Form For Trust In Ala Form

Description

Form popularity

FAQ

To obtain a certificate of trust, reach out to the trustee or legal representative who established the trust. They will provide guidance on obtaining this crucial document. Alternatively, you can use the form for trust in ala form available through US Legal Forms, which offers a convenient way to create a compliant certificate without hassle.

A trust certificate is a document that confirms a trust's existence and designates the authority of the trustee. It serves as proof that the trustee has the legal power to act on behalf of the trust. By using the form for trust in ala form, you can ensure your trust certificate is properly drafted and fulfills all legal obligations, making it easier for you to manage your trust.

You can acquire a trust amendment form through various online legal services or by consulting your attorney. Platforms such as US Legal Forms offer easy access to the specific form for trust in ala form, streamlining the amendment process. You can fill it out to reflect any changes you wish to make to your trust agreement.

To obtain a certificate of trust, you typically need to contact the trustee or the attorney who established the trust. They will provide you with the document, which validates the trust's details. Utilizing the form for trust in ala form can make it easier to compile all needed information effectively. This process ensures that your certificate is accurate and compliant.

A certificate of trust is generally created by the trustee of the trust. The trustee prepares this document to confirm the existence of the trust and their authority. You can simplify this process by using the form for trust in ala form, available on platforms like US Legal Forms. This will help ensure the certificate meets all necessary legal requirements.

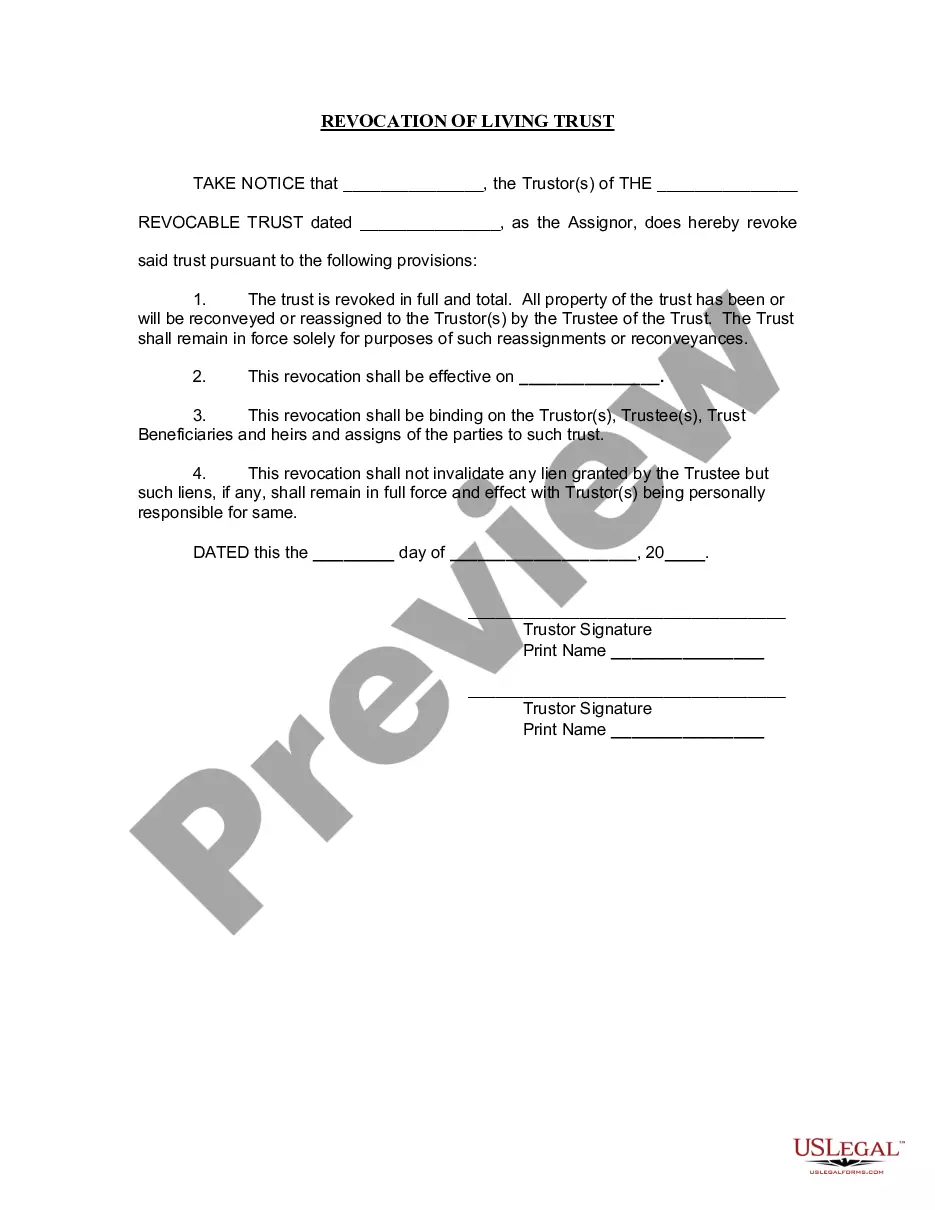

The simplest form of trust is typically a revocable living trust. This type of trust allows you to maintain control over your assets during your lifetime and make changes as needed. It can also facilitate a smoother transfer of assets upon your death. For those considering starting a trust, the Form for trust in ala form offers an easy and straightforward option.

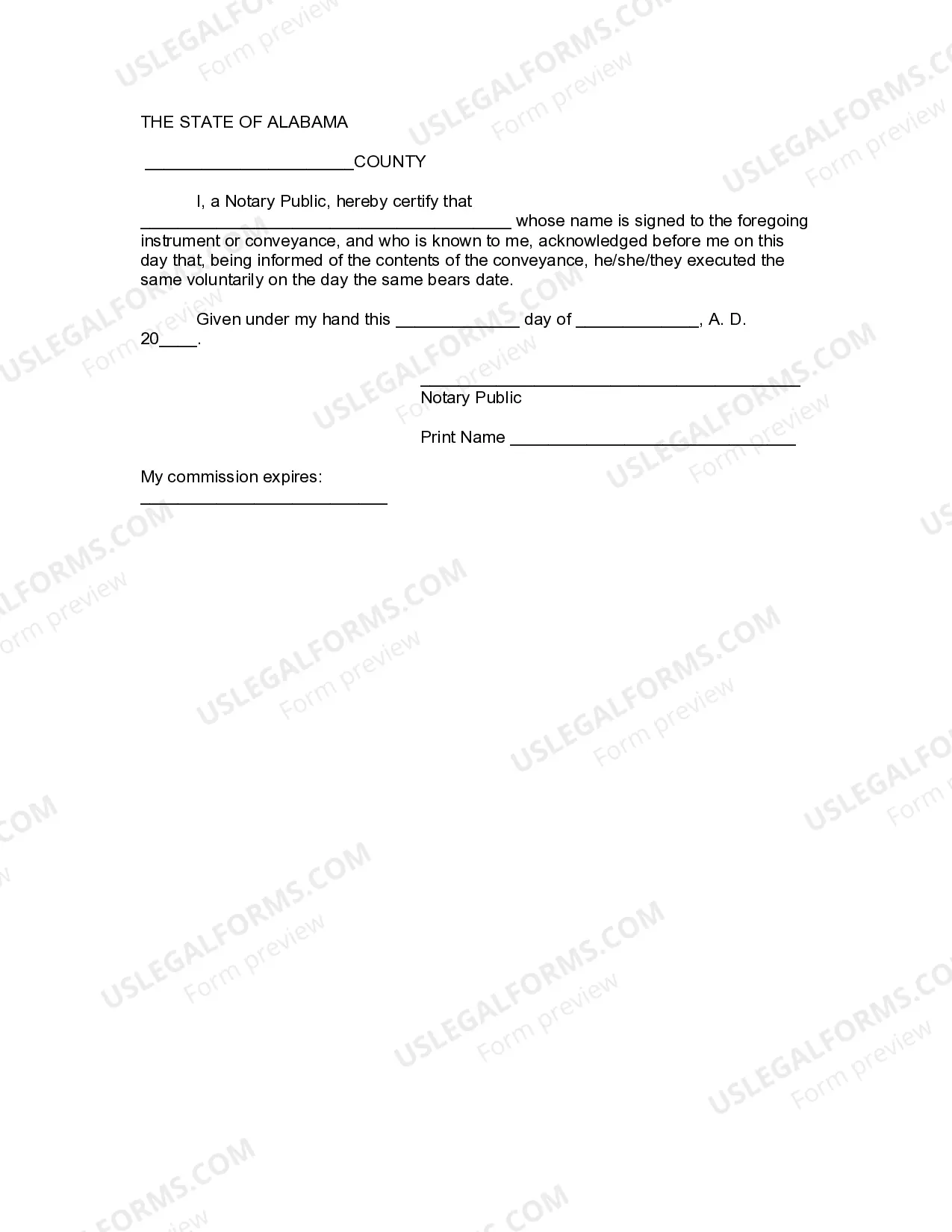

In Alabama, trusts must comply with state laws that govern their formation and management. Trust creators must clearly outline the terms, beneficiaries, and asset management strategies within the trust document. Additionally, Alabama allows for various types of trusts, each with specific rules and benefits. If you are unsure, using the Form for trust in ala form can simplify compliance with Alabama's legal requirements.

Some assets may not be suitable for a trust. For example, assets with named beneficiaries, like life insurance policies and retirement accounts, typically bypass the trust process. Additionally, personal belongings that may be difficult to value or liquidate can also be complicated to include. Understanding what assets to exclude is crucial when designing your Form for trust in ala form.

Not all trusts must file a 1041. Typically, only trusts with taxable income or multiple beneficiaries are required to submit this form. Understanding the nuances of your trust's requirements can be clearer when you refer to resources like the Form for trust in ala form and platforms such as uslegalforms.

To file for a trust, you generally need Form 1041, but additional forms may be required depending on the trust's specific situation. It is vital to identify and gather all necessary documentation beyond just the 1041, as the right paperwork is crucial for compliance. Consider using services like uslegalforms to find the right forms and receive guidance tailored to your needs.