Complex Guaranty Agreement to Lender

Understanding this form

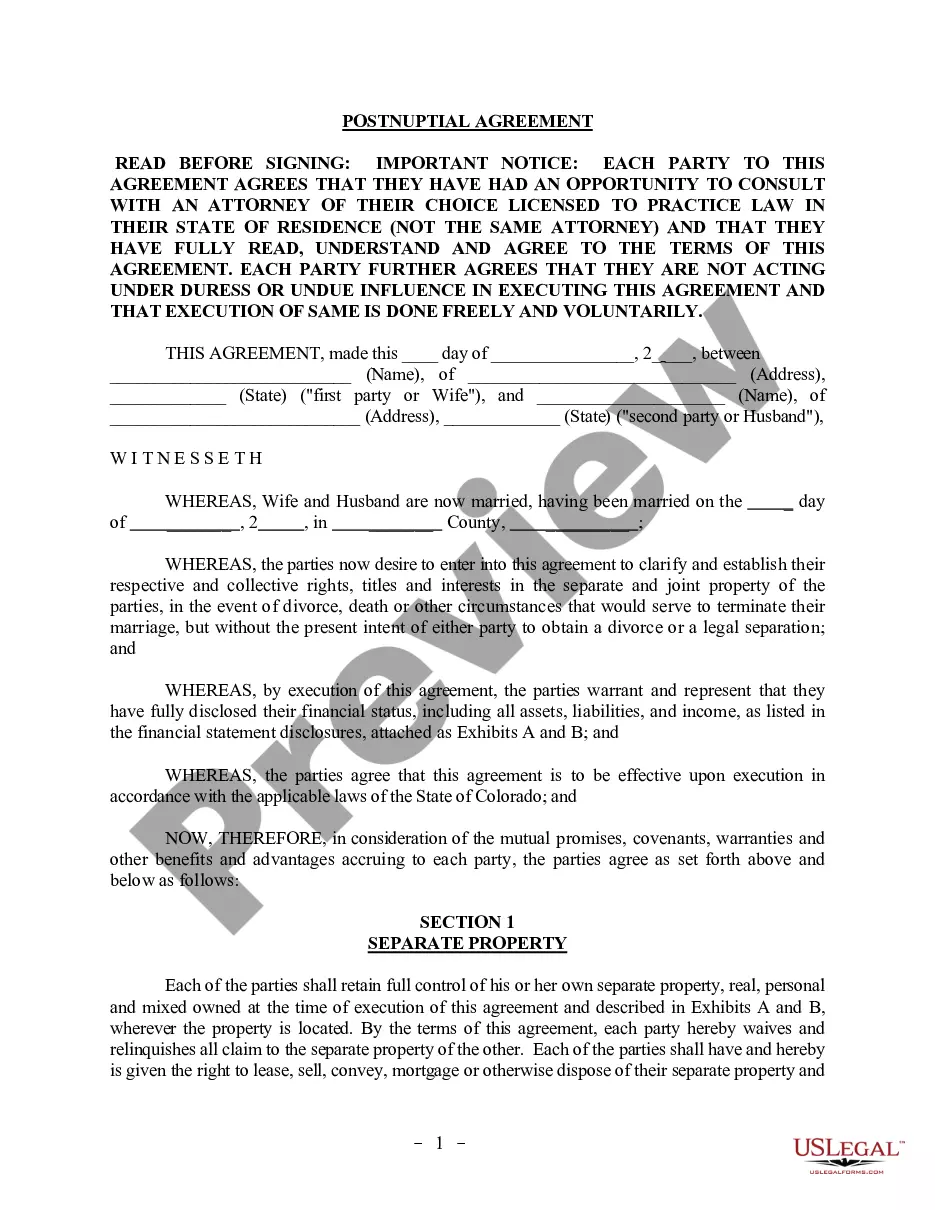

A Complex Guaranty Agreement to Lender is a legal document where a guarantor agrees to assume the obligations of a borrower under a loan. This form establishes that the guarantor will pay the lender amounts due under the loan, including principal, interest, and related costs, as a principal obligor. Unlike standard guaranty agreements, this version outlines extensive responsibilities and guarantees, making it crucial for lenders seeking a higher assurance of payment.

Main sections of this form

- Identification of parties involved (Guarantor and Lender).

- Reference to loan documents, including the promissory note and credit agreement.

- Detailed definitions of guaranteed obligations.

- Representations and covenants made by the guarantor.

- Conditions under which costs and expenses are paid by the guarantor.

- Notices and reporting obligations of the guarantor regarding financial changes.

- Terms related to the continuation of guarantees despite borrower obligations.

Situations where this form applies

This form is typically used in various financial agreements where a borrower seeks a loan, and a guarantor is required to assure the lender of payment. It is especially useful in complex transactions involving significant sums or where the borrower's creditworthiness may be in question. Use this form when you want to secure a loan with an additional assurance from a corporate or personal guarantor.

Who this form is for

- Lenders seeking additional security for loans.

- Corporations or individuals who are acting as guarantors for a borrower's loan.

- Borrowers needing to provide a guarantor to secure financing.

- Legal professionals drafting agreements related to loan guarantees.

How to complete this form

- Identify the parties: Enter the names and addresses of the guarantor and lender.

- Reference the loan documents: Specify the original principal amount and details of the borrower.

- Define the guaranteed obligations: Clearly outline the obligations that the guarantor is responsible for.

- Provide representations: Include all necessary warranties and covenants from the guarantor.

- Fill in the legal identifiers: Include dates, signatures, and any state-specific requirements.

Notarization requirements for this form

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to correctly identify all parties involved.

- Not properly outlining the guaranteed obligations.

- Leaving out vital representations and warranties.

- Incorrectly referencing loan documents which can lead to legal disputes.

- Not including a specified date for the agreement or signatures.

Benefits of completing this form online

- Convenient access to legal templates without needing extensive legal knowledge.

- Edit and customize the form easily to meet specific requirements.

- Download instantly and securely, saving time on paperwork.

- Confidence in the validity of the document, prepared by licensed attorneys.

Looking for another form?

Form popularity

FAQ

If the guarantor refuses to make the repayment when due, the lenders can then begin to take legal action. A warning letter of pre-court action is typically then sent to the guarantor, with court proceedings beginning 14 days after, provided the repayment is still not made in this period.

At law, the giver of a guarantee is called the surety or the "guarantor". The person to whom the guarantee is given is the creditor or the "obligee"; while the person whose payment or performance is secured thereby is termed "the obligor", "the principal debtor", or simply "the principal".

Unlike a co-signer, a guarantor has no claim to the asset purchased by the borrower. If the borrower defaults on their loan, then the guarantor is liable for the outstanding obligation, which they must meet, otherwise, legal action may be brought against them.

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.

A surety is an insurer of the debt, whereas a guarantor is an insurer of the solvency of the debtor. A suretyship is an undertaking that the debt shall be paid; a guaranty, an undertaking that the debtor shall pay.A surety binds himself to perform if the principal does not, without regard to his ability to do so.

1 : an undertaking to answer for the payment of a debt or the performance of a duty of another in case of the other's default or miscarriage. 2 : guarantee sense 3. 3 : guarantor. 4 : something given as security (see security sense 2) : pledge used our house as a guaranty for the loan.

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A suretyship is an accessory contract by which one person undertakes liability for another's debt or financial obligations.In simple terms the surety agrees to step into the principal debtor's shoes, if and when the debtor can no longer fill those shoes financially.