North Carolina Dissolution Package to Dissolve Corporation

About this form

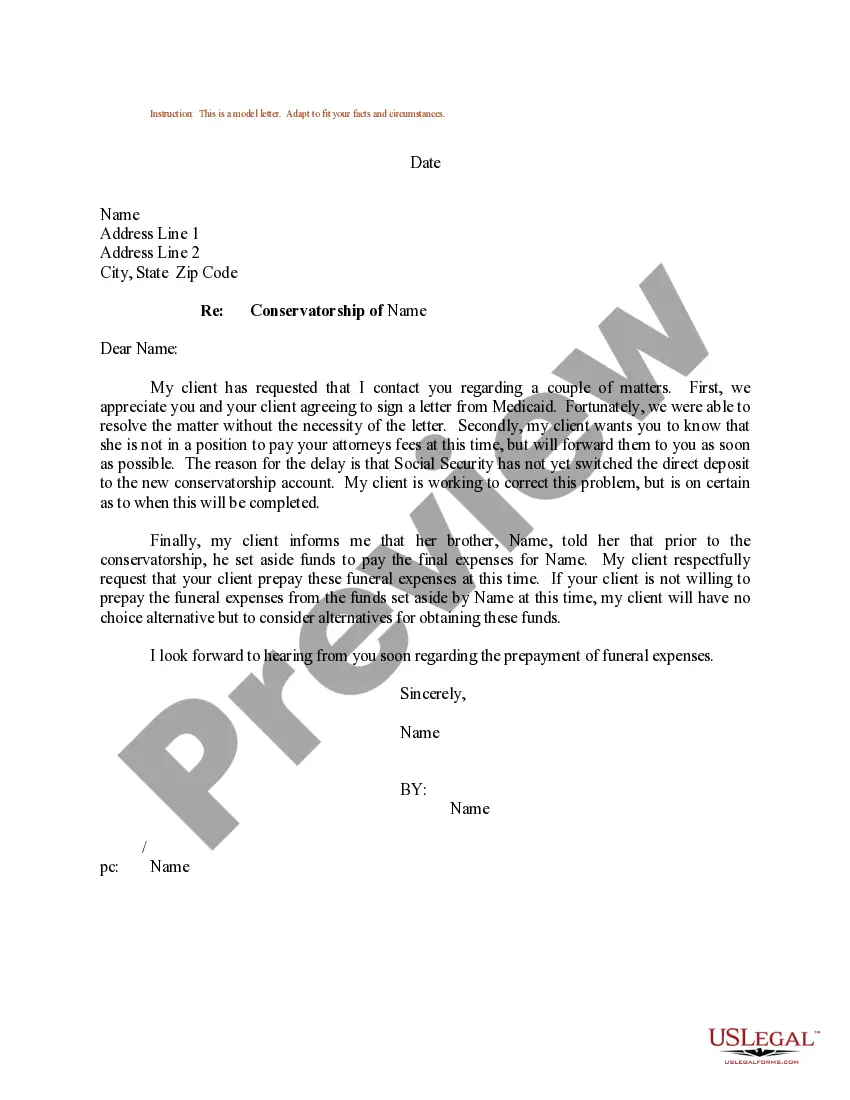

The North Carolina Dissolution Package is a comprehensive set of legal documents designed to facilitate the dissolution of a corporation in North Carolina. This package includes all necessary forms along with step-by-step instructions, transmittal letters, and essential information relevant to the dissolution process. Unlike other business forms, this package is specifically tailored for corporate dissolution and takes into account the unique legal requirements in North Carolina.

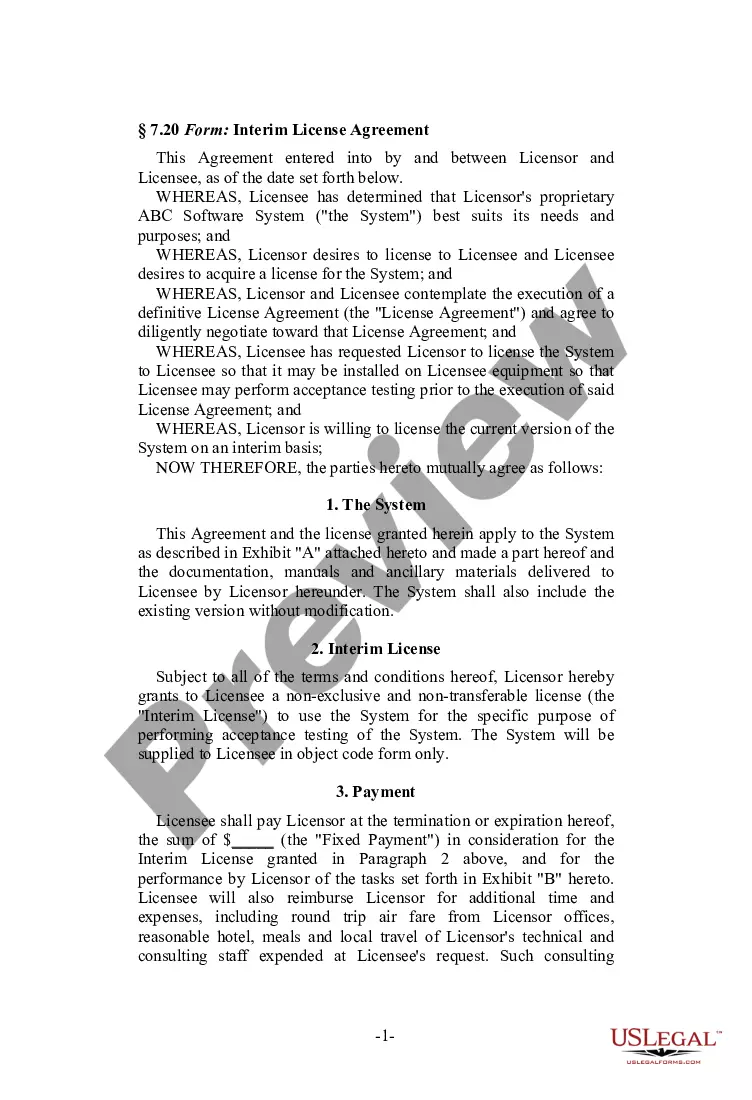

Form components explained

- Cover Sheet: Required for filing any documents with the Secretary of State.

- Articles of Dissolution: Necessary to officially dissolve the corporation, with provisions for corporations that have or have not issued shares.

- Notice of Special Meeting: Informs shareholders of a meeting to vote on the dissolution.

- Resolution of Board: Documents the board's recommendation for dissolution.

- Notice to Claimants: Communicates the dissolution to known claimants.

- Notice to Unknown Claimants: Publishes a legal notice to alert unknown claimants of the dissolution.

Situations where this form applies

This form package is necessary when the owners of a corporation in North Carolina decide to voluntarily dissolve the business. Situations may include ceasing operations, merging with another company, or when shareholders agree that continuing the corporation is no longer feasible. It ensures that the dissolution is conducted legally and thoroughly, safeguarding all parties involved.

Who can use this document

This package is intended for:

- Corporation directors wishing to formally dissolve the business.

- Shareholders looking to initiate the dissolution process.

- Incorporators of a corporation that has not issued shares and needs to dissolve.

- Legal representatives assisting clients with corporate matters.

Completing this form step by step

- Step 1: Complete the Cover Sheet accurately and include it with your filing.

- Step 2: Fill out the Articles of Dissolution, ensuring to provide the corporation's name, details of the officers and directors, and the date of the corporation's formation.

- Step 3: Notify shareholders of the special meeting to discuss the proposed dissolution.

- Step 4: Obtain approval from the board of directors and shareholders through a resolution or written consent.

- Step 5: Notify known claimants about the dissolution and publish notice to unknown claimants as required by law.

- Step 6: Submit all required documents and the associated filing fee to the Secretary of State.

Notarization requirements for this form

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to notify all shareholders before the dissolution vote.

- Not completing the Cover Sheet or Articles of Dissolution correctly.

- Overlooking the requirement to notify known claimants of the dissolution.

- Not adhering to the appropriate filing fee or submission guidelines.

Advantages of online completion

- Convenient access to all necessary forms in one package.

- Editable templates ensure accuracy and personalization.

- Reliable guidance from experienced legal professionals.

- Instant download capability for immediate use.

Legal use & context

- The dissolution process must follow statutory requirements to be legally effective.

- Failure to properly dissolve a corporation may lead to continued liability for directors and shareholders.

- The package facilitates compliance with North Carolina laws governing business corporations.

Summary of main points

- The North Carolina Dissolution Package provides essential forms and instructions for corporate dissolution.

- Proper execution of the dissolution process is crucial to avoid future liabilities.

- All involved parties must be notified to ensure a legal and transparent dissolution.

Looking for another form?

Form popularity

FAQ

In legal terms, when a company is dissolved, it ceases to exist. It cannot still be trading - although a person may trade (misleadingly) using its name.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

If the company has ceased trading and is closed owing money and your debt is with that company then your liability ends with that company.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets.Assets used as security for loans must be given to the bank or creditor that extended the loan, or you must pay off the loan before selling such assets.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

North Carolina requires business owners to submit their Articles of Dissolution by mail or online. Online filers must select "Submit a Filing to an Existing Entity" search for their business, and then select "Upload a PDF Filing".

If you want to close a North Carolina business, you do so by voluntarily filing Articles of Dissolution for the entity type (Business Corporation, Nonprofit Corporation, Limited Liability Company (LLC)).

Hold a Board of Directors meeting and record a resolution to Dissolve the North Carolina Corporation. Hold a Shareholder meeting to approve Dissolution of the North Carolina Corporation. File all required Annual Reports with the North Carolina Secretary of State. Clear up any business debts.

After dissolution, you cannot use the funds remaining in your business bank account for new business. LLC members no longer have the authority to conduct business or do anything that would indicate that the LLC is still active. Your bank account can cover only essential winding up affairs.