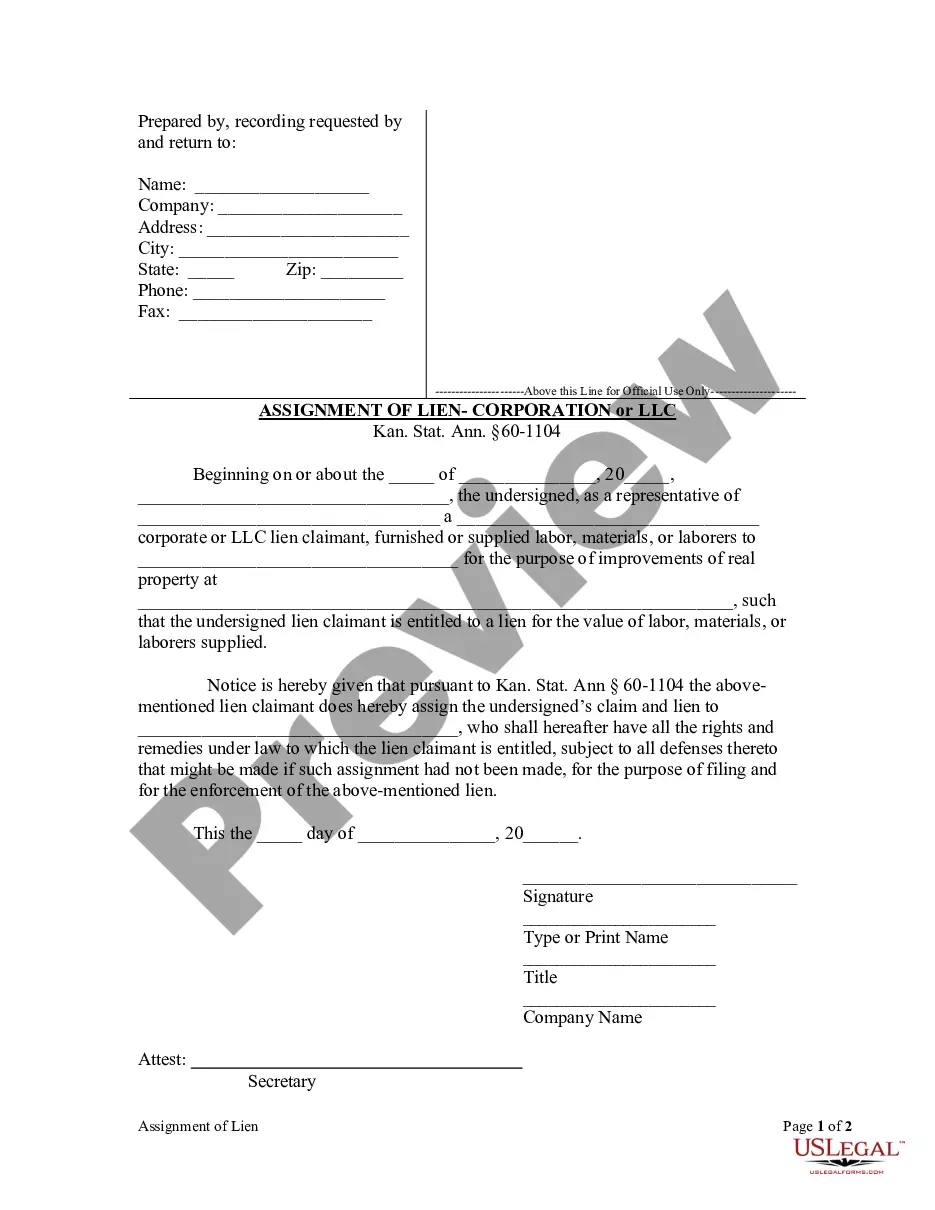

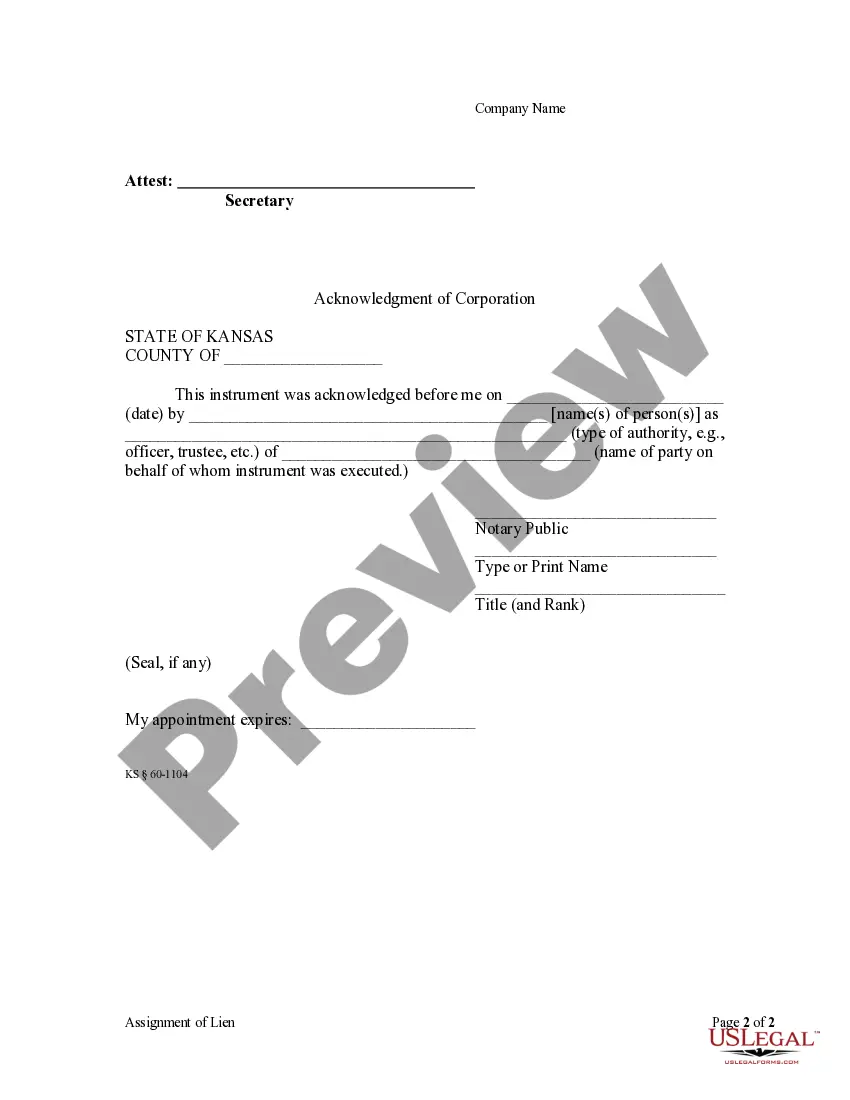

This Assignment of Lien form is for use by a corporate or LLC lien claimant that furnished or supplied labor, materials, or laborers for the purpose of improvements of real property, such that the lien claimant is entitled to a lien for the value of labor, materials, or laborers supplied, to assign its claim and lien, including all the rights and remedies under law to which the lien claimant is entitled, subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

Kansas Assignment of Lien - Corporation or LLC

Description

How to fill out Kansas Assignment Of Lien - Corporation Or LLC?

Searching for Kansas Assignment of Lien - Corporation or LLC documents and completing them could be a task.

To conserve time, expenses, and effort, utilize US Legal Forms to find the suitable template specifically for your state in just a few clicks.

Our legal experts create every document, so you merely need to complete them.

Select your pricing plan and create your account. Choose your payment method by credit card or PayPal. Download the document in your preferred format. You can print the Kansas Assignment of Lien - Corporation or LLC form or edit it using any online editor. Don’t worry about making errors, as your template can be utilized and submitted, and printed as many times as needed. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to download the document.

- All your downloaded templates are kept in My documents and are accessible anytime for future use.

- If you haven’t registered yet, you should enroll.

- Review our detailed instructions on how to obtain your Kansas Assignment of Lien - Corporation or LLC template in mere minutes.

- To find a valid sample, verify its relevance for your state.

- Examine the form using the Preview feature (if available).

- If there's a description, read it to grasp the specifics.

- Click on the Buy Now button if you found what you're looking for.

Form popularity

FAQ

While Kansas does not require an operating agreement for an LLC by law, creating one is a prudent choice for any business owner. It outlines the roles of members and managers, processes for decision-making, and procedures for transferring interests if needed. Moreover, for those involved with Kansas Assignment of Lien - Corporation or LLC, this agreement is essential for establishing clear guidelines in financial matters.

Removing someone from an LLC in Kansas involves following the procedures outlined in your LLC's operating agreement. If there is no agreement, members must agree on the removal and document the decision accordingly. The removal must also be recorded with the Kansas Secretary of State if mentioned in the formation documents. To ensure a smooth process, consider utilizing US Legal Forms, which can aid in creating the necessary documentation for the Kansas Assignment of Lien - Corporation or LLC.

Articles of Organization. The Articles of Organization also called Certificate of Organization is the equivalent of the corporation's Articles of Incorporation. Operating Agreement. An Operating Agreement specifies the rights and duties of the Limited Liability Company members. Employee Identification Number.

A corporation becomes an S corporation by filing an S corporation election with the IRS. The election is made on IRS Form 2553, Election by a Small Business Corporation. It must be signed by all the shareholders and timely filed.

Save time and money by filing your articles of incorporation online at www.sos.ks.gov. There, you can also stay up-to-date on your organization's status, annual report due date, and contact addresses. Instructions: All information must be completed or this document will not be accepted for filing.

To start a corporation in Kansas, you must file Articles of Incorporation with the Secretary of State. You can file the document online or by mail. The Articles of Incorporation cost $90 ($89 online) to file.

To qualify as an S corporation in Kansas, an IRS Form 2553 must be filed with the Internal Revenue Service. In very few states, you will also be required to file a separate state election, as specified by that state, in order to qualify as a Sub S Corporation.

Choose a corporate structure. Incorporating means starting a corporation. Check Name Availability. Appoint a Registered Agent. File Kansas Articles of Incorporation. Establish Bylaws & Corporate Records. Appoint Initial Directors. Hold Organizational Meeting. Issue Stock Certificates.

You must file the Articles of Incorporation with the California Secretary of State, along with a filing fee of $100. Note that your corporation will also be responsible for an annual tax of $800 to the California Franchise Tax Board.

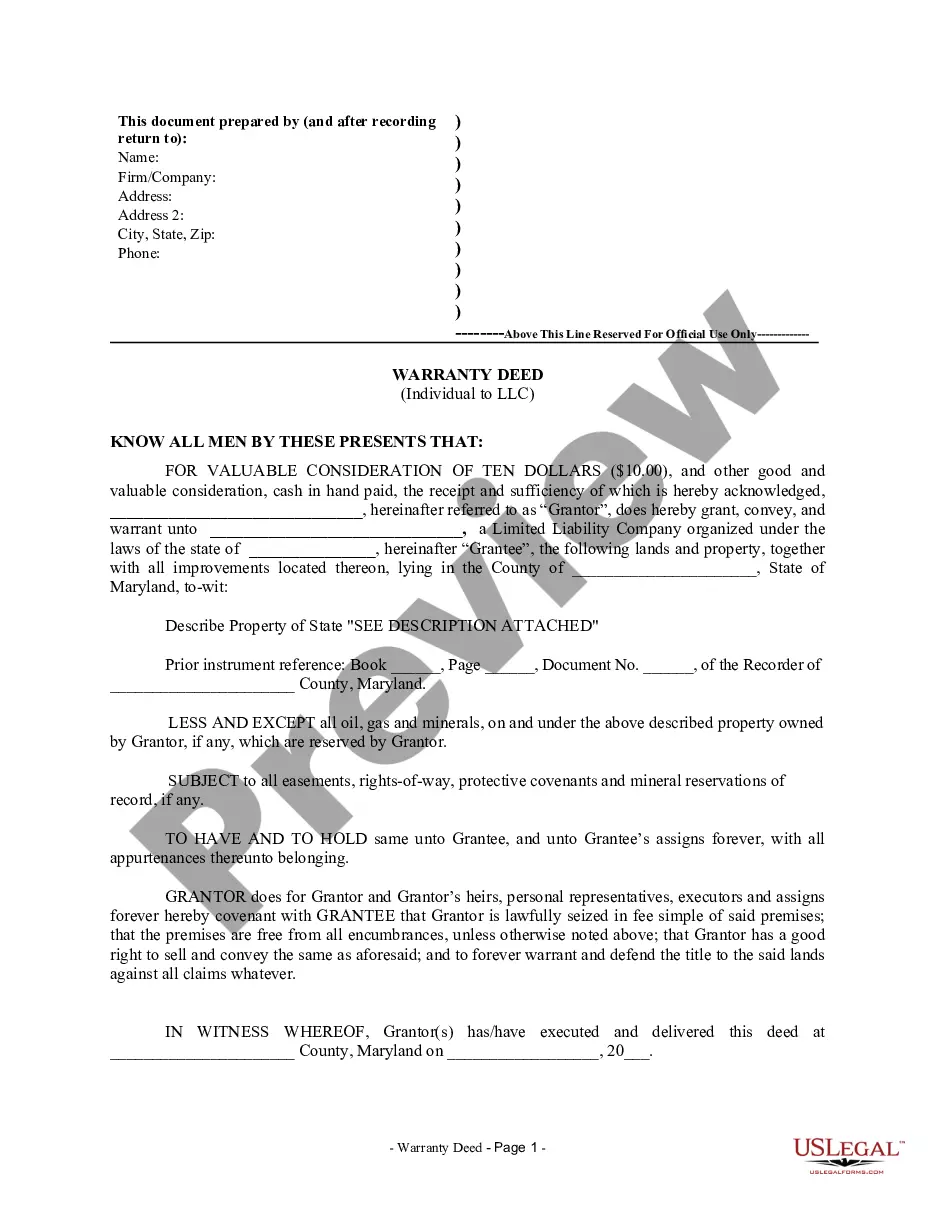

A limited liability company (LLC) is a business structure in the United States whereby the owners are not personally liable for the company's debts or liabilities. Limited liability companies are hybrid entities that combine the characteristics of a corporation with those of a partnership or sole proprietorship. 1feff