PLLC Operating Statement

What is this form?

The PLLC Operating Statement is a crucial document that outlines the operational guidelines and structural framework of a Professional Limited Liability Company (PLLC) formed by licensed professionals such as accountants or lawyers. This agreement serves to establish the rules and management protocols among members, distinguishing it from simpler business formation documents by providing comprehensive provisions that govern member interactions and responsibilities.

Form components explained

- Company name and ratification of certificate of formation

- Purpose of the PLLC and scope of services

- Duration of the company and conditions for dissolution

- Internal governance including voting rights and roles

- Financial accounting, including distribution of income and expenses

- Procedures for member withdrawal, incapacity, and retirement

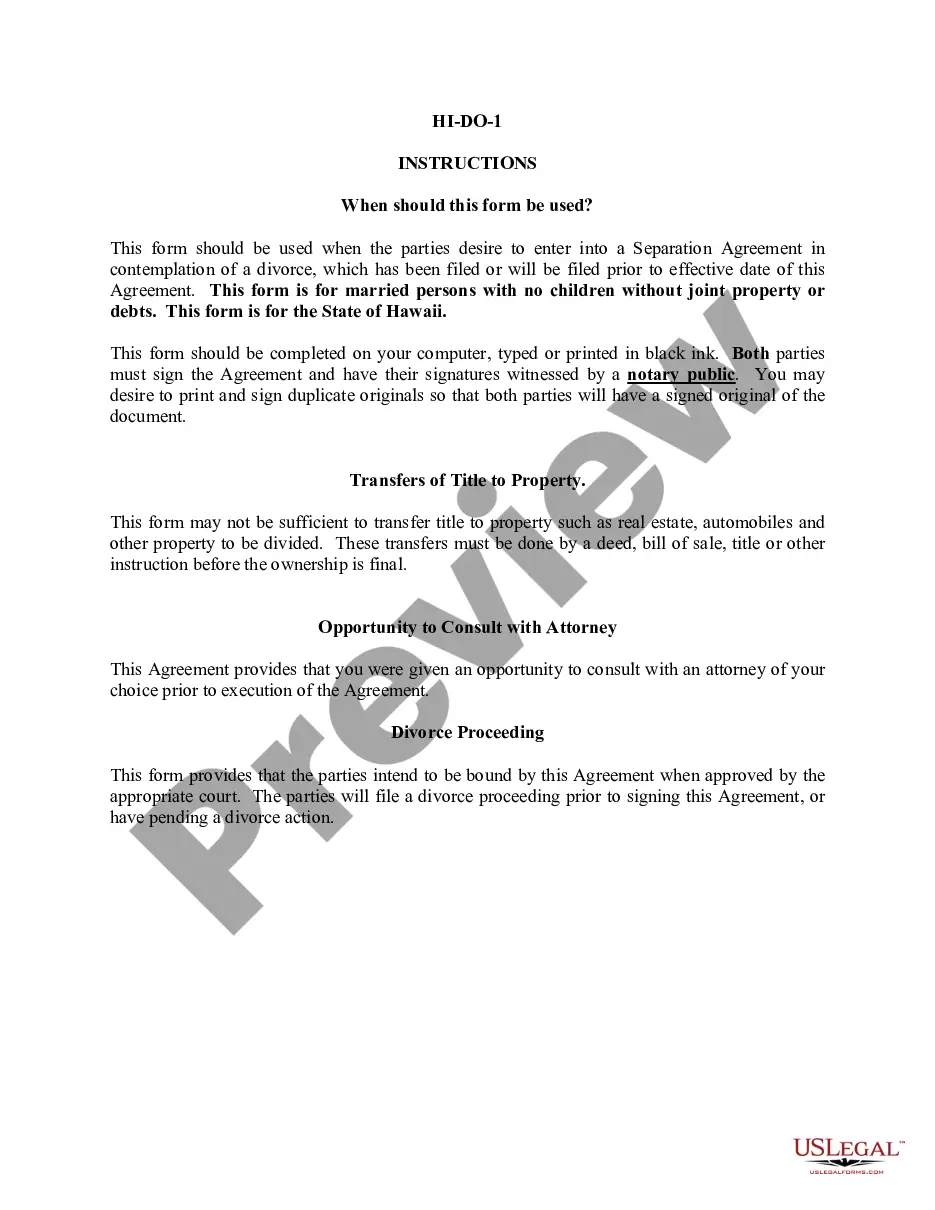

When to use this form

This form is essential when establishing a Professional Limited Liability Company, particularly for licensed professionals planning to collaborate in their practice. It is used to clearly define the roles, responsibilities, and operational procedures among members, ensuring compliance with legal requirements and protecting each member's interests.

Who should use this form

- Accountants, lawyers, and other licensed professionals looking to form a PLLC.

- Founding members or partners in a professional practice.

- Existing PLLC members needing to formalize operational agreements.

Completing this form step by step

- Identify and list the names of all founding members and members of the PLLC.

- Specify the purpose of the PLLC, including the type of professional services offered.

- Detail the management structure and voting rights of members in the document.

- Outline financial contributions, responsibilities, and distribution of profits among members.

- Include provisions for member withdrawal or retirement, as well as the process for resolving disputes.

Notarization guidance

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to clearly outline the roles and responsibilities of each member.

- Neglecting to update the operating statement when changes occur within the PLLC.

- Omitting details about financial accounting and profit distribution.

Benefits of completing this form online

- Convenience of downloading and using the form at any time.

- Editability to customize the document to your specific needs.

- Access to professionally drafted templates that ensure legal compliance.

Looking for another form?

Form popularity

FAQ

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

You do not need an attorney to form an LLC. Most states allow LLC formation by registering the business entity on your secretary of state's website and with the Internal Revenue Service (IRS). Once you register, you can buy or rent a building and have company bank accounts. Unfortunately, your company can also be sued.

As the owner of a single-member LLC, you don't get paid a salary or wages. Instead, you pay yourself by taking money out of the LLC's profits as needed. That's called an owner's draw. You can simply write yourself a check or transfer the money from your LLC's bank account to your personal bank account.

Choose a name for your LLC. File Articles of Organization. Choose a registered agent. Decide on member vs. manager management. Create an LLC operating agreement. Comply with other tax and regulatory requirements. File annual reports. Out of state LLC registration.

The LLC structure offers protection of personal assets in the same way a corporation protects shareholder assets. Creditors cannot sue members for liabilities of the company if the LLC goes into default. Owners receive a share of the profits of the company in proportion to their equity contribution as in a partnership.

Member Financial Interest. What percentage ownership does each member have? Corporate Governance. Corporate Officer's Power and Compensation. Non-Compete. Books and Records Audit. Arbitration/Forum Selection. Departure of Members. Fiduciary duties.

Pursuant to California Corporation's Code §17050, every California LLC is required to have an LLC Operating Agreement. Next to the Articles of Organization, the LLC Operating Agreement is the most important document in the LLC.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.