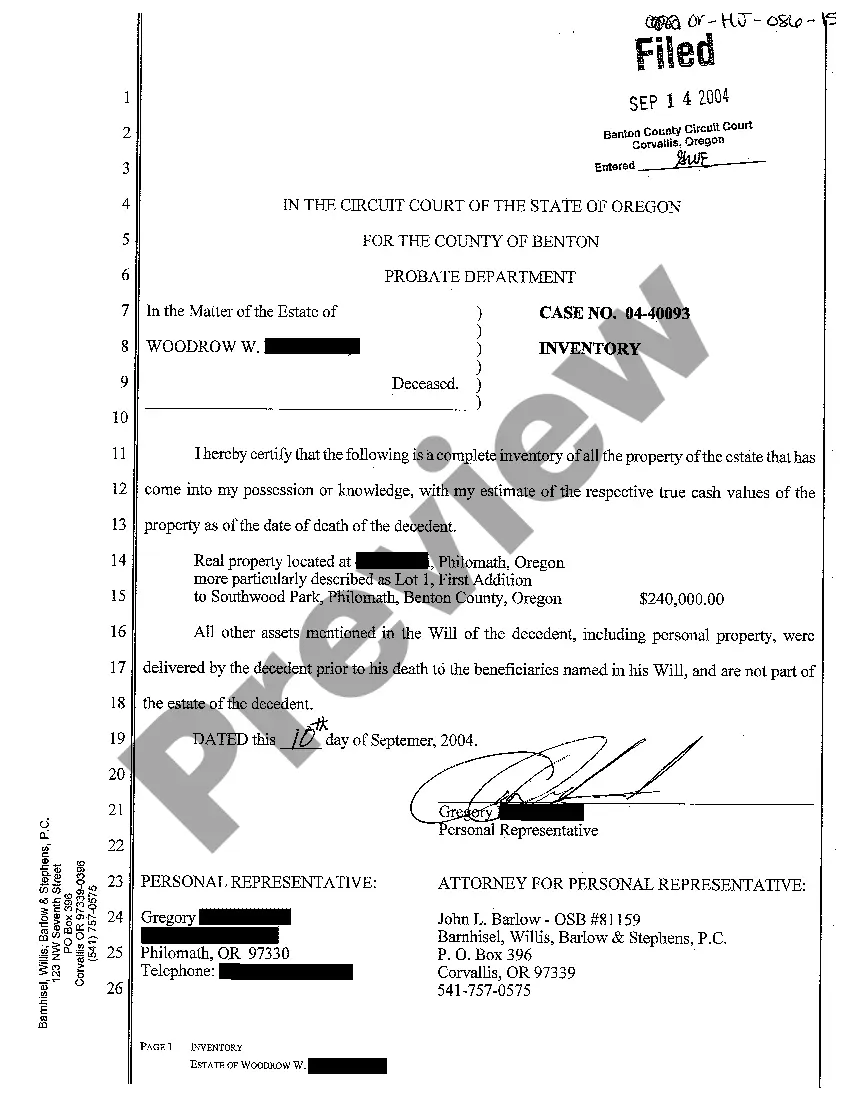

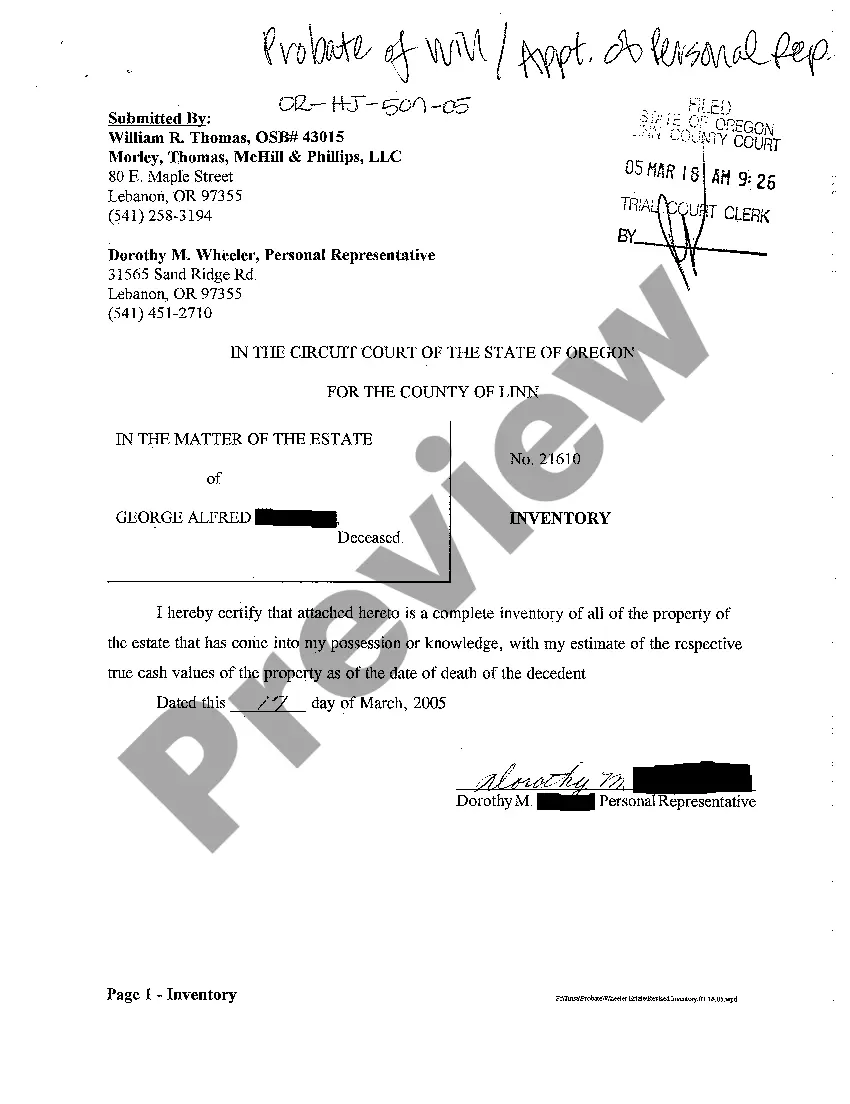

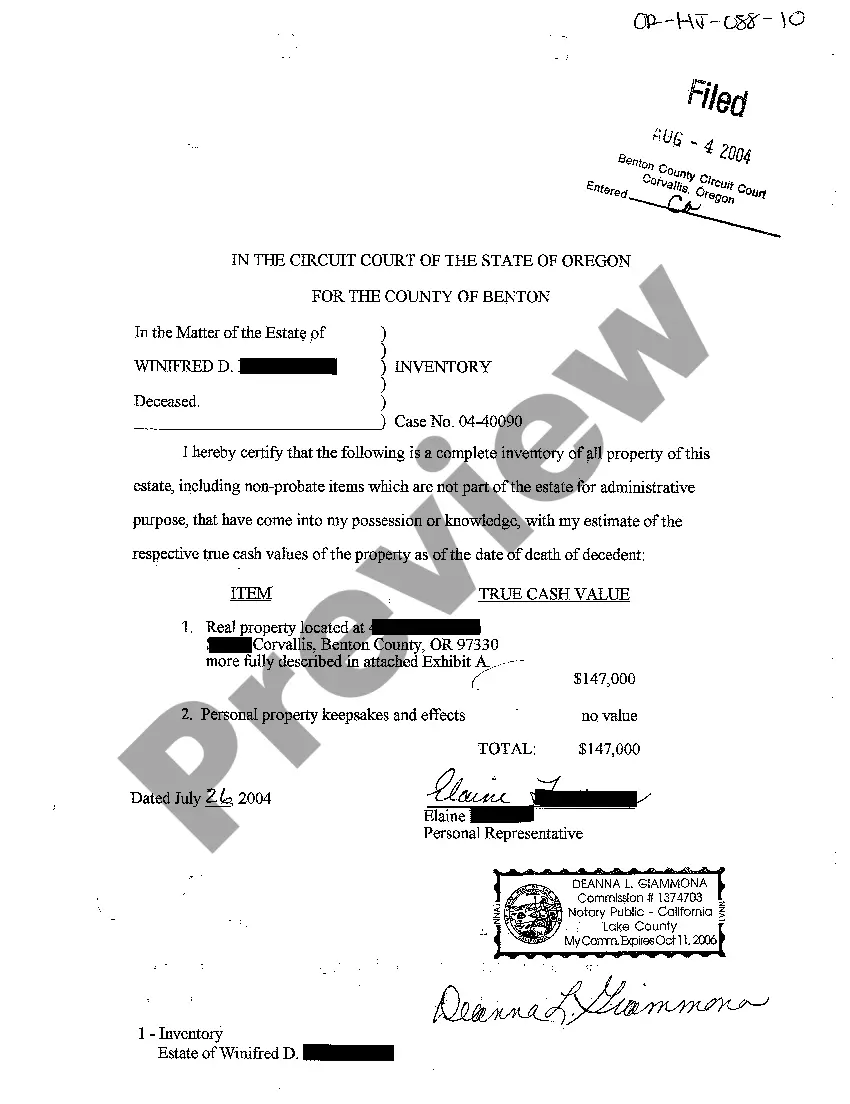

Oregon Inventory of Estate

Description

How to fill out Oregon Inventory Of Estate?

When it comes to filling out Oregon Inventory of Estate, you probably imagine an extensive procedure that consists of getting a suitable form among countless very similar ones then needing to pay a lawyer to fill it out for you. In general, that’s a slow-moving and expensive option. Use US Legal Forms and choose the state-specific template in a matter of clicks.

For those who have a subscription, just log in and click on Download button to get the Oregon Inventory of Estate template.

If you don’t have an account yet but want one, keep to the point-by-point guideline listed below:

- Make sure the file you’re downloading applies in your state (or the state it’s required in).

- Do it by reading through the form’s description and by clicking the Preview option (if available) to view the form’s information.

- Click Buy Now.

- Pick the proper plan for your budget.

- Sign up for an account and select how you would like to pay: by PayPal or by card.

- Download the file in .pdf or .docx format.

- Get the document on the device or in your My Forms folder.

Skilled attorneys draw up our templates to ensure after downloading, you don't have to worry about editing and enhancing content outside of your personal information or your business’s information. Sign up for US Legal Forms and get your Oregon Inventory of Estate sample now.

Form popularity

FAQ

Under Oregon law, a small estate affidavit can be filed if the estate has no more than $75,000 in personal property and no more that $200,000 in real property. These limits may be subject to change. A larger estate may require probate.

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

In general, an estate inventory checklist will include financial assets that belonged to the deceased.You will need a certified copy of the death certificate to show the bank to find out the amounts held in each account. Probate inventory samples generally list savings bonds, annuities and certificates of deposit.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

Real Estate, Bank Accounts, and Vehicles.Stocks and Bonds.Life Insurance and Retirement Plans.Wages and Business Interests.Intellectual Property.Debts and Judgments.