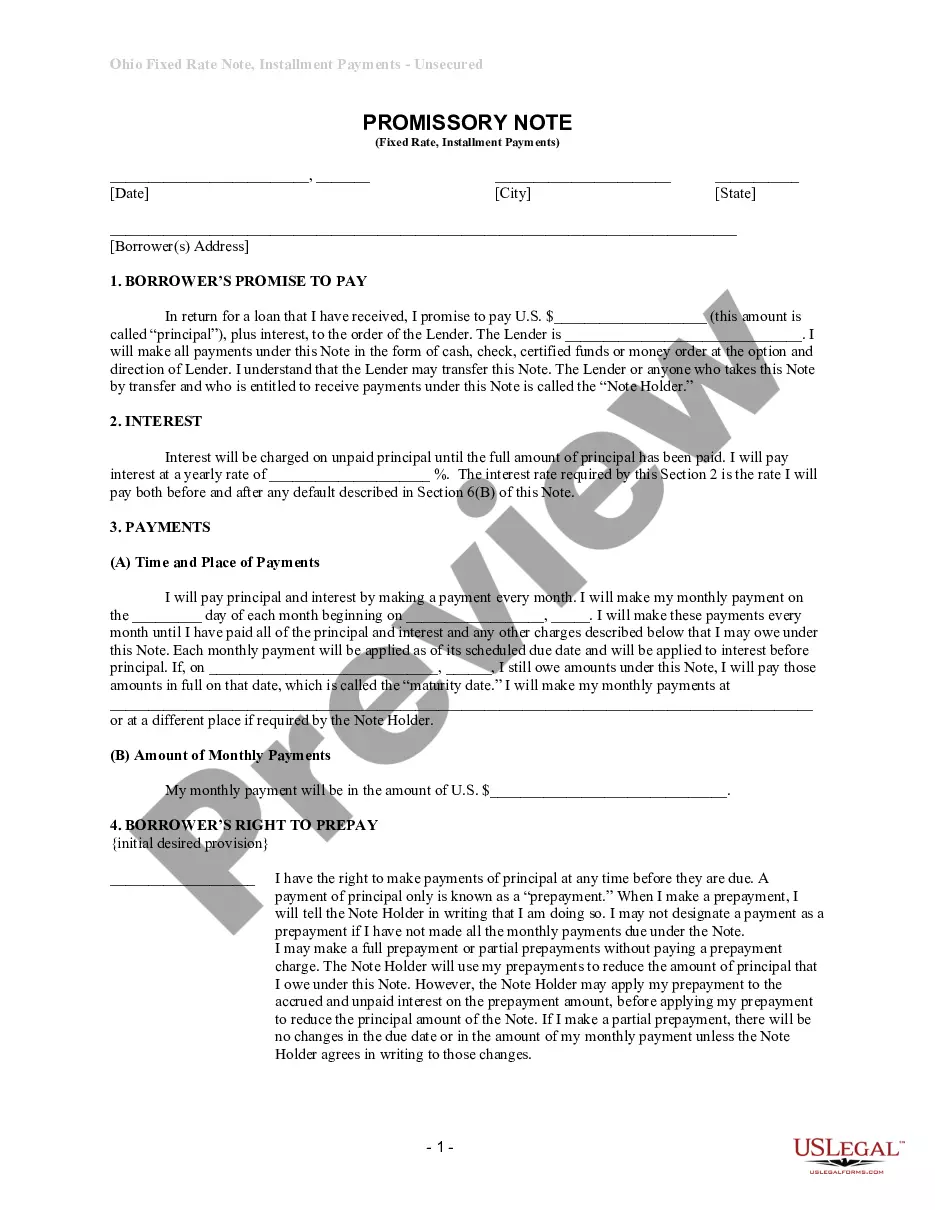

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Ohio Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Ohio Installments Fixed Rate Promissory Note: A financial document used in Ohio that dictates the terms under which money is borrowed and to be repaid in fixed installments at a fixed interest rate. Promissory Note: A written, legally binding document where one party promises to pay another a definite sum of money either on demand or at a specified future date. Secured Residential: Refers to loans or obligations secured by residential real estate. Real Estate: Property consisting of land and the buildings on it.

Step-by-Step Guide

- Determine the Loan Amount: Decide the total amount that will be loaned and the interest rate applicable.

- Create Promissory Note Terms: Outline repayment terms, such as the number of installments and duration of the loan.

- Secure the Note: Attach a collateral, often residential real estate, to secure the loan.

- Finalize Documentation: Ensure all parties read and understand the terms before signing the promissory note.

- Registration: Register the document as required by local laws in Ohio.

Risk Analysis

- Default Risk: The borrower may fail to make payments, impacting the lender's financial plans.

- Legal Issues: Inadequate documentation or failure to comply with local laws can lead to legal complications.

- Interest Rate Risk: Fixed rates might result in a loss if market rates go higher than the rate agreed upon in the note.

Key Takeaways

- Utilizing a fixed rate promissory note can offer predictable payment schedules and interest.

- Securing the note with residential real estate offers safety against default.

- Professional legal consultation is advised to comply with all applicable laws and regulations.

Common Mistakes & How to Avoid Them

- Unclear Terms: Always specify all loan details clearly in the promissory note to avoid disputes.

- Ignoring Legal Requirements: Always consult with a legal expert familiar with Ohio laws to ensure full compliance.

- Failure to Secure the Note: Always use a secured contract especially with substantial loan amounts.

Legal Use

A promissory note in Ohio can be used for a range of transactions, primarily focusing on real estate and large personal loans. Ensure compliance with the Ohio Revised Code and consult legal professionals when drafting the note.

How to fill out Ohio Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

When it comes to submitting Ohio Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you probably imagine an extensive procedure that requires finding a ideal sample among a huge selection of similar ones after which having to pay a lawyer to fill it out for you. Generally speaking, that’s a sluggish and expensive option. Use US Legal Forms and select the state-specific form within just clicks.

In case you have a subscription, just log in and click on Download button to find the Ohio Installments Fixed Rate Promissory Note Secured by Commercial Real Estate template.

If you don’t have an account yet but need one, keep to the point-by-point guide listed below:

- Make sure the file you’re saving applies in your state (or the state it’s needed in).

- Do this by reading through the form’s description and by clicking the Preview option (if readily available) to see the form’s content.

- Simply click Buy Now.

- Pick the suitable plan for your budget.

- Subscribe to an account and select how you want to pay out: by PayPal or by credit card.

- Download the file in .pdf or .docx file format.

- Find the file on the device or in your My Forms folder.

Skilled attorneys draw up our samples to ensure after saving, you don't have to worry about modifying content material outside of your individual information or your business’s info. Join US Legal Forms and get your Ohio Installments Fixed Rate Promissory Note Secured by Commercial Real Estate sample now.

Form popularity

FAQ

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.