returning user, log into your account and click the Download button to save the required form template. Ensure your subscription is valid; renew if necessary.

- For first-time users, start by reviewing the Preview mode and form descriptions to choose a document that meets your needs and complies with local jurisdiction requirements.

- If you need a different template, utilize the Search tab to find a suitable option before proceeding to the next step.

- Select the document by clicking on the Buy Now button, and choose your preferred subscription plan. You will need to create an account to access the entire library.

- Complete your purchase by entering your payment details or using your PayPal account to secure your subscription.

- Finally, download the chosen form to your device for easy access. You can find it in the My Forms section of your profile.

Using US Legal Forms allows for quick and reliable legal document preparation, ensuring accuracy with the support of premium experts.

Don't miss out on the peace of mind that comes with having access to extensive legal forms. Start your journey with US Legal Forms today!

Form popularity

FAQ

The term 'limit limited' generally refers to restrictions placed on an entity's operations or assets. This might mean that something is confined within specific boundaries, whether in finance, inventory, or permissions. For businesses, adopting a 'limit limited' approach can help manage risk while allowing for effective resource allocation. USLegal forms can assist you in navigating these limitations with ease.

In the United States, 'Ltd' stands for 'Limited', which signifies a limited liability company or limited company structure. This legal designation limits the owners' liability, safeguarding their personal assets from business debts and obligations. Companies that operate under the Ltd designation can enjoy certain tax benefits and operational flexibility. Understanding Limited limited is essential for entrepreneurs looking to structure their businesses effectively.

AS Ltd stands for 'Aktieselskab Limited', which is a type of limited company commonly found in Denmark and similar jurisdictions. This designation indicates that the company operates with limited liability, similar to a corporation. Investors may find companies structured as AS Ltd appealing due to the limited financial risk involved. The concept of Limited limited plays a critical role in international business structures.

Ltd. Ltd. is an abbreviation that denotes a company structure known as a Limited Liability Company. This means the owners' financial liability is limited to their investment in the company, thus protecting personal assets. Companies using this structure are often established to limit risks while enjoying the benefits of a corporate entity. Being familiar with Limited limited can be beneficial when exploring business structures.

To fill out a W-9 form for an LLC, start by entering the LLC's name in the appropriate box. After that, indicate your entity's tax classification, either by checking 'Limited liability company' followed by the appropriate designation (C or S). Lastly, provide your business address and signature to complete the form.

No, an LLC is not limited to 100 members, which is a common misunderstanding. In fact, one of the appealing features of an LLC is the flexibility it offers regarding member capacity. This can be particularly beneficial for businesses planning to expand or add more partners over time.

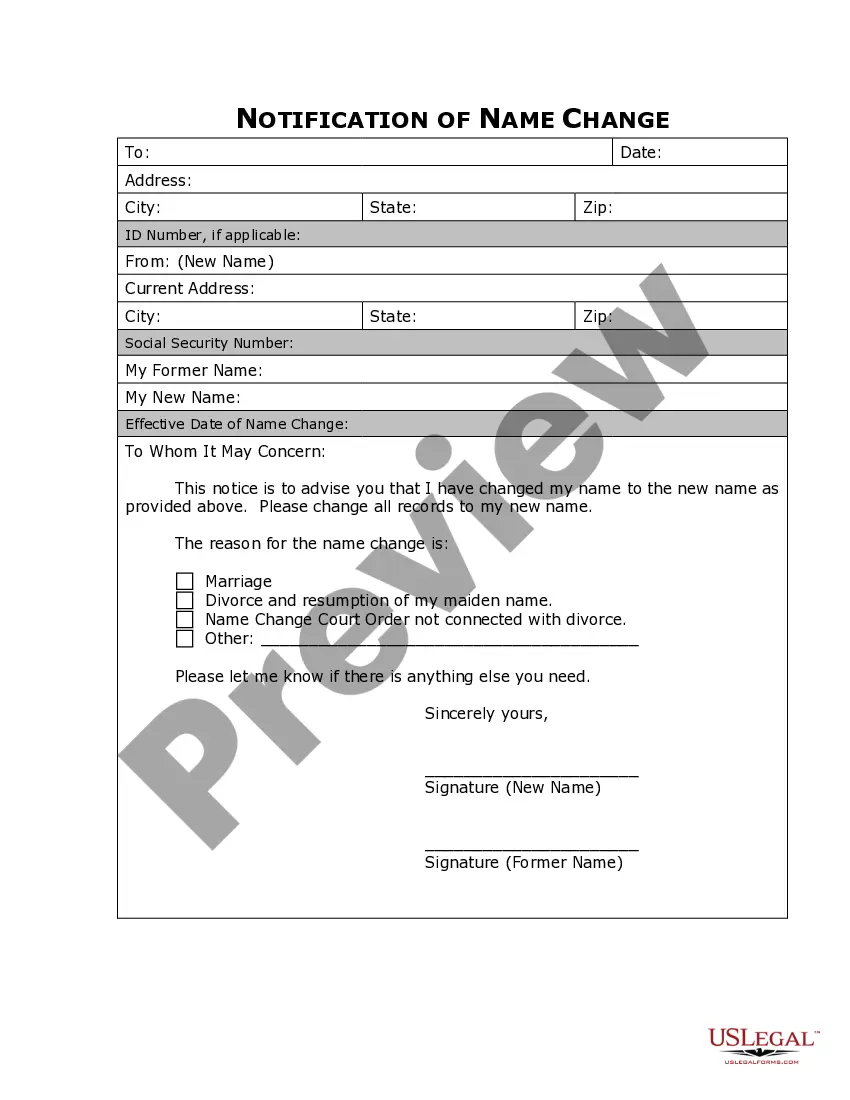

To complete a limited power of attorney form, first, define the specific powers you wish to grant and the duration of those powers. Clearly state the name of both the principal and the attorney-in-fact. After filling in the necessary details, don’t forget to sign and date the document, as it is crucial for its validity.

Yes, you can establish a 50-50 ownership agreement in an LLC, permitting two members to share equal control and profit. Such arrangements can simplify decision-making processes. Ensure to have a well-documented operating agreement to outline responsibilities and expectations.

Yes, an LLC can have unlimited partners or members, which makes it a very flexible business entity. This feature presents significant advantages for growing businesses that want to bring in more investors. Therefore, if you seek a structure with fewer restrictions, an LLC may be the right choice for you.

The S Corporation is the business structure that is specifically limited to a maximum of 100 owners, also known as shareholders. This limitation can enhance your tax situation under certain conditions. Knowing this helps when deciding on your business formation, particularly if you plan to have a limited number of owners.