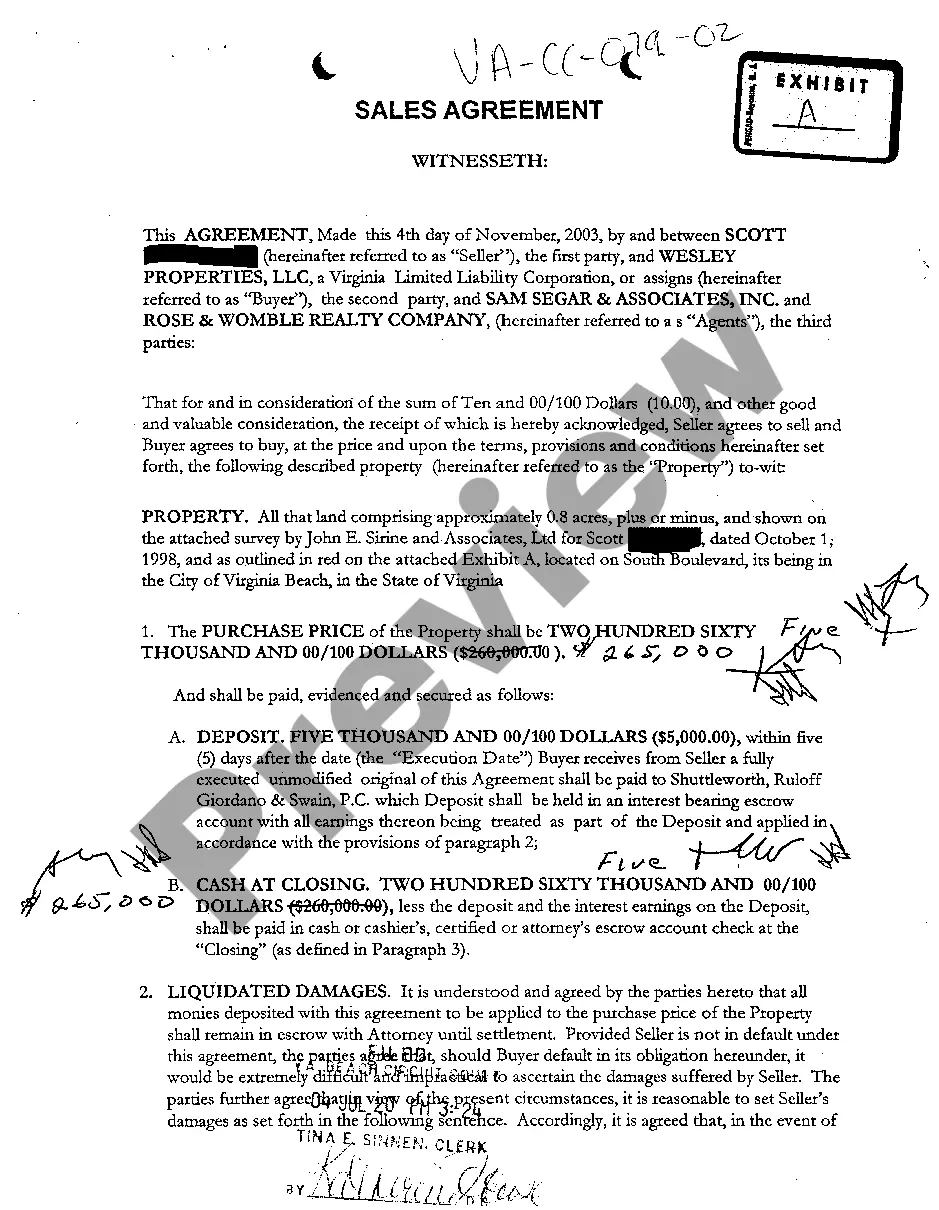

An escrow may be terminated according to the escrow agreement when the parties have performed the conditions of the escrow and the escrow agent has delivered the items to the parties entitled to them according to the escrow instructions. An escrow may be prematurely terminated by cancellation after default by one of the parties or by mutual consent. An escrow may also be terminated at the end of a specified period if the parties have not completed it within that time and have not extended the time for performance.

Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow

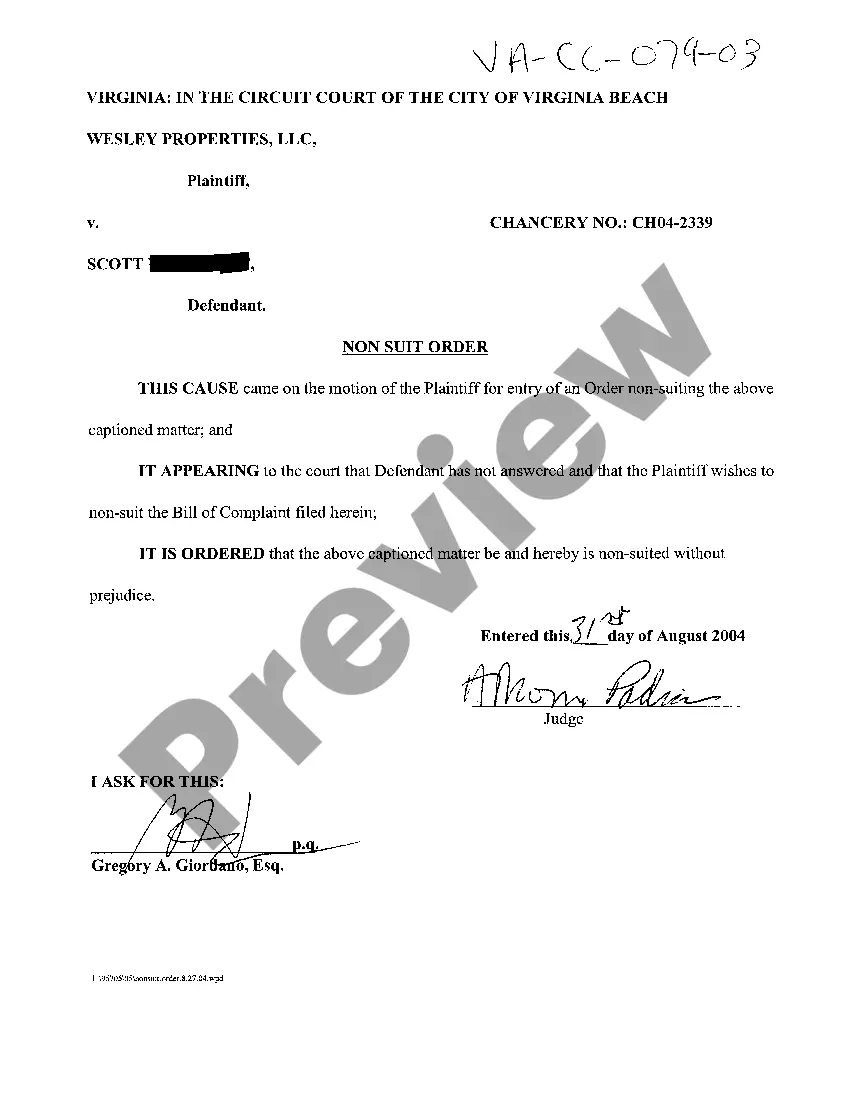

Description

How to fill out Instructions To Title Company To Cancel Escrow And Disburse The Funds Held In Escrow?

Aren't you sick and tired of choosing from hundreds of templates each time you need to create a Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow? US Legal Forms eliminates the lost time countless American citizens spend exploring the internet for appropriate tax and legal forms. Our expert group of attorneys is constantly upgrading the state-specific Samples catalogue, so it always offers the proper documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have a subscription should complete simple steps before having the capability to download their Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow:

- Utilize the Preview function and read the form description (if available) to be sure that it is the correct document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the appropriate example for your state and situation.

- Utilize the Search field on top of the web page if you have to look for another document.

- Click Buy Now and choose a preferred pricing plan.

- Create an account and pay for the services utilizing a credit card or a PayPal.

- Get your template in a convenient format to complete, create a hard copy, and sign the document.

When you have followed the step-by-step guidelines above, you'll always have the capacity to log in and download whatever document you need for whatever state you require it in. With US Legal Forms, completing Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow samples or other official files is not difficult. Get going now, and don't forget to recheck your samples with certified attorneys!

Form popularity

FAQ

When the buyer cannot close escrow on time, it can cause all sorts of problems. The main problem is that purchase contracts contain an acceptance date coupled with a closing date. If the closing date is missed, at a minimum, the contract is in jeopardy; the worst-case scenario is the contract has expired.

Generally, most escrow purchases can take from five to 20 days.

An escrow holdback is money set aside at the closing of a home that will be refunded once repairs are completed. Because a portion of the seller or buyer proceeds are held in an escrow account until the work has been finished, they are given an incentive to actually finish the work.

Funds or assets held in escrow are temporarily transferred to and held by a third party, usually on behalf of a buyer and seller to facilitate a transaction. "In escrow" is often used in real estate transactions whereby property, cash, and the title are held in escrow until predetermined conditions are met.

YES, they most certainly can. Title companies play several key roles in matters concerning real estate transactions. Funds are set aside in escrow accounts to ensure that the money is used only for its main purpose, namely for settlement and closing costs.

Escrow is the use of a third party, which holds an asset or funds before they are transferred from one party to another. The third-party holds the funds until both parties have fulfilled their contractual requirements.

In real estate, an escrow disbursement is a process of dispensing the amount held in escrow to pay for homeowners insurance, property taxes, and other property expenses.When the time comes to pay property expenses, escrow disbursement is done. This is strictly carried out by a third party known as an escrow agent.

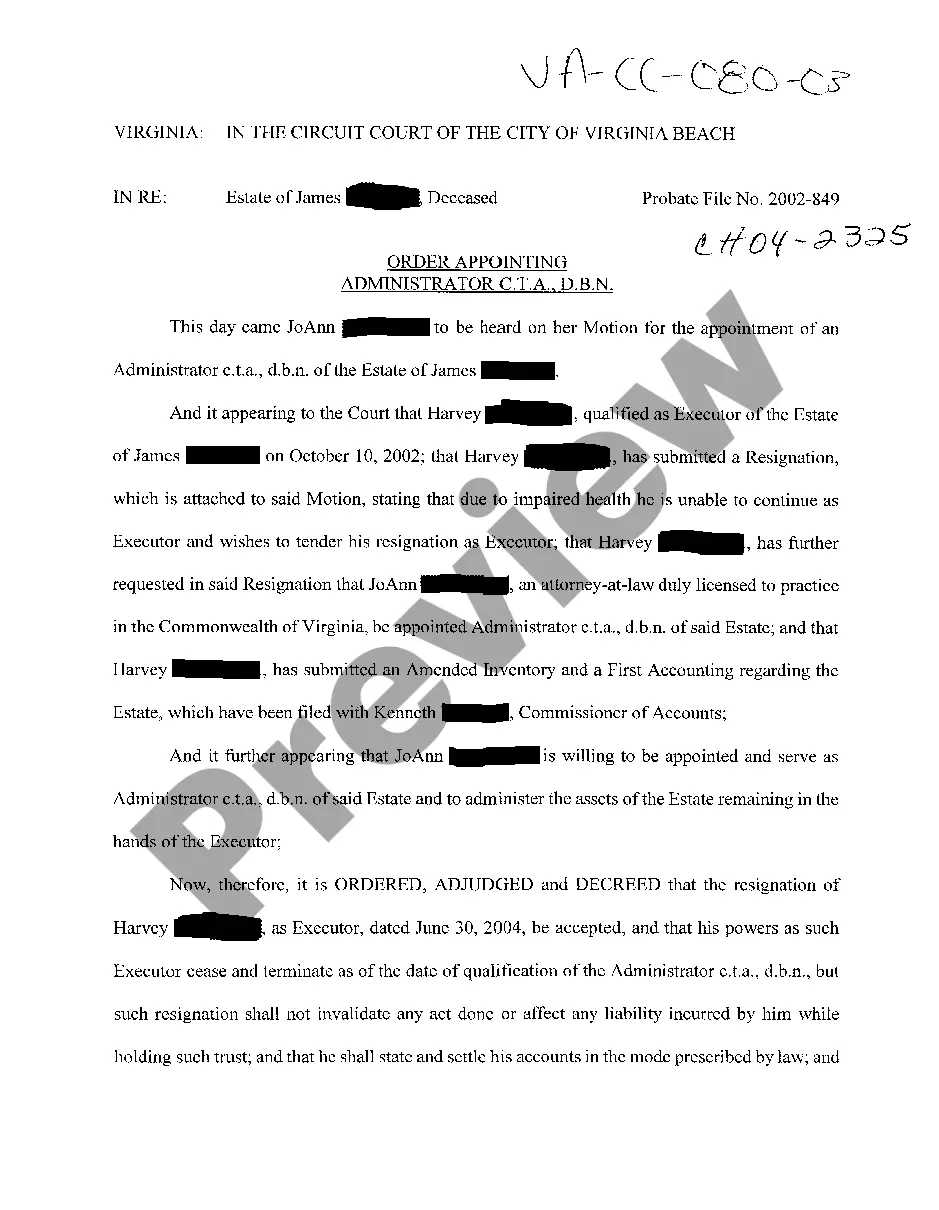

The title company will hold the escrow until they receive a satisfaction of the judgment or until your attorney completes a bar claim action. Your attorney needs to follow up with the judgment creditor to get the satisfaction of judgement.

Get it in writing A contingency clause allows the buyer to receive full written approval from the lender, before moving forward to the closing. So, if your loan is denied for whatever reason, you can exit the contract and get your deposit back.