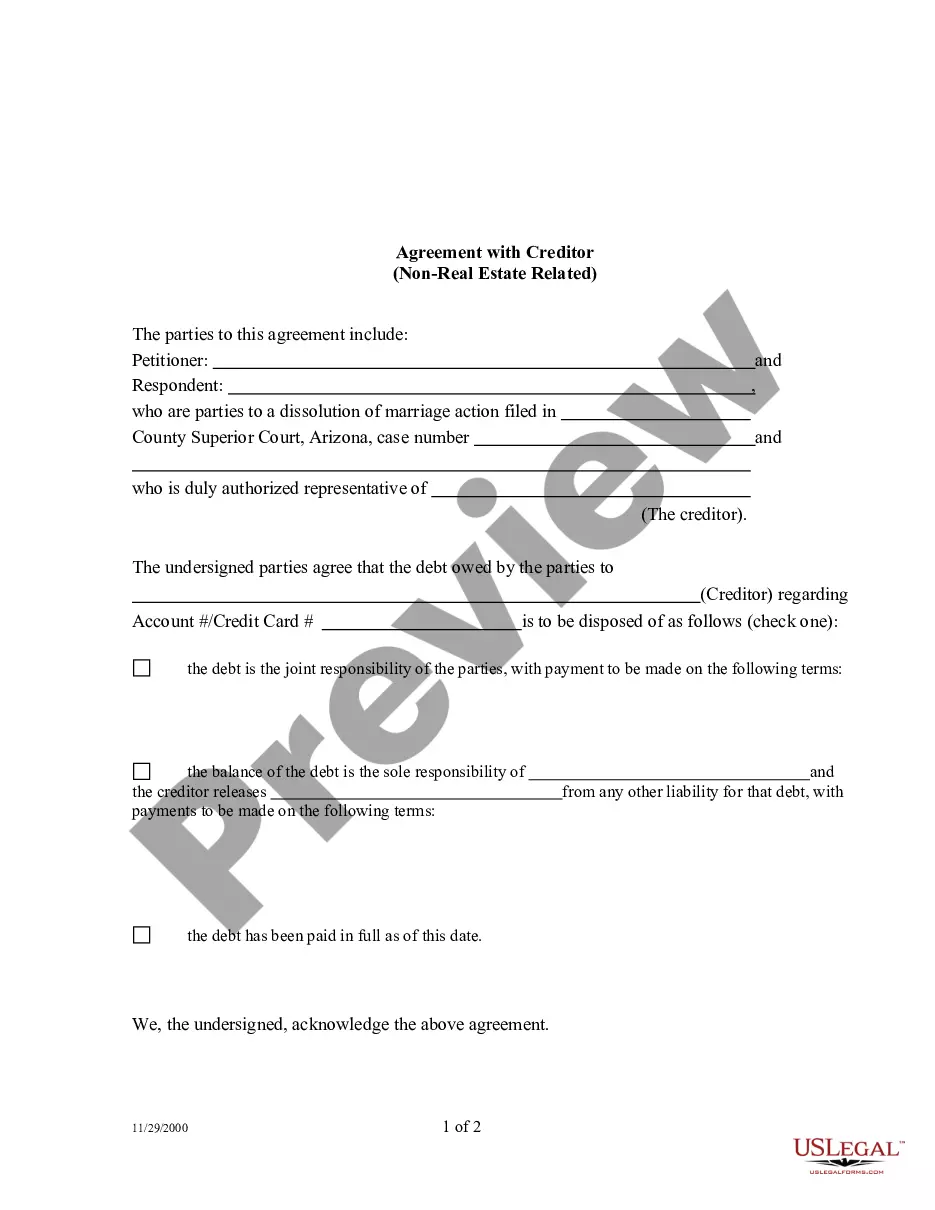

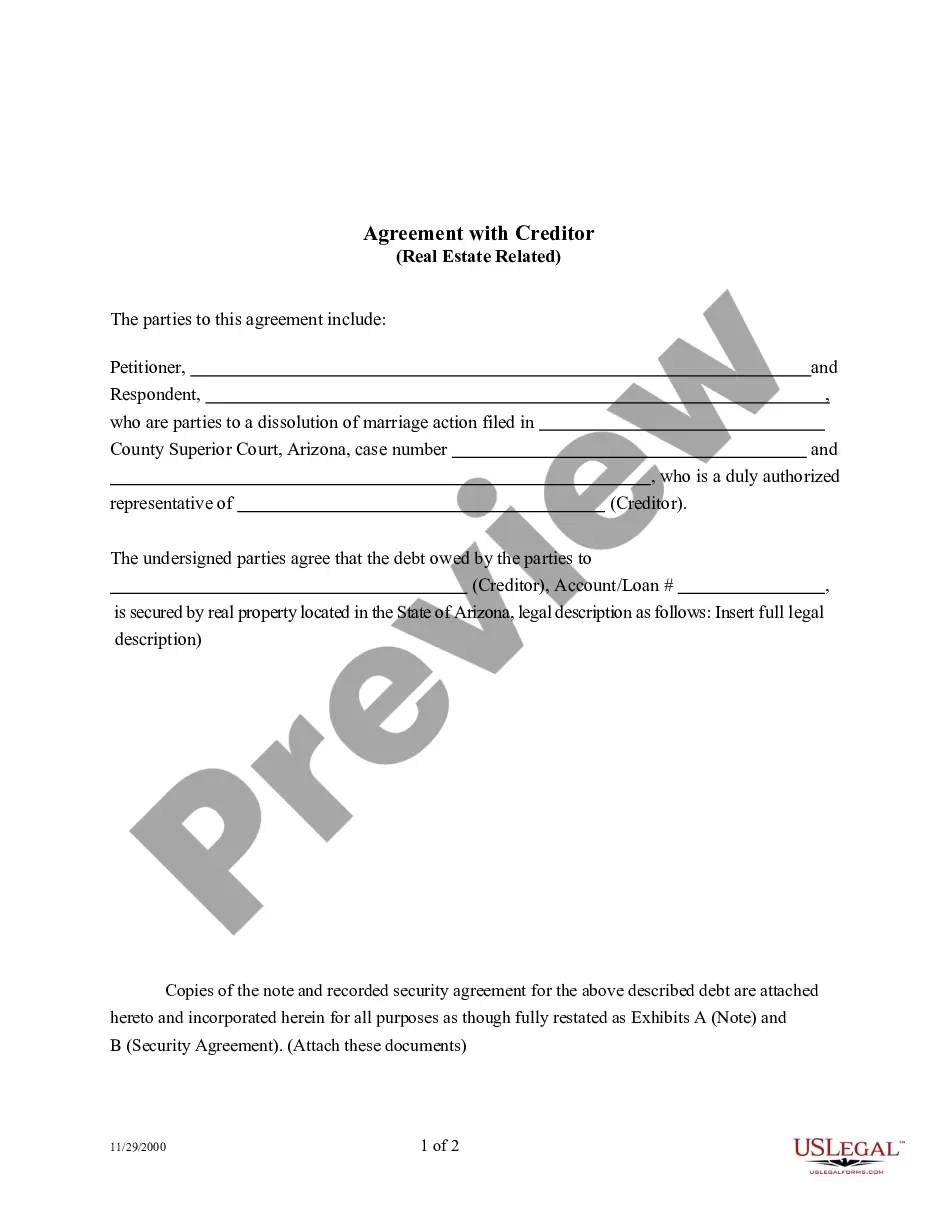

An Agreement with Creditor on Real Estate matters is a form used by both parties to a dissolution of marriage cause of action. It seeks to modify and/or reaffirm all non-real estate related debts.

Arizona Agreement with Creditor - Debt Not Related to Real Estate

Description

How to fill out Arizona Agreement With Creditor - Debt Not Related To Real Estate?

Among numerous free and paid instances available on the internet, you cannot guarantee their precision and dependability.

For instance, who produced them or if they are qualified enough to handle what you require them for.

Always stay calm and make use of US Legal Forms!

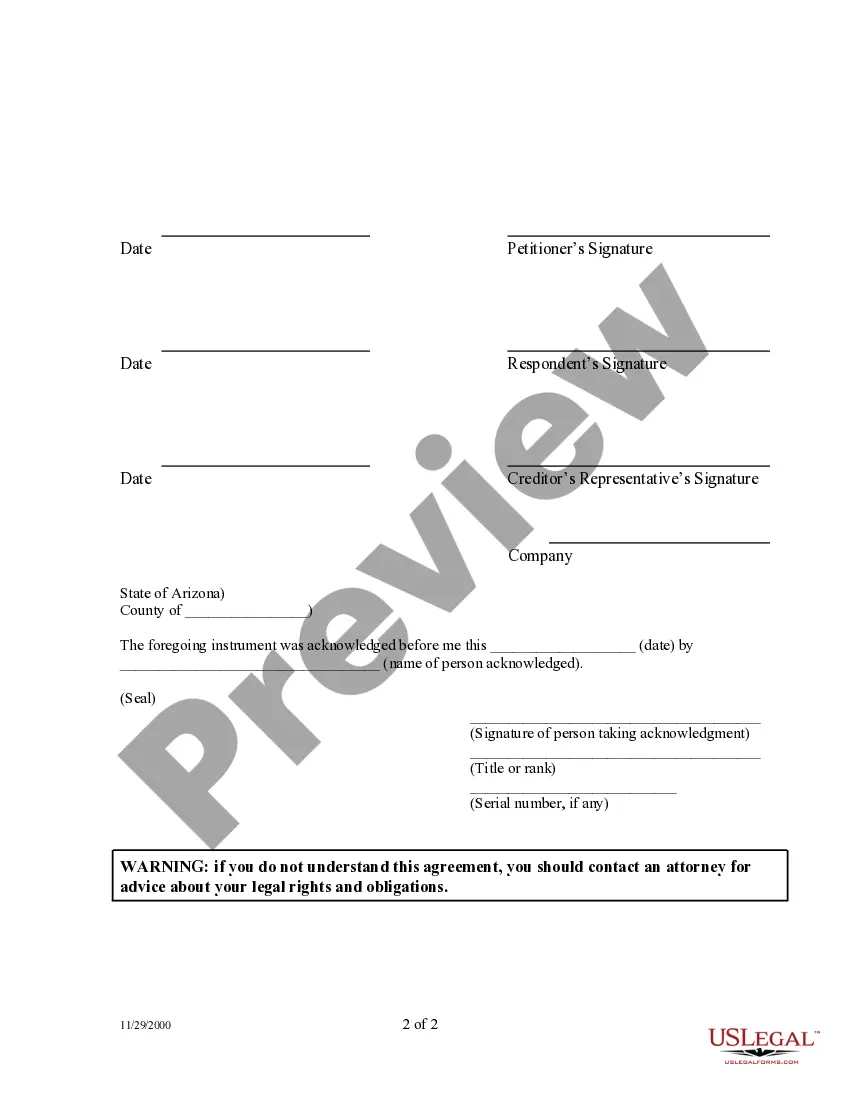

After you’ve registered and purchased your subscription, you can utilize your Arizona Agreement with Creditor - Debt Not Related to Real Estate as often as you need or as long as it remains valid in your state. Modify it with your preferred online or offline editor, complete it, sign it, and generate a physical copy of it. Achieve more for less with US Legal Forms!

- Locate Arizona Agreement with Creditor - Debt Not Related to Real Estate templates developed by experienced legal professionals and eliminate the expensive and lengthy process of searching for an attorney and then compensating them to draft documents for you that you can easily obtain yourself.

- If you have a subscription, Log In to your account and locate the Download button next to the file you seek.

- You will also be able to reach your previously saved templates in the My documents section.

- If you’re using our site for the first time, follow the instructions below to acquire your Arizona Agreement with Creditor - Debt Not Related to Real Estate quickly.

- Confirm that the document you observe is applicable to your state.

- Examine the template by reviewing the details for utilizing the Preview feature.

Form popularity

FAQ

To answer a summons for debt collection in Arizona, review the document carefully and prepare a response. Make sure to address each claim made by the creditor, especially regarding any Arizona Agreement with Creditor - Debt Not Related to Real Estate. It’s often wise to consult with a legal expert, as they can provide guidance specific to your situation.

Writing a letter to a creditor for proof of debt is straightforward. Start by including your personal information, the date, and the creditor's details. Clearly state your request for validation of the debt, mention the Arizona Agreement with Creditor - Debt Not Related to Real Estate, and include any account numbers to facilitate their response.

A creditor must provide specific documentation to validate a debt. This includes the original contract, account statements, and a record of payment history. If you are dealing with an Arizona Agreement with Creditor - Debt Not Related to Real Estate, make sure all documents reference the agreement.

You can make a creditor prove a debt by sending them a formal request for validation. Under the Fair Debt Collection Practices Act, you have the right to ask them to provide evidence of the debt, including the original agreement. This is particularly important if the debt relates to an Arizona Agreement with Creditor - Debt Not Related to Real Estate.

When you need proof of a debt, you should reach out to the creditor directly. Write a clear and polite request that specifies you want validation of the debt, especially if it involves an Arizona Agreement with Creditor - Debt Not Related to Real Estate. Providing your account number and any relevant details can help expedite the process.

To prove you owe a debt, you need to gather documentation that supports your claim. This might include contracts, statements, and account records that show your debt balance. If the debt involves an Arizona Agreement with Creditor - Debt Not Related to Real Estate, make sure to keep any communication related to the agreement as evidence.

Debt in Arizona generally becomes uncollectible after six years due to the statute of limitations governing most types of debt. This timeframe allows creditors to pursue their claims against debtors legally. However, the implications of an uncollected debt can linger, impacting financial well-being. Utilizing tools like the Arizona Agreement with Creditor - Debt Not Related to Real Estate can help in negotiating terms and resolving debts before they reach this endpoint.

Creditors in Arizona have a specific timeframe of four months to file a claim against an estate after receiving notice of the probate proceedings. This period is crucial for ensuring all debts, including those stemming from an Arizona Agreement with Creditor - Debt Not Related to Real Estate, are duly addressed. If creditors miss this deadline, they may not be able to enforce their claims against the estate. Executors should remain vigilant about notifying creditors promptly.

In Arizona, an executor typically has a maximum of one year to distribute assets to beneficiaries after a person passes away. However, the executor may finish the process sooner if all debts are settled and the estate administration is straightforward. If challenges arise, such as disputes or complex assets, the timeline might extend. Thus, it is vital for executors to effectively manage the estate, especially in cases involving an Arizona Agreement with Creditor - Debt Not Related to Real Estate.

Debt collectors in Arizona can generally pursue old debts for up to six years, depending on the nature of the debt. Collectors may not take legal action after this timeframe, but they can still attempt to collect the debt through other means. Being informed about your rights is vital, and an Arizona Agreement with Creditor - Debt Not Related to Real Estate can provide essential guidance in such scenarios.