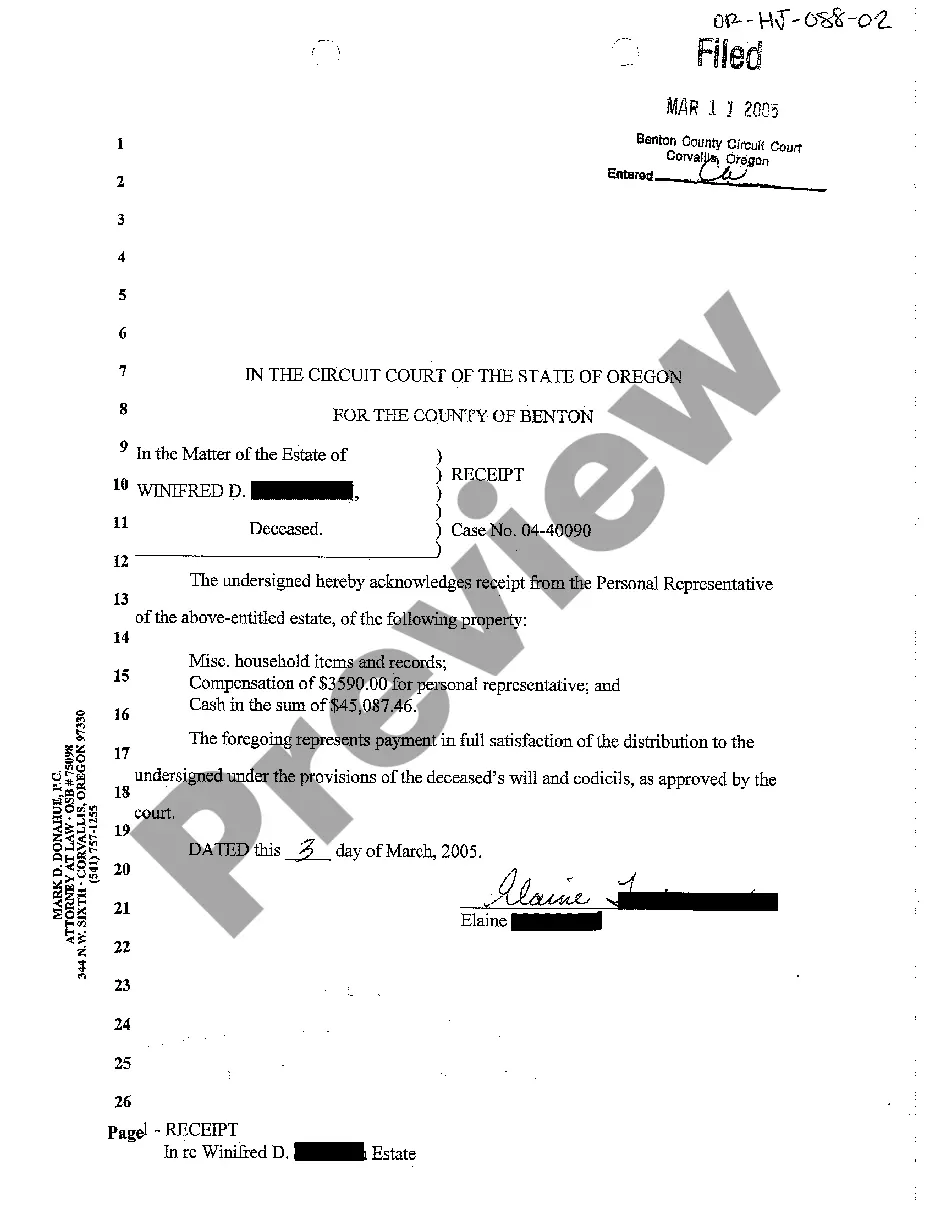

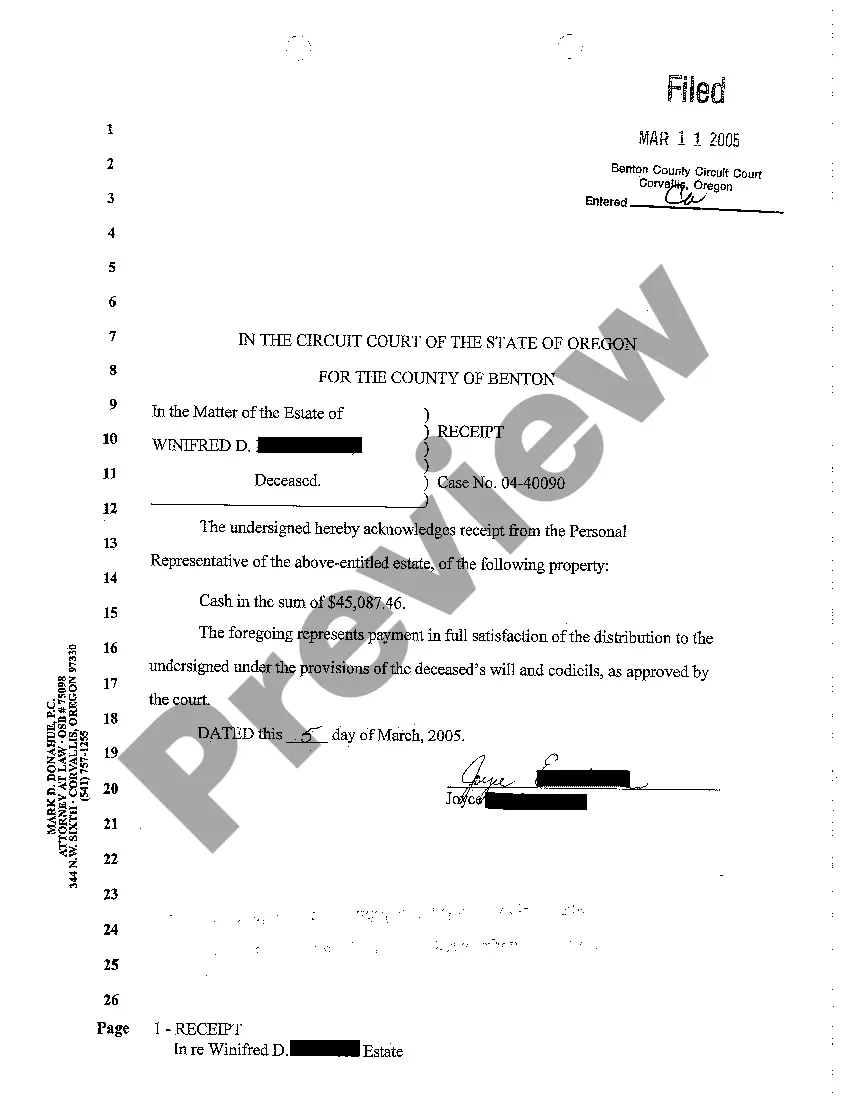

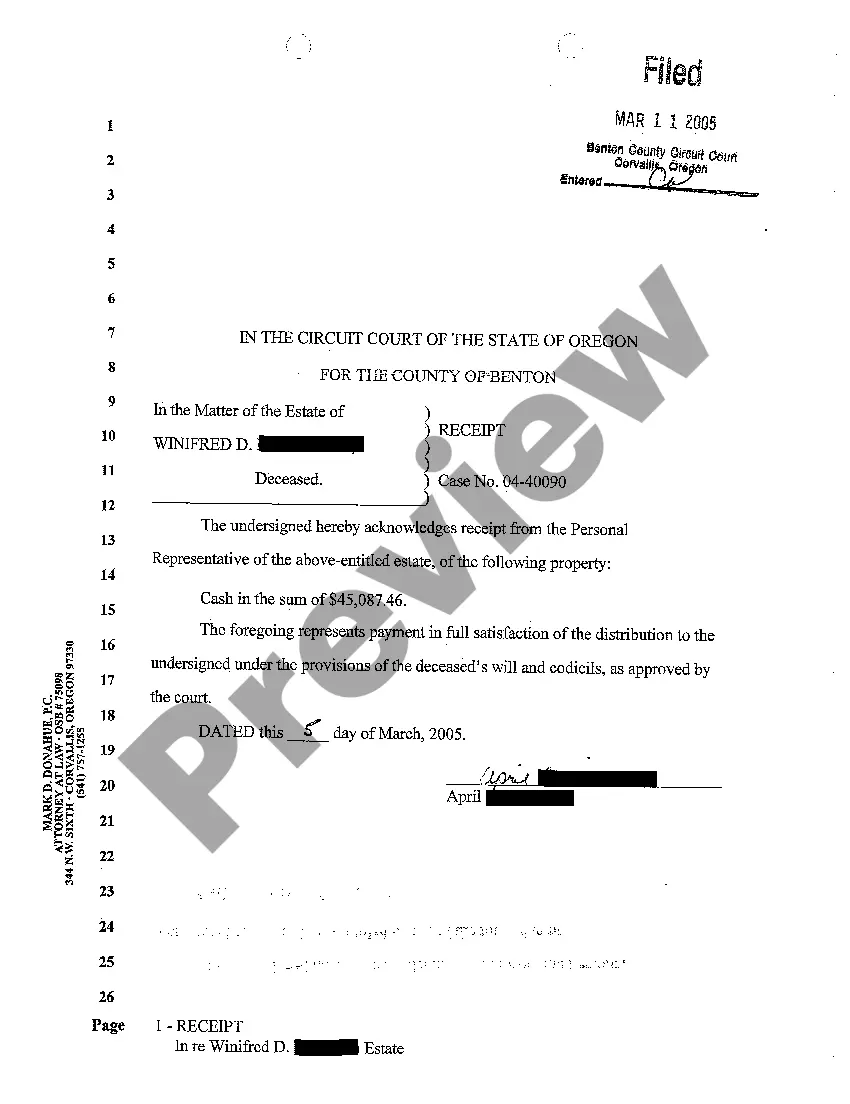

Oregon Receipts

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Oregon Receipts?

In terms of completing Oregon Receipts, you probably imagine a long procedure that consists of getting a suitable sample among countless similar ones and then having to pay legal counsel to fill it out to suit your needs. In general, that’s a slow and expensive option. Use US Legal Forms and choose the state-specific document in a matter of clicks.

For those who have a subscription, just log in and then click Download to find the Oregon Receipts sample.

In the event you don’t have an account yet but need one, keep to the step-by-step guide below:

- Make sure the file you’re getting applies in your state (or the state it’s required in).

- Do so by reading through the form’s description and through clicking on the Preview option (if readily available) to view the form’s information.

- Simply click Buy Now.

- Choose the suitable plan for your financial budget.

- Sign up for an account and select how you want to pay out: by PayPal or by credit card.

- Download the document in .pdf or .docx format.

- Find the file on your device or in your My Forms folder.

Professional legal professionals work on creating our samples so that after saving, you don't have to worry about editing and enhancing content material outside of your individual info or your business’s info. Sign up for US Legal Forms and get your Oregon Receipts example now.

Form popularity

FAQ

File your Corporate Activity Tax return through the electronic filing program. With approved third-party software, you can e-file your return with all schedules. You can also conveniently include an electronic payment with your e-filed original return. See E-file.

In May 2019, Oregon Governor Kate Brown signed into law House Bill (HB) 3472A, the Oregon Corporate Activity Tax (CAT). The new tax will be imposed on businesses that have the privilege of doing business in Oregon at a rate of 0.57% of receipts less deductions on sales over $1 million.

The tax due is equal to $250 plus 0.57% of the taxpayer's taxable commercial activity over $1 million. Taxable commercial activity is Oregon's commercial activity less 35% of the greater of the taxpayer's apportioned cost of goods sold or apportioned labor costs.

Originally Answered: Why does Oregon have no sales tax? Because we have a state wage tax. Because we have property taxes. The State government tries with some frequency to pass a sales tax and its always been voted down by a large margin.

As of 2019, 5 states have 0.000% sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon do not impose state sales taxes,2feff but each state has its own regulation on excise taxes, income taxes, and taxes imposed on tourist locations - as well as local sales taxes that may be imposed by cities or municipalities.

Local governments and schools are largely funded by property taxes. Oregon is one of only five states in the nation that levies no sales or use tax. State government receipts of personal income and corporate excise taxes are contributed to the State's General Fund budget, the growth of which is controlled by State law.

Sales taxes are different from income taxes in one big way: While most states and the federal government charge income taxes, the federal government is totally out of the sales tax game. What this means: State governments hew pretty closely to the standards set in federal income taxes.

Add up your total sales to get gross receipts. If you've kept good records, it should be simple. Then subtract the cost of goods sold, as well as sales returns and allowances, to get your total income.

Originally Answered: Why does Oregon have no sales tax? Because we have a state wage tax. Because we have property taxes. The State government tries with some frequency to pass a sales tax and its always been voted down by a large margin.