Acquisition Worksheet

Understanding this form

The Acquisition Worksheet is a comprehensive tool used to conduct due diligence during an acquisition transaction. This form helps potential buyers gather essential information about the property, including title opinions, seller's interests, and any potential issues. Unlike other forms, this worksheet is specifically designed for transactions involving acquisitions, making it an invaluable resource for investors and businesses navigating the complexities of such deals.

Key components of this form

- Prepared by: Space to enter the name of the person completing the worksheet.

- Well name: Field for identifying the name of the oil or gas well involved.

- Date: The date the worksheet is completed.

- Field and county information: Areas to specify the geographic locations of the property.

- Working interest and net revenue interest: Sections to document ownership and revenue details relevant to the acquisition.

- Operator and address: Information regarding the operator managing the well and their contact details.

- Documents examined and problems or exceptions: Important sections to note any issues and reference pertinent documents.

When to use this form

This form should be used when a buyer is evaluating a potential acquisition of oil and gas properties. It is particularly useful during the due diligence process, where verifying ownership, understanding revenue interests, and identifying any legal issues are crucial steps in making an informed investment decision.

Who needs this form

- Real estate investors involved in oil and gas transactions.

- Businesses looking to acquire mineral rights or oil and gas operations.

- Legal professionals assisting clients in due diligence for acquisitions.

- Corporations needing to assess property values before mergers or acquisitions.

How to complete this form

- Identify the parties involved by filling in the prepared by section with your information.

- Specify the well name, relevant fields, counties, and property descriptions in the designated fields.

- Document the working interest and net revenue interest to clarify ownership and financial stakes.

- Provide information regarding the operator and any pertinent contracts examined.

- Record any problems or exceptions that may arise during the title opinion and due diligence process.

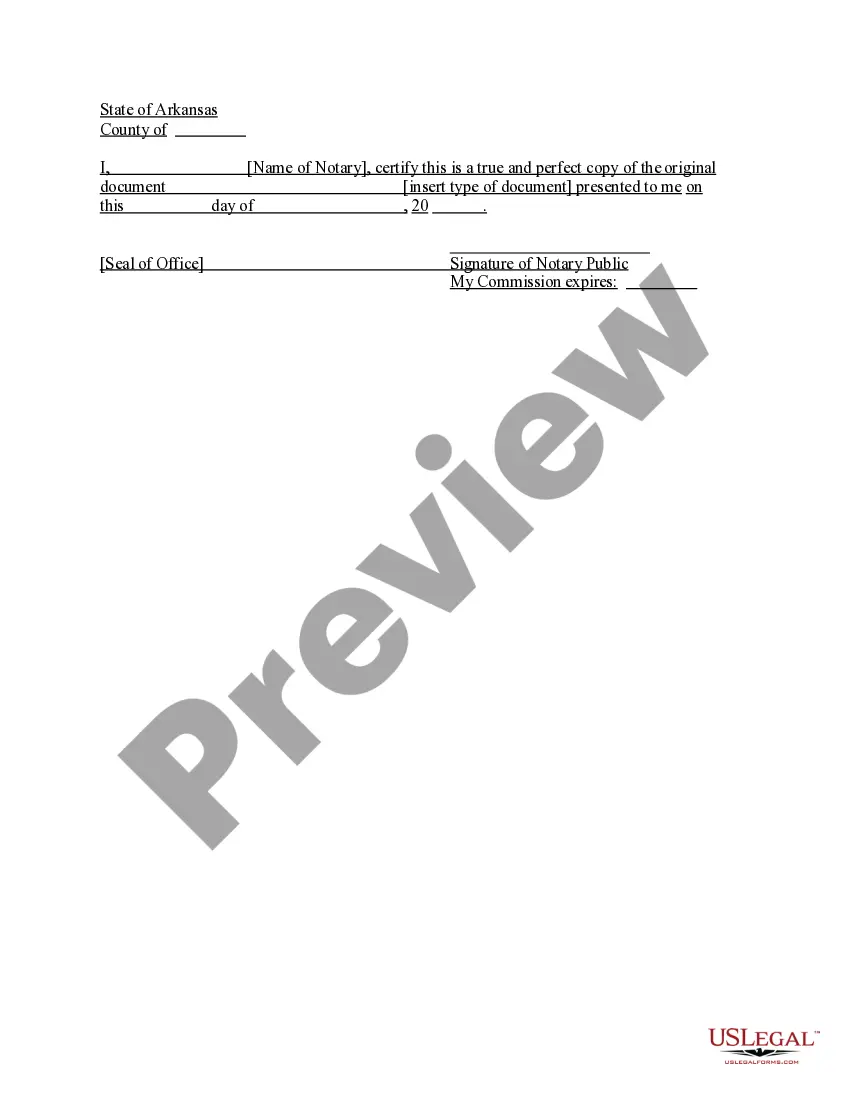

Is notarization required?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to thoroughly review title opinions before completing the worksheet.

- Inaccurately documenting the names of parties involved in the acquisition.

- Leaving fields blank or incorrectly filled, leading to misunderstandings or disputes.

- Neglecting to note problems or exceptions that could affect the acquisition process.

Benefits of completing this form online

- Immediate access to the Acquisition Worksheet template from anywhere.

- Editable sections allow users to customize the form for specific transactions.

- Reliable format ensures compliance with industry standards and practices.

Looking for another form?

Form popularity

FAQ

Measure any tangible assets and liabilities that were acquired. Measure any intangible assets and liabilities that were acquired. Measure the amount of any noncontrolling interest in the acquired business. Measure the amount of consideration paid to the seller. Measure any goodwill or gain on the transaction.

Definitive acquisition agreement It will include definition, structure of the transaction, the price and other financial terms, details of stock issue and closing conditions. It will also include the general obligation to sell, as well as any conditions related to continuation of employment.

An acquisition is when one company purchases most or all of another company's shares to gain control of that company.Acquisitions, which are very common in business, may occur with the target company's approval, or in spite of its disapproval.

The definition of an acquisition is the act of getting or receiving something, or the item that was received. An example of an acquisition is the purchase of a house.

A merger or acquisition transaction is the combination of two companies into one resulting in either one corporate entity or a parent-holding and subsidiary company structure.In a reverse merger or a reverse triangular merger, the target company shareholders and management gain control of the acquiring company.

Even though each M&A deal is usually unique, they all consist of a single or combination of the three rudimentary acquisition structures: asset purchase, the merger of companies, or stock sale. Stock sale transactions consist of purchasing the whole business entity, including future loans, liabilities, and receivables.

Value creating Value creating is where a company acquires another company, improves its performance and then sells it again for a profit. Consolidating This is where a company acquires another company to remove competition from an over-supplied market.

Decision to acquire companies as inorganic growth. Criteria for acquiring a company. Company search and selection. Planning. Evaluation. Negotiation. Due Diligence. Contract of acquisition.