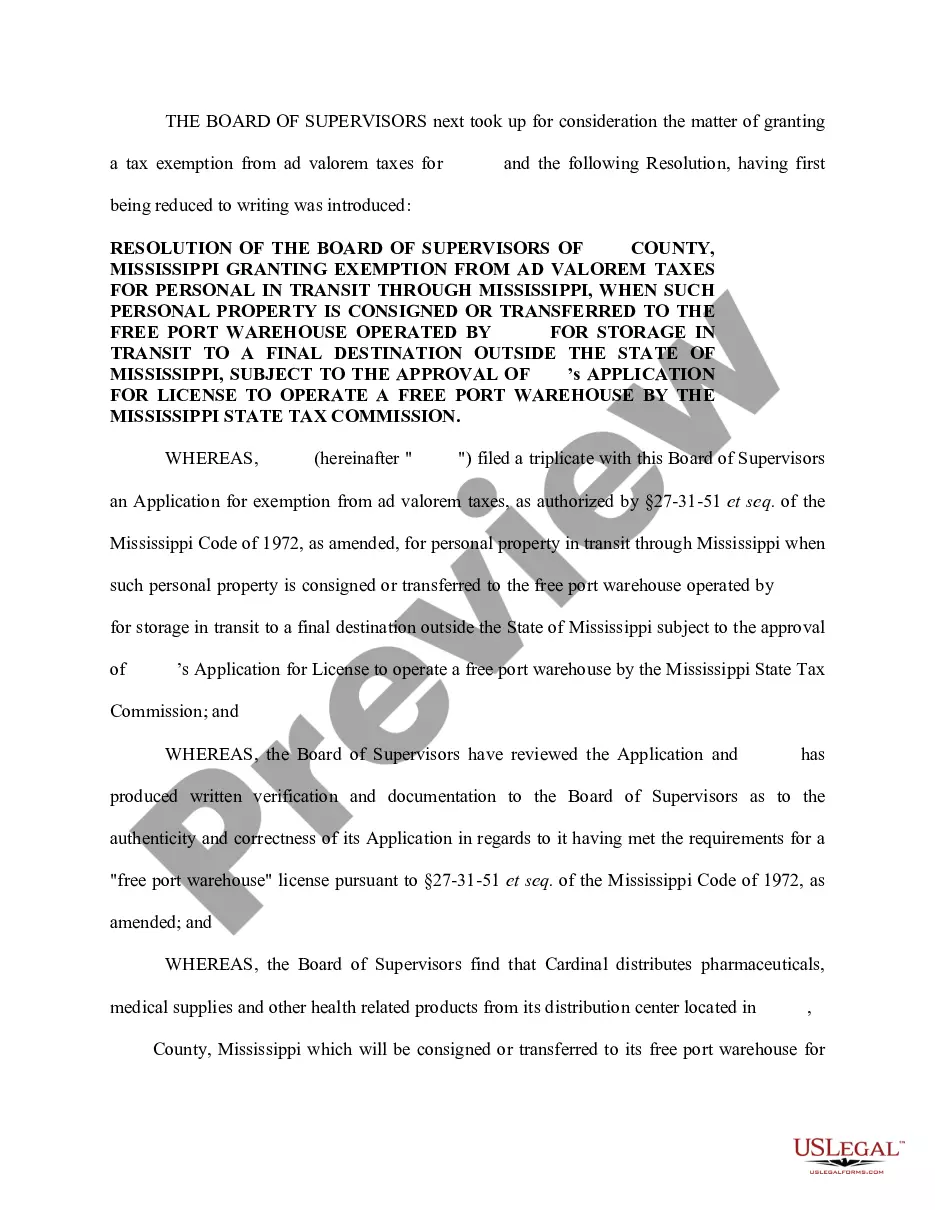

Mississippi Application for Exemption from Ad Valorem Taxes

What is this form?

The Application for Exemption from Ad Valorem Taxes is a legal document used by businesses seeking to exempt their personal property from taxes while it is temporarily stored in Mississippi. This form specifically caters to property in transit that is housed in a free port warehouse, allowing for a temporary exemption until it reaches its final destination outside the state.

Key parts of this document

- Applicant information, including business name and location

- Details about the free port warehouse and related license

- Explanation of the business's eligibility for exemption under state laws

- Effective date of the exemption and duration

- Signature of a corporate officer to validate the application

When to use this form

This form should be used when a business operating in Mississippi stores personal property in a free port warehouse while it is in transit to a destination outside the state. It is essential when the business wants to avoid ad valorem taxes during this period, ensuring compliance with local tax laws.

Who can use this document

- Businesses operating in Mississippi that utilize free port warehouses

- Companies storing personal property temporarily while in transit

- Organizations looking to comply with state tax exemption requirements

How to complete this form

- Identify and fill out the applicant's information, including the name and address of the business.

- Provide details about the free port warehouse, including its operational license status.

- Describe the type of personal property being stored and its intended final destination.

- Specify the effective date for the requested tax exemption.

- Sign the application with the authorized corporate officer's signature.

Notarization guidance

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to provide complete business information, which can delay processing.

- Not including all required signatures, particularly from corporate officers.

- Submitting the form without confirming that all state requirements are met.

Benefits of completing this form online

- Convenient access to the form at any time and from anywhere.

- Editability allows for quick adjustments and updates before final submission.

- Security in managing sensitive business information through our platform.

Looking for another form?

Form popularity

FAQ

Arizona. California. Oklahoma. South Carolina. Texas. Wisconsin.

Specifically, the law exempts 160 acres or $75,000 in equity, whichever is lower, from the reach of creditors. The sole requirement of a property owner to receive this exemption is to occupy the property as his or her primary residence.

To apply for Homestead Exemption for the first time, you need to come to the Tax Assessor's Office (365 Losher Street, Suite 100, Hernando, MS 38632) and bring the following: A copy of your recorded Warranty Deed. Your Mississippi car and/or truck tag numbers.

Applications for homestead exemption must be filed between January 1 and April 1. Who is eligible for homestead exemption? Anyone owning a home in Mississippi may be eligible for homestead exemption.

Since the Mississippi Department of Revenue doesn't provide resale certificates, a vendor who regularly works with resellers might put together a form that serves the same purposes. Essentially, you'll have a form to collect the buyer's name, address, and permit number.

The answer is simple no. In Mississippi, paying the property taxes on someone else's land does not affect ownership in any manner. You simply cannot obtain title to someone's land by paying their taxes for them.

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value.

The state of Mississippi issues just one exemption form, to be utilized when purchasing exempt items such as items intended for resale. The state is one of the few states to only offer one exemption form.

Applications for homestead exemption must be filed between January 1 and April 1. Who is eligible for homestead exemption? Anyone owning a home in Mississippi may be eligible for homestead exemption. Contact your local Tax Assessor for further details.