Subcontractors For Roofing

Description

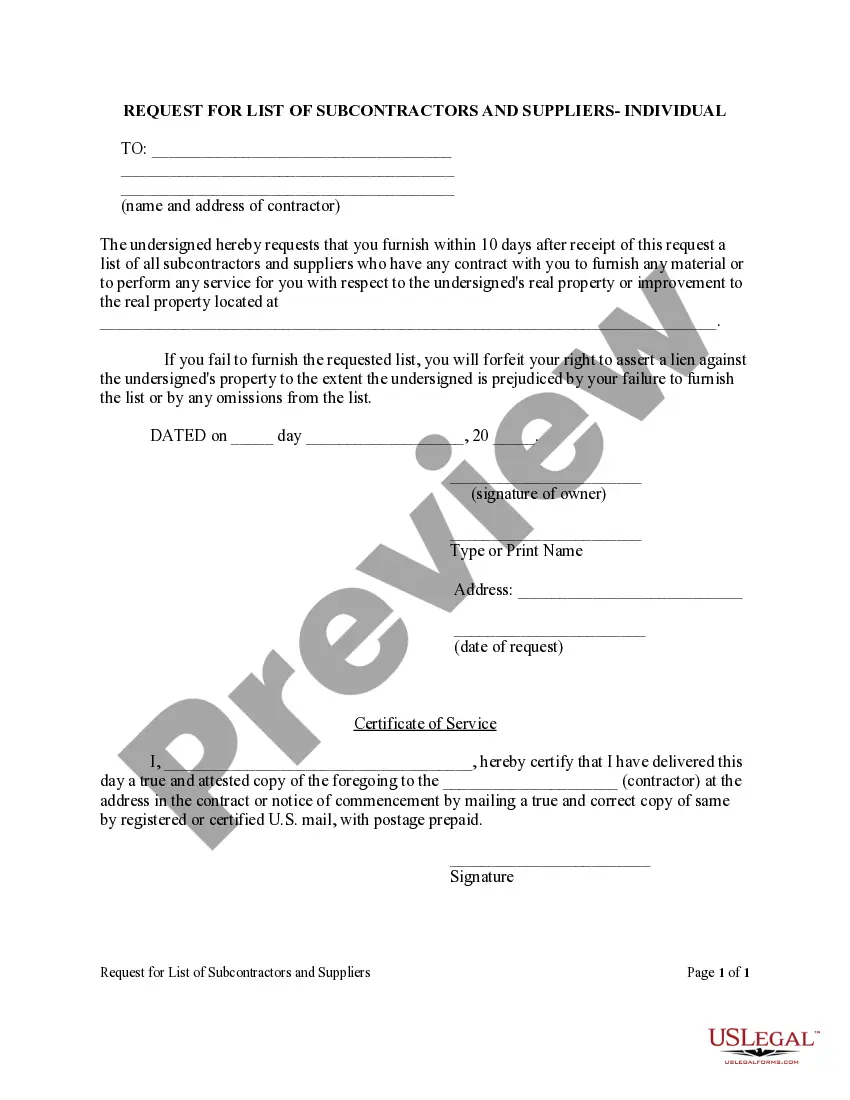

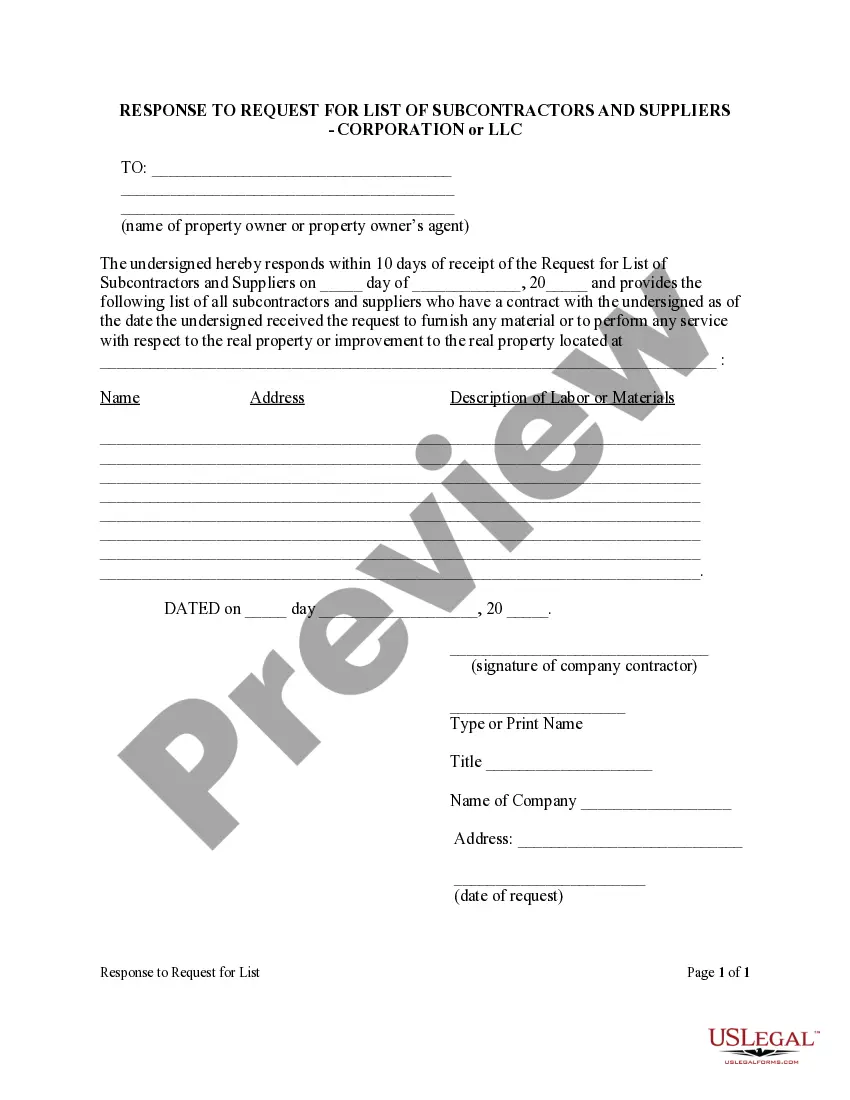

How to fill out Florida Response To Request For List Of Subcontractors And Suppliers - Individual?

- If you're a returning user, log in to your account and select the form template you need from the library. Ensure your subscription is active—if not, renew it based on your payment plan.

- For first-time users, begin by exploring the Preview mode and reading the form description to identify the correct document that meets your roofing needs and complies with local jurisdiction requirements.

- If necessary, utilize the Search tab to locate alternative forms, ensuring you find a template that fully matches your requirements before proceeding.

- Purchase the desired document by clicking the Buy Now button and selecting a subscription plan. Note that you will need to create an account to access the full library.

- Complete your purchase by providing your credit card details or opting for PayPal for a hassle-free transaction.

- Download the form onto your device, making it easy to fill out. You can also access your purchased forms anytime in the My Forms section of your profile.

US Legal Forms is committed to empowering users with a vast library of legal documents, giving them the tools they need to navigate the complexities of legal compliance effortlessly.

Don’t hesitate—begin your journey towards efficient legal form management today with US Legal Forms. Your documents are just a few clicks away!

Form popularity

FAQ

To find a roofing subcontractor, you can start by asking for recommendations from colleagues or others in the construction field. Online platforms also offer directories where you can search for qualified subcontractors for roofing based on reviews and ratings. Additionally, USLegalForms provides resources that can guide you in the selection process. Engaging a reliable subcontractor will ensure your roofing projects are completed on time and to your satisfaction.

Finding roofing employees involves a strategic approach to recruitment. You can start by leveraging job boards, local trade schools, and referrals from existing employees. Networking in the construction industry also helps to identify potential candidates. Remember, working with subcontractors for roofing can alleviate the hiring burden and provide you with skilled labor.

A roofing subcontractor specializes in completing roofing projects for general contractors or builders. They bring specific skills and expertise required for roofing tasks, ensuring the project meets quality standards. Subcontractors for roofing typically handle installation, repair, and maintenance jobs. By relying on these professionals, you can enhance the efficiency of your construction projects.

When writing a subcontractor agreement for roofing, begin by clearly defining the scope of work and responsibilities. Include terms for payment, project timelines, and quality standards. It's also wise to incorporate provisions for liability and project termination to protect both parties. Using templates from platforms like USLegalForms can simplify this process.

Whether subcontractors for roofing receive a 1099-MISC or 1099-NEC depends on the nature of the work. Generally, a 1099-NEC is issued for services provided, which is common in the construction industry. It's important for subcontractors to understand the distinction to ensure accurate tax reporting.

Filling out a roofing contract with subcontractors involves several key steps. First, outline the details of the project, including the scope of work, materials, and timelines. Next, ensure to include payment terms and conditions. Finally, both parties should review the contract thoroughly before signing to avoid future disputes.

A 1099 employee, often considered a subcontractor for roofing, must fill out a W-9 form to supply their tax information. At the end of the tax year, they should also be prepared to report their earnings from any 1099 forms received. This process helps ensure that they accurately file their taxes and claim any eligible deductions.

Subcontractors for roofing need to complete a W-9 form to provide their Tax Identification Number. They may also need to complete contracts outlining the scope of work and payment terms. Additionally, depending on the project, they might need to submit specific licenses or insurance documents to comply with local regulations.

When working with subcontractors for roofing, contractors typically request a W-9 form. This form provides the necessary information for proper tax reporting. Once the year ends, contractors must issue a 1099-MISC or 1099-NEC to report payments made to subcontractors. This ensures compliance with tax regulations.

Filing taxes as a subcontractor involves reporting your income on a Schedule C form, which details profit and loss from your business activities. You will also need to file self-employment taxes to cover Social Security and Medicare contributions. It is vital to maintain accurate records of your income and expenses, and you might consider consulting a tax professional for guidance specific to your situation as a subcontractor for roofing.