The Maryland Financial Statement (Child Support Guidelines) is a form used to determine the amount of child support owed by a non-custodial parent in the state of Maryland. The guidelines are based on the gross income of each parent, the number of children, and other factors. The statement is used to calculate the amount of child support that is due and can be used in any court proceeding involving child support. There are two types of Maryland Financial Statement (Child Support Guidelines): the Standard Form and the Short Form. The Standard Form is used when the combined income of the parents is $15,000 or more per year, while the Short Form is used when the combined income of the parents is less than $15,000 per year.

Maryland Financial Statement (Child Support Guidelines)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Financial Statement (Child Support Guidelines)?

If you're searching for a method to correctly fill out the Maryland Financial Statement (Child Support Guidelines) without engaging a legal professional, then you've come to the right spot.

US Legal Forms has demonstrated itself as the most comprehensive and trustworthy collection of official templates for every personal and business situation. Each document you discover on our online platform is crafted in accordance with federal and state laws, so you can rest assured that your paperwork is accurate.

Another fantastic aspect of US Legal Forms is that you will never misplace the documents you have bought - you can access any of your downloaded templates in the My documents section of your profile whenever needed.

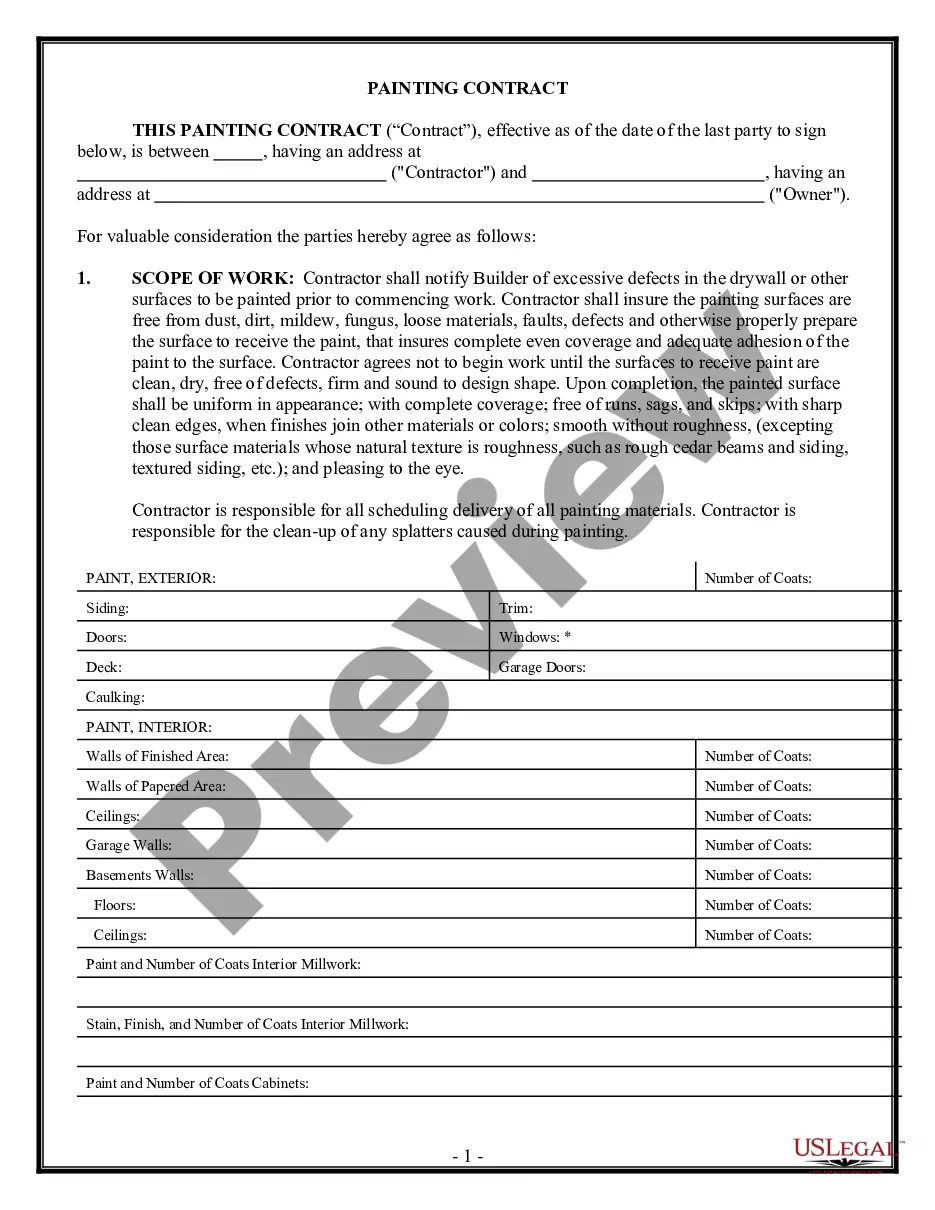

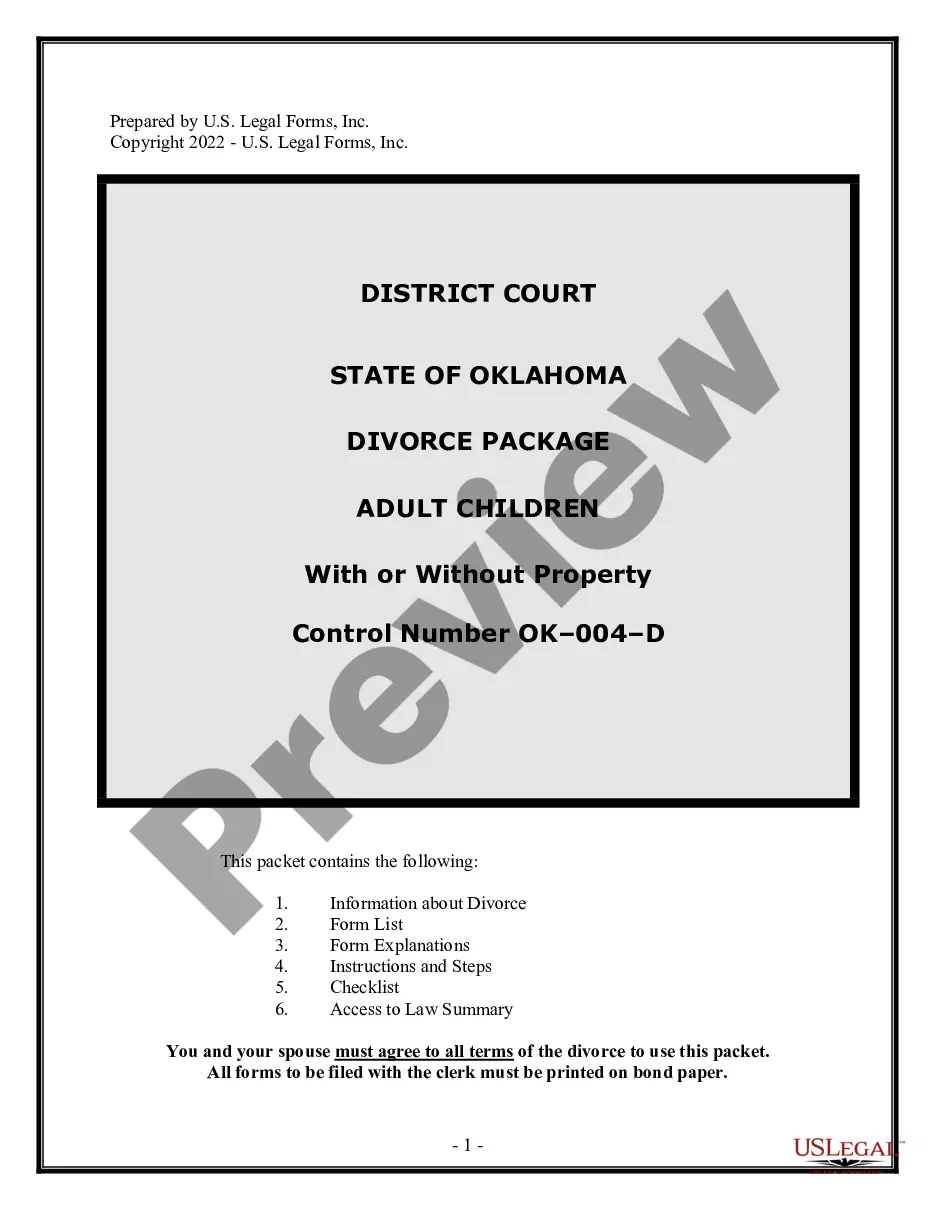

- Confirm that the document visible on the page aligns with your legal needs and state laws by reviewing its description or utilizing the Preview mode.

- Type the form title into the Search tab at the top of the page and select your state from the dropdown to locate an alternative template should there be any discrepancies.

- Repeat the content verification and click Buy now when you are confident that the paperwork meets all the requirements.

- Log in to your account and select Download. If you don’t have an account yet, register for the service and choose a subscription plan.

- Use your credit card or PayPal to purchase your US Legal Forms subscription. The document will be available for download immediately afterwards.

- Choose the format in which you prefer to receive your Maryland Financial Statement (Child Support Guidelines) and download it by clicking the relevant button.

- Add your template to an online editor for quick completion and signature, or print it out to manually prepare your physical copy.

Form popularity

FAQ

To check your child support balance in Maryland, you can visit the Maryland Child Support Administration website and use their online tools. Additionally, you can opt to contact your local child support office directly for detailed information. If you want to manage your records effectively, consider using the US Legal Forms platform, where you can access the forms and resources needed for better tracking and understanding of your Maryland Financial Statement (Child Support Guidelines).

Rule 9-205.2 - Parenting Coordination (a) Applicability. This Rule applies to the appointment of parenting coordinators by a court and to consent orders approving the employment of parenting coordinators by the parties in actions under this Chapter.

Under Maryland law, child support continues until the minor child reaches the age of 18. It may be extended to age 19 if the child is still enrolled in high school. If there is past-due child support, the agency will continue to enforce payment until the arrears are paid in full, regardless of the age of the child.

Child Support Guidelines Have Changed Meaning Increased Child Support for Many Parents. The legislature recently changed the Maryland Child Support Guidelines such that beginning July 1, 2022, child support increases for parents whose combined adjusted actual income is more than $19,200/year.

Rule 9-204 - Educational Seminar (a) Applicability. This Rule applies in an action in which child support, custody, or visitation is involved and the court determines to send the parties to an educational seminar designed to minimize disruptive effects of separation and divorce on the lives of children.

The incomes that are considered for purposes of calculating the recommended amount of child support ing to the Maryland Child Support Guidelines are the income of both parents. The income of spouses or boyfriends or girlfriends usually is not considered.

Rule 9-202 - Pleading (a)Signing-Telephone Number. A party shall personally sign each pleading filed by that party and, if the party is not represented by an attorney, shall state in the pleading a telephone number at which the party may be reached during ordinary business hours.

Child Care Expenses: Actual child care expenses incurred on behalf of a child due to employment or job search of either parent with amount to be determined by actual experience or the level required to provide quality care from a licensed source.