Mississippi Application for Exemption from Ad Valorem Taxes for Certain Manufactured Products Held for Sale or Shipment to Other than Final Consumer for a Period of 10 Years

What this document covers

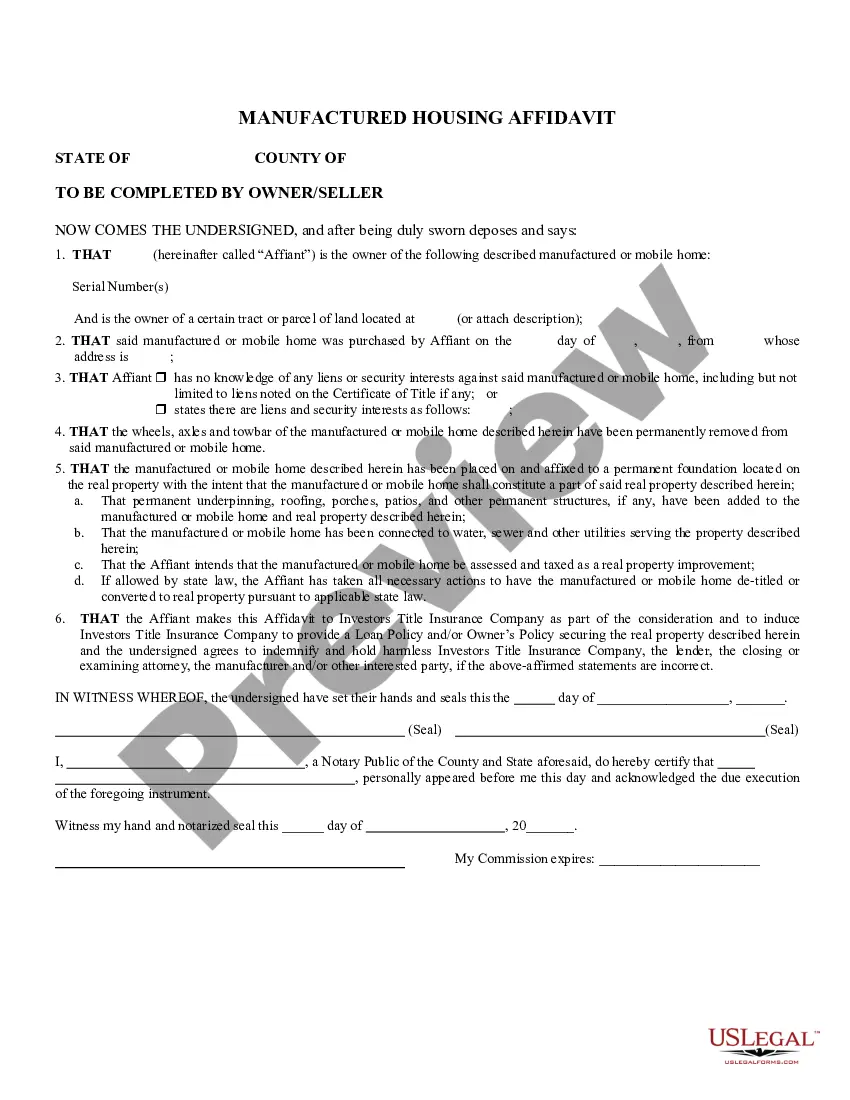

The Application for Exemption from Ad Valorem Taxes for Certain Manufactured Products Held for Sale or Shipment to Other than Final Consumer for a Period of Ten Years is a legal document submitted to the Mayor and Board of Aldermen in Mississippi. This form allows manufacturers to apply for an exemption from paying ad valorem taxes on certain products held for sale or shipment, granted for a period of ten years. This application must achieve approval from both the mayor and the Mississippi State Tax Commission, differentiating it from other tax exemption forms that may not require such dual approval.

Key parts of this document

- Applicant's information: Details about the business applying for the exemption.

- Description of the manufactured products: Specifics about the items held for sale or shipment.

- Duration of the exemption: Clearly states the ten-year exemption period requested.

- Signatures: Required signatures from both the mayor and relevant committee members for approval.

When this form is needed

This form is needed when a manufacturer in Mississippi wishes to apply for a tax exemption on certain products that are intended for sale or shipment to non-final consumers. This is particularly applicable if the products will not be used directly by the final consumer and may include items like bulk goods or supplies meant for resale or further distribution.

Who can use this document

- Manufacturers looking to reduce their tax burden on certain products held for sale.

- Business owners who plan to sell or ship manufactured goods to other businesses, rather than to individual consumers.

- Tax professionals advising clients on property tax exemptions in Mississippi.

How to complete this form

- Identify the applicant: Fill in the business name and contact information for the party applying.

- Describe the manufactured products: Clearly list out the items for which the tax exemption is being requested.

- Specify the duration: Indicate the desired ten-year period for the tax exemption.

- Gather signatures: Obtain necessary signatures from the mayor and designated officials to complete the application.

Does this form need to be notarized?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Avoid these common issues

- Failing to provide complete and accurate product descriptions.

- Omitting signatures from required parties, particularly the mayor.

- Not specifying the correct duration of the exemption period.

Advantages of online completion

- Convenience: Easily access and download the form from anywhere.

- Editability: Fill out the form electronically, ensuring clarity and accuracy.

- Reliability: Access templates drafted by licensed attorneys, ensuring compliance with legal standards.

Form popularity

FAQ

How do you register for a sales tax permit in Mississippi? Business owners can register online at Mississippi's TAP website. Mississippi encourages online sellers to register and file sales tax online.

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value.

Application Requirements A copy of your recorded Warranty Deed. Your Mississippi car and/or truck tag numbers. Social Security Numbers for You and Your Spouse if You Are Married. Birth dates for you and your spouse or all parties applying for homestead.

Since the Mississippi Department of Revenue doesn't provide resale certificates, a vendor who regularly works with resellers might put together a form that serves the same purposes. Essentially, you'll have a form to collect the buyer's name, address, and permit number.

Under Mississippi law, families have the right to keep a certain portion of their homestead exempt from creditors. Specifically, the law exempts 160 acres or $75,000 in equity, whichever is lower, from the reach of creditors.The homestead law's intent is to keep families on their property.

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value.

Sales of property, labor or services sold to, billed directly to, and payment is made directly by the United States Government, the state of Mississippi and its departments, institutions, counties and municipalities or departments or school districts of its counties and municipalities are exempt from sales tax.

A valid Florida driver's license. Either a valid voter's registration or a Declaration of Domicile, reflecting the homeowner's Florida address. At least one of your automobiles must be registered in Florida.

The state of Mississippi issues just one exemption form, to be utilized when purchasing exempt items such as items intended for resale. The state is one of the few states to only offer one exemption form.