Mississippi Application for Exemption from Ad Valorem Taxes

What is this form?

The Application for Exemption from Ad Valorem Taxes is a legal document used by businesses in Mississippi to request exemption from property taxes for personal property that is in transit. This form specifically applies when the property is temporarily stored in a free port warehouse before being shipped to an out-of-state destination. It is crucial for businesses that wish to avoid unnecessary tax burdens on goods that are not permanently located in Mississippi.

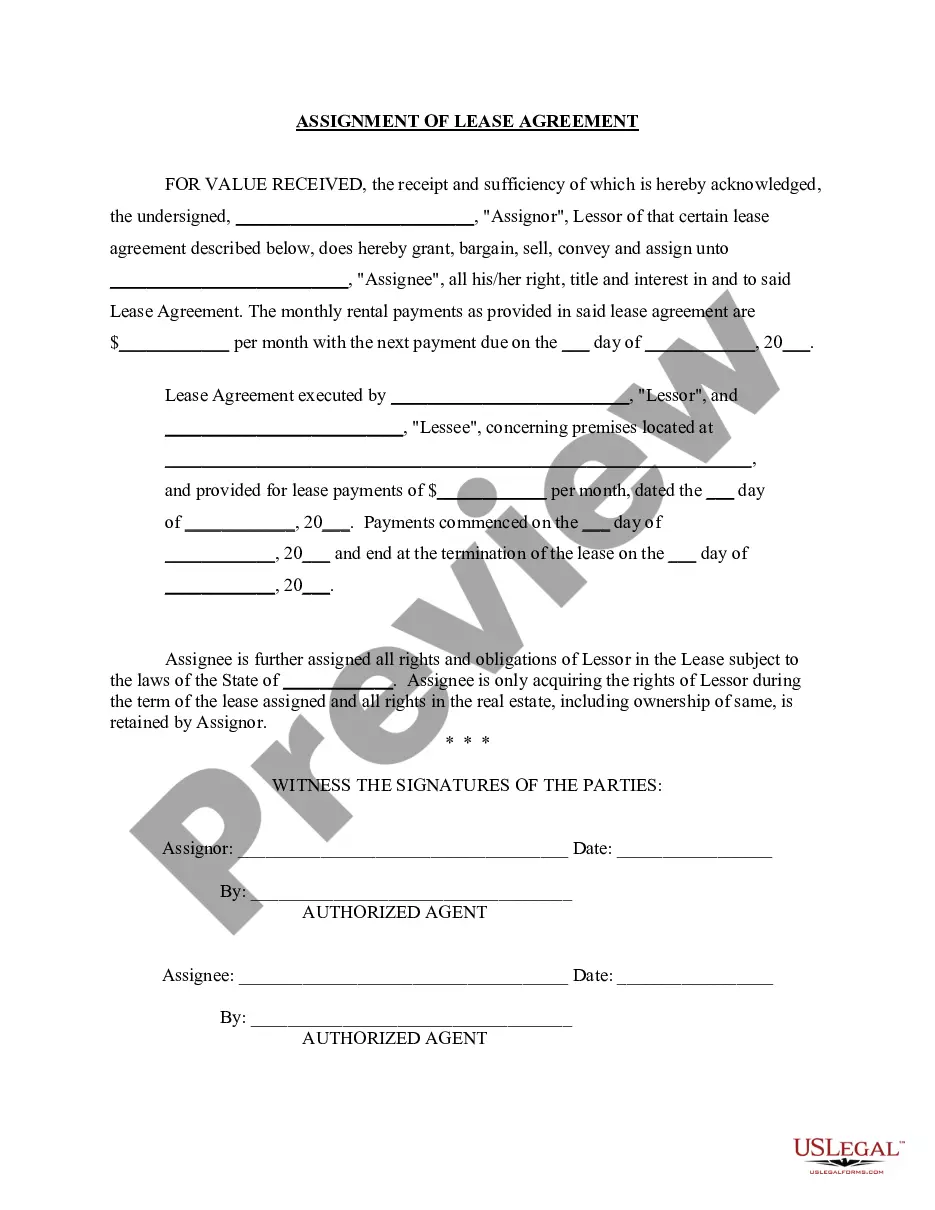

Key components of this form

- Applicant Information: Details about the business filing the application.

- Property Details: Description of the personal property in transit and its intended final destination.

- Compliance Statements: Confirmation that the applicant meets state licensing requirements for free port warehouses.

- Tax Exemption Request: Specific request for exemption from ad valorem taxes based on the criteria established in Mississippi law.

- Signatures: Required signatures from authorized company representatives to validate the application.

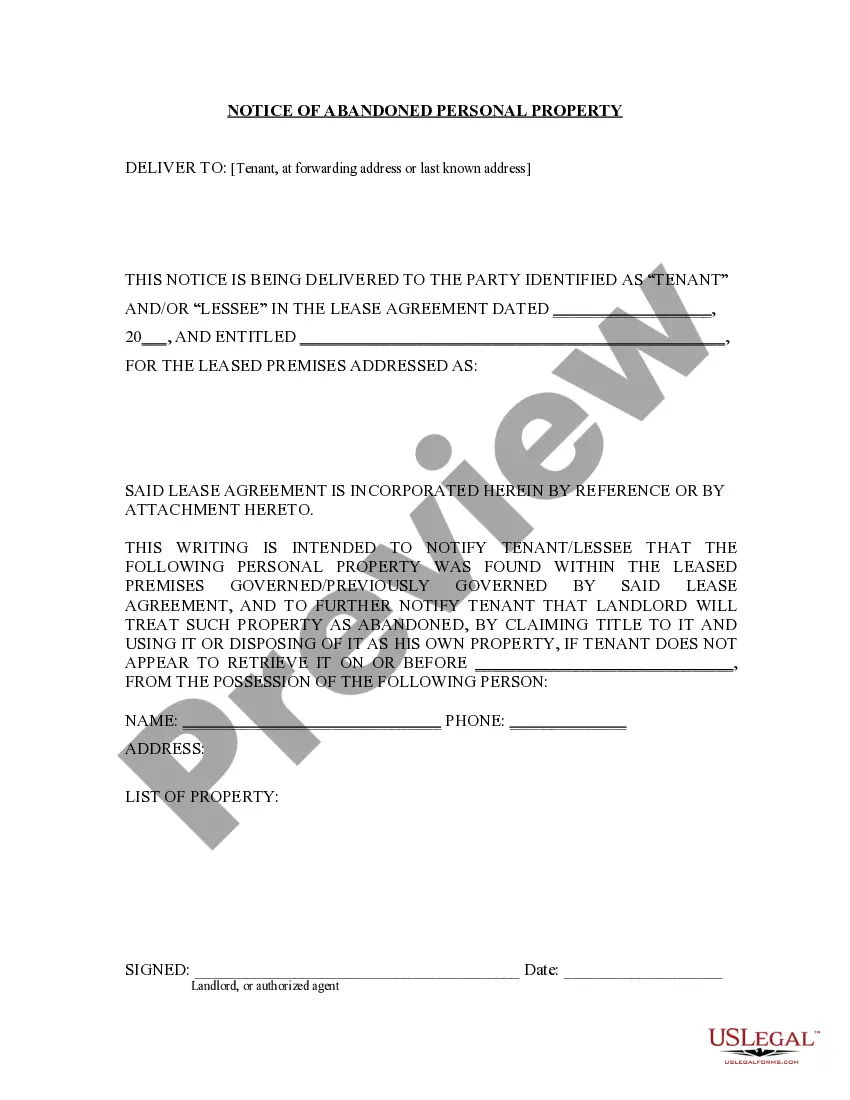

When to use this form

This form should be used when a business intends to store personal property temporarily in a Mississippi free port warehouse while awaiting shipment to a destination outside the state. It is particularly relevant for companies dealing in goods that are frequently in transit, such as pharmaceuticals or medical supplies, which may benefit from tax exemptions during transport. Filing this application is essential for businesses to legally obtain tax relief on their stored inventory that is not intended for local sale.

Who this form is for

- Businesses operating in Mississippi that own personal property in transit.

- Companies using free port warehouses for temporary storage of goods.

- Entities involved in the warehousing and distribution of products destined for out-of-state locations.

- Corporations that meet licensing requirements set by the Mississippi State Tax Commission.

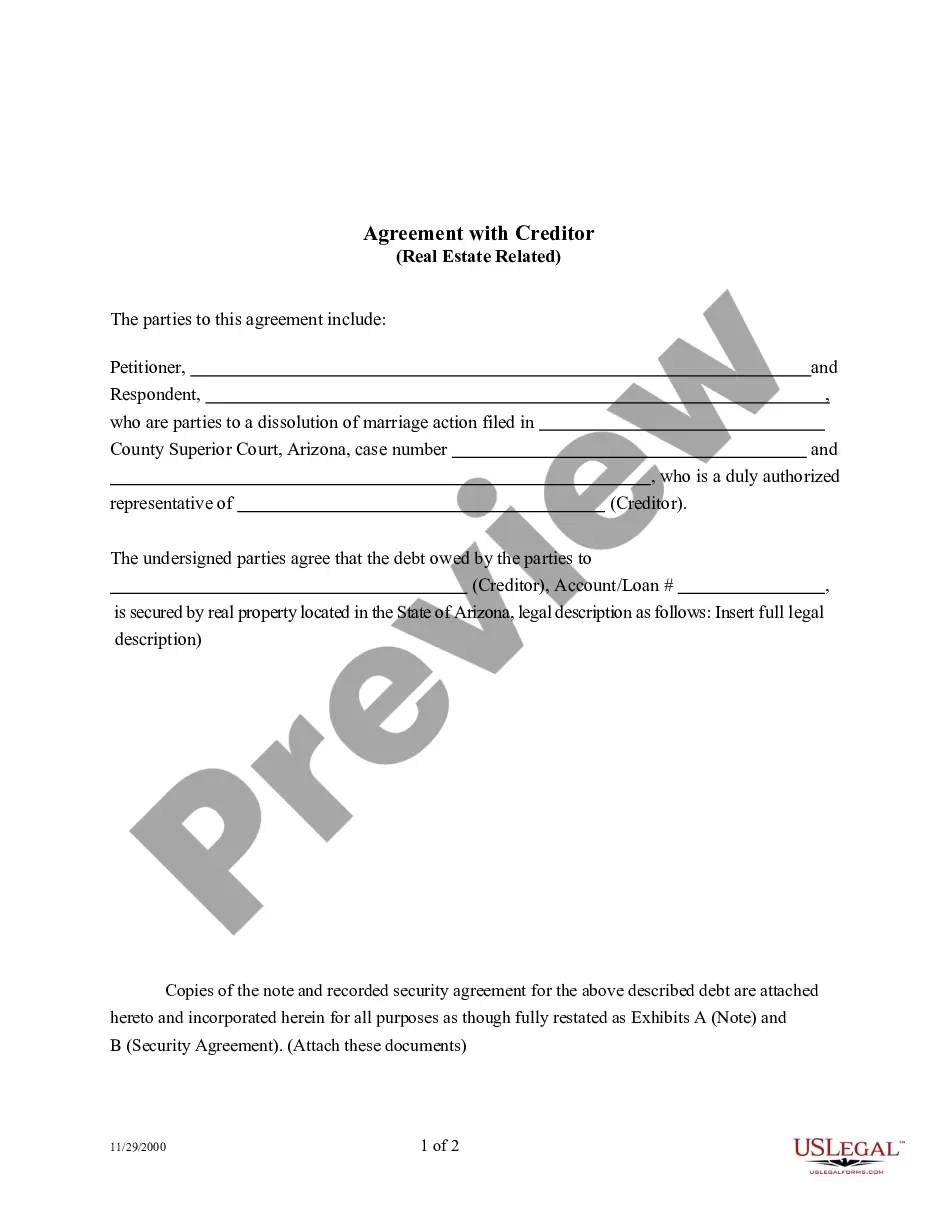

How to prepare this document

- Identify the business as the applicant, providing the company name and principal location.

- Describe the personal property being stored, including details on its type and condition.

- Specify the final destination of the property, ensuring it is outside the State of Mississippi.

- Include information regarding compliance with the Mississippi Tax Commissionâs requirements.

- Obtain signatures from authorized representatives to complete the application.

Does this document require notarization?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

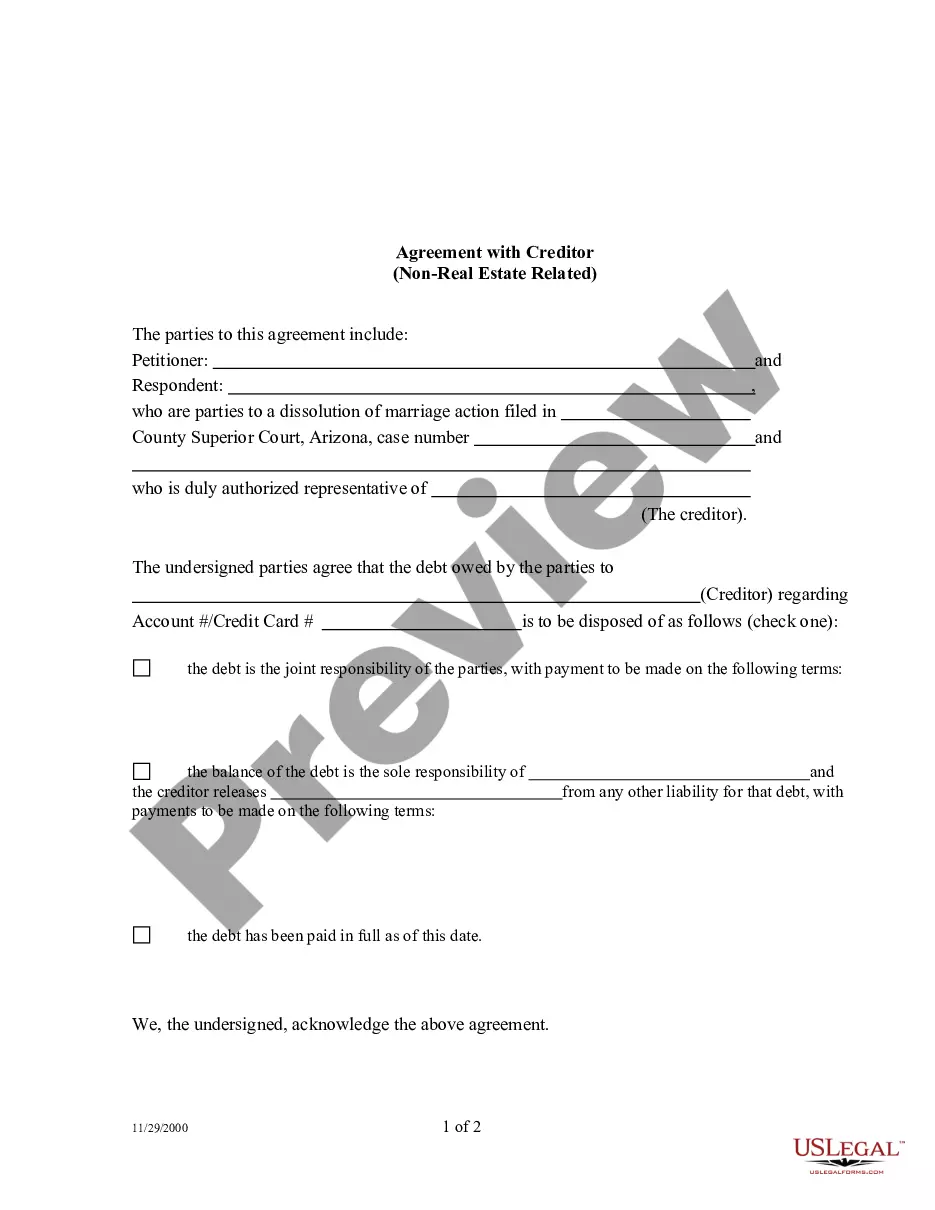

Mistakes to watch out for

- Failure to provide accurate business information or property details.

- Not including necessary signatures from authorized individuals.

- Submitting the form without ensuring compliance with state licensing requirements.

- Neglecting to state the final destination of the personal property clearly.

Why complete this form online

- Convenience of downloading and filling out the form at your own pace.

- Editability allows businesses to make necessary modifications easily.

- Access to attorney-drafted forms ensures compliance with legal standards.

- Instant availability helps expedite the exemption application process.

Looking for another form?

Form popularity

FAQ

Arizona. California. Oklahoma. South Carolina. Texas. Wisconsin.

Specifically, the law exempts 160 acres or $75,000 in equity, whichever is lower, from the reach of creditors. The sole requirement of a property owner to receive this exemption is to occupy the property as his or her primary residence.

To apply for Homestead Exemption for the first time, you need to come to the Tax Assessor's Office (365 Losher Street, Suite 100, Hernando, MS 38632) and bring the following: A copy of your recorded Warranty Deed. Your Mississippi car and/or truck tag numbers.

Applications for homestead exemption must be filed between January 1 and April 1. Who is eligible for homestead exemption? Anyone owning a home in Mississippi may be eligible for homestead exemption.

Since the Mississippi Department of Revenue doesn't provide resale certificates, a vendor who regularly works with resellers might put together a form that serves the same purposes. Essentially, you'll have a form to collect the buyer's name, address, and permit number.

The answer is simple no. In Mississippi, paying the property taxes on someone else's land does not affect ownership in any manner. You simply cannot obtain title to someone's land by paying their taxes for them.

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value.

The state of Mississippi issues just one exemption form, to be utilized when purchasing exempt items such as items intended for resale. The state is one of the few states to only offer one exemption form.

Applications for homestead exemption must be filed between January 1 and April 1. Who is eligible for homestead exemption? Anyone owning a home in Mississippi may be eligible for homestead exemption. Contact your local Tax Assessor for further details.