Assumed Corporate Name Illinois

Description

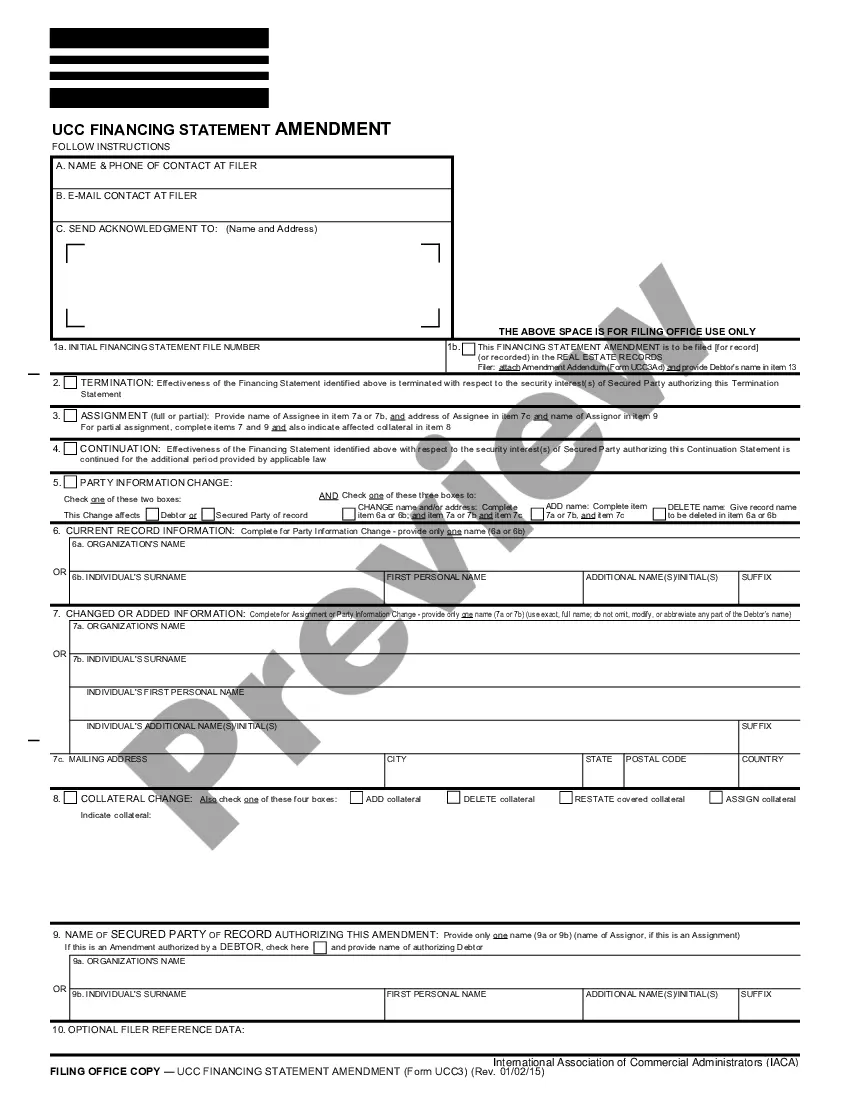

How to fill out Withdrawal Of Assumed Name For Corporation?

The Presumed Business Name Illinois displayed on this page is a reusable legal format crafted by experienced attorneys following federal and local statutes.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal professionals with over 85,000 validated, state-specific documents for any business and personal event. It is the fastest, simplest, and most reliable method to secure the paperwork you require, as the service assures the utmost level of data safety and anti-malware defense.

Pick the format you need for your Presumed Business Name Illinois (PDF, Word, RTF) and save the template onto your device. Complete and sign the documents. Print the template to fill it out by hand. Alternatively, utilize an online versatile PDF editor to swiftly and accurately fill out and sign your form with a legally-binding electronic signature. Download your documents again. Reuse the same document as needed. Access the My documents section in your profile to redownload any previously saved forms. Subscribe to US Legal Forms to have validated legal formats available for every aspect of life.

- Identify the document you require and review it.

- Browse the example you searched and view it or examine the form description to ensure it meets your needs. If it does not, utilize the search tool to find the suitable one. Click Buy Now once you have found the template you require.

- Sign up and Log In.

- Choose the pricing plan that fits your needs and establish an account. Use PayPal or a credit card for a prompt payment. If you already possess an account, Log In to check your subscription and proceed.

- Obtain the editable template.

Form popularity

FAQ

No person shall be in violation of any provision of this chapter prohibiting the acceptance of a gift if the gift is not used by such person and the gift or its equivalent in money is returned to the donor or delivered to a charitable organization within a reasonable period of time upon the discovery of the value of ...

A deed of gift must be signed by all parties, notarized by a Virginia notary, and witnessed by two or more parties who have no ownership interest in the property.

Deeds of gift are exempt from recordation taxes under Va. Code 58.1-811(D). The deed must state on its face that the transfer is exempt from the tax. Virginia does not levy a state gift tax, but the grantor must pay the Federal Gift Tax.

No recordation tax shall be required for the recordation of any deed of gift between a grantor or grantors and a grantee or grantees when no consideration has passed between the parties. Such deed shall state therein that it is a deed of gift. E.

A deed of gift must be signed by all parties, notarized by a Virginia notary, and witnessed by two or more parties who have no ownership interest in the property. The deed must be submitted to the recorder's office in the county of Virginia where the property exists.

In Virginia, gifting a home involves transferring ownership of the property from the current owner (the parent) to their child or children as a gift. This transfer can be made during the parent's lifetime or after their death. Gifting a home can be done through a quitclaim deed or other legal instrument.

How to Transfer Virginia Real Estate Locate the most recent deed to the property. ... Create the new deed. ... Sign and notarize the new deed. ... Record the deed in the land records of the clerk's office of the circuit court in the jurisdiction where the property is located.