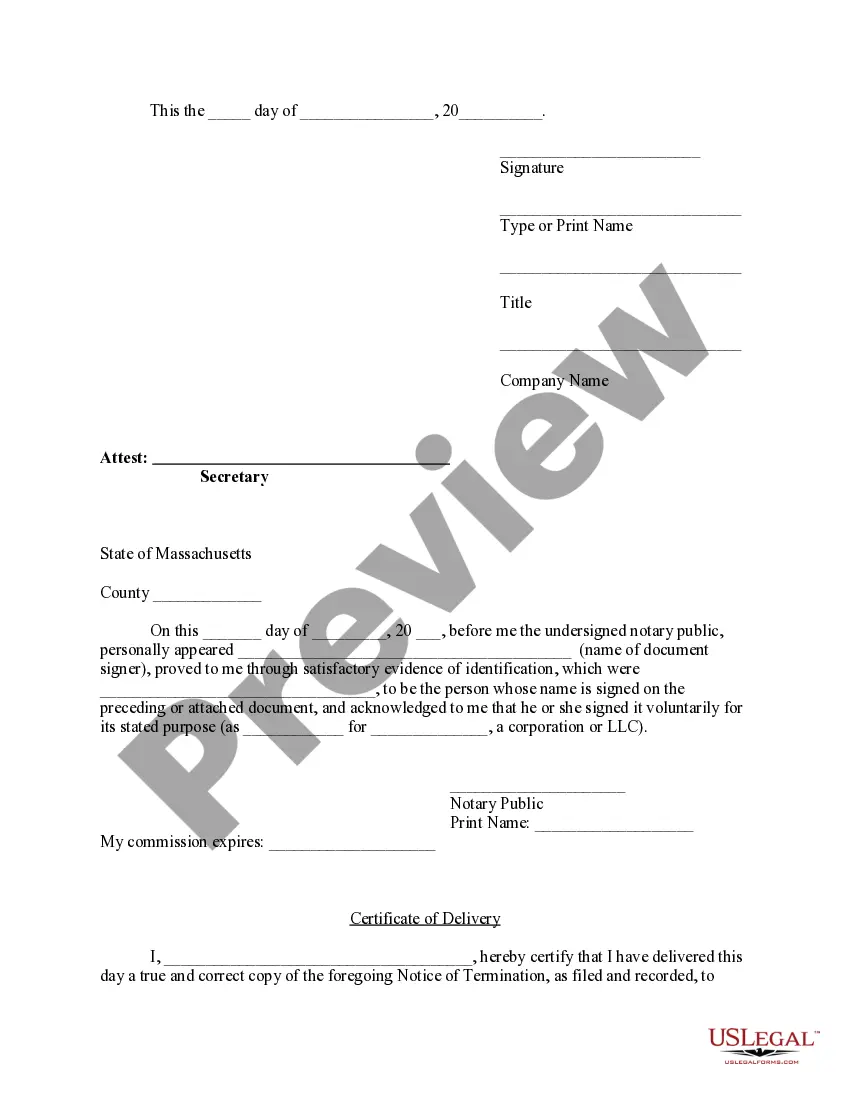

If in the event that a contract has been terminated prior to substantial completion, the owner shall provide a notice of termination by certified mail to every person who has filed or recorded a notice of contract and to the contractor. The contractor must then deliver a copy of said notice to every person who entered into a written contract directly with the contractor or who has given to the contractor written notice of identification.

Massachusetts Notice of Termination by Corporation or LLC

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Notice of Termination by Corporation or LLC: This is a formal declaration issued by a business entity, either a corporation or a limited liability company, to notify relevant stakeholders about its intent to terminate its existence. Operating Agreement Process: Refers to the procedures outlined within an LLC's operating agreement that governs the companys operations and steps for dissolution.

Step-by-Step Guide to Processing a Notice of Termination

- Review the Companys Operating Agreement: Begin by consulting the operating agreement to understand any stipulations about the dissolution process.

- Vote on Dissolution: Hold a formal vote among members (LLC) or shareholders (corporation) as required under state law.

- File Form Online: Use state-provided digital resources to submit necessary dissolution documents, such as the Articles of Dissolution.

- Settle Debts and Obligations: Close out all financial obligations including tax liabilities using tax accounting software.

- Distribute Remaining Assets: After all debts are settled, distribute the remaining assets amongst the rightful owners.

- Submit Final Tax Returns: Utilize a tax return guide or financial management solutions to accurately file final tax returns.

- Notify Relevant Parties: Send out the notice of termination to all stakeholders, including clients and suppliers.

Risk Analysis

- Legal Risks: Non-compliance with state laws and regulations can lead to legal actions against the former members of the corporation or LLC.

- Financial Risks: Inadequate handling of financial obligations could result in unresolved debts affecting former members personal finances.

- Reputation Risks: Poor management of the termination process might harm the business reputation, impacting stakeholders future business endeavors.

Pros & Cons of Using CT Corporation Services for Company Dissolution

- Pros: Provides expert insights into the dissolution process; ensures compliance with local laws; easy navigation through the file form online system.

- Cons: Can be costly compared to self-managed dissolution; potential privacy concerns with third-party handling.

Best Practices

- Ensure thorough review of all legal documents by startup legal clarity experts.

- Utilize reliable financial management solutions to manage end-of-business finances and tax reporting.

- Maintain clear communication with all stakeholders throughout the dissolution process.

Common Mistakes & How to Avoid Them

- Failing to Notify Creditors: Make a comprehensive list of all creditors and ensure they are informed about the dissolution.

- Incorrect Filing: Double-check all forms for accuracy and completeness before submission. Consider using ct corporation services for assured compliance.

- Neglecting Tax Obligations: Leverage tax accounting software and follow a tax return guide to manage final tax submissions meticulously.

FAQ

Q1: How long does it take to process a notice of termination?

A1: The duration can vary significantly by state law and the completeness of the submission.

Q2: Can a company reverse a notice of termination?

A2: Typically, once the process has started, reversing it can be complicated and is often not possible without significant legal and financial implications.

How to fill out Massachusetts Notice Of Termination By Corporation Or LLC?

Greetings to the most important legal documents collection, US Legal Forms. Here you will discover various samples including Massachusetts Notice of Termination by Corporation or LLC forms and retain them (as many as you desire). Generate official documents in merely a few hours, instead of days or weeks, without spending a fortune on a lawyer. Obtain your state-specific template in just a few clicks and feel assured with the knowledge that it was prepared by our state-certified lawyers.

If you are already a registered user, simply Log Into your account and select Download next to the Massachusetts Notice of Termination by Corporation or LLC you require. Since US Legal Forms is an online service, you will always have access to your saved templates, regardless of the device you are using. Find them under the My documents section.

If you do not have an account yet, what are you waiting for? Follow our instructions below to get started.

Once you have finished the Massachusetts Notice of Termination by Corporation or LLC, send it to your lawyer for verification. It’s an additional step, but a crucial one to ensure you’re entirely protected. Join US Legal Forms today and access thousands of reusable templates.

- If this is a state-specific form, verify its validity in your state.

- Read the description (if available) to ensure it's the right sample.

- Explore more content using the Preview feature.

- If the document fits your needs, click Buy Now.

- To set up your account, select a subscription plan.

- Use a credit card or PayPal to register.

- Download the template in your preferred format (Word or PDF).

- Print the document and complete it with your or your business’s information.

Form popularity

FAQ

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.

To legally dissolve an LLC, a certificate of dissolution should be filed with the state of formation. The state will generally not issue the certificate until the LLC can provide documentation that the company is current on all its state tax liabilities.

The ending of a corporation, either voluntarily by filing a notice of dissolution with the Secretary of State or as ordered by a court after a vote of the shareholders, or involuntarily through government action as a result of failure to pay taxes.

Massachusetts requires business owners to submit their Certificate of Cancellation by mail, fax, or in-person. You can also have a professional service provider file your Articles of Dissolution for you. Incfile prepares the Articles of Dissolution for you, and files them to the state for $149 + State Fees.

Corporations may either dissolve voluntarily or involuntarily. A voluntary dissolution is done under the authorization of shareholders, or if there are no shareholders, under the authorization of the director(s).

Dissolution. The first step to closing up shop is receiving shareholder approval to formally close the corporation. The board of directors should adopt a resolution to dissolve the corporation and receive approval for the action.