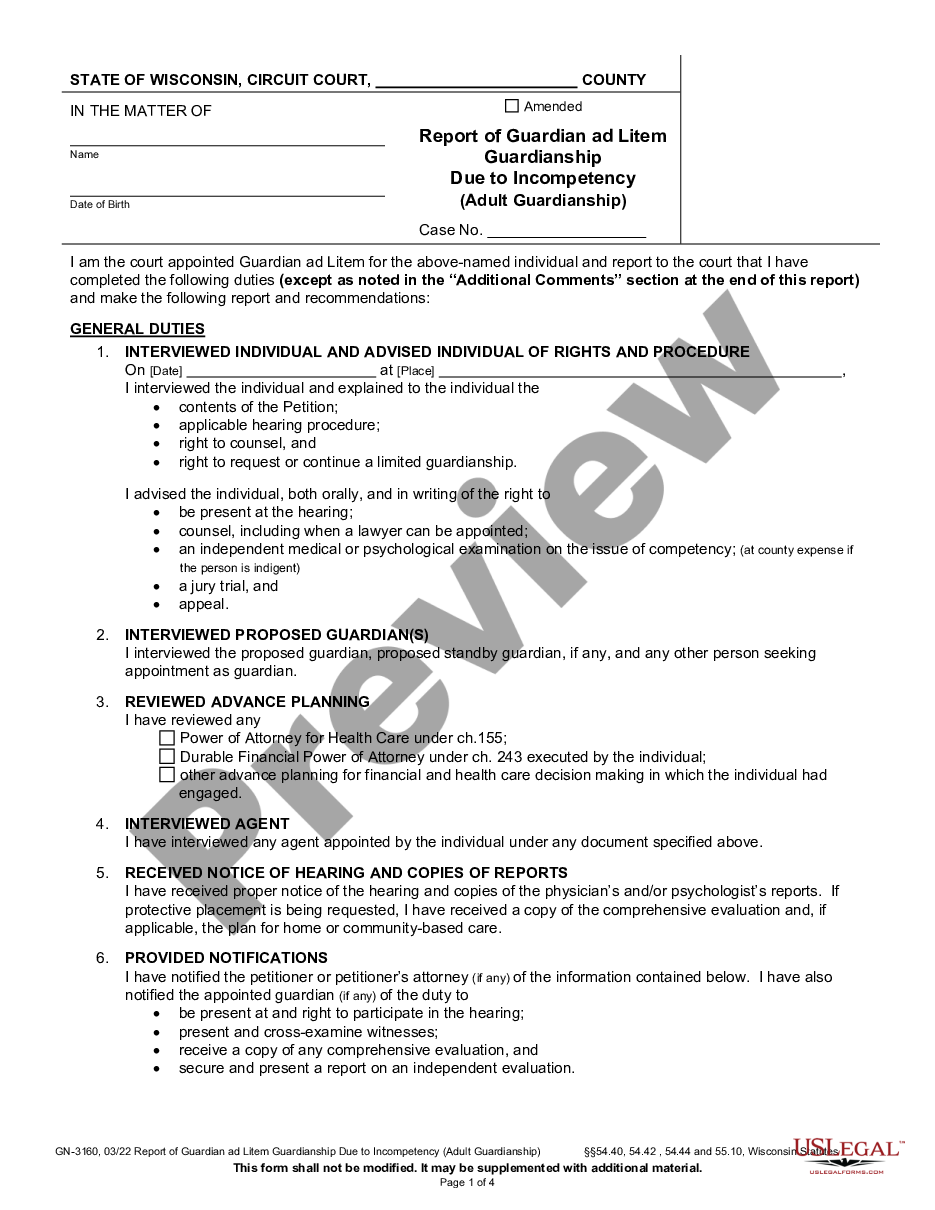

This form is an official state form to be used in the courts in the state of Wisconsin. This form is used to provide an accounting of the financial activity of the estate by the guardian/conservator. This may be an annual, interim or final account.

Wisconsin Account Of Guardian Or Conservator Annual Interim Final

Description

Key Concepts & Definitions

In the United States, an account of guardian or conservator annual interim refers to a financial report that must be filed by a guardian or conservator. This report details the financial management and stewardship of resources for an individual deemed unable to handle their own affairs due to reasons like age, disability, or incapacity. The account typically includes details on income, expenditures, assets, and liabilities.

Step-by-Step Guide

- Gather Financial Documents: Collect all financial records related to the ward's assets, income, and expenses from the past year.

- Record Income and Expenses: Detail all sources of income and categories of expenses incurred during the reporting period.

- List Assets and Liabilities: Provide a current list of assets at the valuation date and note any liabilities.

- Prepare the Accounting Report: Use a state-provided form or approved format to compile the account information in a clear, orderly manner.

- Review with Legal Counsel: Before submission, review the account with legal counsel specialized in estate or guardianship law to ensure compliance with applicable laws.

- Submit the Report: File the report with the appropriate court by the deadline, usually annually, unless otherwise directed by the court.

Risk Analysis

- Non-Compliance: Failing to file an accurate and timely report can lead to legal penalties, including fines or removal of guardianship or conservatorship.

- Financial Mismanagement: Poor handling of assets can result in financial losses for the ward, which might also attract legal consequences for the guardian or conservator.

- Legal Disputes: Inaccuracies or omissions in the report can lead to disputes with interested parties such as family members or other stakeholders, potentially culminating in court battles.

Best Practices

- Maintain Detailed Records: Keep detailed, organized records of all financial transactions involving the ward throughout the year to simplify the reporting process.

- Use Approved Accounting Principles: Apply generally accepted accounting principles to safeguard against errors and ensure consistency in reporting.

- Engage Professional Help: Consider hiring a professional accountant or lawyer who specializes in guardianship or conservatorship to assist with the preparation of the annual account.

- Stay Informed: Stay updated on changes in laws and regulations concerning guardianship and conservatorship responsibilities to ensure compliance.

Common Mistakes & How to Avoid Them

- Procrastination: Avoid last-minute compilations by keeping financial records up to date throughout the year.

- Lack of Detail: Provide comprehensive details in the report to prevent questions or rejections from the court.

- Failure to File on Time: Keep track of filing deadlines with reminders to ensure timely submission.

How to fill out Wisconsin Account Of Guardian Or Conservator Annual Interim Final?

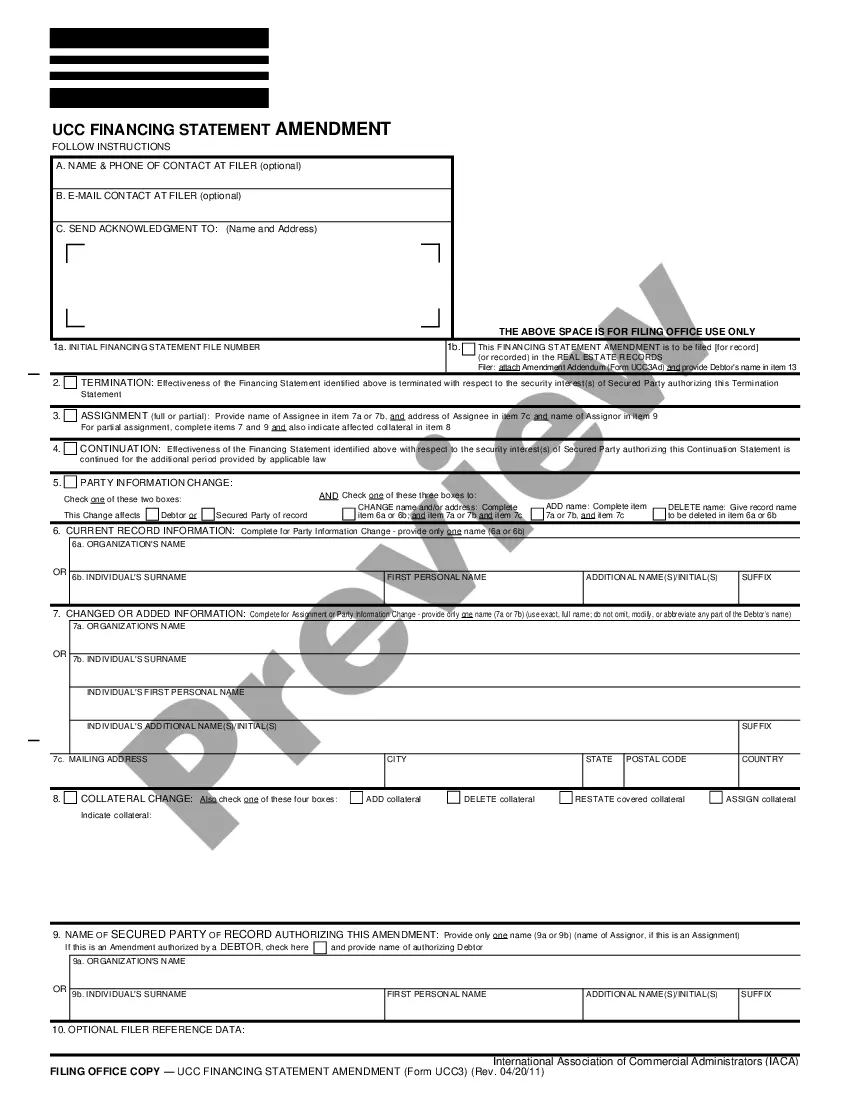

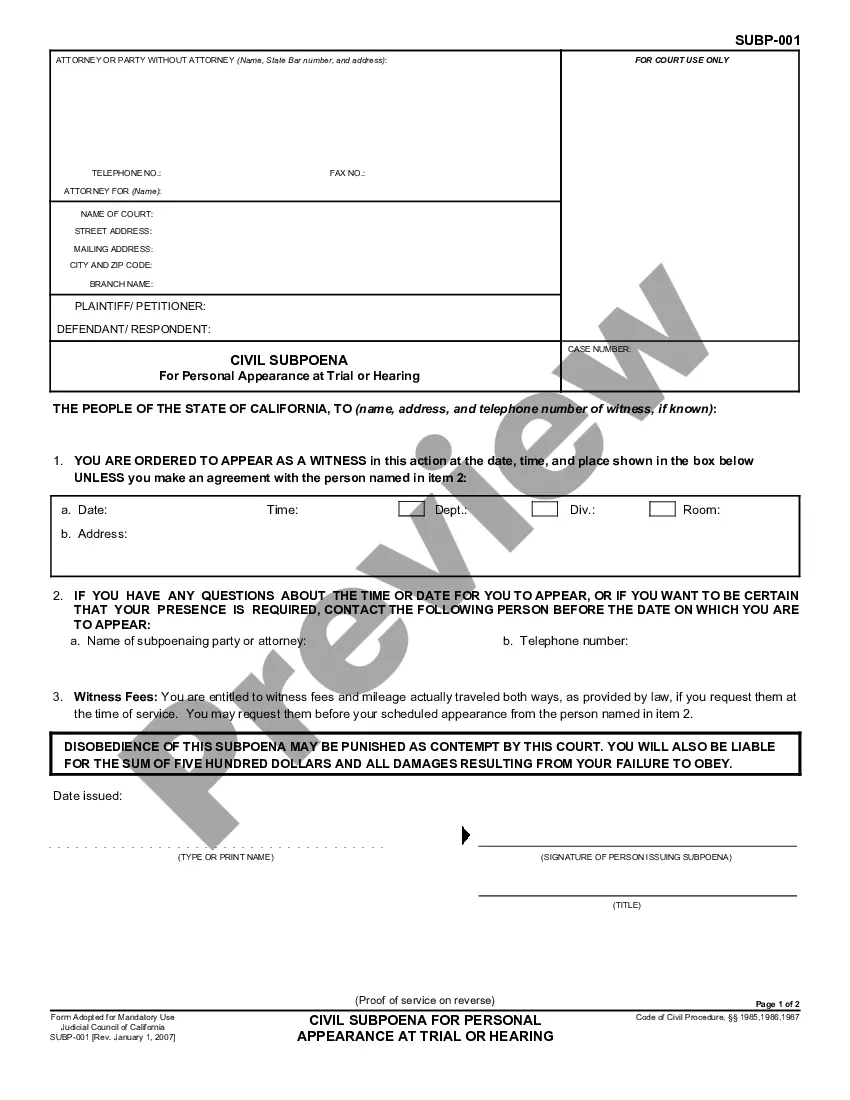

Out of the large number of platforms that provide legal templates, US Legal Forms offers the most user-friendly experience and customer journey while previewing forms before purchasing them. Its comprehensive catalogue of 85,000 templates is grouped by state and use for efficiency. All the documents on the platform have been drafted to meet individual state requirements by certified lawyers.

If you already have a US Legal Forms subscription, just log in, search for the template, hit Download and obtain access to your Form name from the My Forms; the My Forms tab holds your saved forms.

Keep to the guidelines below to get the form:

- Once you discover a Form name, make sure it’s the one for the state you really need it to file in.

- Preview the form and read the document description prior to downloading the sample.

- Look for a new sample using the Search field if the one you’ve already found isn’t appropriate.

- Just click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the template.

When you have downloaded your Form name, you may edit it, fill it out and sign it in an online editor that you pick. Any form you add to your My Forms tab can be reused many times, or for as long as it remains the most updated version in your state. Our platform offers quick and easy access to templates that suit both lawyers as well as their customers.

Form popularity

FAQ

A conservatorship is a court case where a judge appoints a responsible person or organization (called the conservator) to care for another adult (called the conservatee) who cannot care for himself or herself or manage his or her own finances.

A conservator is paid from the property or assets of the person who is the subject of the guardianship. A conservator operates under the supervision of the court and must account for all expenditures from the conservatee's assets.

Conservatorship has to do with the management of things that the ward or protected person owns or has had control over.The representative payee may only be given certain rights for using income from the protected person to manage the bank account and to pay bills.

A conservator will generally have no personal financial responsibility for payment of the conservatee's bills. A conservator will be expected to act reasonably in making decisions and managing the conservatee's funds, and if negligent in do so, may face liability.

Guardians assume responsibility for the supply of food, clothing, and personal necessities. And for ensuring protected individuals are receiving the proper care, maintenance, and support. As a conservator of the person, they become the healthcare contact for the protected person.

There are two types of guardianships, a full guardianship and a limited guardianship.

Conservator Responsibilities In rare cases, conservatorships can last much longer than state laws mandate (generally 18 or 21 years of age). The conservator uses the ward's finances to pay the bills, including medical and personal bills. They also make sure income taxes are filed and paid as needed.

Conservatorship account The term conservatorship account refers to a financial account in which a person or institution has been appointed by a court to manage and preserve the assets of an individual which are held in the account.

In California, guardianship refers only to the court appointment of an individual with the legal authority to represent and manage the affairs of a minor child. Conservatorships are for protecting incapacitated adults and typically involve matters related to health care and estate.