Living Trist

Description

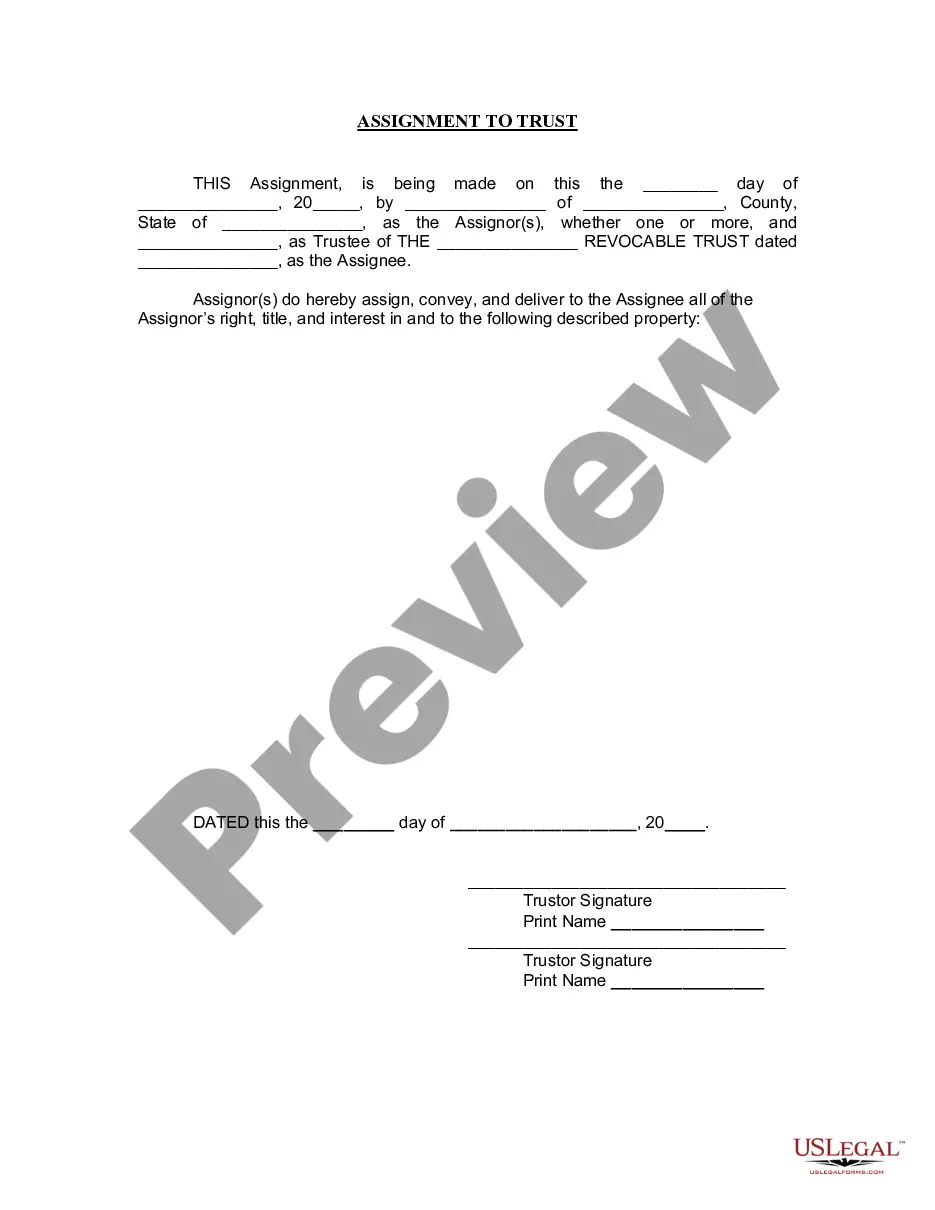

How to fill out Hawaii Assignment To Living Trust?

- If you are a returning user, simply log in to your account. Ensure your subscription is active; renew it if necessary.

- Preview the form you need to confirm its suitability for your requirements and local jurisdiction. Verify that it meets your specific needs.

- If the initial form isn’t a perfect match, utilize the Search feature at the top of the page to find a more appropriate template.

- Select the desired document and click on the Buy Now button. Choose your preferred subscription plan and create an account to access the library.

- Complete your purchase by providing your credit card information or using your PayPal account.

- Download the completed document for your records. You can also access it anytime from the My Forms section of your profile.

By following these steps, you can leverage the benefits of US Legal Forms, which not only provides a vast selection of forms but also connects you with experts for assistance if needed.

Start simplifying your legal document needs today—visit US Legal Forms and explore the convenience they offer!

Form popularity

FAQ

The main purpose of a living trust is to manage your assets during your lifetime and facilitate the smooth transfer of those assets upon your death. A living trust allows you to specify how you would like your property distributed without going through the lengthy probate process. Additionally, this type of trust offers privacy since it does not become a public record. Using Uslegalforms can help you create a comprehensive living trust tailored to your needs.

Yes, you can put your house in a living trust in Pennsylvania. This process allows you to transfer ownership of your property to a trust, providing benefits like avoiding probate and ensuring privacy. It's essential to follow the correct legal procedures to make this transfer effectively. Uslegalforms provides resources and templates to simplify setting up a living trust.

The three primary types of living trust are revocable, irrevocable, and testamentary trusts. Revocable trusts can be altered or canceled at any time during your life, providing flexibility. In contrast, irrevocable trusts cannot be changed once established, offering different tax benefits and asset protection features. Using US Legal Forms allows you to explore these options and create the right type of living trust for your situation.

One major disadvantage of a living trust is that it may not provide tax benefits like some other estate planning tools. Additionally, while a trust helps avoid probate, it can still incur costs for management and setup. Understanding these aspects is crucial, and consulting with platforms like US Legal Forms can provide clarity on how to effectively manage your trust.

Yes, you can write your own living trust in Minnesota, but you need to ensure it meets state requirements. A well-drafted living trust requires attention to detail and proper execution to be valid. Using tools from US Legal Forms can guide you through the process and help you avoid common pitfalls, making it easier for you to create a trust that serves your needs.

Filling out a living trust involves several straightforward steps. Begin by collecting information about your assets and their values, then use a template or legal service to draft the trust document. US Legal Forms offers comprehensive tools to help you create a living trust that specifies how your assets will be managed and distributed, ensuring your wishes are honored.

A common mistake parents make is failing to clearly define their intentions for the trust fund. Without proper guidance, beneficiaries may misunderstand the terms, leading to disputes later on. To avoid this, consider using resources like US Legal Forms, which provide you with templates and advice for establishing a living trust that reflects your family's needs.

Placing your house in a living trust can complicate your finances, as it might affect your mortgage or insurance. Furthermore, if your home value increases, you may face additional tax implications. It is essential to evaluate these factors carefully, ensuring that a living trust aligns with your overall financial strategy.

One downside of a living trust is that it may involve upfront costs. Setting up a living trust requires legal assistance, which can add to the expense. Additionally, once created, you must actively manage the trust to ensure it reflects your wishes and includes all relevant assets, which can be a time-consuming process.

No, you do not have to file a living trust with the court in California. Unlike a will, which requires probate, a living trust provides an efficient alternative for managing your assets outside the court system. This privacy benefit protects your financial affairs from public scrutiny. Embracing a living trust can greatly streamline your estate planning process.