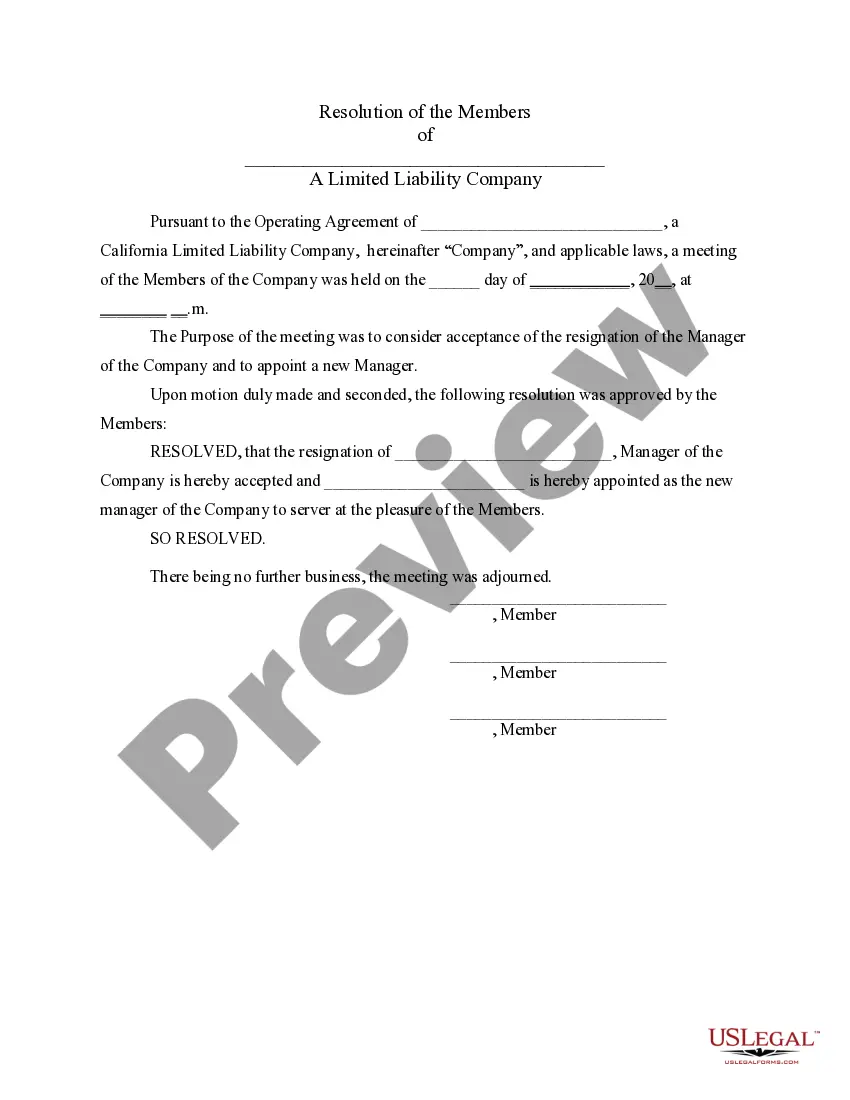

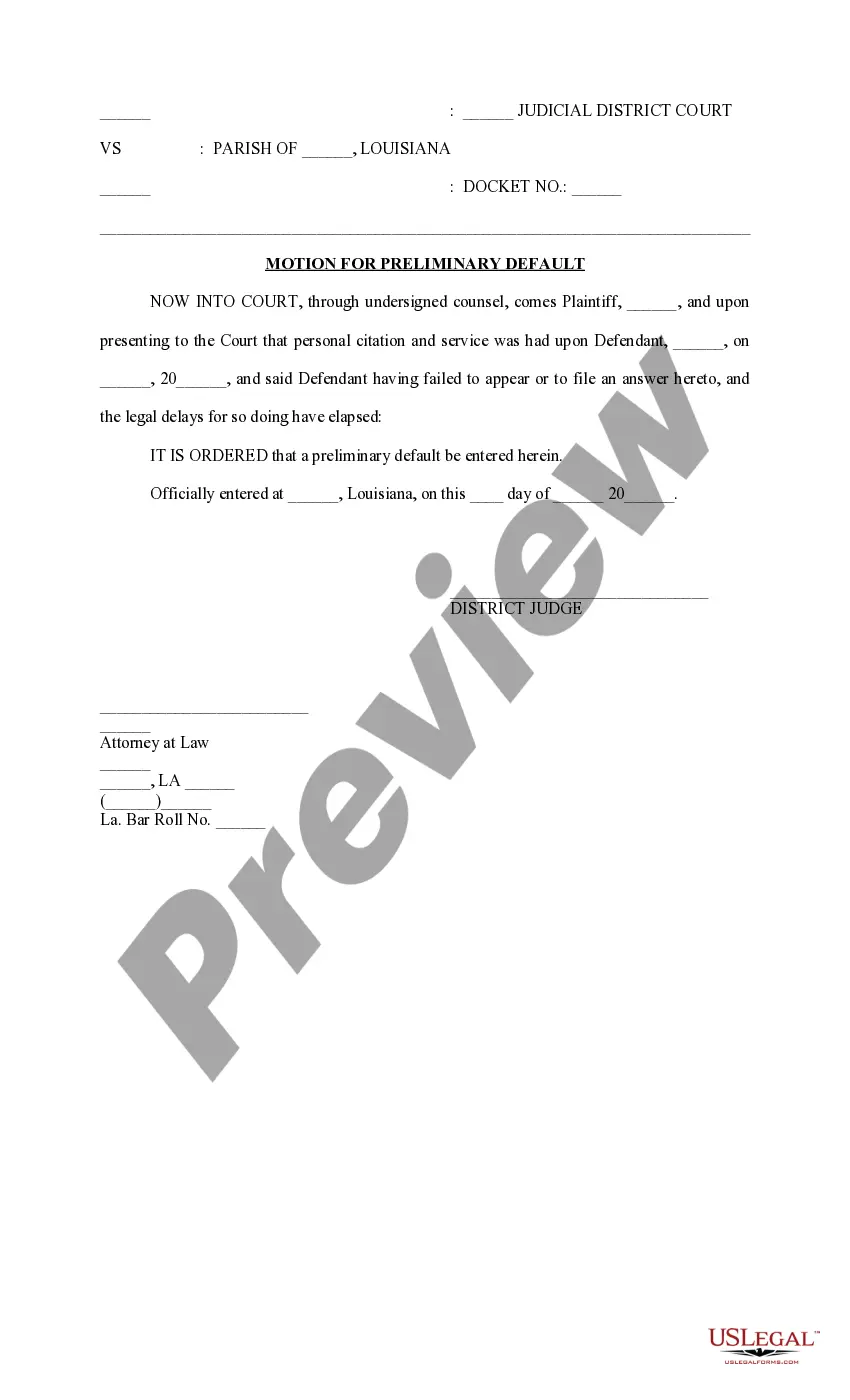

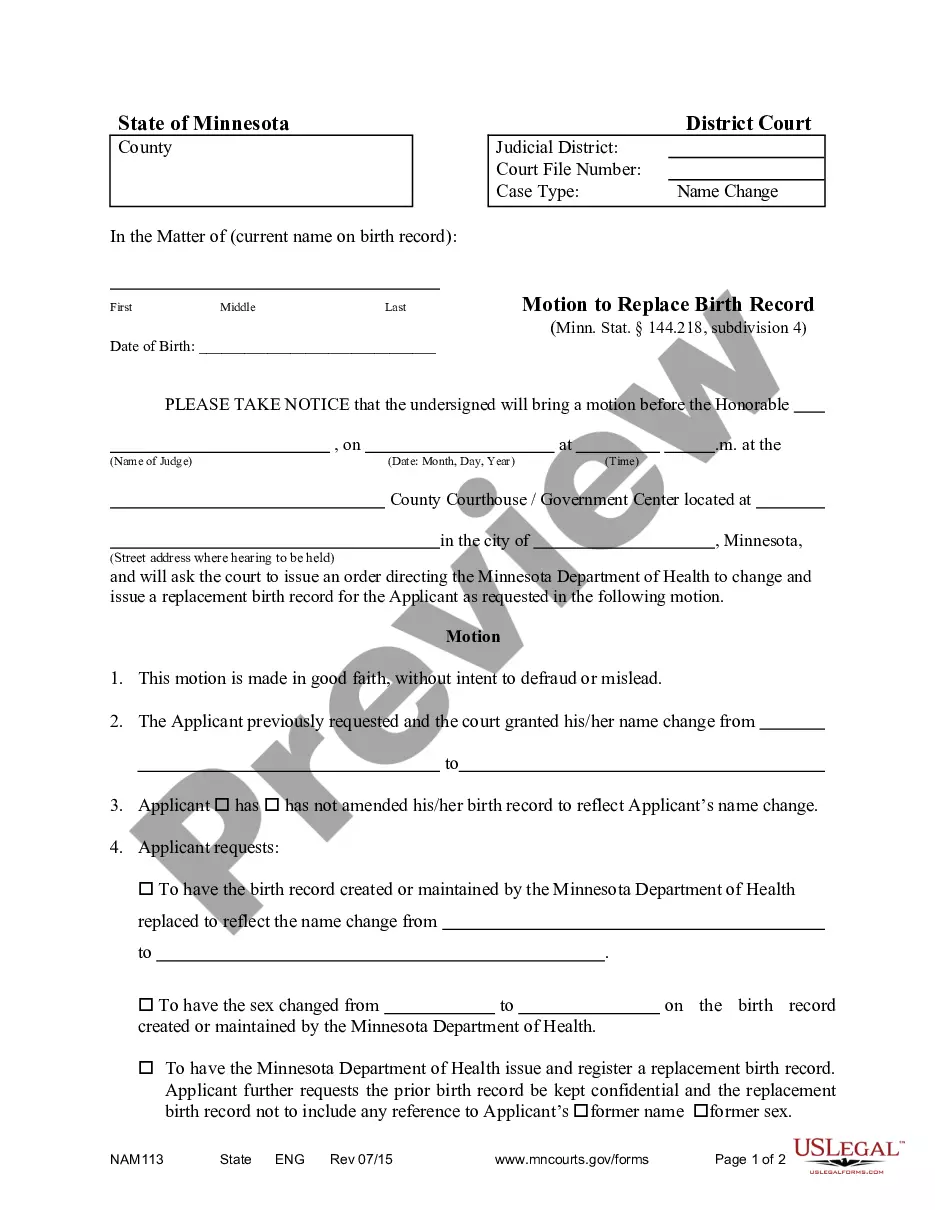

California Llc Forms

Description

Form popularity

FAQ

Starting an LLC in California offers numerous benefits that can outweigh the initial costs. An LLC provides personal liability protection, ensuring your personal assets are safe from business debts and liabilities. Additionally, it can help streamline tax reporting and offers flexibility in management structure. With the right California LLC forms, you can set up your business efficiently and focus on growth.

To avoid the $800 minimum franchise tax for your California LLC, consider filing your LLC during the second half of the year. If you operate your LLC for less than 15 days in the year, you may be exempt from paying this tax for the first year. Additionally, you could explore the possibility of an LLC being classified as an S corporation, which may offer tax advantages. Utilizing US Legal Forms can provide you with the necessary California LLC forms and advice on how to navigate these tax considerations.

To form an LLC in California, start by selecting a unique name that complies with California's naming requirements. Next, file the Articles of Organization with the Secretary of State, which you can easily do online or by mail. After that, create an Operating Agreement to outline the management structure of your LLC. Finally, obtain any necessary permits or licenses, and complete the California LLC forms to comply with state regulations.

Yes, you can file California LLC forms online, making the process convenient and efficient. Many online platforms, such as US Legal Forms, offer user-friendly services that guide you through each step of the filing. By using these platforms, you can easily access detailed instructions and the necessary forms to establish your LLC in California. Filing online not only saves time but also ensures that you complete the required documentation accurately.

The best way to file taxes as an LLC is to choose the tax structure that suits your business model, such as being taxed as a sole proprietorship, partnership, or corporation. Each option has unique benefits depending on your revenue and expenses. Keeping accurate financial records is crucial for compliant tax filing. Consider using uslegalforms for guides and resources on California LLC forms and associated tax obligations.

The best way to file an LLC in California is by completing the Articles of Organization online through the California Secretary of State's website. Online filing is generally faster and more efficient compared to paper submissions. Ensure you have all necessary information ready to avoid delays. Using uslegalforms can help streamline this process and ensure compliance with California LLC forms.

In California, an LLC must file the Articles of Organization, which is Form LLC-1. This form officially creates your limited liability company with the state. You can submit it online, by mail, or in person. Once filed, you will receive a confirmation, allowing you to operate under California LLC forms.