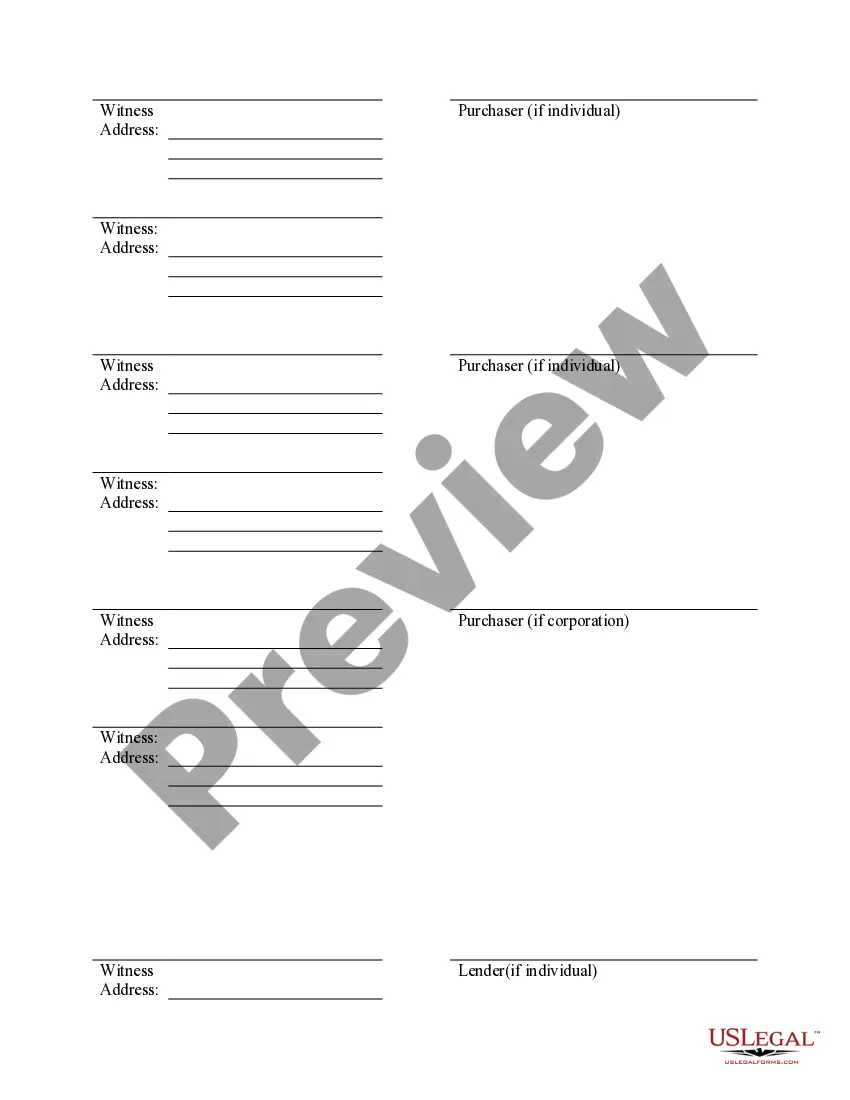

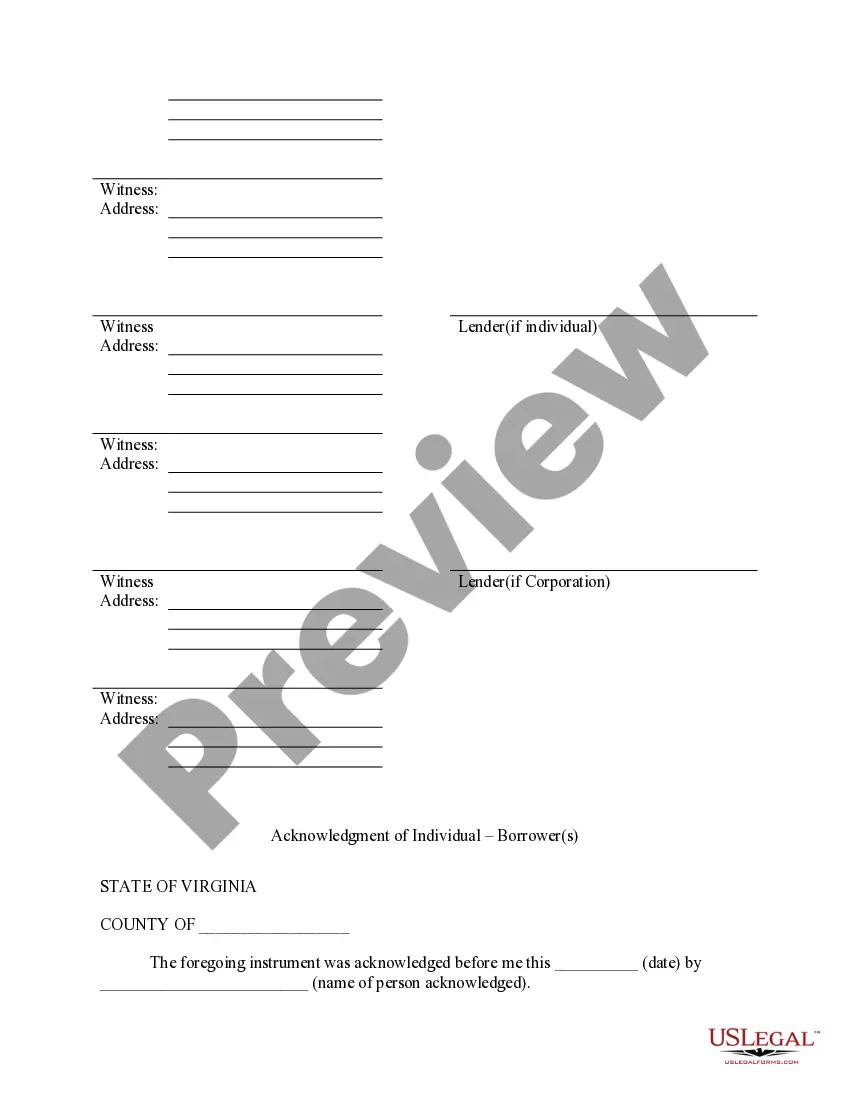

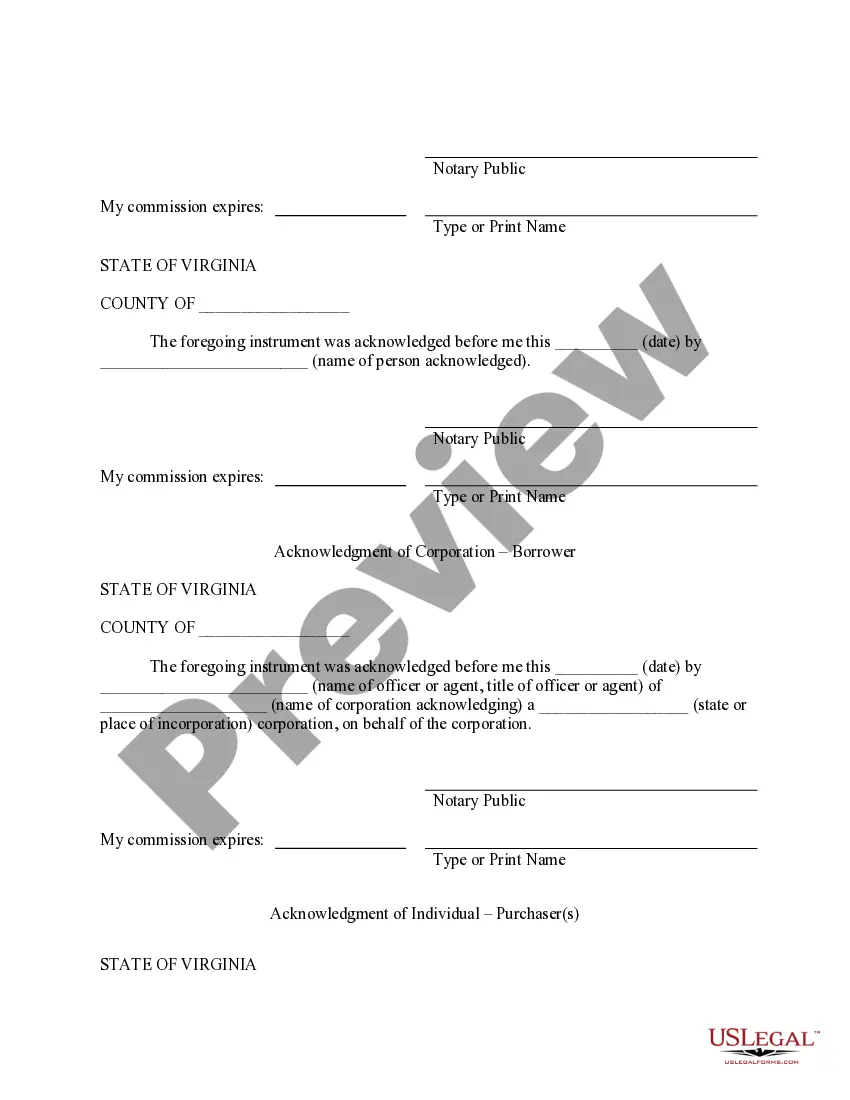

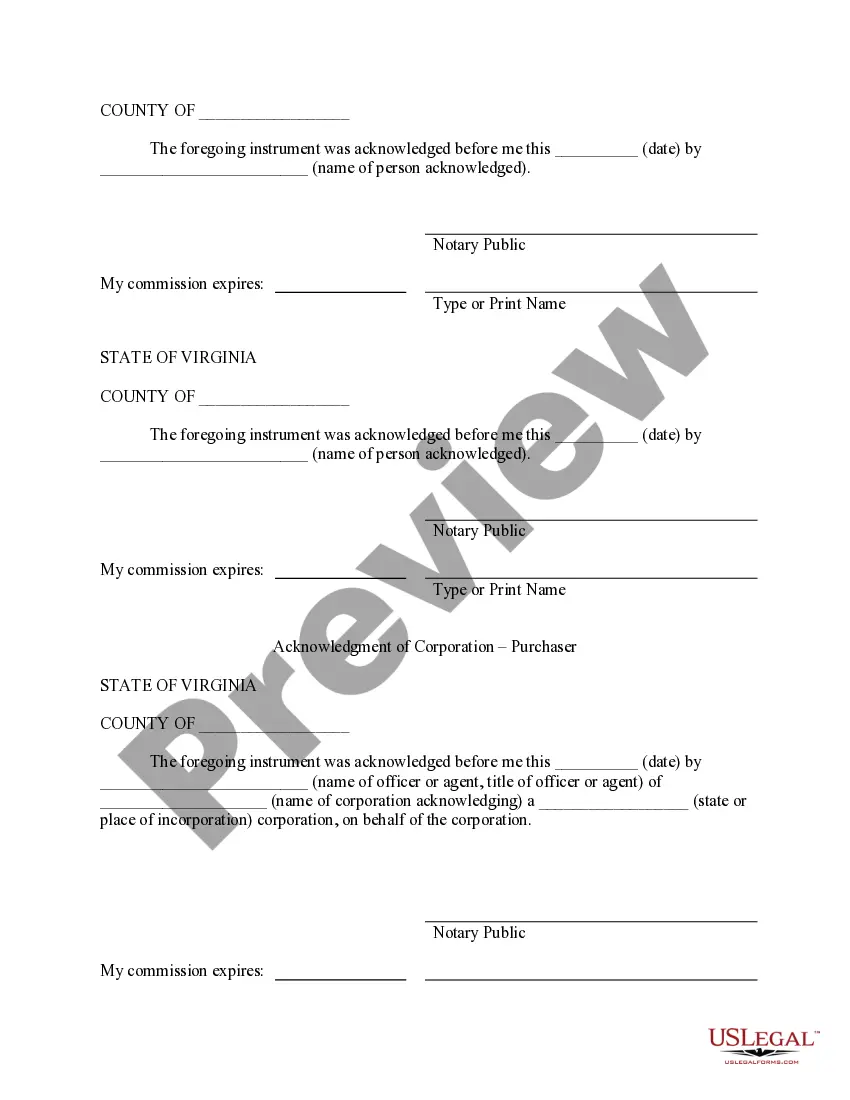

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Virginia Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Virginia Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

Searching for a Virginia Assumption Agreement of Deed of Trust and Release of Original Mortgagors on the internet can be stressful. All too often, you find papers that you believe are alright to use, but discover afterwards they are not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional attorneys according to state requirements. Get any document you are looking for in minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll instantly be added to your My Forms section. In case you don’t have an account, you should sign-up and pick a subscription plan first.

Follow the step-by-step guidelines below to download Virginia Assumption Agreement of Deed of Trust and Release of Original Mortgagors from our website:

- Read the document description and click Preview (if available) to verify whether the form meets your expectations or not.

- If the form is not what you need, find others using the Search field or the provided recommendations.

- If it is right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the document in a preferable format.

- After downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal forms from our US Legal Forms library. In addition to professionally drafted templates, users will also be supported with step-by-step guidelines regarding how to get, download, and fill out forms.

Form popularity

FAQ

Where to Find the Deed. In California, property deeds are in the County Recorders Office or Office of the Assessor-Recorder in the county in which the property is located. In some counties, if you request an older record, you may be redirected to yet another department that maintains archived records.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

The original deed is returned to the owner of the property from the office of the recorder after proper entry. The office of the Recorder of Deeds maintains a set of indexes about each deed recorded, for an easy search. Almost all states have a grantor-grantee index including a reference to all documents recorded.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

The property's title remains in the trust until the loan is paid off, or satisfied, then it is released from the trust. To complete the release, the lender prepares a deed of reconveyance. This document states that the conditions of the loan have been met and you have no further financial obligations to the lender.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.